Algorithmic trading is a flexible approach for financial investors to make money from the market with the help of computer programs. Investors can select or modify different calculations or parameters to understand the market context. So it makes sense that many crypto investors choose to practice algorithmic trading in crypto assets.

However, several approaches to performing algorithmic trading depend on different factors or elements, including arbitrage trading, DMA chart, price action chart, market sentiment chart, statistical chart, iceberg chart, etc. This article will introduce you to crypto algo trading and describe sustainable trading strategies. Moreover, we list the top pros and cons to enlighten the potential.

What is algo trading?

It is a unique approach to the marketplace using computer programs. These programs execute trades automatically depending on various market data. In most cases, they collect several asset accounting variables, including volume, time, price performance, etc.

Algorithmic trading has become popular in this era of technology as it depends on computer programs and, in most cases, doesn’t require human interruptions. Any computer program runs and executes trades automatically depending on the logic of the code.

How to trade crypto using algorithmic methods?

Trading cryptos using algo methods depends on several factors. Some may enable participation in trades for the short term.

On the other hand, some may allow executing trades that may last for days or even weeks as users can modify or change the parameters and logic when creating any Algo strategy. For example, you may write an algorithm depending on the MA crossover concept.

You use two EMA lines of 10 and 30 periods. When the smaller EMA (10) crosses above the other EMA (20) line, your program executes a buy order and closes the order when the opposite crossover occurs and vice versa.

Short-term trading strategy

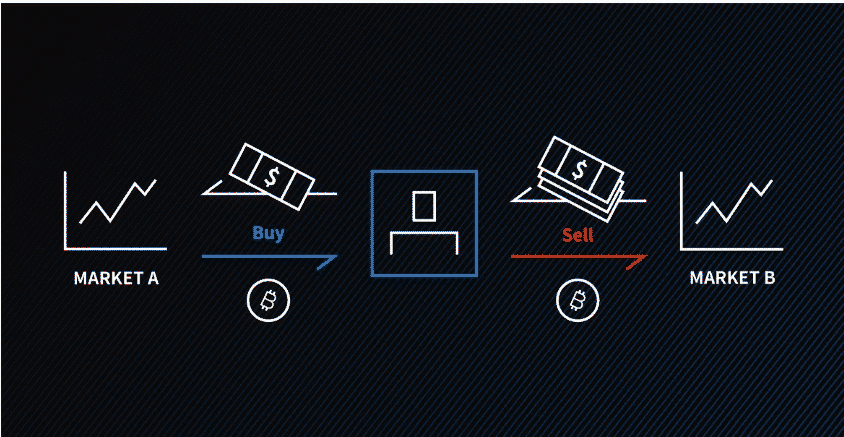

In this trading method, we use the arbitrage trading method. It is a unique way to approach the marketplace to profit from the inefficiency of asset prices in different markets. An exceptional trading approach involves simultaneously buying and selling assets in the same or different marketplace, rather than traditional “buy and hold” trading techniques. Arbitrage trading suggests making money from the price differences of assets, so the trading idea is to obtain profit from minor changes.

Arbitrage trading

You may multiply your investment or increase volume if you want to have impressive returns through this technique. This method is suitable for leveraged by hedge fund investors.

Bullish/bearish approach

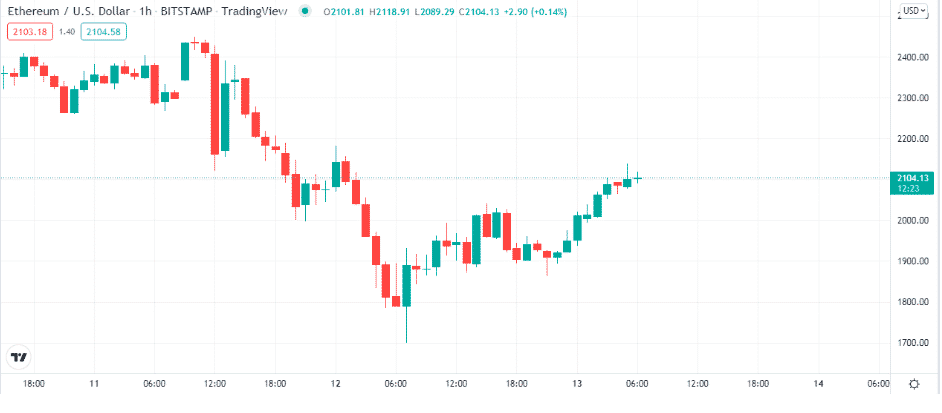

We all know that we are in an era of automatic trading. Although the crypto market is a decentralized marketplace, it often involves price inefficiency due to many reasons. The ETH USD pair may be floating at $2104.30 in a Washington-based crypto exchange. Meanwhile, an Amsterdam exchange may offer $2104.80 for the same pair. A trader may access both exchanges; he can buy ETH/USD in the first exchange (Washington) and sell the same crypto pair at the second exchange (Amsterdam). Later, the ETH/USD may converge at $2104.90, and the investor closes both active trades.

ETH/USD 1H chart

He loses ten cents in Amsterdam and gains fifty cents in Washington if the trade volume is the same for both trades. So the trader has a forty cents profit per coin without transaction fees and more negligible risk.

It is a simple short-term arbitrage trading strategy that applies to many trading instruments and will take a little time to execute, maybe a minute or a few minutes or an hour. Many opportunities you will get to trade with this effortless trading strategy during the whole trading day. The volatile market and price quote errors can create opportunities to profit from this type of trading.

Long-term trading strategy

We use the quant trading method for our long-term approach. ‘Quant trading’ uses quantitative algorithms and methods to generate profitable trade ideas. ‘Quant trading’ is the short form of quantitative trading, usually a data-based trading system.

A trader who uses quant trading methods works with mathematical formulas to identify potential trading positions or predict the future price movement of certain assets. Often investment banks and hedge fund managers use quant methods as executing trading techniques. You can refer to this type of trading method as the ‘market making’ concept as it provides liquidity for particular assets in the marketplace.

Leverage information may not be available in quant trading; instead makes it easier to buy/sell certain assets to participants. This market keeps the market running smoothly, especially when it is volatile. You can define any trader who uses quantitative methods or mathematical trading strategies as a quant trader.

Quant trading often involves a large amount of computational power, so it suits financial institutions and hedge funds, but with the availability of technology nowadays, it is becoming popular among individual traders.

Bullish/bearish approach

There are many techniques to determine the direction and riding trends through quant trading. You can use popular indicators such as moving average convergence/divergence (MACD), MAs, Relative strength index (RSI), Bollinger Bands, etc., to short out the momentum and trends. Trend following strategies are simple; they identify the trends and ride them until they remain intact.

For instance, you can monitor significant investors’ sentiments and build methods to follow those sentiments of buying/selling certain crypto assets. Inversely, you can find patterns that will help you identify new trends and volatility breakout signals.

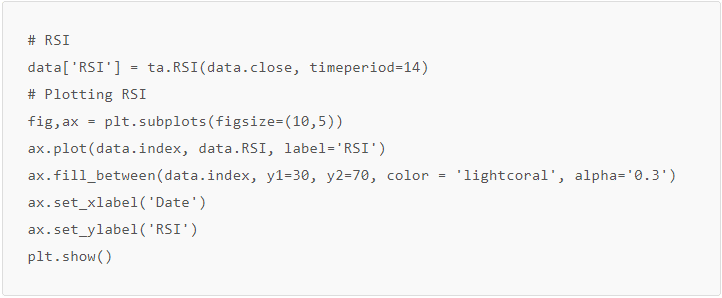

You can easily create invincible long-term quant trading methods that will work fine on daily charts using these suggestions. For example, the RSI indicator uses the formula.

RSI = 100 – 100 / (1 + RS)

RSI indicator code

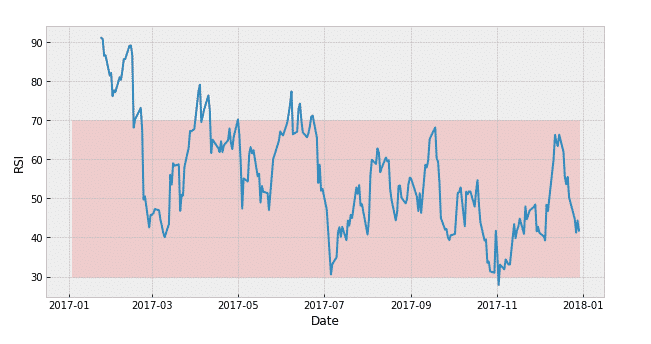

When applying this RSI code to the chart, the chart will look like below.

Price chart after RSI code applying

Now, you can make a trend following the trading method using this code of the RSI indicator. Create a code to enter a buy order when the price enters a bullish zone and a sell order when the price comes to the bearish zone.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Finally, algo trading combines mathematical background data, computational power, automatic trade executions, etc. You can apply any logic that you find potentially profitable through algo trading if you have a particular level of coding skill.

Comments