In forex trading, harmonic patterns are becoming popular day by day for their effectiveness and accuracy. Harmonic patterns use Fibonacci retracement calculations and make geometric structures to define the future price movements of the asset.

There are two types of harmonic patterns: internal and external. Internal patterns include Bat and Gartley, and the example of external patterns are the Crab and the Butterfly ones.

The following section includes a complete knowledge about the Butterfly pattern: what it is, how to identify, the fundamental facts to check, and trade setups using this pattern.

What is the Butterfly pattern?

The Butterfly pattern was discovered by Bryce Gilmore and further defined by Scott Carney. It is a harmonic pattern that suggests the reversal trade ideas.

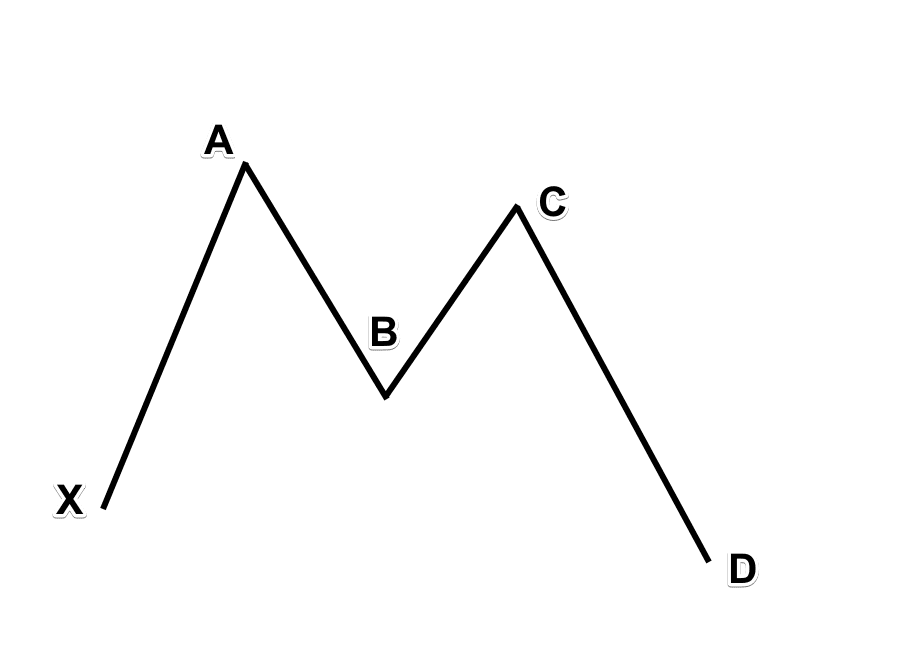

This pattern has four legs similar to the Bat, Crab, or Gartley pattern. Its structure starts with point X and ends with point D. Idea is simple: follow the legs to reach a certain price level to identify precious entry positions. Like the Crab pattern, it is also a reversal pattern that allows traders to enter at extreme lows or highs. Therefore, point D is vital in this pattern because this suggests the entry point or potential reversal zone.

How to identify the Butterfly pattern?

This pattern has four legs that connect with five points, which start with X and ending with D. It also ends with the Fibonacci extension level.

The difference is that the Crab pattern ends with a 161.8 percent Fibonacci extension level of the first leg XA. In contrast, the Butterfly pattern ends with a 127 percent Fibonacci extension level of the first leg. In this part, we will specify the legs and points to get an idea of the whole structure.

The Butterfly pattern consists of four price swings. It becomes like the letter ‘W’ in uptrends and ‘M’ in the downtrends by connecting all five points. However, sometimes it is mistaken with a double top/double bottom pattern. The difference is that the Butterfly pattern doesn’t always appear at the end of a trend, although it sometimes does.

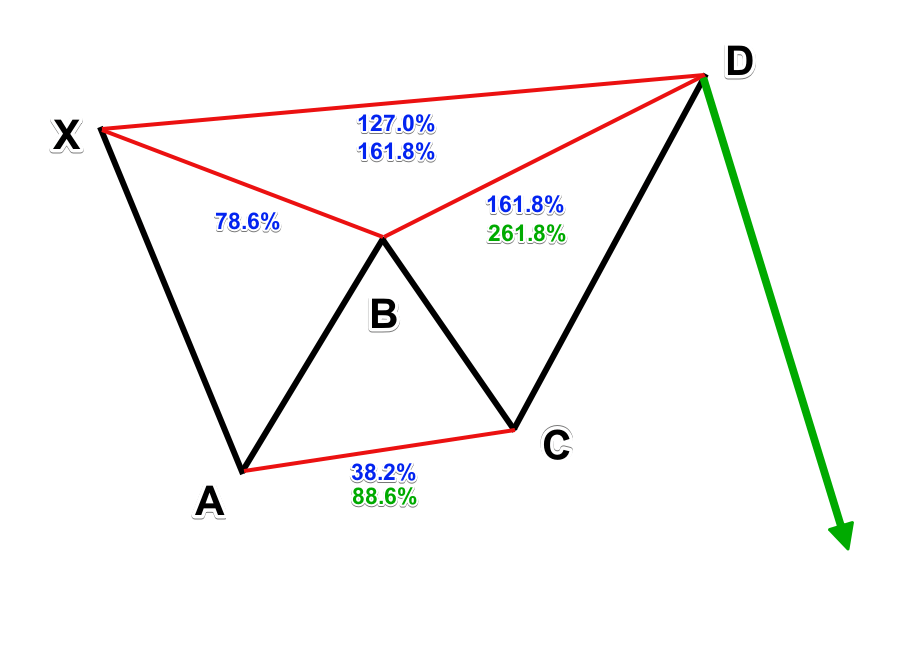

Here is a simple illustration of this pattern.

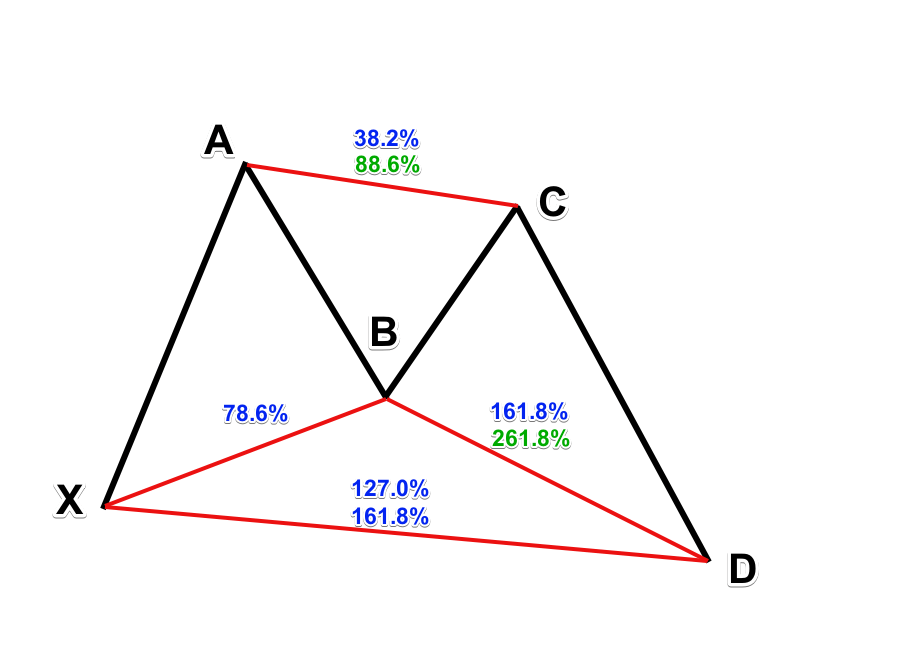

Let’s have a closer look at the Fibonacci relationship within the Butterfly structure:

- XA

It is the first leg that forms the whole structure. Therefore, no specific move is required for this leg. However, it is vital as other portions depend on its Fibo calculation.

- AB

The next leg is AB. Point B is a critical point of the whole pattern which should retrace the 78.6% Fibo level of the XA leg.

- BC

The next leg BC depends on the Fibo retracement level last leg AB. It should retrace between 38.2% or 88.6% level of the AB move.

- CD

If BC is 38.2% of AB, the CD is likely to reach the 161.8% Fibo extensions of BC. On the other hand, if BC is 88.6% of AB, the CD is expected to reach the 261.8% extension of BC.

- AD

Lastly, the general AD move consisting of AB, BC, and CD should be either 161.8% or 127.0% of XA.

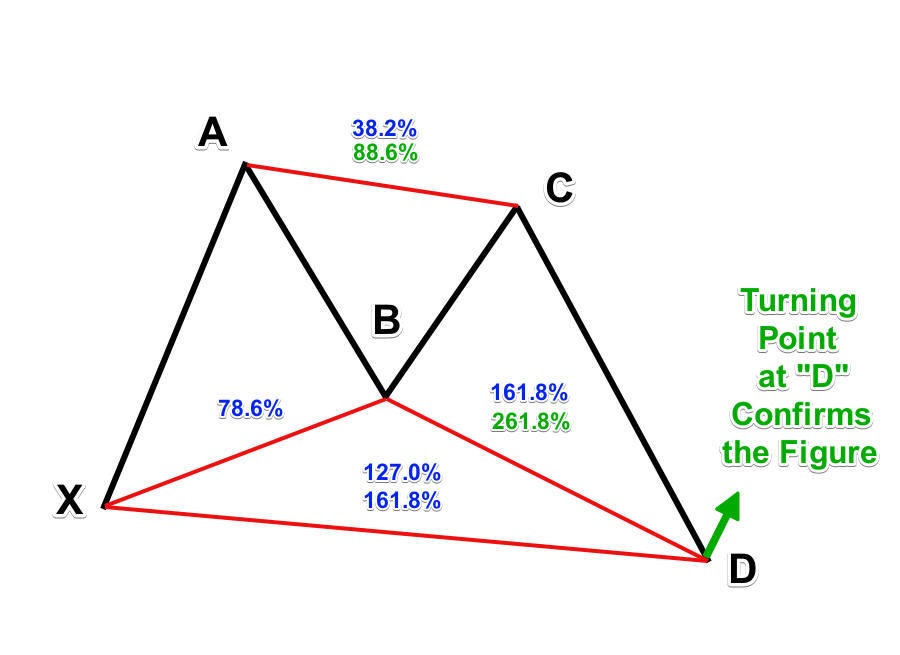

The above is a visualization of the harmonic relationship of the Butterfly pattern that shows a possible buying point in the chart.

- If BC reaches 38.2% of AB, the CD should go to 161.8% of BC.

- If BC comes 88.6% of AB, then the CD should get 261.8% of BC.

It is not an absolute rule but rather a general guideline that you should be aware of. However, as mentioned earlier, the B point retracement of 78.6% of XA is critical and must be met to classify a Butterfly pattern correctly.

Butterfly pattern: critical conditions

There are some basic rules or conditions to identify this pattern. These rules are like checklists. Before you place any trade, you must verify these conditions are proper on your chart.

Let’s have a look at the unavoidable rules or essential conditions of this pattern:

- AB is not more than 78.6 percent Fibo retracement level of XA leg.

- 127% Fibonacci extension of the X-A leg.

- 161.8% — 261.8% Fibonacci extension of the B-C leg.

- BC is a minimum 38.2 percent and maximum 88.6 percent Fibonacci retracement of the second leg AB.

- CD is a target between 1.618 to 2.618 percent Fibonacci extension of AB leg between 1.272 to 1.618 of the first leg XA.

Butterfly pattern trading strategy

Butterfly pattern generates complete trade ideas, including entry, exit, stop loss of any trading entry. In addition, this pattern identifies both bullish/bearish trading ideas.

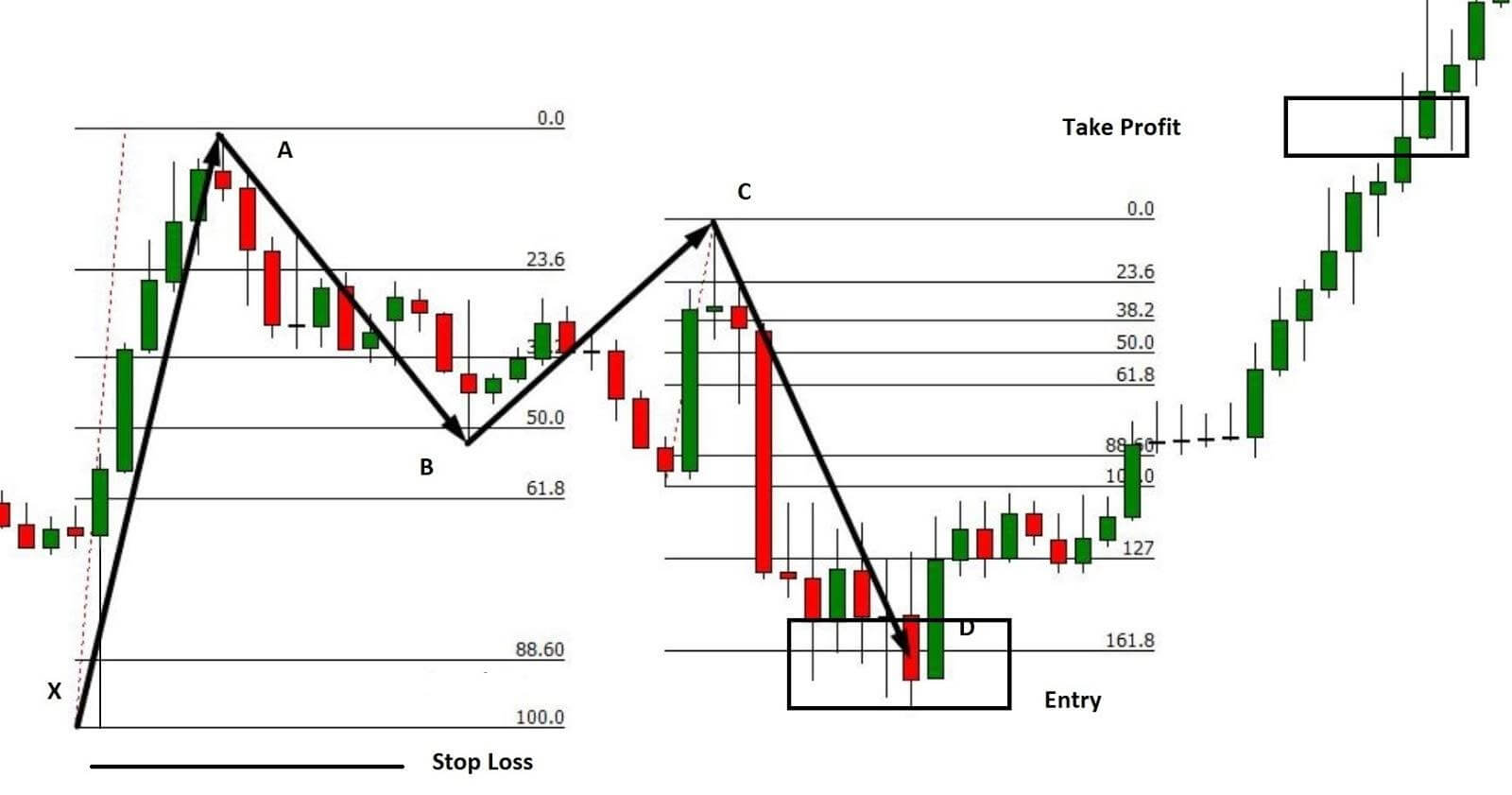

Bullish strategy

-

Entry

Determine the point D that should be at the 127 percent Fibonacci extension of the first leg XA. Then, place a buy order after the bearish candle forms.

-

Stop loss

Place a stop loss below a Fibonacci extension of 161.8 percent of the first leg XA with 5-10 pips buffer.

-

Take profit

However, the exit or profit this pattern suggests is dependable with both your trading goal and market condition. For example, for a conservative profit target, the exit or take profit would be at point B, and for an aggressive profit target, it would be near point A. However, the price could reach more above point A if there is any massive force driving the market.

Let’s see the practical example of the bullish Butterfly pattern in the actual chart.

Note

Exit or not, when the price reaches point B after taking entry, it would be wise to shift the entry position at the breakeven point to reduce risk.

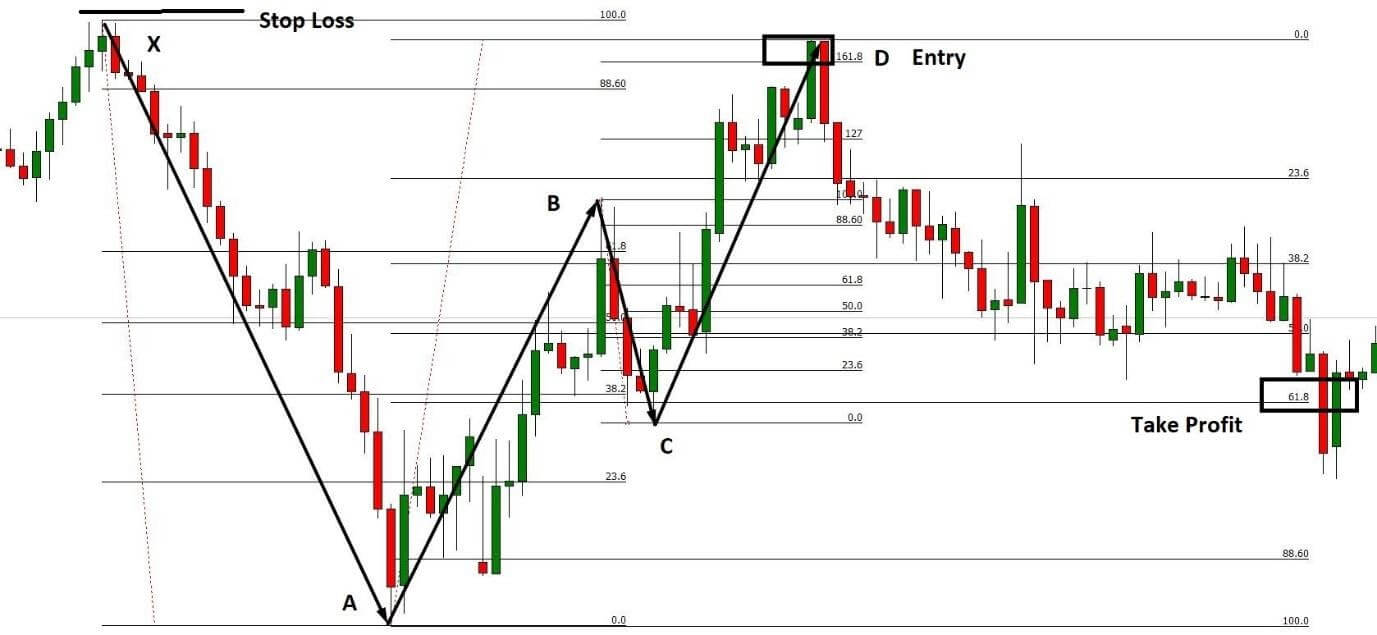

Bearish strategy

Entry

Determine the point D that should be at the 127 percent Fibonacci extension of the first leg XA. Then, place a sell order after the bullish candle forms.

Stop loss

Place a stop loss above a Fibonacci extension of 161.8 percent of the first leg XA with 5-10 pips buffer.

Take profit

However, the exit or profit this pattern suggests is dependable with both your trading goal and market condition. For example, for a conservative profit target, the exit or take profit would be at point B, and for an aggressive profit target, it would be near point A. However, the price could reach more above point A if there is any massive force driving the market.

Let’s see the practical example of the bearish Butterfly pattern in the actual chart.

Note

Exit or not, when the price reaches point B after taking entry, it would be wise to shift the entry position at the breakeven point to reduce risk.

Conclusion

No one can underestimate chart patterns as an efficient trading analysis tool. However, when it comes to indicating a reversal or continuation of the current trend and determining entry and exit positions, they are vital anyway.

Finally, with a proper mind setup and trade management, this harmonic pattern can be legitimate for any beginner or professional trader.

Comments