WallStreet Forex Robot 3.0 Domination is the latest version of the long-standing expert advisor released in March 2011. This is one of the main reasons why we have decided to conduct a detailed analysis of this FX trading system so that our readers know whether it is a worthwhile trading solution to invest in.

FX Automater is the team that stands behind this EA. They’ve developed many EAs, including Forex Diamond, Forex Trend Detector, Gold Scalper Pro, Omega Trend EA, and many more.

The developers of WallStreet Forex Robot say that they’ve kept the best elements from the proven, core trading principles of this original, but made some major adjustments to take the EAs functionality ‘to a whole NEW LEVEL’. According to the sales page of the product, FX Automater has designed ‘Broker Spy Module’, a ‘first in its kind’.

This trading tool was designed to protect traders’ accounts from ‘unethical brokers’ that can hurt traders with high spreads, high negative slippage, or delayed order execution. The updated version also has a real-time update system that automatically checks new settings, updates the EA, and restarts the robot for you. In addition to this, the FX Automater team claims that the new EA version goes with increased profitability thanks to improvements the team has made for WallStreet Forex Robot.

Although these claims sound good, we cannot make a verdict trusting the dev blindly. Therefore, our analysts have prepared a detailed WallStreet Forex Robot review.

WallStreet Forex Robot Strategies and Tests

Now let’s jump to the system performance, its key features, and trading strategy details:

- It is a completely automated EA.

- The WallStreet Forex Robot comes with a real-time update system and increased trading frequenc.

- It guarantees increased profitability.

- It has a NEW, improved exit trading logic.

- The team claims they have decreased the risk to the minimal reasonable level.

- There’s a possibility of using pending stop and limit orders.

- It trades on EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, NZDUSD, and AUDUSD on the M15 timeframe.

- This EA allows you trade Forex, Crypto and Gold.It has 20 years of backtesting data.

- The minimum deposit is $100-$500.

- The recommended deposit to get started with this EA is $1000-$5000.

- The recommended leverage is 50:1.

- It’s recommended to test an EA on a Demo account to check whether it is compatible with your broker.

This Forex expert advisor was designed to follow short and medium-term trends. This method of trading has proven its worth ever since Forex has been traded online. It is an effective way of generating profits for traders who use it.

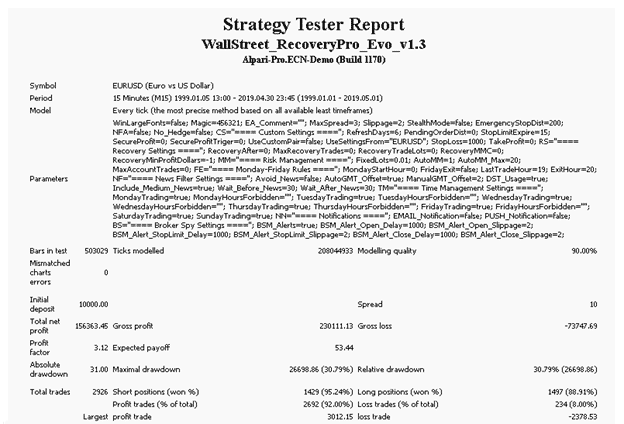

It’s impressive that the devs share multiple backtesting reports for every currency pair on the sales page. Let us analyze one of them in detail.

It’s a EURUSD backtest performed on the M15 time frame. The modeling quality was 90.00%. The initial deposit was $10K. For 20 years of trading, the EA could generate $15636, 45 of profit. The profit factor was high–3, 12. The maximum drawdown was 30, 79%. It traded 2926 trades and won 2692 out of them. The average loss was x3 times higher than the average win: -$315,16 and $85, 48, respectively.

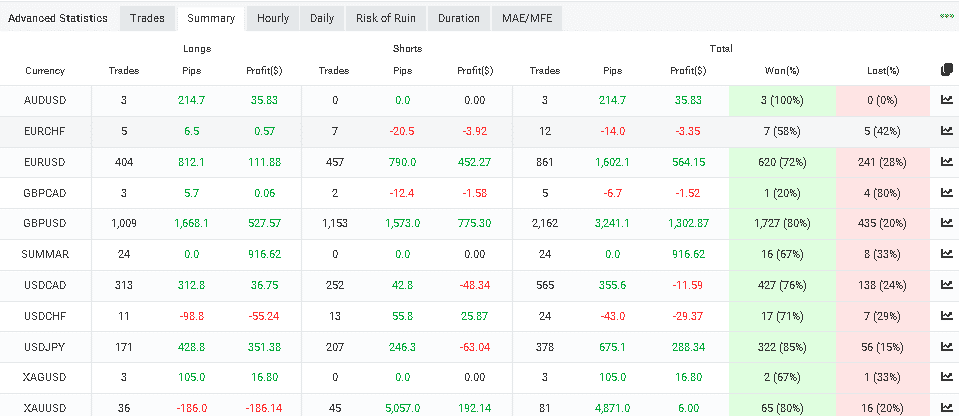

WallStreet Forex Robot Live Trading Account Review

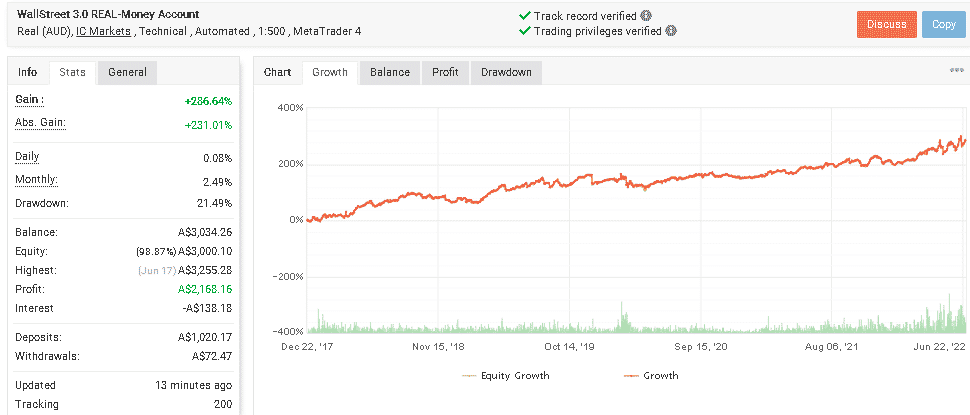

This is a real (AUD) account the devs represent as the main one on their website. It trades under the IC Markets brokerage on the MT4 platform. Since its date of inception (December 22, 2017), its total gain profit has grown to 286.64%, which resulted in A$2,168.16 of the total net profit. Its daily ad monthly gains are 0.08% and 2.49%, respectively. The peak drawdown was 21.49%.

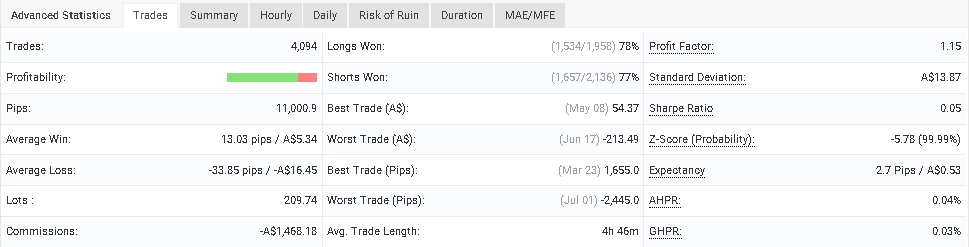

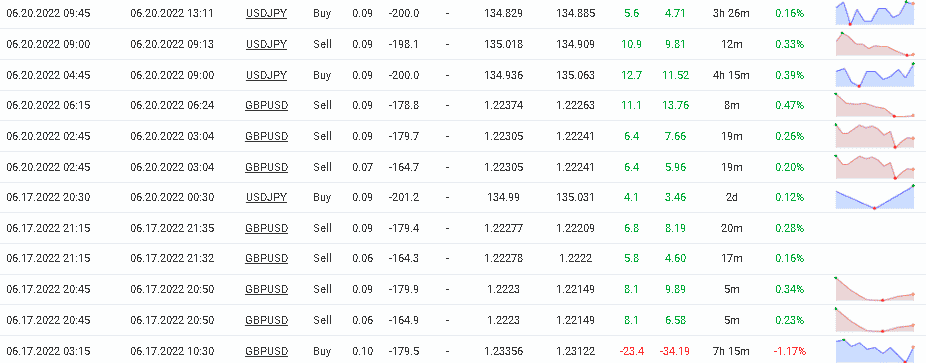

As could be seen from the trading stats, it trades with a high RRR of 1:3. Its profit factor is low‒1.15. It holds an order open for 4 hours and 46 minutes on average.

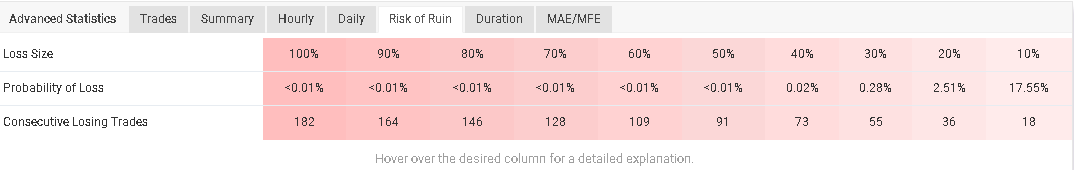

The most frequently traded currency pair is GBPUSD–2,162 trades. The robot trades 24/5 with the highest trading activity on Thursdays–855 trades and Monday–836 orders. It trades with medium risks to the account balance. In the case of 18 consecutive losses in a row, 10% of the account balance will be lost.

The system uses a Grid of orders plus a Scalping combo. Moreover, it does not trade with a fixed lot size. It is not explained when the system decides to increase its lot size in the presentation. This strategic approach can easily blow your trading account.

Pricing

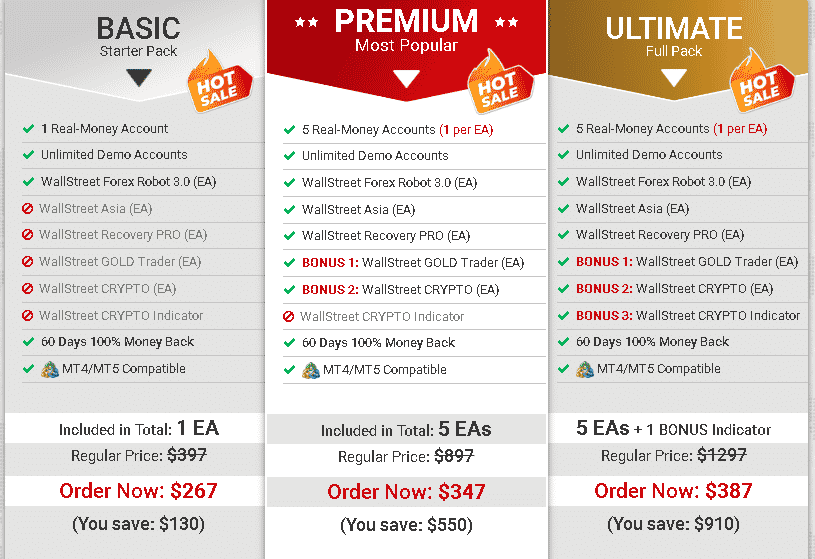

There are 3 packages offered: Basic, Ultimate, and Premium. The Basic package includes one EA and is sold with a -70% OFF. Instead of paying $397 traders can buy the robot for $267. The Premium package come for $347 (instead of $897) and includes 5 EAs: WallStreet CRYPTO, WallStreet GOLD Trader, WallStreet ASIA, WallStreet Recovery Pro, and WallStreet Forex Robot. The ULTIMATE pack includes the same EAs plus an indicator. It is sold for $387(the regular price is $1297). All packages are protected by a 60-day money-back guarantee.

The limited sale offer is always used on this website. It is purposely made to boost sales.

Is WallStreet Forex Robot a good system to rely on?

The system trades with a sky-high risk-reward ratio and tree trading approaches that can easily ruin any trading account. We could not find any actual trader review on the reputed 3rd party websites to analyze their trading experience with this FX EA.

User Reviews

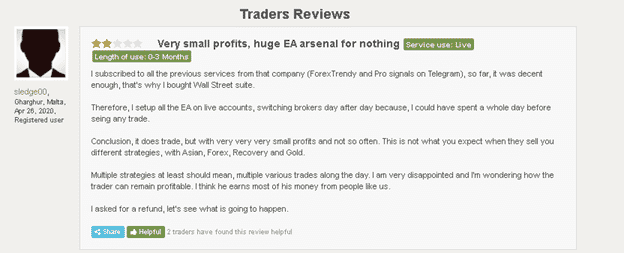

There is a WallStreet Forex Robot page on FPA. It has a 2, 8 out of 5 star rate based on 18 reviews from their customers.

The last customer review has a 2-star rating. It was written in 2020, so that should be kept in mind. The company did not answer any customer feedback.

Comments