Pattern trading is a reliable price indicator that investors can use to identify where the most recent trend can reverse. The price of a currency pair does not move in a straight line. Instead, the price moved lower in a bullish trend and higher in a bearish trend known as swing.

Traders often find it challenging to identify the swing level from where the reversal may happen. It is widespread for beginner traders to consider a swing level as a reversal point, but after making some movement, the price continues.

The same thing might happen to you. Therefore, it is vital to find which swing level is trustworthy. What if you find a Bat pattern after a strong bullish rally?

In the following section, we will see a complete Bat pattern guide that may increase your trading performance.

What is a Bat pattern?

It is a harmonic pattern that combines with price swings and Fibonacci levels. We all know that the price moves within swings, and Fibonacci works as a critical identifier of the reversal point. We can identify the correction using the Fibonacci retracement and major trend using the Fibonacci extension.

It is a trend continuation pattern that will show how the current trend may continue after a correction. This pattern is profitable in any financial instrument and any timeframe. Moreover, you will find this pattern in both bullish and bearish market conditions.

How to identify Bat pattern

Apart from the theoretical knowledge of the Bat pattern, we will see how to spot it in the actual chart using specific conditions.

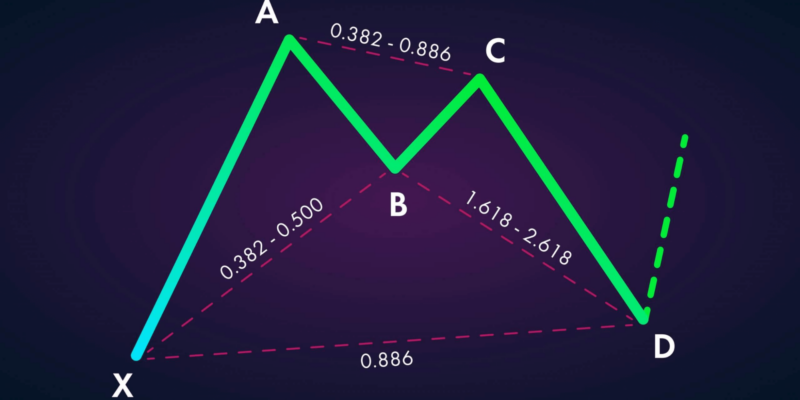

First, let’s have a look at how the Bat pattern looks like.

It starts from XA leg, followed by AB, BC, and CD. These legs are price swings, and we will use Fibonacci retracement and extension tools to identify the correct swing point. It is very critical for traders as there is a possibility of getting confused with other harmonic patterns. In addition, every harmonic pattern is unique as their swing levels, and Fibo calculation is different.

What we should consider finding a Bat pattern:

-

Primary leg

The primary leg of the Bat pattern is XA, which is the most extended leg here. The significance of AB is that it will form by moving above or below the recent swing level. Therefore, it is the first indication that the price wants to break out from a level, but it requires more confirmations.

-

Retracement swing

After the primary leg, we will see a retracement swing, where the price will not break above or below the XA leg. Finally, the AB leg will retrace the XA leg from 38.2%-50%, Fibonacci retracement.

After confirming the swing point B, BC will make another retracement of AB from 38.2% to up to 88.8%. Here, the critical point is that swing point C will be within the XA leg. If point B breaks above or below the Swing XA, the pattern will not work.

-

Final leg

After two consecutive corrections, the price will move against the direction of the XA leg and form the CD leg. As a result, the CD is bullish for a bearish XA leg and bearish for a bullish XA leg.

But, how long does the CD leg extend?

The CD leg may extend from 161.8% Fibonacci extension to 261.8% Fibo extensions. Here point D is the final swing point of this pattern from where a trader should enter the trade.

Bat pattern: critical conditions

Many harmonic patterns in the world may make a trader confused. Therefore, if you can follow critical conditions of Bat pattern, you can eliminate unexpected mistake of choosing wrong patterns:

- AB=BC or AB> BC.

- Point C stays within the high/low of the XA leg.

- The maximum retracement level of CD may move up to 88.6% Fibo retracements.

- Only one Fibo extension applies to this strategy to find point D from 161.8% to 261.8% extension level of BC leg.

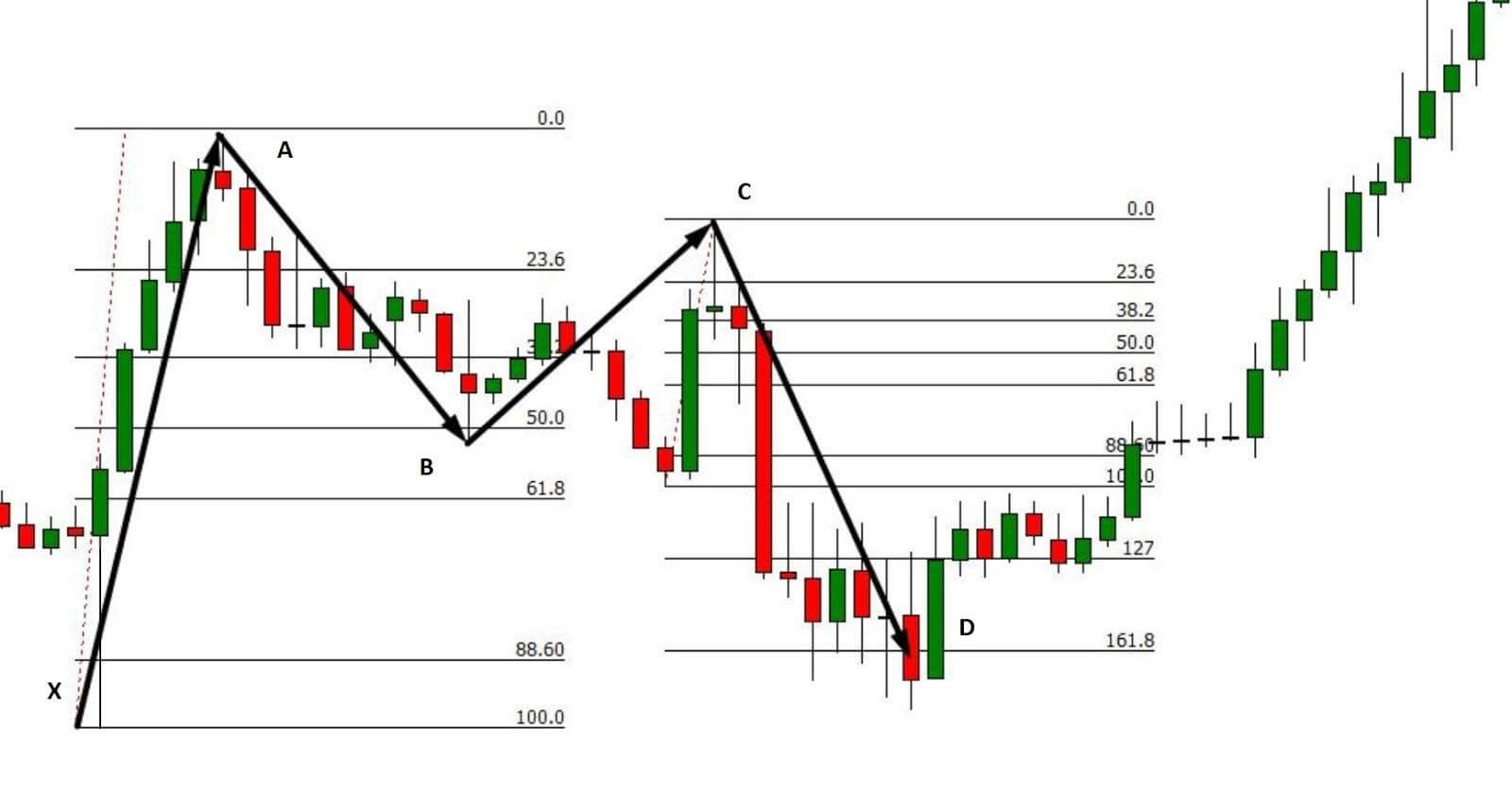

Bullish Bat pattern trading strategy

For a bullish Bat pattern, the primary leg XA should show a sudden movement, as shown in the image below.

- We have to calculate XA, AB, BC, and CD legs based on the method discussed above. Later on, we have to match critical conditions to confirm the accuracy of the pattern and move to entry.

- Wait for the price to reach point D and show a bearish rejection candle, like pin bar, two bar, engulfing bar, etc. After that, wait for the candle to close and open a buy position.

- In the Bat pattern, the lowest swing point is point X. Therefore, if the price comes below the point X, it will invalidate the Bat pattern. Therefore, you should put the stop loss below point X with some buffer.

- The primary take profit level is 61.8% Fibonacci retracement of AD, and the final take profit is above point A, depending on the price condition.

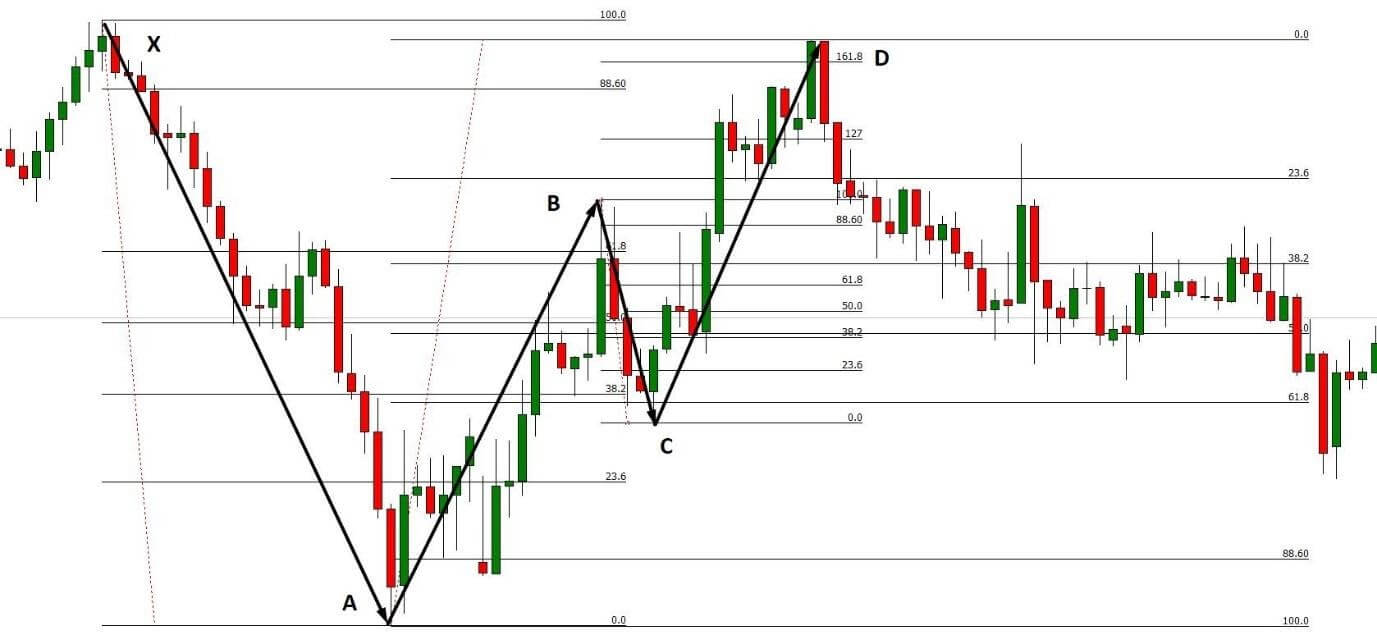

Bearish Bat pattern trading strategy

For a bearish Bat pattern, the primary leg XA should show a bearish impulsive movement, as shown in the image below.

- We can see that the XA moved lower, and AB, BC followed the XA leg as a correction. Now, we have to match critical conditions to confirm the accuracy of the pattern and move to entry.

- Wait for the price to reach Point D and show a bullish rejection candle, like bearish pin bar, bearish two bar, engulfing bar, etc. After that, wait for the candle to close and open a sell position.

- In the Bat pattern, the highest swing point is point X. So, you should put the stop loss above point X with some buffer.

- The primary take profit level is 61.8% Fibonacci retracement of AD, and the final take profit is below point A.

Conclusion: trade management rules

Trade management is an essential tool for every trading strategy that a trader should follow. Although the trade management depends on traders personality and trading style, we will see a basic trade management idea for the Bat pattern:

- It is a trend continuation pattern, so you should apply it to follow the current trend.

- Do not take more than 1% risk per trade.

- Close 50% of the trade after reaching 61.8% of the AD leg.

- Move your stop loss at breakeven after hitting the first take profit.

Overall, the Bat pattern is profitable in any trading instrument where the challenging part is to match all trading conditions. Therefore, you should be careful while identifying swing levels using Fibonacci tools.

Comments