While accumulating their own experience and statistics, traders are looking for effective investment sources for accrued capital. Today, forex signals are included in the standard set of tools for most traders, allowing timely and efficient determination of trading prospects at a specific moment in real-time.

These options provide the ability to quickly respond to a changed situation, remove assets from under attack. Or vice versa — connecting additional reserves to the most promising positions.

What is a forex signal?

It is a recommendation when to open or close a trade depending on the asset, its price, and the set time. These signals serve as a warning to the forex market. They notify traders when they should enter or exit a trade.

The trade signal contains:

- The name of the instrument by which the call was generated.

- Operation direction or the name of a pending order.

- Trade entry-level — price.

- Stop-loss level — limiting losses.

- Take-profit level — profit fixing level.

- A description of the reasons for the occurrence of the signal.

- Graphic explanation of the call with the applied technical analysis method.

Types of forex trading signals

Forex calls can be long, medium, and short term. This is a conditional division, and it is based on the timeframe. For example, on a 30-minute, hourly, 4-hour, daily, weekly, or monthly basis.

Experts divide forex signals into two big categories: manual and automated.

Manual forex trading signals

A manual trading strategy entails an individual placing buy and sell orders. Manual calls are also available via social trading brokers, email, SMS, and messengers.

Some traders claim that manual trading is superior because it requires human intuition to gauge market conditions and monitor risk. Let’s look at some advantages and disadvantages of manual trading.

Pros and cons of manual trading

PROS |

CONS |

|

|

Automated forex trading signals

Forex calls produced by automatic trading software are automated calls or expert advisors (EAs). They are based on various approaches and can be incredibly helpful. Mainly when the market shows strong patterns.

Automated systems still need to be built by humans, which means they are prone to human errors. Except the mistakes occur in the programming code and not in the execution of the code. Let’s look at the advantages and disadvantages of this signal type.

The pros and cons of automated trading

PROS |

CONS |

|

|

We have prepared some tips for traders who want to test both manual and automated signals.

Tips for a trader using manual signals

-

Trade entry point

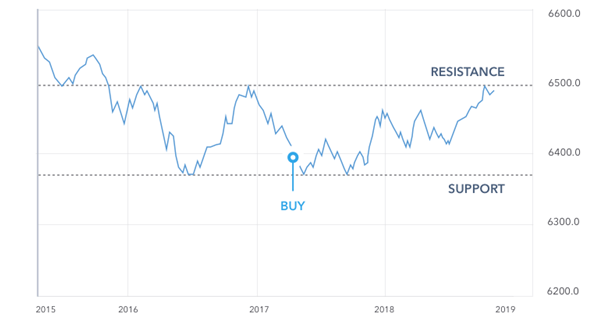

Before entering a trade, consider the following factors to help you determine the best entry points:

- Is the market trending: uptrend or downtrend?

- Is there support or resistance nearby?

- Does an indicator back up the trade?

- How is the risk-to-reward ratio?

- How much money am I putting at risk?

- Are there any significant economic releases that affect the trade?

- Is my trading strategy on track?

-

Use the stop-loss order

You can use the following approaches to set your stop-loss order:

- Utilizing the support method, a trader calculates the stock’s most recent support level and puts a stop-loss order below that level.

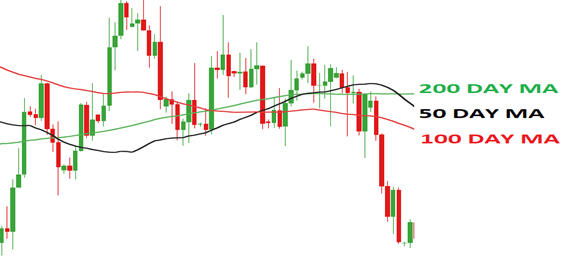

- The stop-loss is set just below an extended moving average price by using the moving average price.

-

Use take profit order

Take profit is best fixed by closing 50% of the position at the 161.8% Fibonacci extension level and adjusting the stop loss to the opening price. Close 50% of the residual place — 25% of the initial post at the next resistance and raise the stop loss. Close the remaining 25% at the next resistance.

-

Take into consideration risk management

Specific measures that traders may take to defend themselves against the disadvantages of trade are forex risk management. More risk means a greater probability of significant returns – but also a greater chance of substantial losses.

To have risk management, operate on the following strategies:

- Limit the use of leverage

- Use a take-profit order

- Use a stop-loss order

- Do not risk more than you can bear the consequence

Tips for a trader using automatic signals

-

Learn 2 Trade

Learn 2 Trade obtains trading cues from experienced traders with more than 15 years of experience in the forex industry. These traders create well-rounded, insightful trading ideas using:

- Fibonacci retracement levels

- Support and resistance levels

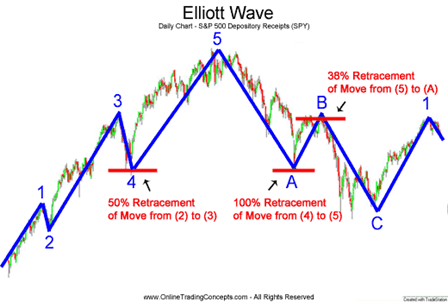

- Patterns such as the Elliott wave

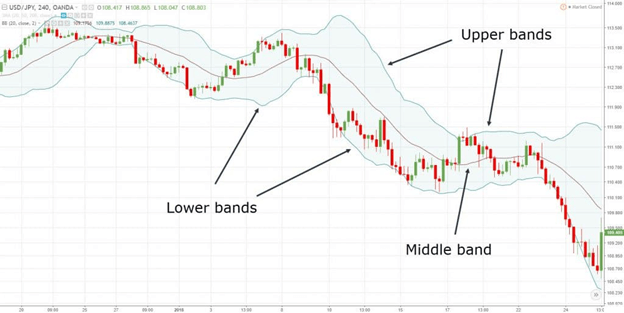

- Bollinger Bands

- Moving averages

-

1000pip Builder

1000pip Builder provides forex signals via email, telegram, and text message. Before conducting an exchange, each call contains an entry, stop-loss, and take-profit rates, so you know what you stand to gain or lose. This forex call service provides bare-bones, “pure” signals, allowing you to use its technical advice however you see fit.

-

eToro

eToro has a diverse range of financial instruments, including forex, bitcoins, and ETFs. Rather than delivering forex signals to its clients, the firm uses an innovative copy trading device that allows consumers to copy a skilled trader’s forex exchanges with a few mouse clicks.

-

Forexsignals.com

This is a well-known forex website that provides a variety of informational tools and services. It is not a signal provider, and instead, the organization focuses on training its customers on finding worthwhile forex exchanges on their own.

-

FOREX.com

Clients of FOREX.com have free access to the broker’s advanced trading platform software, offering trading cues such as pivot points.

Conclusions

Automatic forex calls are the most lucrative and secure alternative for automated trading in the currency exchange game. Traders and investors must be able to make reliable predictions, execute successful markets, and minimize risks. You can choose between paying and free options based on your preferences and needs. On the one hand, free trading signals can only have a trim level of efficiency.

Comments