Trading patterns are an unavoidable part of the financial market. Technical investors who make frequent trades often depend on trading patterns while making trade decisions. They make invincible trading methods by combining these candle formations to determine entry/exit points of trades. So no wonder these patterns are effective in the crypto marketplace.

However, it is mandatory to follow a particular way alongside identifying these pattern formations while executing successful trades using any trading pattern. In this article, we describe different crypto trading strategies using patterns.

What are crypto trading patterns?

Trading patterns are unique candle formations that take place during any price movement. There are three types of trading patterns available currently that technical traders follow:

Bilateral pattern

These candle formations don’t signal any future direction, only declare the volatility, and the price can go either way.

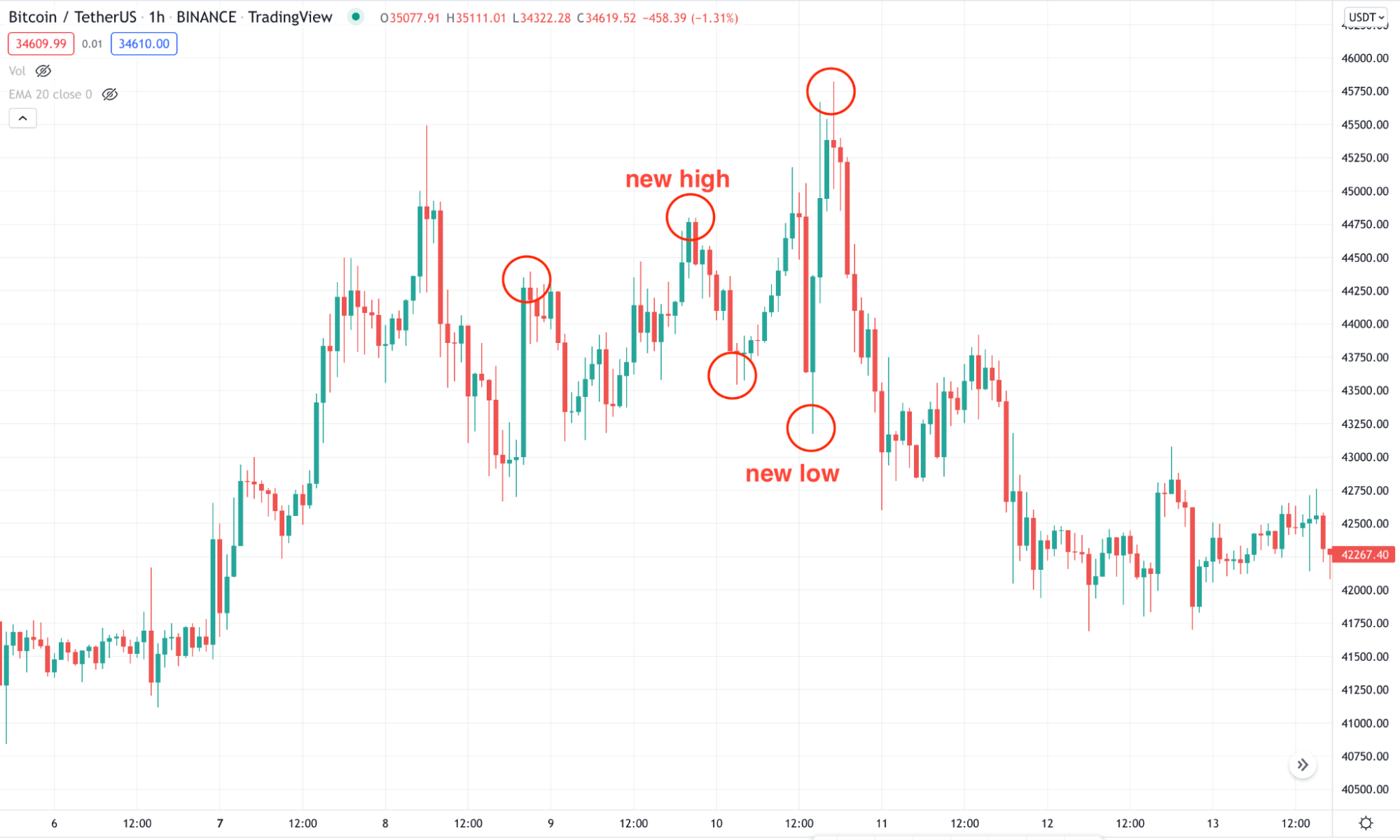

Bilateral pattern example

In the above image, the price moved indecisively by violating near-term swing levels. It is a sign of retail stopping out from the market, which is not suitable for opening a trade.

Continuation pattern

These candle formations usually signal an ongoing trendy price movement.

Continuation pattern example

The above image shows that the price is moving up within a bullish trend where any higher low opens a buying opportunity. This pattern is perfect for adding buying positions within a long-term bullish trend.

Reversal pattern

These candle formations usually occur near the finish line of any trend and signal different directions of the current trend.

Many patterns in the financial market typically signal the same on any timeframe chart of financial assets, including cryptocurrencies. So technical traders frequently rely on these candle formations. Any trading method that uses these patterns is a trading pattern strategy.

In cryptocurrency trading, bullish reversal patterns where bears lose momentum and bulls become active are the most effective ways to buy the coin. The below section will cover effective bitcoin buying methods using this pattern only.

How to trade using trading pattern strategies?

Traders often spot any trading pattern during price movements and combine that info with other technical or fundamental information to create sustainable trading methods. Many trading indicators calculate the market data in various ways to obtain the market context.

The most popular trading patterns are Evening Star, Triple Top or Bottoms, Double Top or Bottoms, Triangle patterns, Cup with Handle patterns, Morning Star, etc. These are popular multi candle patterns alongside many other single candle patterns that are also available and effective in generating trading ideas.

A short-term trading method

We use Morning Star and Evening Star patterns alongside the RSI indicator to determine any trade’s buy/sell positions in this trading method.

- Morning Star contains three candles, one bearish candle, the next candle, whether green or red, has a small body, and the last candle will be a solid buy candle.

- The Evening Star is the exact opposite formation of the morning star containing three candles. These candle formations are effective near any finish line of existing trades. This trading method suits any trading asset at any timeframe; we recommend using a 15-min or hourly chart to catch the best short-term trades.

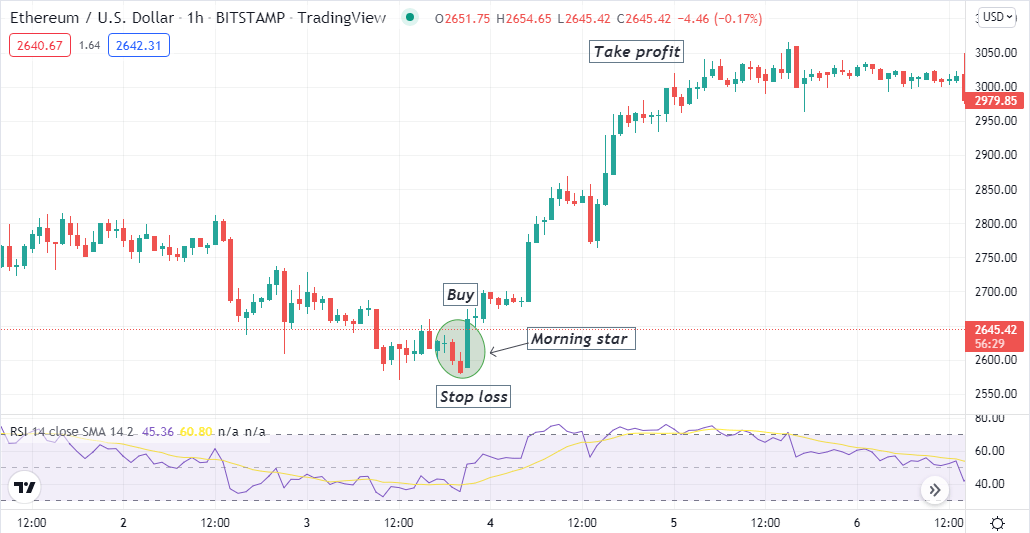

Bullish trade scenario

First, spot the Morning Star formation near any support level and check:

- The last candle completes the appearance of the trading pattern.

- The RSI dynamic line remains at the central (0.0) line or above it and heading upside.

Bullish setup

Entry

When these conditions match your target asset chart, it declares sufficient bullish pressure on the asset price. Place a buy trade.

Stop loss

The initial stop loss will be below the pattern formation with a buffer of 5-10pips.

Take profit

You can continue the buy order till the bullish pressure remains intact. Otherwise, close the buy order when the RSI line reaches the upper (70) line or above that level, or maybe start to decline back toward the central (0.0) line after getting that level.

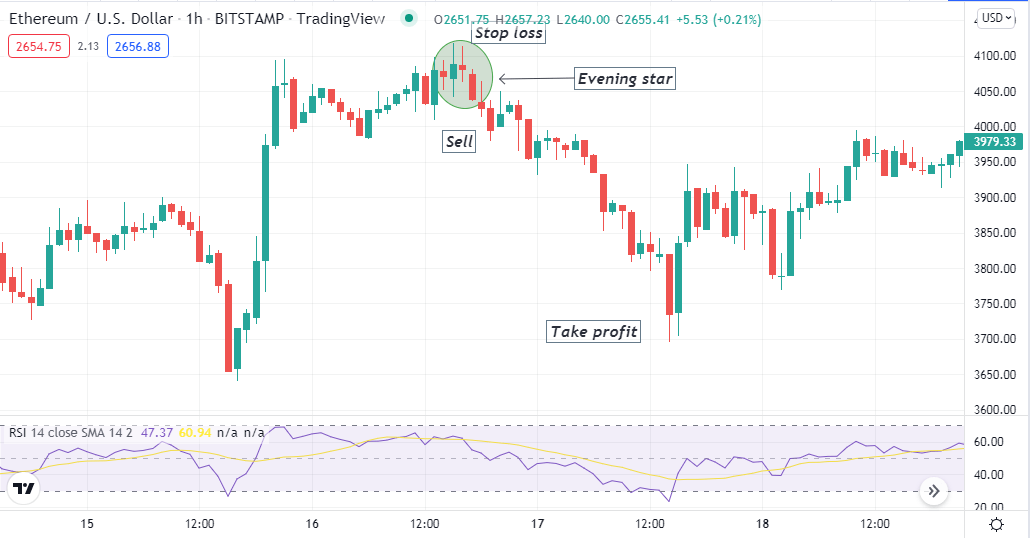

Bearish trade scenario

First, spot the Evening Star formation near any resistance level and check:

- The last candle completes the appearance of the trading pattern.

- The RSI dynamic line remains at the central (0.0) line or below it and heading downside.

Bearish setup

Entry

When these conditions match your target asset chart, it declares sufficient bearish pressure on the asset price. Place a sell trade.

Stop loss

The initial stop loss will be above the pattern formation with a buffer of 5-10pips.

Take profit

You can continue the sell order till the bearish pressure remains intact. Otherwise, close the sell order when the RSI line reaches the lower (30) line or below that level, or maybe start to increase back toward the central (0.0) line after getting that level.

Long-term trading strategy

We use the bullish and bearish engulfing patterns alongside the MA crossover concept in this trading method. Engulfing patterns are multi-candle formations containing two candles. In bullish pattern has a sell candle, and the following buy candle will be larger (close above the previous candle range).

The bearish pattern is the exact opposite formation of the bullish one. We use EMA 10 (green) and EMA 30 (yellow) lines. This trading method suits many timeframe charts; we recommend using an H4 or D1 chart to obtain the best results.

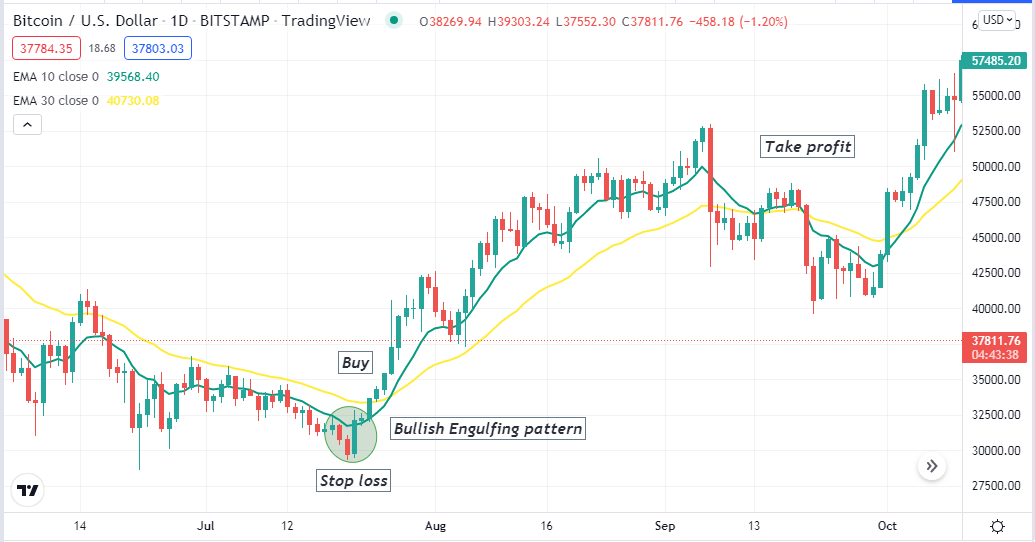

Bullish trade scenario

When seeking to open buy positions, spot a bullish engulfing pattern near any support level and check:

- The pattern completes the formation.

- The green EMA crosses the yellow EMA on the upside.

- Both EMA lines are heading toward the upside.

Bullish setup

Entry

Match these conditions above and open a buy position.

Stop loss

Place an initial stop loss below the trading pattern.

Take profit

You can continue the buy position till the price remains on the uptrend. When the green EMA crosses the yellow EMA line on the downside, close the buy position.

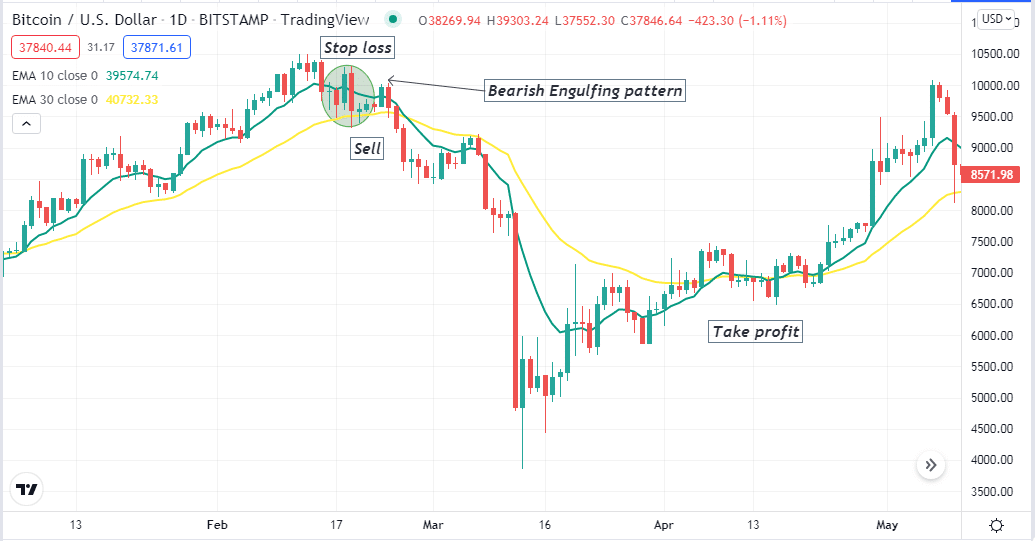

Bearish trade scenario

When seeking to open sell positions, spot a bearish engulfing pattern near any resistance level and check:

- The pattern completes the formation.

- The green EMA crosses the yellow EMA on the downside.

- Both EMA lines are heading toward the downside.

Bearish setup

Entry

Match these conditions above and open a sell position.

Stop loss

Place an initial stop loss above the trading pattern.

Take profit

You can continue the sell position till the price remains on the downtrend. When the green EMA crosses the yellow EMA line on the upside, close the sell position.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Professional financial traders, including crypto experts, frequently use trading patterns while making trade decisions. Many other patterns and indicators are available to create other trading methods for trading crypto assets. We suggest following proper trade and money management concepts while trading using these trading strategies.

Comments