The crypto industry has been booming in recent years. The marketplace has trillions of dollars in market cap and thousands of crypto projects. Many crypto investors have made millions of dollars in recent years from this marketplace, so the crypto-verse has become an exciting topic, and the market has become attractive.

However, all novice traders come to the crypto market intending to make millions of dollars, all of them don’t get the same results, and some may lose their capital. This article will guide you to crypto trading alongside describing trading strategies that can lead you to become a millionaire.

How old do you have to be to buy cryptocurrency?

There are no age restrictions to buying cryptocurrencies. If you are underage or below 18 years old, you won’t have the privileges of mature persons with credit cards or bank accounts. It requires opening an account in crypto exchange platforms or having a crypto wallet to buy cryptocurrency. Most exchange platforms and wallets mandate at least 18-years old to gain access to various facilities. If you are below 18, you can buy cryptocurrencies with the help of senior persons.

What is a millionaire mindset in crypto trading?

Regarding graph appearance, crypto assets are similar to other financial assets like stocks, bonds, or fiat currencies. Expert traders who make millions from this sector never stop learning as crypto assets are a new addition to the financial world. They explore the complexity of crypto trading psychology to build a built fortune over time.

Novice crypto investors often feel confused about the impulsive and erratic behavior of chaotic price movements and volatility of crypto assets. The proper way is to remain calm, non-reactive to the crypto market, and learn from previous mistakes. Successful crypto traders follow some specific methods and choose assets wisely by checking on several significant factors, including historical price movements, the utility of the asset, acceptance, future projections, the community behind the project, etc.

How to trade using a millionaire mindset?

It is a mandatory fact to have a proper mindset while trading cryptocurrencies. There are many ways to generate income, including trading, staking/lending, investing, etc. Long-term crypto investors often store cryptocurrencies in wallets and hold them for the long term till the price reaches the top. Scalper and day traders like to frequent trades; they conduct technical and fundamental analysis while making trade decisions.

Short-term trading strategy

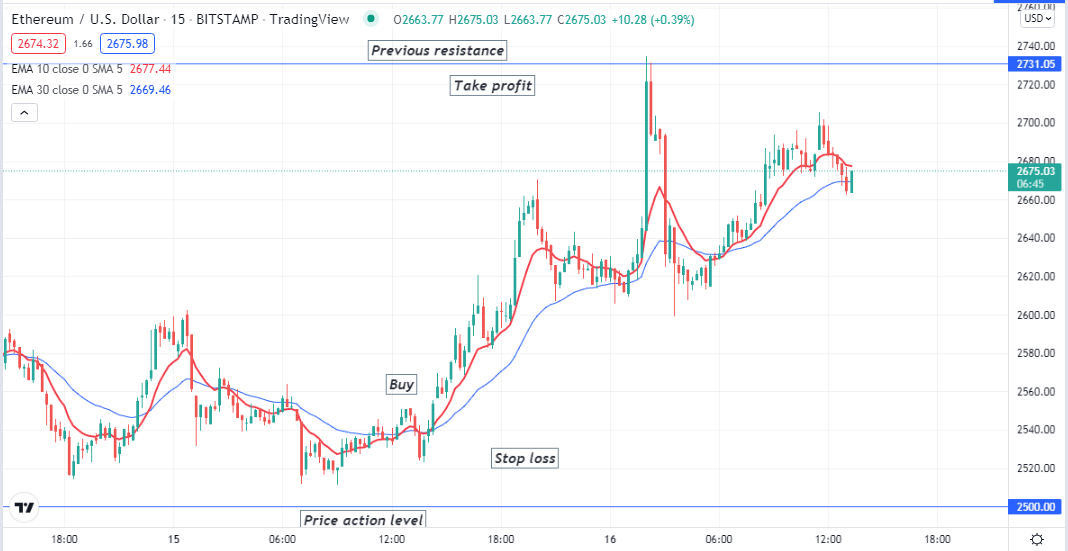

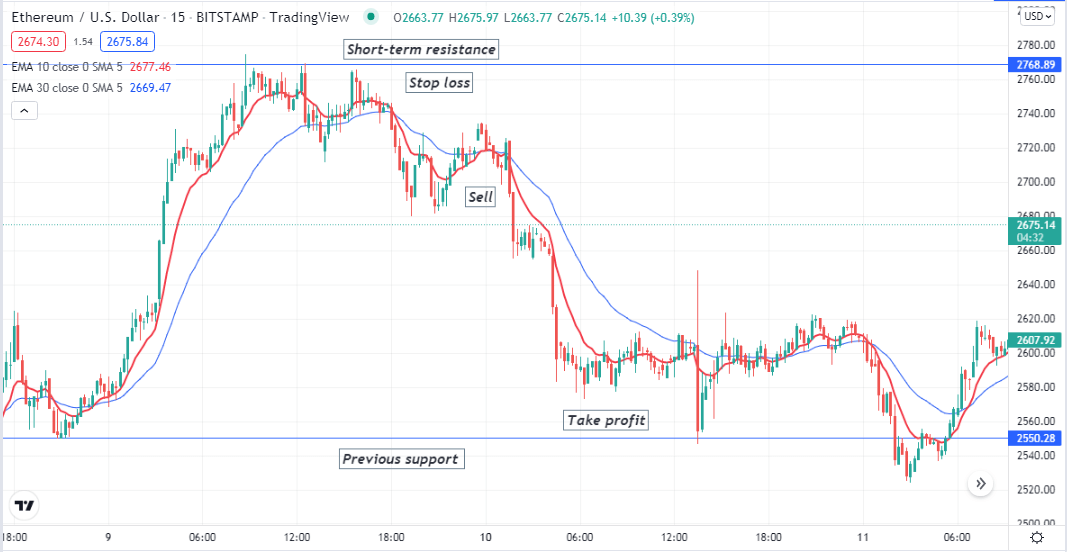

This short-term trading method combines support resistance with the MA crossover concept to determine trading positions. First spot basic levels such as support resistance, historical levels, price action levels, etc., from H4 or daily charts. Then seek entry/exit positions at a lower time frame, including 15 min or hourly charts. We use EMA 10 and EMA 30 crossovers for confirmation before entering trades.

Bullish trade scenario

When the price reaches any support level, check moving average lines. Observe when:

- The EMA 10 line crosses the EMA 30 on the upside.

- Both EMA lines are heading toward the upside.

Bullish setup

Entry

These conditions above match your target asset chart and declare bullish momentum on the asset price. Open a buy order.

Stop loss

Place an initial stop loss below the bullish momentum with a 5-10 pips buffer.

Take profit

Continue the buy trade till the bullish momentum remains intact, but the initial take profit target will be below the next resistance level. Close the position when the EMA 10 drops below the EMA 30.

Bearish trade scenario

When the price reaches any resistance level, check moving average lines. Observe when:

- The EMA 10 line crosses the EMA 30 on the downside.

- Both EMA lines are heading toward the downside.

Bearish setup

Entry

These conditions above match your target asset chart and declare bearish momentum on the asset price. Open a sell order.

Stop loss

Place an initial stop loss above the bearish momentum with a buffer of 5-10 pips.

Take profit

Continue the sell trade till the bearish momentum remains intact, but the initial take profit target will be below the next support level. Close the position when the EMA 10 crosses above the EMA 30.

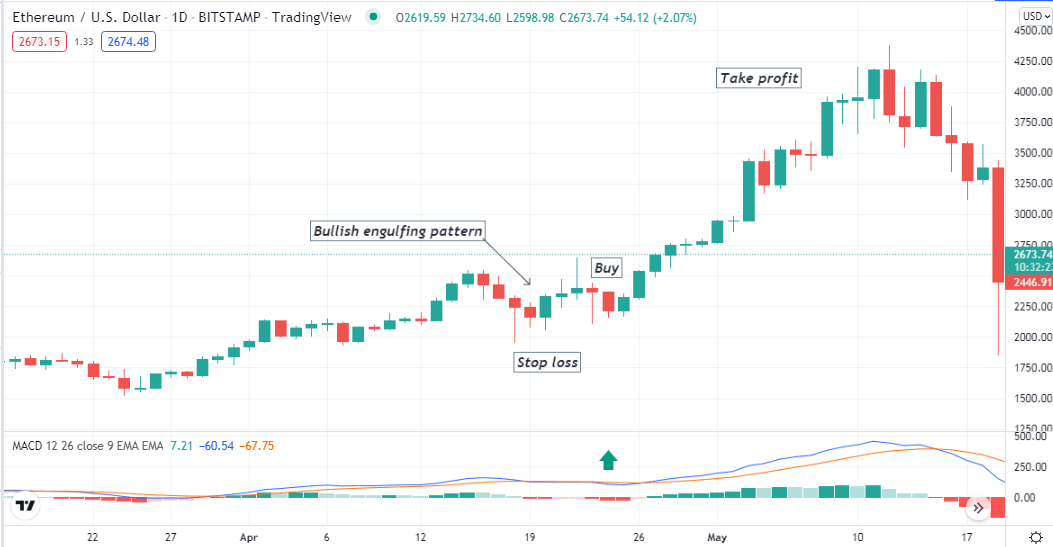

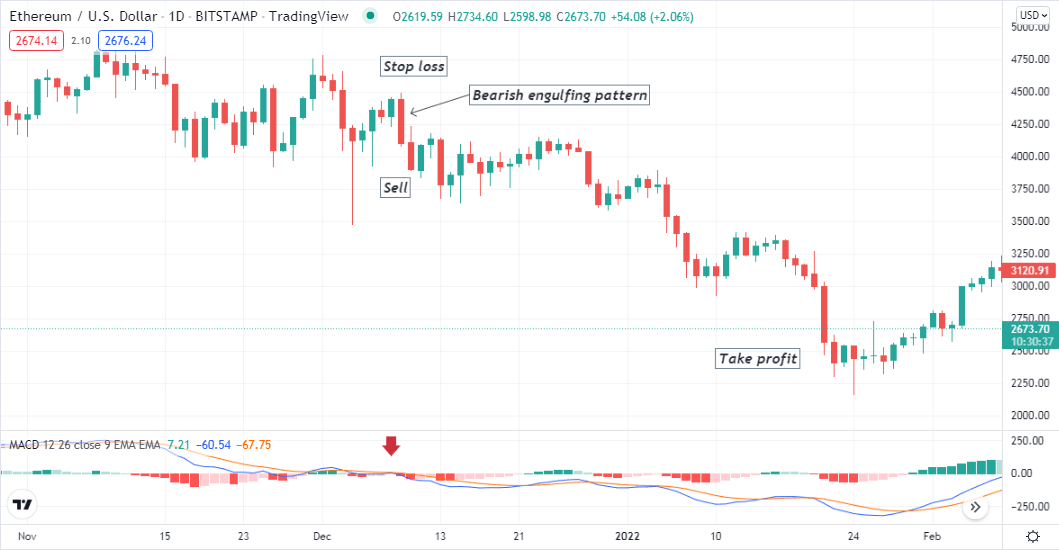

Long-term trading strategy

We combine the bullish and bearish engulfing pattern with the MACD indicator readings to generate long-term trading ideas. First, we mark engulfing patterns near support resistance and then verify the order directions from the MACD indicator window. This trading method suits many time frames; we recommend using a daily or an H4 chart to determine the most potent long-term trading positions.

Bullish trade scenario

First spot a bullish engulfing pattern near any finish line of a downtrend containing a small sell candle and the next big buy candle covering the previous candle’s range. Then check the MACD window.

- The dynamic blue line reaches above the dynamic red line, and both head on the upside.

- MACD green histogram bars take place above the central line.

Bullish setup

Entry

These conditions match your target asset chart, declaring the buyer’s domination on the asset price. Place buy order.

Stop loss

The initial stop loss level will be below the current swing low.

Take profit

You can continue the buy order till the price surges upside. Close the buy order when:

- The dynamic blue line crosses the dynamic red line on the downside at the MACD indicator window.

- MACD red histogram bar takes place below the central line.

Bearish trade scenario

First spot a bearish engulfing pattern near any finish line of an uptrend containing a small buy candle and the next big sell candle covering the previous candle’s range. Then check the MACD window.

- The dynamic blue line reaches below the dynamic red line, and both head on the downside.

- MACD red histogram bars take place below the central line.

Bearish setup

Entry

These conditions match your target asset chart, declaring the seller’s domination on the asset price. Place sell order.

Stop loss

The initial stop loss level will be above the current swing high.

Take profit

You can continue the sell order till the price declines. Close the sell order when:

- The dynamic blue line crosses the dynamic red line on the upside at the MACD indicator window.

- MACD green histogram bar takes place above the central line.

Pros and cons of these strategies

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

The journey to be a millionaire crypto trader is either easy or not complicated. Following some specific rules can lead you to be a millionaire crypto trader over a certain period.

Comments