The crypto industry enables making money in several ways alongside traditional trading, generating passive income becoming increasingly popular among crypto investors alongside frequent trading, mining, and investing. Many crypto projects allow considerable returns for holding those assets for a particular period. There are dozens of ways to generate returns in the background without participating in frequent trades.

However, it is mandatory to learn procedures and execute them correctly by following particular methods while generating passive incomes from cryptocurrencies. This article will briefly discuss various passive income crypto trading strategies.

What is passive income crypto?

Crypto projects generate passive incomes alongside traditional buy/sell like many other financial assets. When earning passive income from cryptocurrencies enables making money without frequent participation. The earning amount depends on the capital sizes and selected methods. Crypto assets allow generating yield by holding several assets for specific periods. However, there is no guarantee that any passive income strategy will work 100% accurately all the time and be dependable on the risk-reward ratio of holding particular cryptocurrencies.

How to generate income using a passive income crypto trading strategy?

Most of the potential ways to earn passive income depend on lending and borrowing crypto assets. Different popular crypto passive income methods are including

- PoS (proof of stake)

- Digital assets accounts of interest-bearing

- Cloud mining

- Lending

- Yield farming

- Dividend earning tokens

- Affiliate programs

- Running a lighting node

- Forks and airdrops

- Master nodes

Most of these methods suit any individual investor from anywhere in the globe. Anyway, these methods of making money through traditional buy/sell/holding and passive income are often stressful and time-consuming. It requires constant tracking of portfolios, capitalizing on opportunities, and managing positions. The following part will discuss different passive income crypto trading strategies.

A short-term trading strategy

You can become a liquidity provider when seeking short-term investment ideas to generate passive income from cryptocurrencies. On the other hand, you can generate short-term sell trade ideas by conducting technical analysis using many technical tools, indicators, price action, or crypto chart patterns.

Bullish trade scenario

A significant number of decentralized exchange (DEX) platforms that use AMM (automated market maker) protocol that enable crypto holders to generate a yield over a particular period. The decentralized liquidity pool feature allows a community to contribute to the liquidity by maintaining their proportionate share of the pool. When crypto investors source liquidity from any pool, they usually pay a 0.2-0.3% trading fee. The earring amount will vary considerably with the platform and pool. More liquidity and trading volume is the key to generating more income through this method. Yield can range over 100% API.

Bearish trade scenario

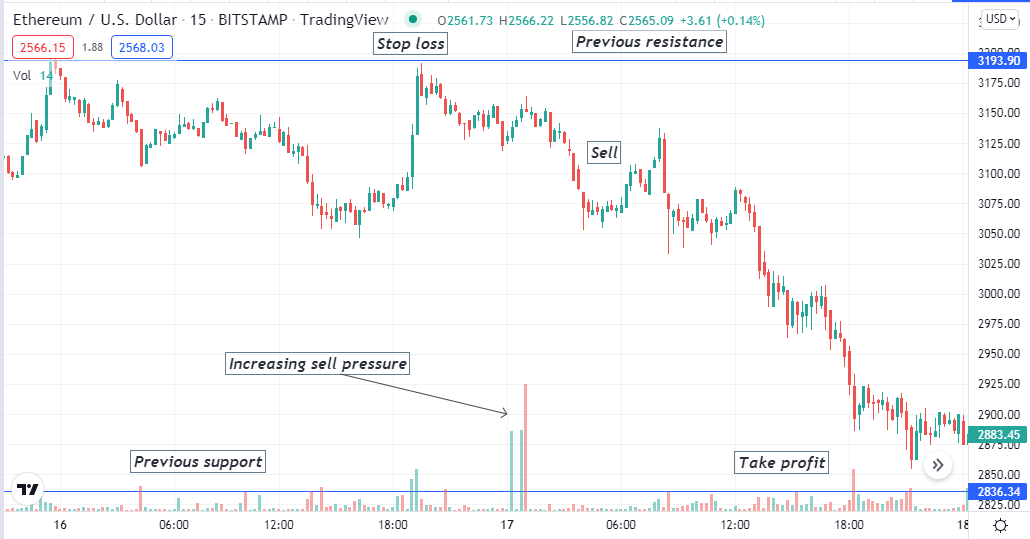

When seeking short-term profit-making from crypto assets, determine adequate levels such as support resistance levels, historical levels, price action levels, etc., from upper timeframes like H4, D1, or weekly charts. Then seek entry-exit positions in a smaller time frame like 15 min or H1 charts. In this trading method, we use the volume indicator for confirmation.

Bearish setup

Entry

When the price reaches near any resistance level, and the volume indicator starts declaring sufficient selling pressure on the asset price, execute sell trades.

Stop loss

The initial stop loss level will be above the bearish momentum with a buffer of 5-10pips.

Take profit

The initial profit target will be above the next support level. You can continue your sell position until the trend remains intact. Otherwise, close the sell position manually when the volume indicator declares increasing buying pressure.

Long-term trading strategy

When seeking to generate long-term passive income, there are several ways, including interest-bearing digital assets account and lending. Meanwhile, you can earn long-term profits by selling any crypto asset for a more extended period depending on several factors. The amount of profit will be dependent on several factors, including investment type, amount, medium, etc. These methods suit any potential crypto asset in any timeframe.

Bullish trade scenario

Interest-bearing crypto accounts enable earning fixed interest over a specific period by holding particular crypto assets on many platforms. In this way, users generate profits from holding crypto assets like any other traditional interest-bearing fiat bank account. The primary difference is these services only support digital assets or cryptocurrencies as an investment. In this way, you deposit your cryptocurrency in these accounts to get a predefined interest rate daily, weekly, monthly, or yearly instead of storing it in any crypto wallet.

Another popular way of generating long-term passive income from crypto assets is lending. It has become an increasingly popular service for both the decentralized and centralized segments of the crypto industry. You can lend your crypto assets to the borrowers and earn interest when you have crypto in your possession. Several approaches are available for lending, such as centralized lending, decentralized lending, P2P lending, and margin lending. Individual investors can choose any of these methods that suit their return expectations as often many platforms offer different amounts of interest.

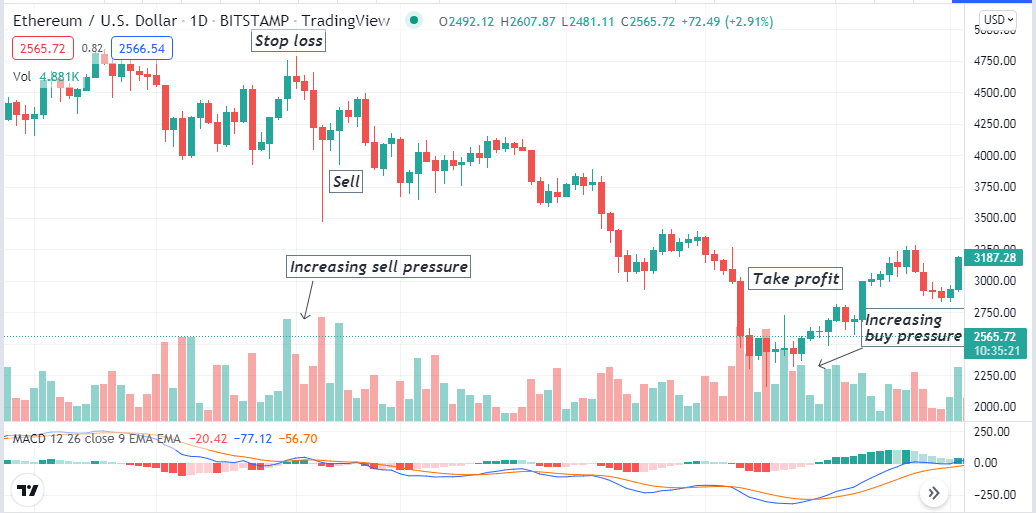

Bearish trade scenario

This long-term bearish trading method combines two popular technical indicators, the MACD and the volume indicator. Observe the price reaches near any peak and starts to decline to seek entry positions when:

- The dynamic blue line comes below the dynamic red line on the MACD indicator window.

- MACD red histogram bars take place below the central line.

- The volume indicator declares increasing sell pressure on the asset price.

Bearish setup

Entry

Match these conditions above and open a sell position.

Stop loss

The initial stop loss will be above the bearish momentum. You can shift the stop loss below or at the breakeven point when the price makes a new lower low.

Take profit

Close the sell position when

- The dynamic blue line crosses the dynamic red line on the downside at the MACD window.

- MACD green histogram bars take place above the central line.

- The volume indicator declares increasing buy pressure.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Financial investors from various sectors sign up to earn money by utilizing opportunities. The crypto industry has become an attractive sector for enabling multiple exciting features in recent years. We suggest doing some additional research before executing any of these methods.

Comments