Forex trading sounds appealing, and it is, indeed, a great way to earn money. But people can sometimes take it to extremes. We mean that people expect to gain too much too fast and don’t take the time to consider the risks that come with the turf.

Some reckless investors also tend to dive in, head-first, into trading, without fashioning any sense of a plan on what they would like to achieve or thinking about the best ways to fulfill their financial goals. Today, we are learning how to trade in forex responsibly.

What is risk management?

Risk management in any area includes implementing specific rules or measures to ensure that the risks that occur during the process are acceptable. In the forex market, risks associated with that kind of trading are something the traders can withstand.

Simply put, while we can’t eliminate the risk of losing money while trading, risk management strategies help us minimize the losses and avoid them when such a thing is possible.

Importance of risk management

The importance of risk management is beyond comparison, and putting it in simple terms, risk management separates a trader from a gambler. Not to sound too harsh, but no trader should place a bet before understanding the risks of taking the position.

Seven best risk management strategies for forex traders

1. Build a plan

The first step in every initiative should be to devise a plan of action to help you determine a goal and the best way to go about it. In trading, the plan will allow you to assess your red lines both in terms of losses and in terms of how risky a position you can assume.

When planning, be sure to make it your own and not just copy somebody else’s work. Not everybody has the same goals, and we don’t all have the same monetary resources at our disposal.

2. Know what you can lose, and only trade that

The second approach ties in perfectly with the first one, and it seems a little bit like a no-brainer. We have to mention it separately because most new people tend to overlook this fact and assume they will be lucky.

You wouldn’t walk into a casino and bet your entire house on one game, right? The same rule applies here; only risk what you are willing to lose and not overtrade by using excessive lot sizes. It would help if you protected your margin and capital at the end of the day.

3. Understand the leverage

Leverage means using the money you borrowed from a brokerage to make your bet, which allows you to increase the return from your bet through the simple fact that you invested more. Take this example, if you use a leverage of 1:100, it means for every $1 you invest, you can potentially make $100. But you can also lose $100 should the trade go in the opposite direction.

Even though that does sound appealing, some beginners tend to think of leverage as a magic pill that will lead them to financial heaven. They fail to consider that leverage can also multiply their losses and make them spend the money they don’t have. So, the advice here is to do your research and go easy on the leverage, at least initially.

4. Utilize stop loss and take profit targets

Many traders can identify a stop loss, but they fail to place the order, and it remains a mental stop loss. They monitor the loss, wait, and hope the price will go in their direction as the market moves. This is often a mistake, and the loss becomes too big that they have lost all or most of their money by the time they realize it. When you decide on a stop loss, you need to enter it into your order and not only keep it in mind.

Setting a take-profit target is just as important as a stop loss. The take profit is where you anticipate the market will reach to allow you to exit in profit.

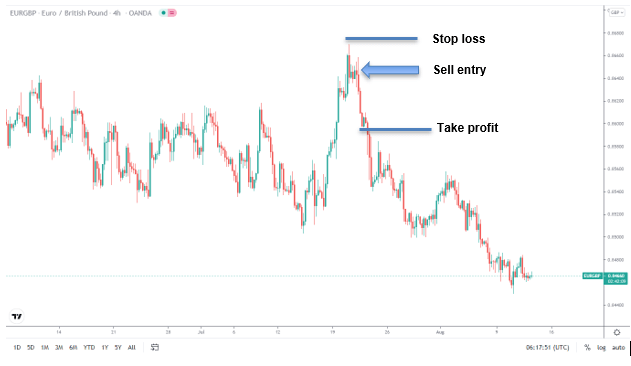

EUR/GBP chart

The chart shows the EUR/GBP pair price chart on the 1-HR time frame. If you were to sell at the blue arrow, you would see a stop loss above the entry price. If the market touched this price, it would close your position in a loss. Conversely, if the price moved down, like in the chart, and reached your take profit level, it would close in profit.

5. Look for a solid risk-to-reward ratio

It is a ratio of how much you are willing to risk for a particular reward. The higher the risk-to-reward ratio, the higher the risk you are ready to take.

There isn’t a correct answer on the ratio, but 1:2 should be solid to get you started. For example, if you choose a 1:2 reward ratio, you risk $1 to make $2. In practical terms, if your stop-loss is 30 pips above your entry price, then your take profit will be 60 pips away.

Of course, as you gain more and more experience, you can adapt your risk ratio accordingly.

6. Keep your emotions in check

It is easy to take our wins or failures personally. Trading is no different in that regard. Of course, we are emotional beings and rational, and our emotions influence our decisions.

Trading and investing can be extremely emotionally taxing, and feelings such as temptation and greed can cloud your judgment in a second. Other emotions, like fear, anxiety, and indecisiveness, can usually make you miss out on opportunities that, at the moment, seem too good to be true or out of reach.

7. Keep an eye on the news

Keeping an eye on the news is an understatement. If you plan to invest in forex, knowing as much as possible about significant economies and principal bilateral ties around the most powerful countries in the world is a must.

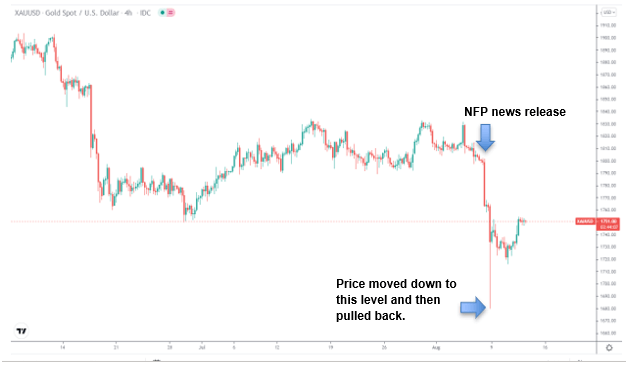

XAU/USD chart

An example of how news events affect currencies is visible in this XAU/USD price chart. The important news that impacted this pair was the US NFP report which releases the number of new jobs added to the US labor market every month.

In this instance, the NFP report released good numbers, which is good news for the US dollar. Therefore the price of gold declined sharply within a few hours. Similarly, this type of news creates a good amount of volatility in the market, which is an unavoidable risk.

Final thoughts

As you probably guessed, there is no quick way to cover it all in just seven points. There are so many nuances to trading and things you can learn once you get into it. Like with everything else in life, it’s trial and error that teaches you how to become better.

That’s why we are going to leave you with one final piece of advice. Make a demo account. There are so many different platforms that allow you to do just that. In the process, you will get to iron out all the minor flaws in your strategy and determine what you like and want. And that is already plenty to begin on.

Comments