In trading, you cannot open a deal just after learning some strategy. It requires patience and practice to get familiar with a trading system. However, the primary requirement has a profitable strategy that you can quickly test with backtesting.

Do you think you have great ideas about the market, but you don’t know how to test them without risking your funds? Learning how to test trading ideas on historical data is bread and butter for an excellent systematic trader.

The basic premise of such testing is that what worked in the past may work in the future. But how do you do it yourself? How to evaluate the results? Let’s take a look at this simple process.

What is the backtesting of the FX trading strategy?

It means testing a trading system in the past chart. You can open it, implement your trading logic there, and see how it shows the result. However, the manual system requires a lot of time and effort to make backtesting hard for traders. On the other hand, some software, MT4 integrations, and websites provide automated backtesting opportunities. You can access their service and implement your logic with the provided chart. Once the analysis is done, you will see the details of the trading performance. If the performance is good, you are ready to use the system with real money. On the other hand, if the system is not good, you have to add logic or change the system.

Besides profitability, the backtesting report shows other information like drawdown, winning percentage, Z-factor, and others. Therefore, traders can justify the overall performance before moving with real money.

How does the backtesting work?

It needs additional attention as your complete FX journey depends on how much profit your trading strategy is. Therefore, make sure to follow the five steps from the below section while choosing the best backtesting method for you.

Step 1. Identify the trading strategy

Logically, you need to have a trading strategy before testing it in the past chart. There are thousands of trading methods in the world, but you can differentiate their category based on three different types:

Automated trading systems are new in the investment world but have become famous due to their strong profitability. However, human brains have some limitations that do not allow people to perform too many activities at a time.

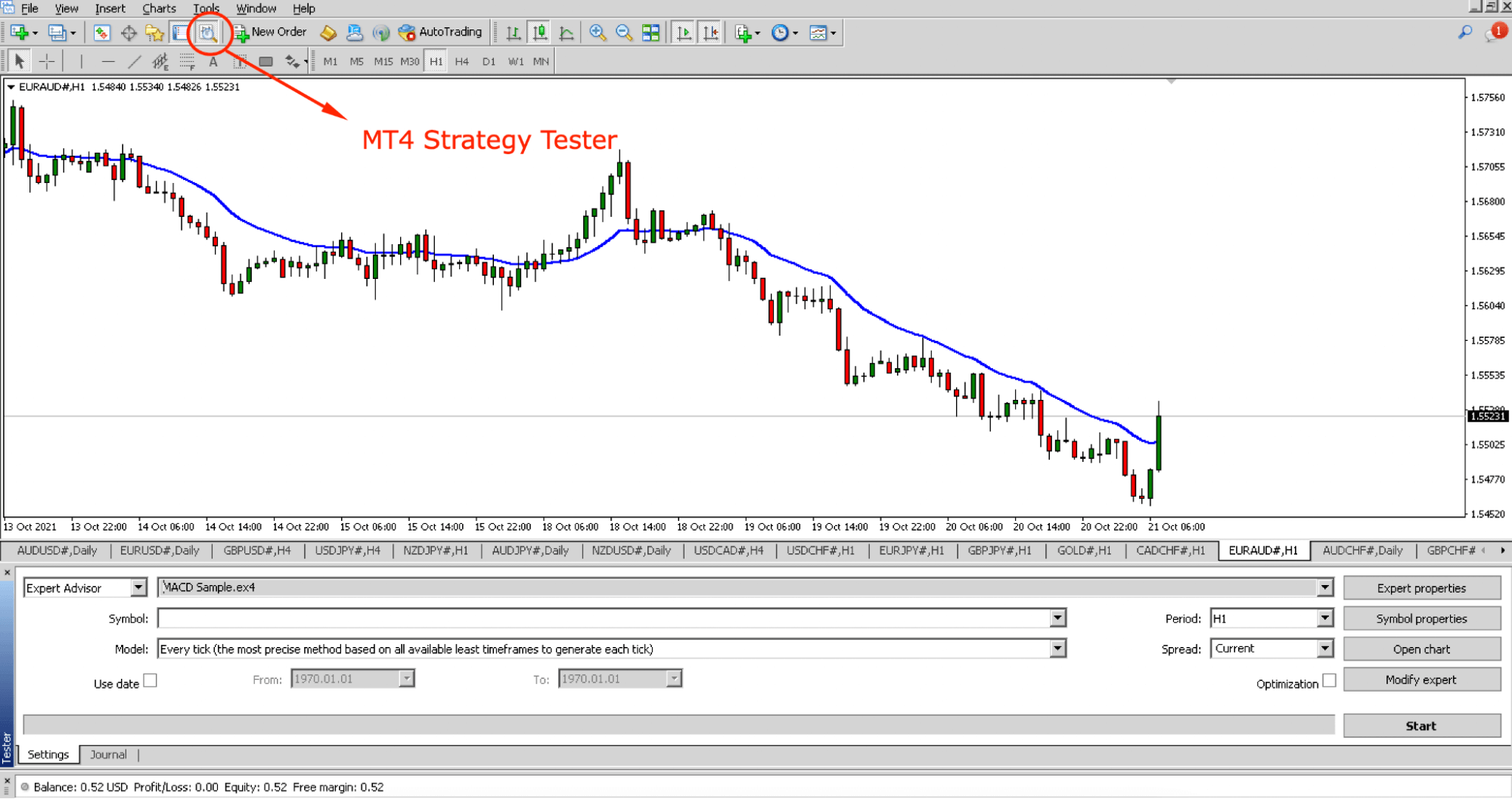

On the other hand, expert advisors can solve complex solutions and make profits within a second. Therefore, if you are interested in an automated system, you should backtest it with the strategy tester in the MT4 platform.

On the other hand, the manual system is based on technical and fundamental analysis where traders research the market with indicators. Before using any manual system, you should backtest it on Strategy Tester or Tradingview.

Step 2. Try understanding the logic

Before backtesting, you should know what logic the strategy uses. In automated trading, systems use complex calculations, but you should know the basic idea about how it works. It does not need any coding knowledge.

On the other hand, the manual trading systems are based on different indicators that require direct knowledge about trading and market analysis. If your trading strategy has a fundamental direction, it will be hard to backtest it as fundamental releases do not repeat the price action. For technical strategy, you can easily backtest it in the past chart using the MT4 strategy tester. Whether you backtest it or know the strategy will help you understand in case of any system disruption.

Step 3. Move to the testing software

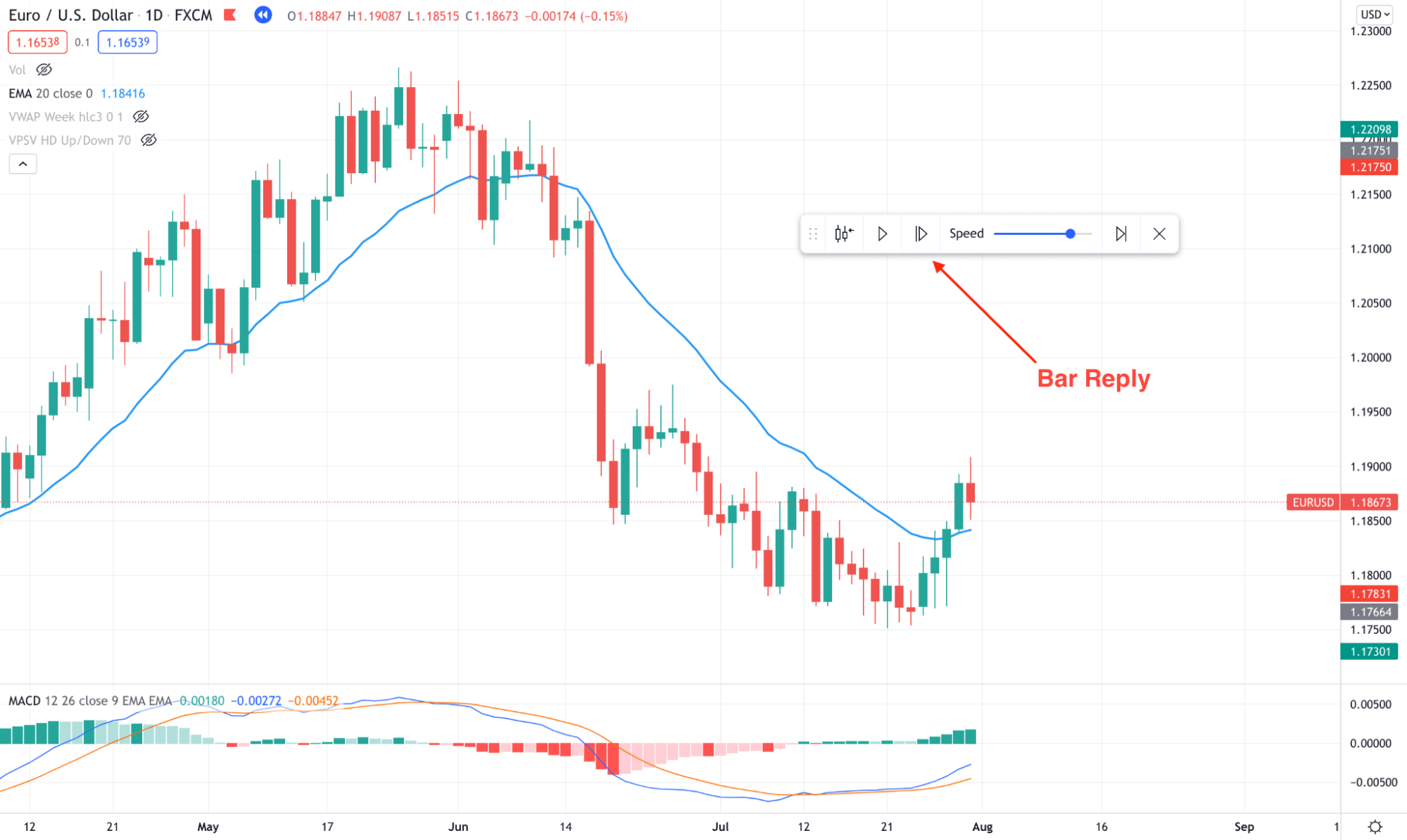

In this section, we will see the list of backtesting software with a comparison to understand which method is best for you. If you have a manual system and want to see the result manually, it is better to use the Tradingview Bar reply. Here you can select the date from where you want to see the chart. Once you set the date, you can see the price like the real market.

Bar reply

On the other hand, for the MT4 automated system, you can use the strategy tester in your MT4 or MT5 platform.

Strategy tester

Step 4. Use long duration

The sentiment of the global FX market changes with the quarter. Therefore, while you backtest a trading strategy, make sure to select the duration more than a quarter. The ideal approach is to use a minimum of six months in backtesting. On the other hand, if you plan to invest a lot of money in a trading system, you should backtest it in more than one year’s price chart.

Step 5. Use analytics

Once you complete backtesting, the system will generate an analysis for you. As a result, you can see the trading performance, including the profitability, drawdown, risk factor, winning percentage, and success rate. Generally, a trading system with a low-risk factor has a low success rate.

On the other hand, trading strategies with higher risks have higher profitability, but it can cause a higher drawdown and even a fund loss. In real trading, you should ensure that the profitability is satisfactory and the risk factor is low. As a trader, we aim to follow a trading method that uses a strong risk management system.

Example of performance report

What are the results of a good trading system?

- Profit in points. If the average profitability is less than 500 points per year, such a system cannot be called effective.

- Low drawdown. A high-quality strategy does not have a drawdown of more than 70% in history. A drawdown of 70% is considered critical since this drawdown can lead to a stop-out (closing of deals by the broker) in real conditions.

- The spread widens several times every day at 00.00 of your terminal time. We are talking about the transfer of positions to the next day, which causes the so-called swap. In a quality strategy, this should be foreseen.

The number of winning trades should prevail over the number of losing ones. Moreover, the maximum loss should not be ten times greater than the minimum profit. Otherwise, the strategy will turn out to be low-profit or lead to the loss of the entire deposit.

Final thoughts

In the last section, we can say that backtesting is a process that can reduce your time and increase trustworthiness in a trading system. In our busy world, spending too much time observing a trading method is not wise. In that case, the only way to get success is to follow an automated backtesting method.

Comments