The FX trading strategy is a set of conditions that allow traders to open buy or sell positions in trading. For successful trading, there is no alternative to having a profitable system. Whatever the strategy you use, the ultimate target is making money online.

Some market participants think the short-term indicator-based systems as profitable, while other traders find naked charts as effective. Many traders switch their trading strategies very often and end up frustrated. From the very beginning, if you have failed to find and follow a profitable forex trading system, your journey in FX trading will not be fruitful.

There is no alternative to having a profitable trading strategy. If you have roamed the internet to find a suitable system, you have noticed enormous methodologies available, and picking a perfect one is not hard.

If you want to save your time, we can suggest you follow the next section, where we will discuss some forex trading systems that are very effective in any currency pair.

What are the types of trading strategies?

Trading strategies are a set of rules or conditions that need to be met before opening a buying or selling entry in any financial market. However, the forex market is the most liquid marketplace where retail traders have a tiny trading volume. In that sense, trading strategies in the forex market might be different from others.

Based on the duration of trade, we can distinguish trading strategies as short-term and long-term systems. The short-term trading system covers scalping and intraday trading, while long-term trading means swing trading or position trading.

Moreover, some trading strategies have multiple indicators to filter out trading conditions, while others include naked price action indicators without any messy tools. Finally, some traders use a combination of automated and manual tools to make trading more perfect. However, the success in forex trading depends on how well you understand the buyer’s and seller’s activity in the price chart.

Which three forex strategies are most profitable?

There are thousands of trading systems online where the profitability depends on how accurate the trading conditions are. Traders often struggle to find a suitable trading system based on their personality. However, it would help to focus on scalping for professional and full-time trading, where all trading activities are completed within the trading day.

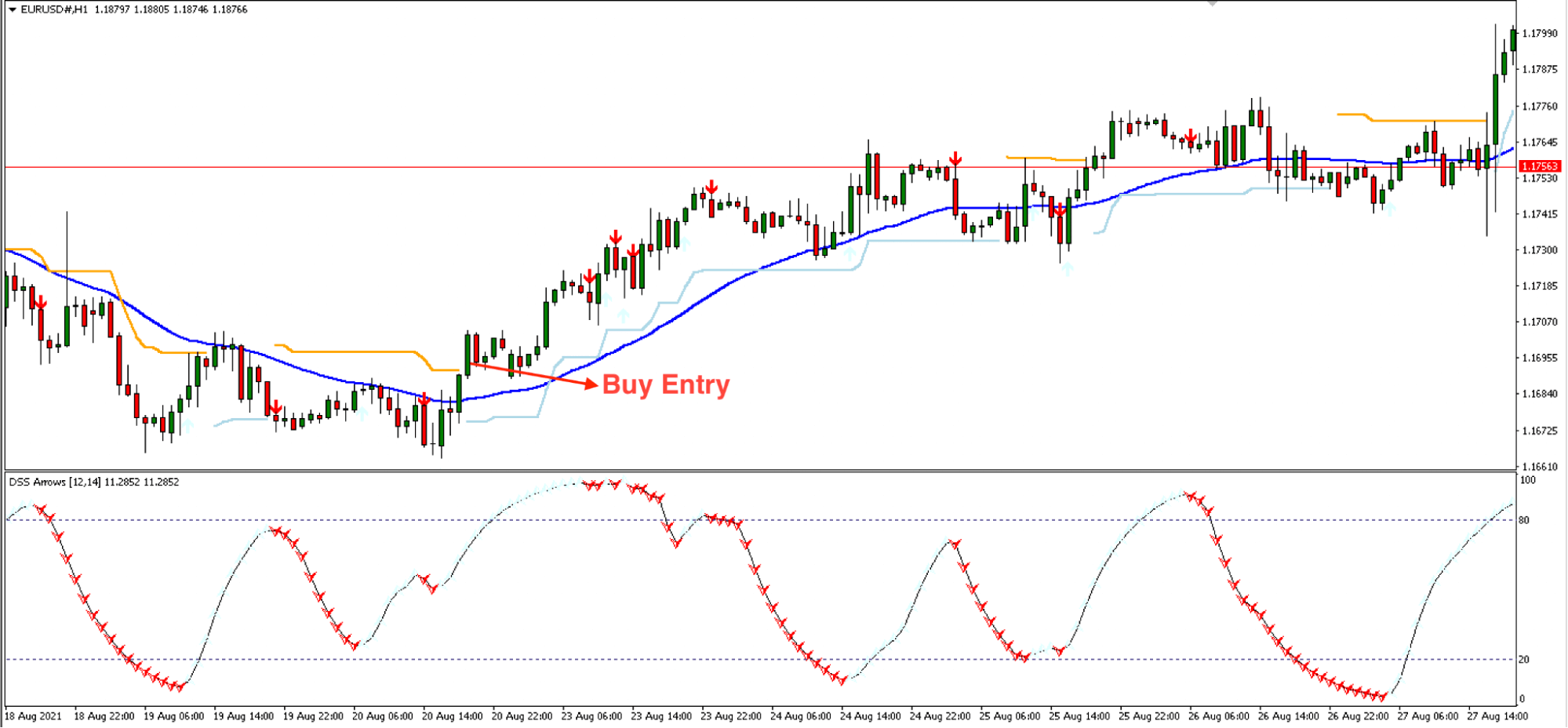

1. Bali scalping strategy

It is a pure indicator-based system that is very profitable on the EUR/USD H1 time frame. A trend-following method catches the profit when the average market participants follow the single direction.

Let’s see what indicators used in this system:

- Moving average linear — value 48

- Trend envelopes_v2 — value 2

- DSS of momentum — 18.16, 3, 8

These indicators should provide the same direction, and the trading entry is valid as long as the price follows the direction.

Entry

The price should move above the moving average with an upward movement in the DSS Arrow. Therefore, open a buy trade from a bullish candle above the Trend envelope — yellow line as marked in the image below.

Example of Bali scalping

Stop loss

This trading strategy ignored the complexity and focused on setting the stop loss at 25 pips away from the entry.

Take profit

The ideal approach of this method is to get 2X profit from the risk. Therefore, based on the stop loss, the take profit should come at 50 pips.

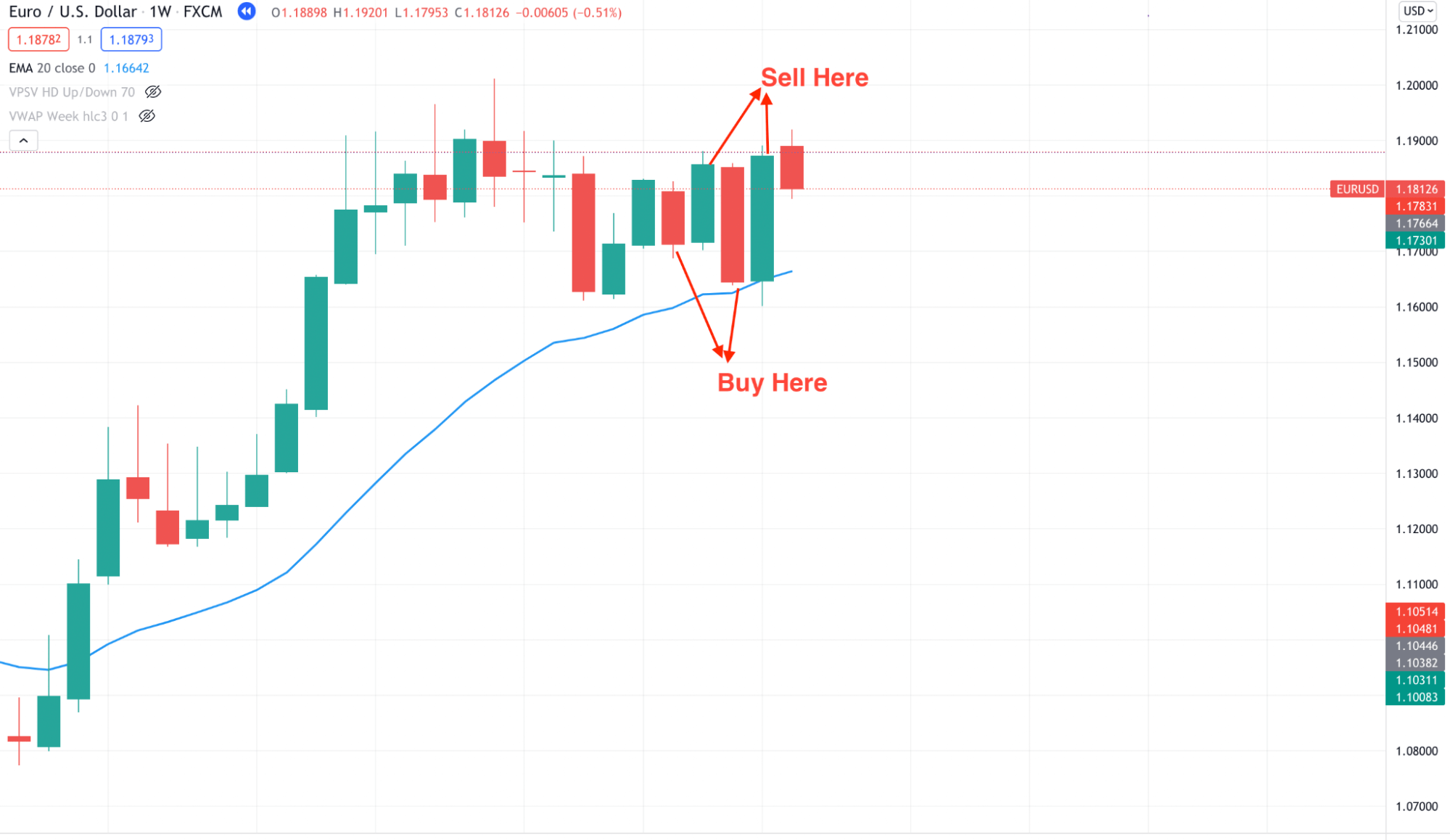

2. All-bank scalping strategy

All bank scalping is different from traditional scalping systems as it uses Weekly timeframes to catch the price movement. It uses the spring principle of the price movement, which requires W1 timeframes in the trading chart.

This method uses multiple trading pairs from majors to minors where a trader should identify a currency pair where the Weekly opening and closing price has the longest distance.

Entry

After finding the longest gap, you should open a buy trade if the weekly candle closes as bearish. Similarly, you should open a sell trade if the candle closes as bullish.

Stop loss

This strategy uses a fixed stop loss of 100-140 pips. Again, make sure to consider the near-term swing levels in calculating the stop loss.

Take profit

In this method, the trade should be closed after getting 50-70 points of profits. However, if the profit target does not reach the middle of the week, you should complete the trade in profit or loss and focus on the weekly closing to make another approach.

All-bank scalping strategy

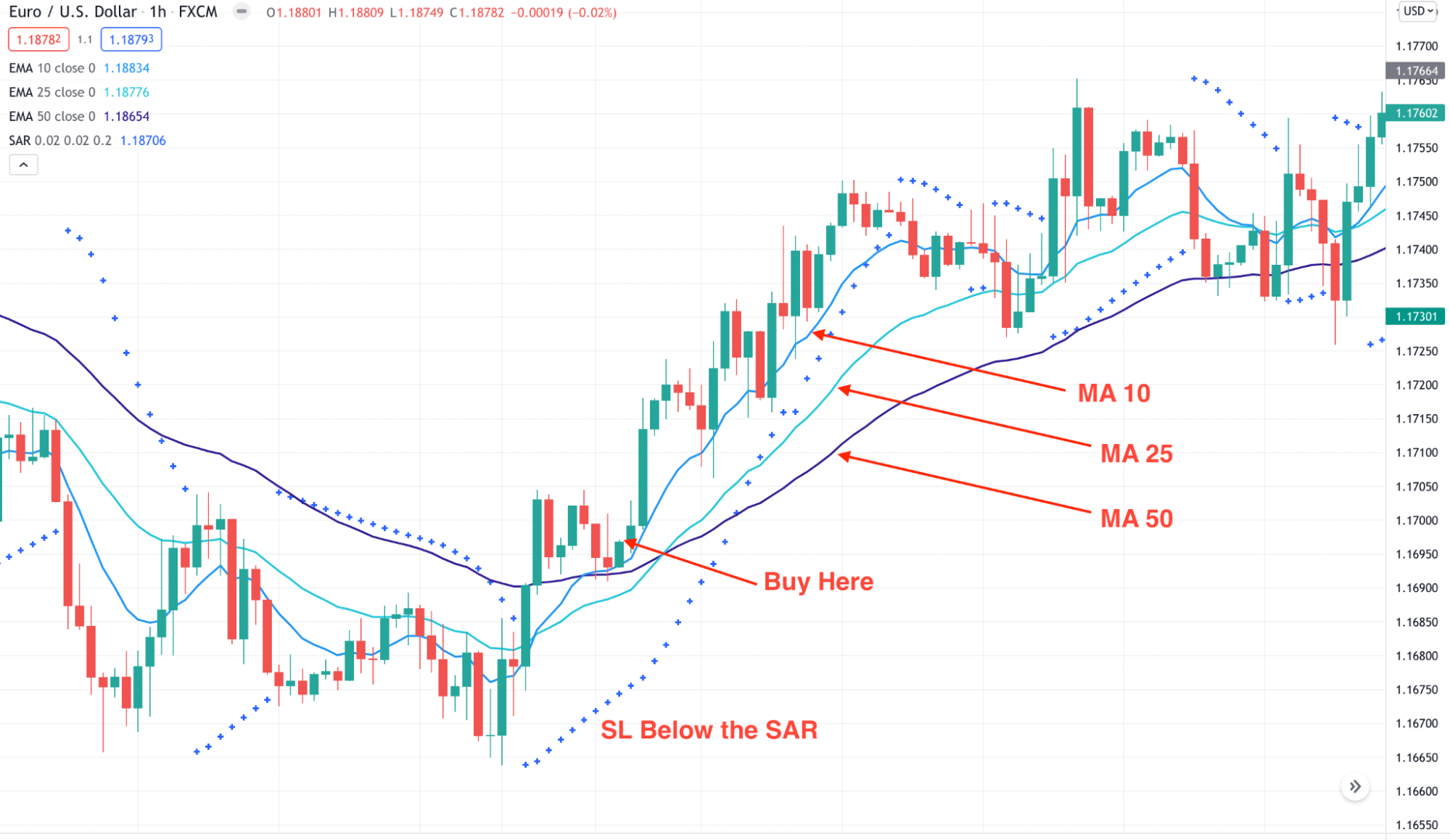

3. Parabolic profits scalping strategy

This method is another indicator-based system where the primary approach is to open a trade using multiple conditions. First, we have to use moving averages of 10, 25, and 50 to identify the overall market direction. Then, later on, filter out the MA signals using the Parabolic SAR.

Entry

The trading entry is valid if the price moves above the dynamic moving averages with a bullish candle close. Meanwhile, the Parabolic SAR should remain below the price.

Parabolic profits scalping strategy

Stop loss

The bullish sentiment has the possibility of working out until the price comes below the Parabolic SAR. Therefore, the stop loss should be below the SAR dots with some buffer.

Take profit

It is a trend continuation pattern that can provide higher profits than fixed trading systems. You can trail the stop loss at break even once the price moves 1:1 risk and reward ratio. Later on, close the 50% of the position and hold the trade until it reaches 1:3 R: R.

Final thoughts

And finally, let’s see what you should consider after finding the most profitable trading systems:

- Do not focus on indicators too much as they lag and can lead you to make the wrong decisions.

- Understand the risks and uncertainties associated with the market and have an approach to minimize them at the lowest level.

- Focus on fundamental indicators carefully as they can increase the price volatility with unexpected stop loss hits.

- Do not take too much risk per trade.

Comments