High-frequency trading (HFT) is a method of following a complex trading algorithm and making profits. The financial market has become more complicated than before in the modern world, where artificial intelligence earns more money than usual.

Therefore, following an HFT strategy would be one of your reliable ways to make money from trading. Unfortunately, many people are still unaware of it, but you might remain at the top of the winners if you follow any high-frequency trading method.

Let’s discuss how this strategy works in the FX market with its exact buying and selling techniques.

What is a high-frequency forex trading strategy?

HFT does not apply to the FX market only. Instead, this method is applicable on any financial market where making a high volume with a quick profit is the primary aim of this strategy. Therefore, this strategy requires a computer program that can handle such movements within a short time.

Besides the technological advance, high-frequency trading comes from the ease of access in any financial market with the flexibility to traders by using more apps and software.

Let’s see what features high-frequency trading have:

- Considerably high volume in trading

- The holding time is shallow

- The execution and order speed is very high

- All trading activities are done within the trading day

- Daily profit target remains lower than manual trading

- Follows a complex algorithm to identify the price direction

- Banks use this method to make their profit

HFT follows an algorithm where finding the market direction is possible even before the movement. Therefore, the high-frequency trading method uses fundamental data to define the market direction and makes millions of daily profits.

Why is a high-frequency forex trading strategy worth using?

However, the effectiveness of this method depends on what you are expecting from the market. Besides, it depends on how much you are ready to invest in.

The use of an algorithm

HFT is an entirely automated system that requires a particular computer program to operate. Therefore, if you have excellent computer programming skills, there is no cost to build an algorithm.

However, hiring someone and providing the logic would be an alternative way to build an algorithm, but you may have to incur additional costs for that.

How much can you spend?

High-frequency trading depends on the trading data. Therefore, you need to send some money to find a reliable source that might cost you $2000 to $5000 a month. Moreover, if you want additional features like managing trades, you may have to spend up to $25.000 a month.

Investment amount

The profit margin for high-frequency trading is shallow. Moreover, it is not a numbering game nor a lottery. Therefore, you should have an investment of a minimum of $25.000 a month. Thus, the return per month should be above the monthly spending to become profitable.

Moreover, the trading approach is another thing to consider. The conservative approach might provide a lower profit, but it may require less monthly expense.

A short-term strategy

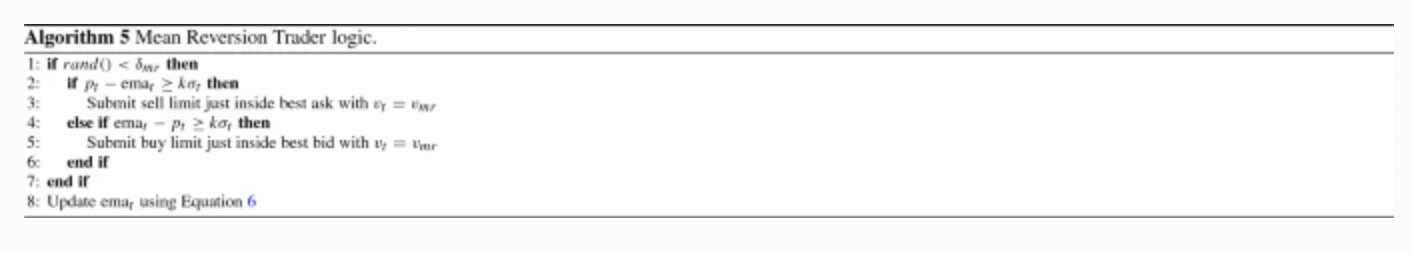

Mean reversion traders are high-frequency agents that follow a well-documented strategy in which they believe that the price will come back to a certain level shortly. Therefore, the aim is to buy any instrument when the price moves below the average price and open sell positions when the price moves above the average price.

Notably, trading agents choose the instrument and compare the current and average price using the following formula:

ema𝑡=ema(𝑡−1)+𝛼(𝑝𝑡−ema(𝑡−1))

Best time frames to use

As it is high-frequency trading, it uses minutes seconds in its strategy.

Entry

If the current price 𝑝𝑡 moves above the 𝑒𝑚𝑎𝑡, the algorithm will open a sell-limit order. Conversely, the price moves below the standard deviation; traders will open buy orders.

Stop loss

It is short-term trading where the stop loss is managed by the algorithm automatically.

Take profit

The ultimate target for this trade is the average price.

Mean reversion algorithm

A long-term strategy

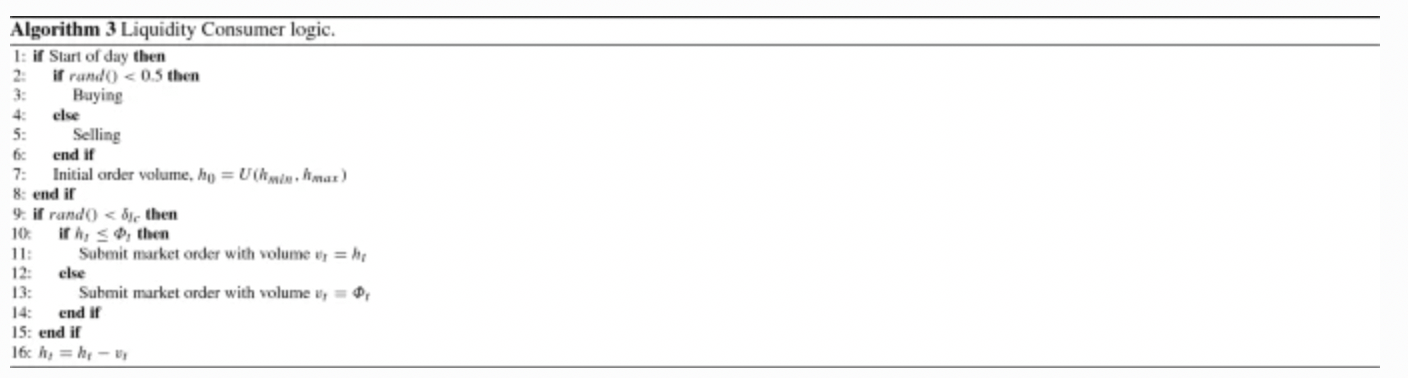

We will talk about slowly moving funds that make profits from rebalancing portfolios in the long-term trading system. They are large institutions that buy or sell a huge amount of stocks over time to minimize the trading cost.

Best time frames to use

Institutional traders usually use higher time frames in their trading strategy that may start from H1 to D1.

Entry

Institutional traders open a large order where they look for the best volume in the opposite direction.

Stop loss

This method uses a long stop-loss order, and they open trades in different phases. In some cases, they do not use stop losses.

Take profit

After opening the trade, the algorithm closes the position gradually based on the opposite party’s activity in the market.

Pros and cons of a high-frequency forex trading strategy

HFT is profitable, but it requires a high investment and trading costs. Therefore, it is important to define whether this method is suitable for you or not.

Pros |

Cons |

|

|

|

|

|

|

Final thoughts

The high-frequency trading firms achieved bad names among investors due to their secret trading methods. However, investors are becoming aware of them as no HFT trading is becoming open to all. For retail trading, following this strategy is often challenging as it requires a higher deposit and cost. However, this method will enrich trading knowledge that will ultimately help traders understand the market context.

Comments