According to thebalance.com, 9 out of 10 traders lose money in the hope of making more while trading. And the same source cites risks as part of the contributing factors. It is best to digest risks comprehensively before putting in capital and opening trade positions.

What is risk management?

In forex, risk management narrows down to a simple concept: reducing the losing trades. Reality places heavy burdens upon traders to explore every probable model to hit a win. Whatever insight and intuition you use, it’s risk management.

Forecasting reality centers on risk management. But, the truth is, you may never be 100% sure what the next minute or day presents. On the contrary, many tools exist to help you figure out things ahead.

Importance of risk management in forex

Risk management is 90% of the game. Larry Williams turned $10,000 into $1.1 million in just one year. In his book The Definitive Guide to Trading Futures, he says: “Money management is the most important chapter in this book.” Risk management is the pre-contemplation of whether a trade is worth it.

With a solid strategy in place, traders require a set criterion to open a trade or stay off the markets. The number one priority is capital protection. Profiting comes second. So risk containment becomes policy and not rules for flouting at will.

How much to risk?

Most beginners are killed by one of two bullets: ignorance or emotion. Beginners gamble by intuition and enter into trades that should never be entered into due to negative mathematical expectations.

If on every trade you risk a quarter of your account, then your collapse is inevitable. You will be ruined by a short series of failures that happen with even the best trading systems.

Experts say that the maximum amount a beginner player can risk in one trade without compromising his long-term prospects is 2% of his deposit. We are not talking about fast overclocking but imply profitable long-term trading. The 2% rule reliably limits, even during a sequence of five or six unprofitable transactions, will not significantly impair your prospects.

Principles of successful forex trading

There are three components for successful trading forex:

-

What trading strategy do you use?

Every strategy a trader uses requires clarity concerning the market behavior at hand. Ask yourself, how do I handle up-trending, down-trending, or choppy markets. The essence is adhering to a focal way to decide the entry and exit of any of the needs.

-

How do you manage capital?

It involves clear-cut clarity regarding trading lots size and capital commitments. Do you trade a set lot size or commit a percentage of your capital for every trade?

-

Are you able to adhere to sets of rules?

It’s merely disciplined within the confines of forex trading. At the bare minimum, good money management ensures you keep growing your account over time. It commits you to approach markets with adequate focus, caution, and an open mind — away from psychological shortcomings.

Three risk management techniques in practice: examples, pros & cons

There are many methods to turn unprofitable systems into profitable ones, but let’s discuss three of them.

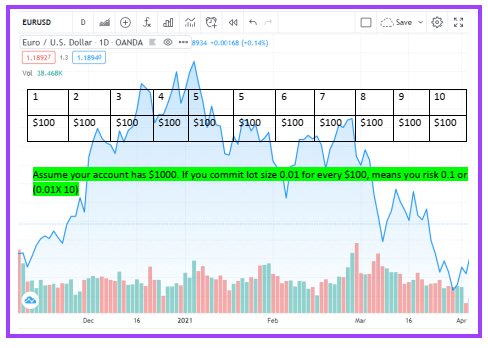

№1. Trading set rate per contract for every “X” dollars in the account

In this case, one minimum lot is taken for each certain amount on the account. Opening your agreement by picking a manageable rate for predefined chunks of capital could be a game-changer.

While the rule of thumb is to minimize risk exposure, two factors are at contest here:

- It raises the rate per contract to magnify returns — few trades, more returns, or equally the losses.

- It involves maintaining the recommended rate and allowing each trade to profit or else hit stop loss for an adverse case.

Example

Assume your account has $1000. if you commit lot size 0.01 for every $100, it means you risk 0.1 or (0.01×10).

Pros

The advantage is lower drawdowns on the account than risk methods with a fixed percentage of the deposit and smoother capital growth.

Cons

The fact is that this approach does not take into account the size of the stop loss. So if the stop losses may differ several times from deal to deal, then the deposit growth curve will be somewhat uneven, and enormous profits or significant losses will often appear.

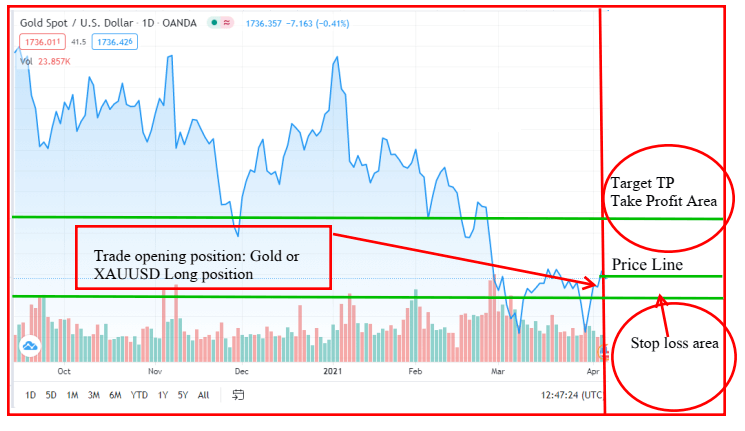

№2. Risking a certain percentage of the account per trade

Here, you calculate the ideal lot size bearing in mind your acceptable risk in the percentage form of your entire account.

| Ideal lot size = | acceptable % risk x capital in the account

_________________________________ |

| stop-loss in points (pips) |

Once you obtain your ideal lot size in light of your acceptable risk levels, you proceed to open contracts when other indicators give you a clearer picture of market performance. The reason for using a stop loss is simple: capital protection via risk minimization.

Whenever market conditions reverse despite your cohort of indicators’ clearance, you lose an amount commensurate with the stop loss you set. It’s best to lose a few pips for a bad trade, as opposed to leaving it to fate and, in extreme conditions, blow your account.

If the trend is in your favor when a trade falls into the money, you can reap huge enough to compensate for the few transactions you lose via stops. Also, adverse market conditions see you lose as heavy as your risk appetites.

Example

You have $1000 on your account. You are going to trade EUR/USD with a stop of 30 pips and a risk of 1%. Then you risk $100 and 100/300 = 0.3333 or 0.34 lots.

Pros

The plus here is that capital growth has a more pronounced exponential progression.

Cons

Large drawdowns can be a downside.

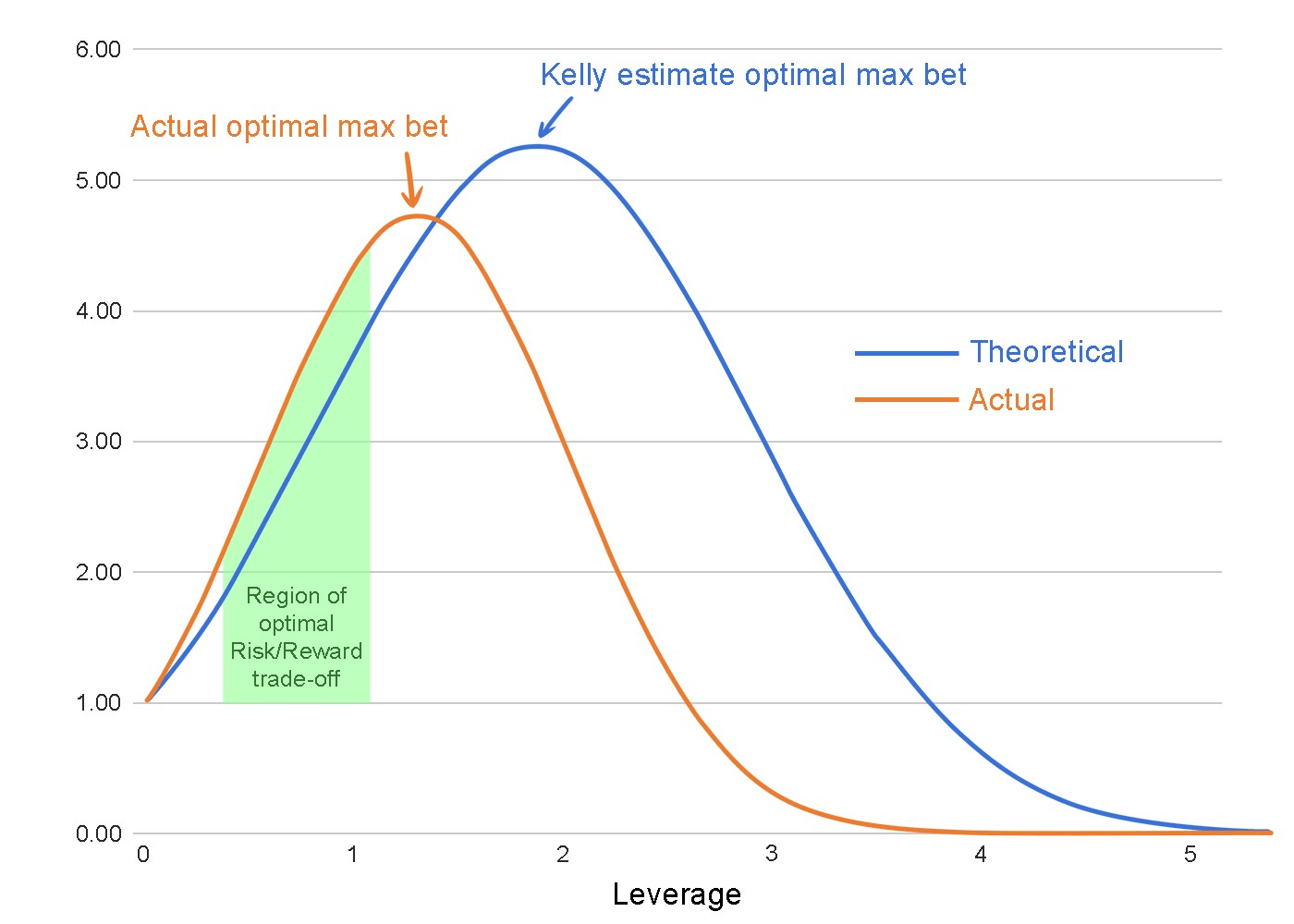

№3. Kelly method

The Kelly method or criteria is cited as a scientific betting that seeks to maximize the gains over the long run.

Here is the way to derive it.

Kelly’s formula is: Kelly % = W — (1-W)/R

where:

- Kelly % = percentage of capital to be put into a single trade

- W = historical winning percentage of a trading system

- R = historical average win/loss ratio

Ideally, the method gets you the risk in percentage, which gives you the best returns for your trades. You iteratively use the ratio to commit for every single transaction you make.

The two metrics above — “W” and “R” require that traders get their homework done right and in time. Best if you have a tested and verified strategy to further strengthen with Kelly method.

Access your last 50 to 60 trades. You could do this by simply asking your broker or checking your recent tax returns if you claimed all your transactions. If you are a more advanced trader with a developed trading system, simply backtest the strategy and take those results. However, the Kelly criterion assumes that you trade the same way now that you traded in the past.

Example

If our equation returns 0.05, we get a percentage multiplying it with 100 to get 5%. Consequently, you’ll use 5% of capital in account for every trade. It’s the optimal % for money management and portfolio diversification. Meaning you commit $50 for an account with $1000 for transactions.

Pros

The main advantage of the Kelly criterion is the exceptional security of the deposit. The probability of going bankrupt, playing according to the algorithm proposed by Kelly, is practically zero.

For example, if, having a deposit of 1000 euros, we lose eight transactions in the amount of 6.67% of the deposit, then we will have $574.19 on our account.

Cons

- To calculate the criterion, you need a ready-made history of transactions. The more there are, the more accurate the calculation will be.

- The Kelly criterion is calculated for a specific next bet. Next time, the measure will have to be recalculated again. Of course, the changes are not critical with each new deal, but once every 5-10 contracts, the criterion will have to be recalculated.

Conclusion

Winner traders comprise roughly not more than 10% of all traders. The basic they deploy range from:

- Careful study of markets

- Smart money management techniques

- Obtaining intelligent inference from the use of an indicator or several to decipher market conditions

Forex traders face unknown risks but never fear taking on risks. They manage them via the above three bullets. If used well, you end up reducing losses significantly as well as increasing winnings too.

The ideal is not for a trader to read and rest but to put everything into practice and master the unique scenarios facing you singly.

Comments