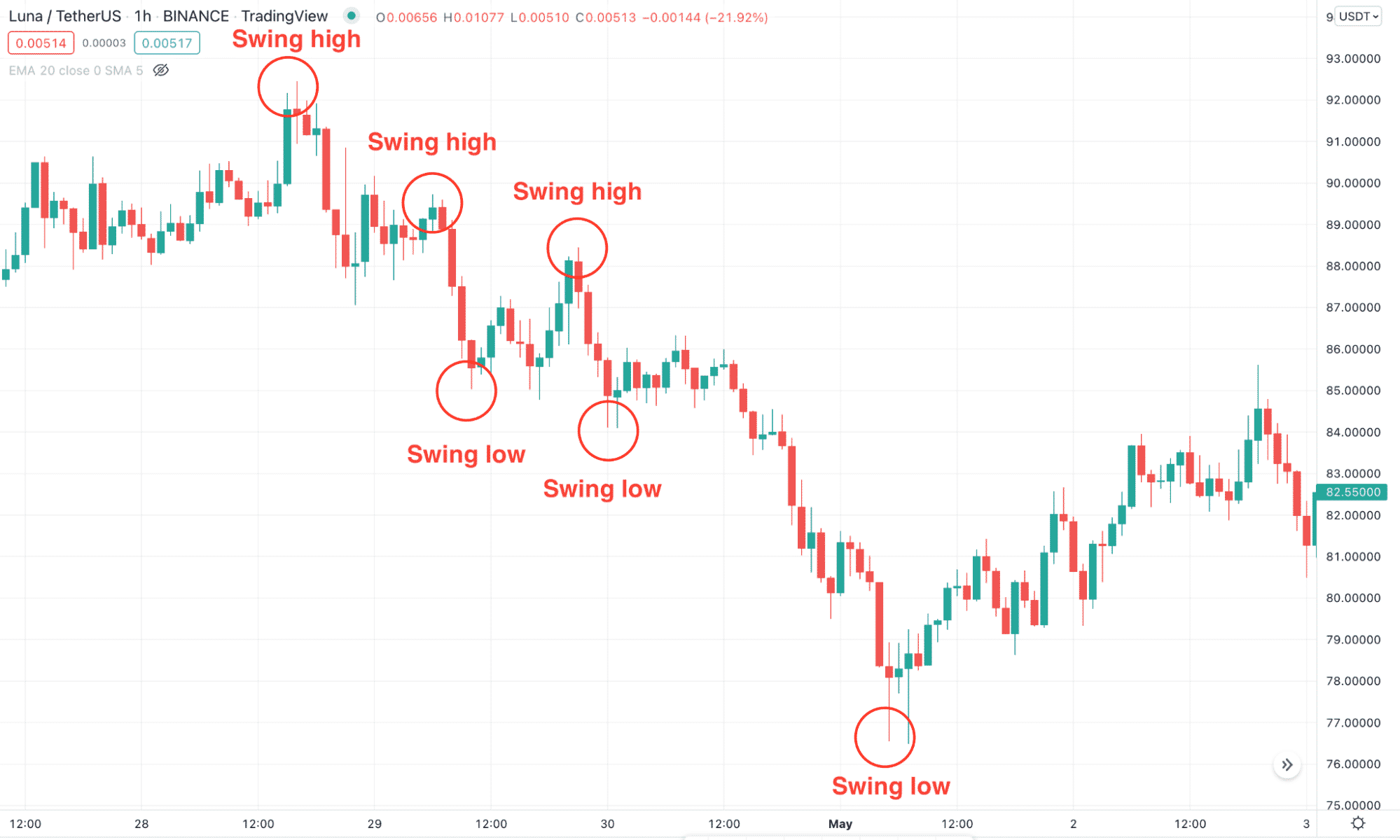

Swing trading is taking trades from swing lows and swing highs from where a good outcome is possible. The crypto price moves like a Zig Zag, allowing traders to benefit from swings like other financial markets.

However, taking trade from swing levels needs close attention to the price action and confirmation. You cannot take a trade just by looking at swings. Instead, you should follow a systematic approach of following a method consisting of multiple confirmations. Today’s lesson will show the nuts and bolts of swing trading, including the bullish and bearish trading strategies.

What is the crypto swing trading strategy?

It is a strategy that is a process to anticipate the price moment of a crypto asset from swing lows and swing highs in the trading chart. Crypto trading instruments move with a Zig Zag formation like other financial markets, allowing investors to trade from swing levels.

Swing low is the most discounted price before taking a crypto asset’s price higher. Similarly, a swing high is the latest higher price before taking it down. Therefore, taking a sell trade from the swing high means investors can open their position from the beginning of a trend. As a result, it is possible to take the maximum benefit from the swing with minimum risk in swing trading.

Swing high and swing low

How to trade using the crypto swing in trading strategy?

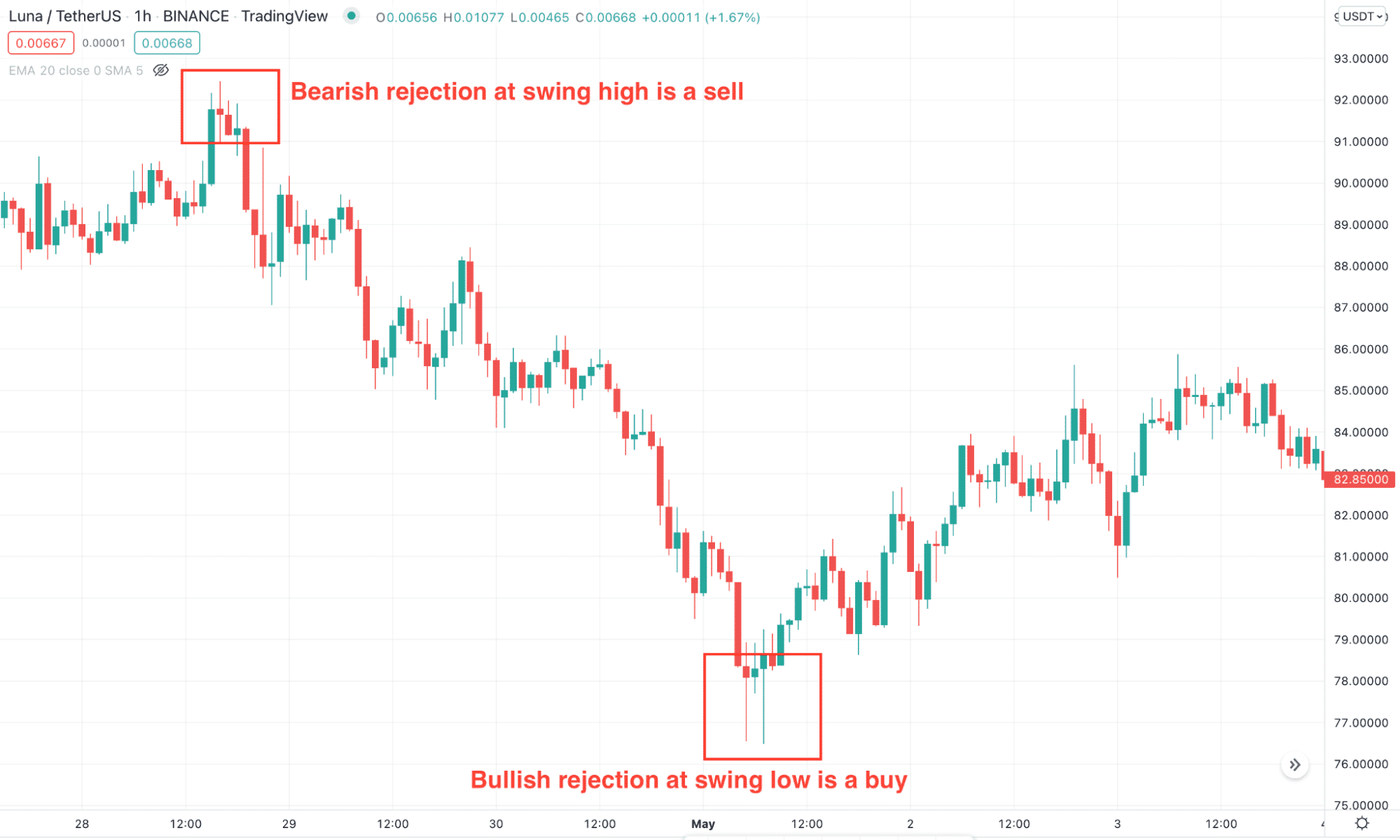

The swing would be a significant portion of the trading strategy in any trading approach. Although we consider it as a profitable element in forecasting the price, it requires additional confirmations to make it complete. For example, if the price makes consecutive swing lows, we can consider it a bearish trend. Therefore, if we want to open a sell trade, we should focus on other confirmations from the candlestick, price action, or indicators besides the swing levels.

Today’s trading lesson will show how to use swing highs and swing lows with candlestick and price action. Before moving to the trading strategy, let’s look at an example of that swing trading method.

Swing high and swing low example

A short-term trading strategy

The blessing of financial trading is that it follows the fractal rule where the same environment is present in both lower and higher time frame charts. Therefore, we can apply the same trading strategies for lower and higher time frame charts. Trading in lower time frame charts allows investors to gain from the intraday price fluctuation. However, investors should follow the higher time’s direction to get the maximum benefit.

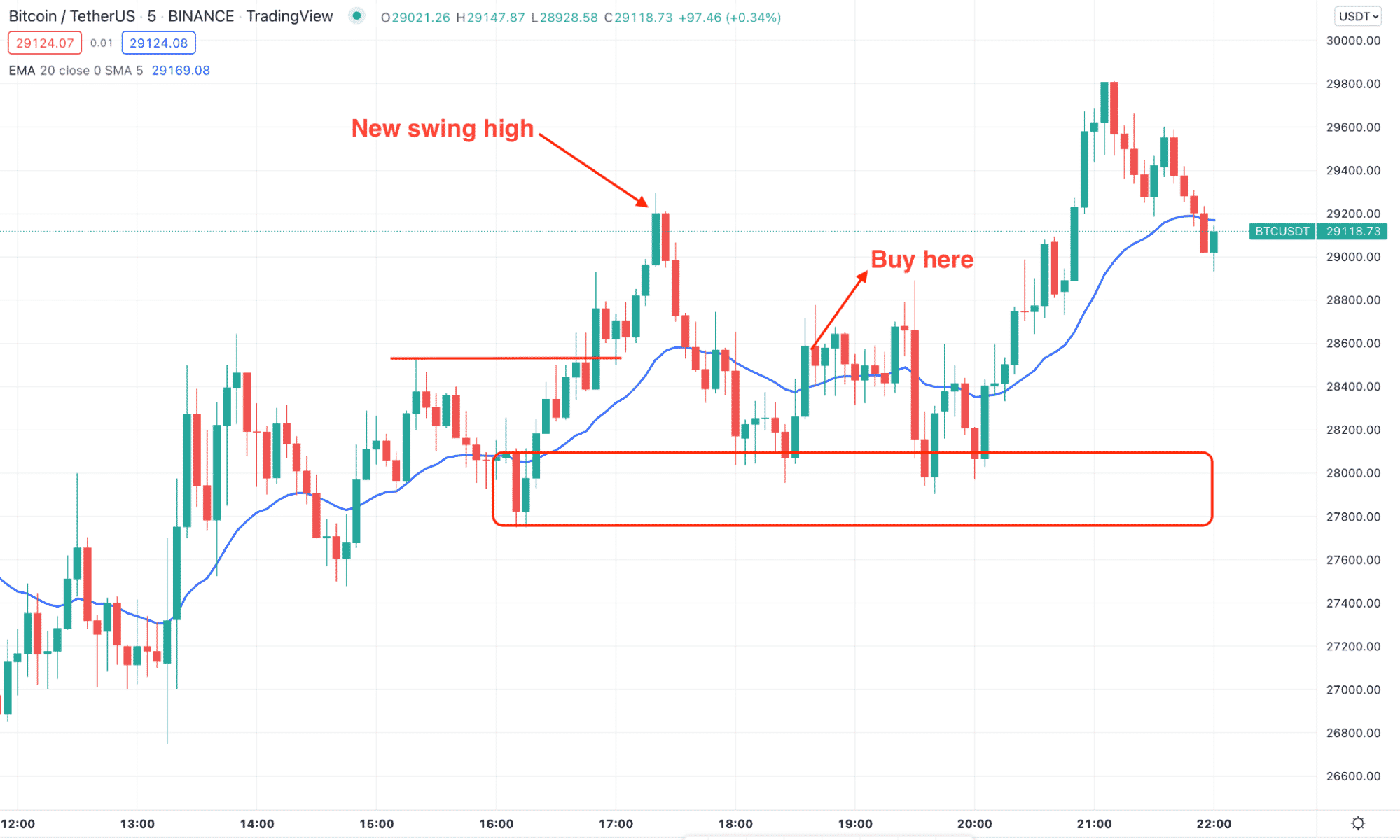

Bullish trade scenario

In the short-term buy trade, we will see how to open a buy position in a crypto trading instrument in the five-minute chart. This method aims to buy an asset from swing low after forming an appropriate rejection.

Entry

The buy trade in the 5 minutes chart is valid once these conditions are present:

- The higher time frame trend is bullish in the H1 or H4 time frame.

- Price made a new swing high in the m5 chart, indicating that bulls have joined the market.

- The price corrected lower and formed a bullish rejection from the previous swing low area.

- Open a buy trade once the price moves above the dynamic 20 EMA after the rejection.

Stop-loss

The ideal stop loss is below the swing low with some buffer.

Take profit

The trade is valid as long as it moves higher and shows a rejection from the previous swing high.

Short-term buy trade

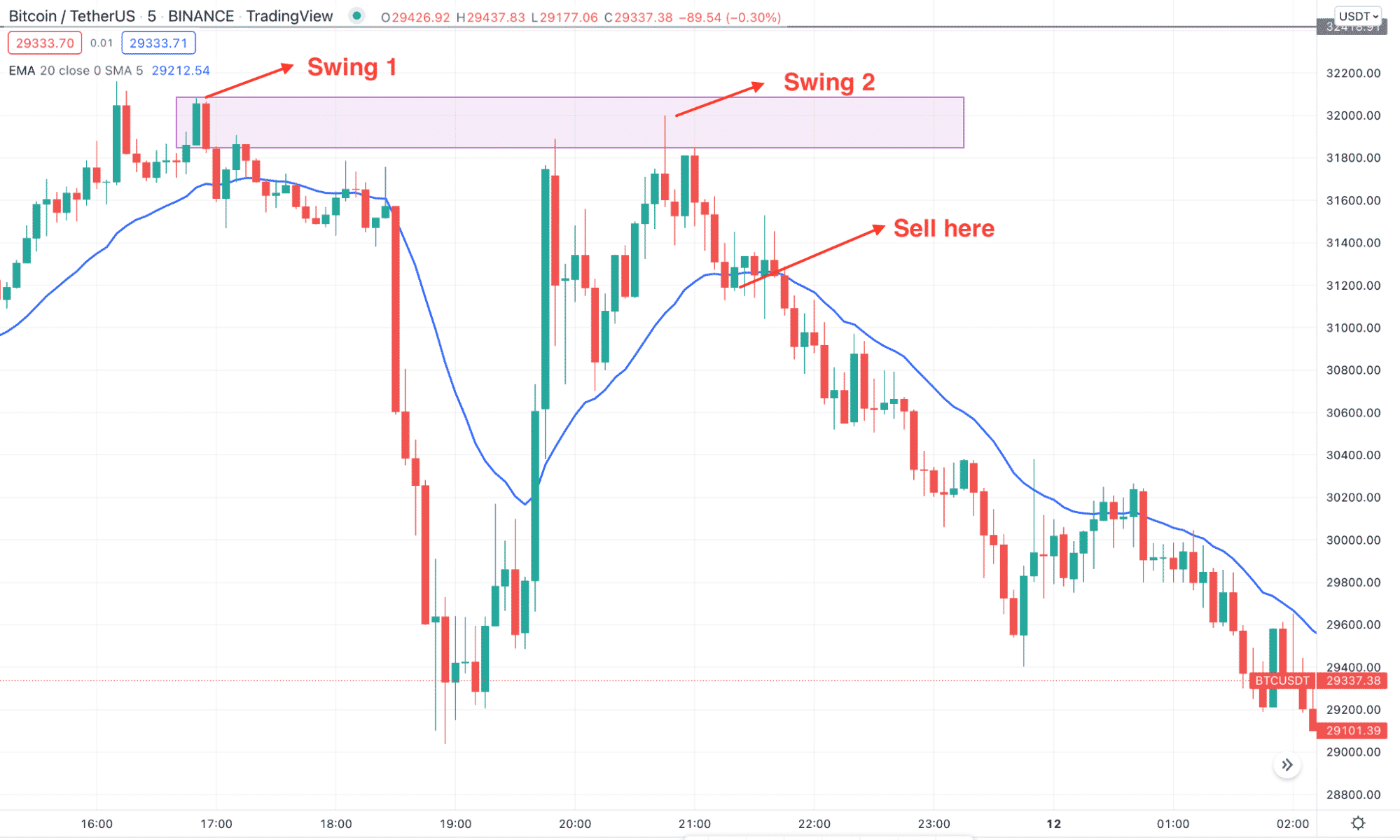

Bearish trade scenario

It is the opposite version of the short-term by trade applicable when the broader crypto market is bearish.

Entry

The sell trade is valid once the following conditions are present in the 5 minutes chart:

- The higher timeframe trend is bearish in the H1 or H4 time frame.

- Price made a new swing low in the m5 chart, indicating that sellers have joined the market.

- The price corrected higher and formed a bearish rejection from the previous swing high zone.

- Open a sell trade once the price moves below the dynamic 20 EMA after the rejection.

Stop-loss

The ideal stop loss is above the swing low with some buffer.

Take profit

The trade is valid as long as it moves down and shows a rejection from the previous swing low.

Short-term bearish trade example

A long-term trading strategy

This method is applicable to take a proper investment decision by buying or selling from a logical price in the daily chart.

Bullish trade scenario

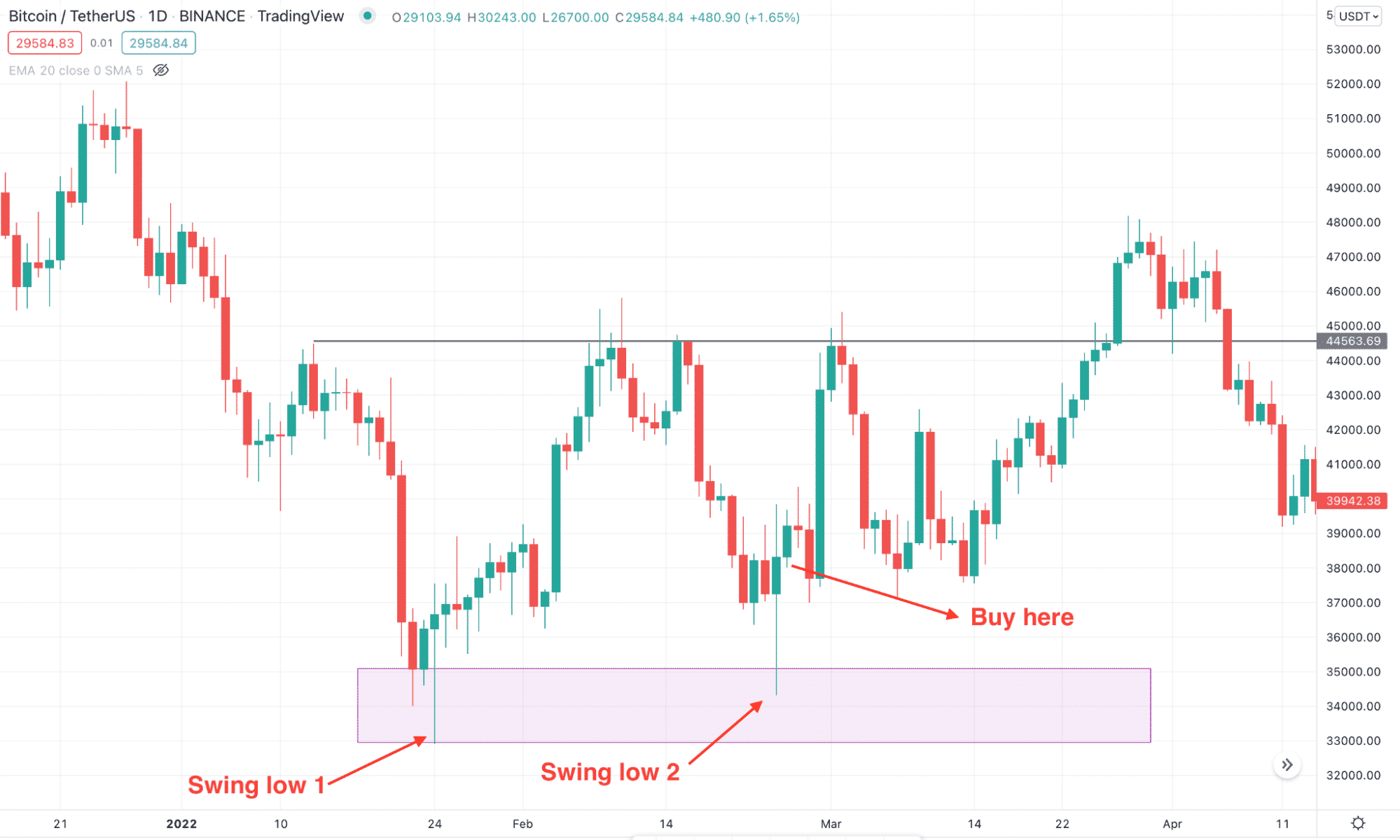

In the long-term trade, investors should wait until the price reaches any significant support level and form a bullish rejection. Later on, the buy trade is valid from any suitable swing low.

Entry

The long-term buy trade is valid once the following conditions are present in the chart:

- The price reached a significant support level and formed a bullish rejection.

- The price moved higher from the support level and made a new swing high, indicating that bulls are active in the market.

- Later on, the price came lower but failed to break below the previous swing low.

- Open a buy trade from the second swing low with an appropriate bullish rejection candlestick.

Stop-loss

The conservative stop loss is below the support level, but you can consider the trade invalid once it breaks below the near-term swing low.

Take profit

The first take profit is the swing level 2, but you can extend it if the price action allows.

Long-term buy trade

Bearish trade scenario

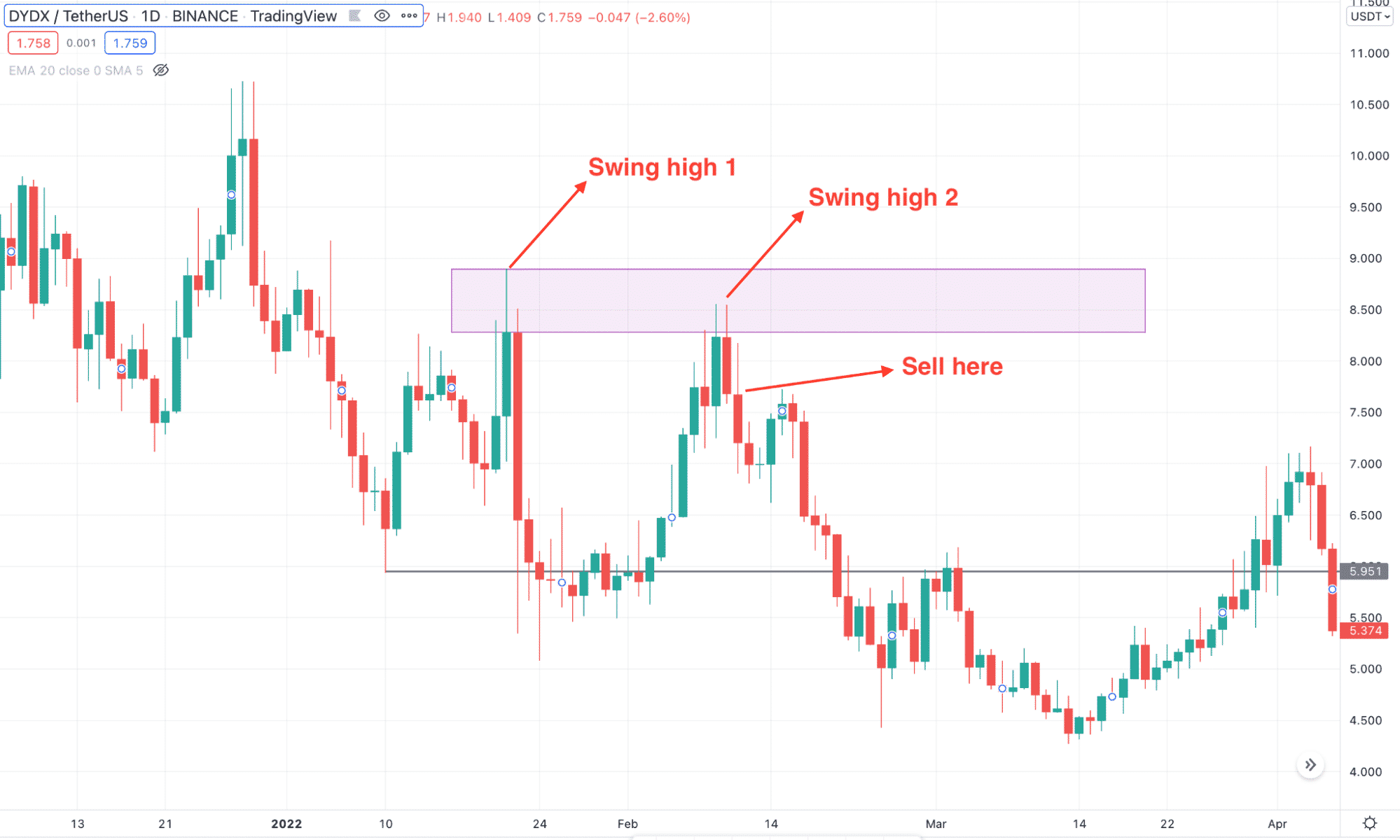

The sell trade applies to finding the proper exit level in the spot price or opening a sell trade in crypto CFDs.

Entry

Before opening a sell trade, make sure to find these conditions in the daily chart:

- The price reached a significant resistance level and formed a bearish rejection.

- The price moved down from the resistance level and made a new swing low, indicating that sellers had joined the market.

- Later on, the price corrected higher but failed to break the swing high.

- Open a sell trade from the second swing high with an appropriate rejection candlestick.

Stop-loss

The stop loss is above the near-term swing high with some buffer.

Take profit

The first take profit is the previous swing low area, but you can hold it if the bearish pressure from the entry price comes with an impulsive pressure.

Long-term sell trade

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

Finally, we can say that swing trading is a reliable opportunity to find the most reliable price to open a trade in the crypto market. The best approach would be using the swing trade within a robust trade management system.

Comments