Financial assets such as forex currency pairs, commodities, CFD products, etc., involve leverage trading. Most forex brokers offer leverage on financial assets that allow traders to make positions worth much more than their investment capital. Without leverage, trading won’t be as beneficial and attractive to individual traders as now.

However, many novice forex traders lose their first deposit in trading for misusing leverage besides not obeying trade and money management rules and proper strategies. This article contains everything about using leverage. A complete guide will enable you to understand what leverage is in forex trading, the calculation procedure of leverage, and the steps to choose the best forex leverages for beginners.

What is leverage in forex trading?

Leverage is the term of borrowing money for investing in financial assets. Leverage enables traders to magnify their profit amount. You can make enormous profits from small price changes by using leverage. For example, when using a trading account with 50:1 leverage, you can make a trade worth $50 with only $1 capital on a standard lot account.

Now you know the most crucial thing about leverage. It also magnifies your losses besides magnifying profit amounts. Most novice traders lose capital for several reasons; misusing leverage is one of the significant facts.

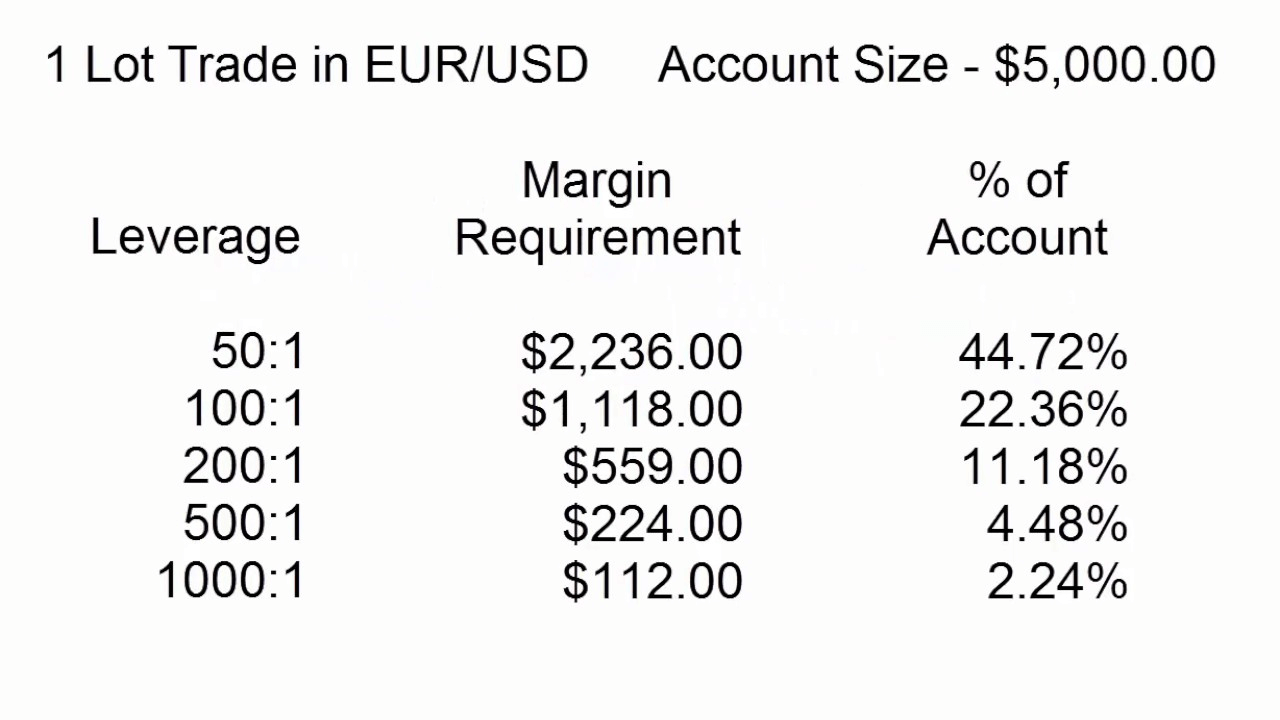

You can make a $50 trading position using 50:1 leverage with only $1 capital. But when the price movement goes against your order worth $1, brokers will automatically close your trading position. Suppose you will make a $50 profit from your order if the price increases ten pips; you will lose the same amount when the price movement goes against ten pips of your order. Forex brokers offer 1:1- 1000:1 leverage for their clients.

How to calculate leverage?

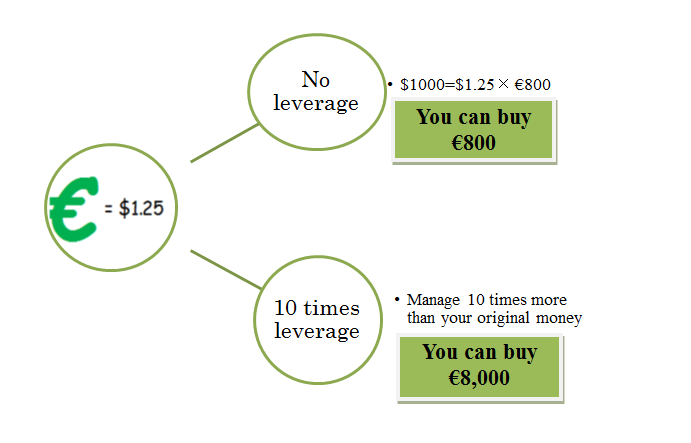

Calculating leverage is not a complicated term. An account with 1:1 leverage with a $100 capital will allow you to make trades worth only $100. Meanwhile, if that account has 500:1 leverage, you will be able to make trades worth $50,000. The broker will loan you the rest of the money. For a better understanding, look at the figure below.

Buying potentiality with 10:1 leverage

Suppose you want to buy EUR/USD at 1.25 with a standard lot account, with $800 trading capital and 10:1 leverage. If the price goes up, you will get a considerable profit with your tiny investment.

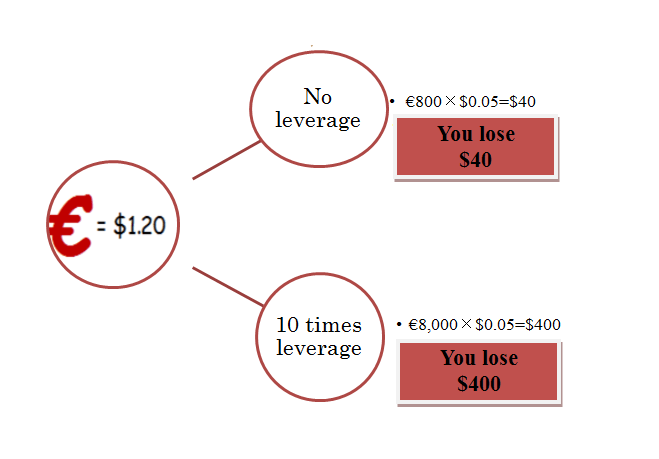

Losing amount with and without leverage

On the other hand, if the price drops to 1.20, your losing amount will be enormous. So leverage is just the concept that will allow you to manage a large amount of money with small capital.

How to choose the best forex leverage for beginners?

Novice traders follow the steps below to choose the best forex leverage and safe trading.

Step 1. Identify the trading object

When choosing leverage, you have to consider the trading object at the very first step. Several financial assets involve different types of volatility. So broker’s leverages offerings also vary for different types of financial assets.

For example, brokers offer a 1:1 to 100:1 or above leverage for forex trading. Meanwhile, the futures market may involve 15:1 and a 2:1 standard leverage offering on equities. So it’s essential to select trading objects before deciding on suitable leverage. When your trading object is currency pairs, or you may try to get involved in forex trading, you can enjoy making trades worth $100 by your $1 trading capital if you use a 100:1 leverage standard lot account.

Step 2. Try to minimize the leverage

You already know the allowable leverage levels for currency trading. Using more leverage can lead you to become a loser.

For example, you may enter a buy order at the GBP/USD pair worth $500 with your $50 capital, and the price starts to decline. When your floating loss is worth $50, you will lose your capital out of your trade. The recommended leverage ratio is 5:1 or 10:1 for forex trading. So you remain comparatively safe rather than traders who use higher leverage such as 50:1 or 100:1.

Step 3. Move to a higher time frame trading

Different time frames show the price movement differently. Using higher time frames for analyzing the price movement is best because it will help you avoid fake swing positions at lower time frames. Moreover, you can control the tendency of making quick money from tiny price movements. Novice traders who choose scalping strategies with high leverage trading accounts end up losing capital.

Step 4. Use trade management system

Forex trading involves high volatility as several microeconomic, macroeconomic, and socioeconomic factors affect currency pairs’ price movement. So you better learn and apply appropriate trade management rules for your trading besides choosing complete trading methods. Use proper stop loss when entering any trade. Never risk more than 2% of your trading capital for placing trades. For example, if you have $1000 trading capital, you can take a $20 risk for making any trade.

Step 5. Increase the leverage gradually

Forex brokers allow changing leverages at any time you prefer. When you are doing good at trading, trading skills will increase with your trading experience. Remember, successful forex traders were the same as you or any other beginners. They develop their trading skills by researching and creating efficient trading methods that allow profits and reduce losing trades. When you gather sufficient knowledge and skills of forex trading, you can increase your leverage to 50:1 or maybe 100:1.

Final thought

Finally, now you have complete primary knowledge on forex leverage. If you have a $10 forex trading account, you may use 888:1 leverage as a gambler. The scenario will not be the same if you try to forex trade with a $5,000 or a $10,000 as then you have to take it as any other traditional business. Leverage is a double-edged sword that can help you make an enormous profit with a tiny amount; the loss amount will also be the same if trades go against your trading direction.

Comments