What will happen when you execute a trade at a place, but the trade opens from another area? Moreover, how do you feel if your stop loss hits even if the market did not reach the stop-loss level? Yes, we are talking about slippage!

It happens when institutions do not get enough orders to fill a buy or sell position. It is widespread in forex trading. The possibility of slippage depends on the market volatility. If you open trades at one place, but for slippage, it might open at another price.

You cannot eliminate the slippage at all, but there are some ways to avoid it. If you want to make your trading hassle-free, you must know when the slippage may happen and how to prevent it. The following section will see everything a trader should know about this case with a step-by-step guide to avoid it.

Why does slippage occur?

It is always annoying for traders; mainly, for retail ones. But if you know why slippage happens, you will have a chance of saving your account from it.

The FX is the world’s most liquid market, where buyers and sellers remain active all the time. In that case, when you find the price at support and open a buy order, there is another person at the other side of the door from whom you are buying. Such persons are banks, hedge funds, and big institutions that are known as smart money.

You never faced any situation where buying and selling did not happen due to the absence of sellers, but it is widespread for smart money traders. They usually trade with 100k or 200k lots, and they only can fill orders once there is enough liquidity. So, for example, if the EUR/USD moves with a prolonged downward pressure, many retail sellers will be active in the market, and smart money can easily buy from them.

What if sufficient traders are not present in the market?

Banks will be unable to fill their orders, and in some cases, the order might be misplaced, which is called slippage. It comes from institutions, and retail traders have no way to overcome it. However, you can easily avoid slippage by following some rules that we will see in the next section.

Slippage: positive & negative

Positive

For example, if you have an active buy in the EUR/USD at 1.1820 and take profit at 1.1880, it might close at 1.1890 due to slippage. In that case, you will earn an additional ten pips of profit.

Negative

Similarly, if the trade would hit stop loss five pips below your stop loss level, you should bear additional five pips of loss.

Although slippage has both positive and negative impacts on the trading account, the dangerous fact is uncertainty. In trading, we are here to make money systematically, not to get rich by luck. Therefore, you should closely follow the below-mentioned steps to get rid of slippage.

Step 1. Manage your order type

Trade management is the core part of financial market trading, where you should know when to move your stop loss at break-even and when to take partial profits. Although the market is open for 24/5, the whole time is not perfect for trading. Most of the trading liquidity comes from London and New York sessions.

Therefore, if you are an intraday trader, you should manage your trades after closing these sessions to save yourself from the effect of low liquidity.

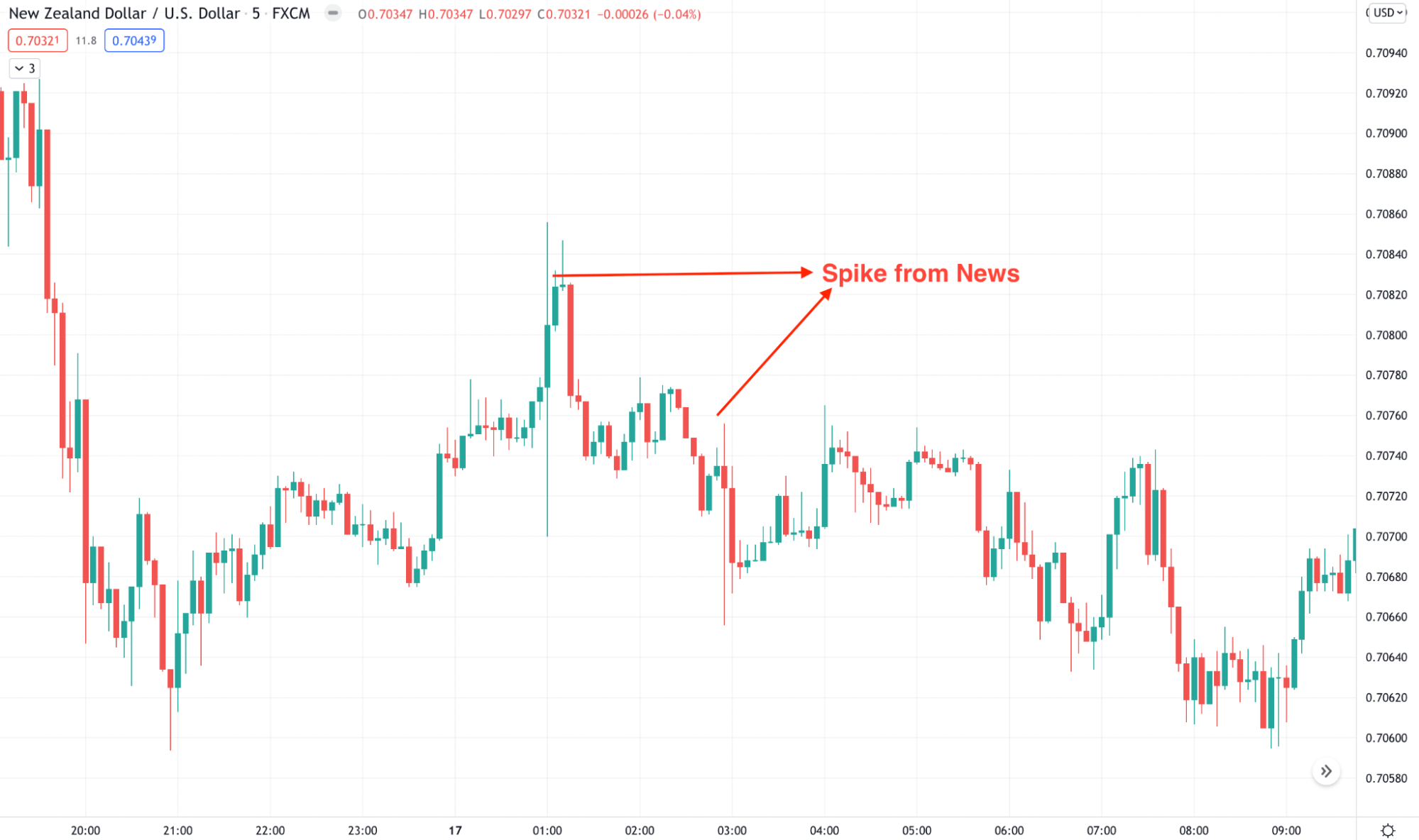

Step 2. Be careful while trading the news

During the vital news release, the intraday chart becomes wild, where an unexpected spike happens. Moreover, institutional traders often struggle to fill their orders that incur a slippage. Therefore, for a retail trader, it is not wise to open trade during the news release. Moreover, they should closely monitor when and how the news is released.

News spike in NZD/USD 5 minute chart

You can see the FX factory chart or other economic calendars that a forex broker provides.

Step 3. Make use of virtual private server

Slippage can occur from a bad internet connection — moreover, the distance between your trading server and liquidity providers’ server matter. However, you can minimize the risk by using a virtual private network.

For manual trading, the use of VPS is not mandatory, but for expert advisor trading, there is no alternative of using the VPS. EA usually uses a lot of trade in a day and closes with a small profit. Any wrong opening or closing price due to slippage may bring an unexpected loss.

Step 4. Trade low volatility and highly liquid markets

In the low volatile market, you will not see unnecessary spikes and false breaks. The volatility comes from a lower number of active traders in the market, which increases slippage. In addition, major currency pairs have lower volatility and higher liquidity. Therefore, trading in the currency pairs like EUR/USD, GBP/USD, USD/JPY, or USD/CAD is more profitable than cross and exotics.

Step 5. Change the type of market orders

Pending orders face the most significant risk of slippage. Therefore, make sure to reduce pending orders as low as possible. If you are not available in front of the market to open a trade, make sure to manage your trades during the news release.

Now it is easy to access the market as the trading software is available on almost every device. However, the slippage effect is not much for long-term and swing traders, but good observation of the price is needed for intraday trading.

Final thoughts

FX brokers usually take orders from retail traders and transfer them to liquidity providers. However, market maker brokers don’t have any liquidity provider, so they often manipulate the price to stop traders. Therefore, using an STP or ECN broker can reduce the risk of slippage, but complete recovery from slippage is not possible.

Comments