Cryptocurrency trading has become a reliable way to make money online as its profitability is high compared to the traditional forex market. The recent use of Bitcoin and other altcoins made people expand their portfolio in the crypto space. However, intraday trading might not be convenient for all crypto investors.

The excessive volatility and uncertainty often make crypto trading difficult for traders. However, the good news is that some strategies work well in the cryptocurrency market. The following section is for you if you are keen to make money from crypto intraday trading. Here, we will discuss everything a trader should know about intraday trading with a decent strategy, including buying and selling.

What is cryptocurrency day trading?

Day trading is a process to open and close all trades within a trading day. This method is effective in the traditional stock or FX market due to having enough liquidity during the running session. Day traders consider making investment decisions based on trading sessions.

Is this situation the same for the cryptocurrency market?

The crypto market is a decentralized marketplace where activities happen without a centralized house. People can sell crypto assets where the validity depends on miners’ movement. In that case, a question remains — are trading sessions practical for the crypto market?

Intraday trading is possible in the crypto market as the liquidity is stable and does not need any session requirement. As a result, you can easily take trades anytime and in any timeframe. Moreover, the demand in the cryptocurrency market is increasing, and it is easy to find buy/sell orders at any time.

How to trade using crypto day trading in trading strategy?

In cryptocurrency trading, you should ensure that the volatility is high, where investors may experience price fluctuation without any solid reason. Moreover, investors who have enough buying power can make the price change, although it is rare.

The following section will cover the exact buying and selling method that might be your weapon to buy any crypto token in the intraday chart.

A short-term trading strategy

We are looking for price actions in the small part of the broader outlook in the short-term trading strategy. Therefore, it is essential to understand where the more general market trend is heading. The core idea is to get the market trend and move to the lower timeframe to find a reliable trading opportunity.

Bullish trade scenario

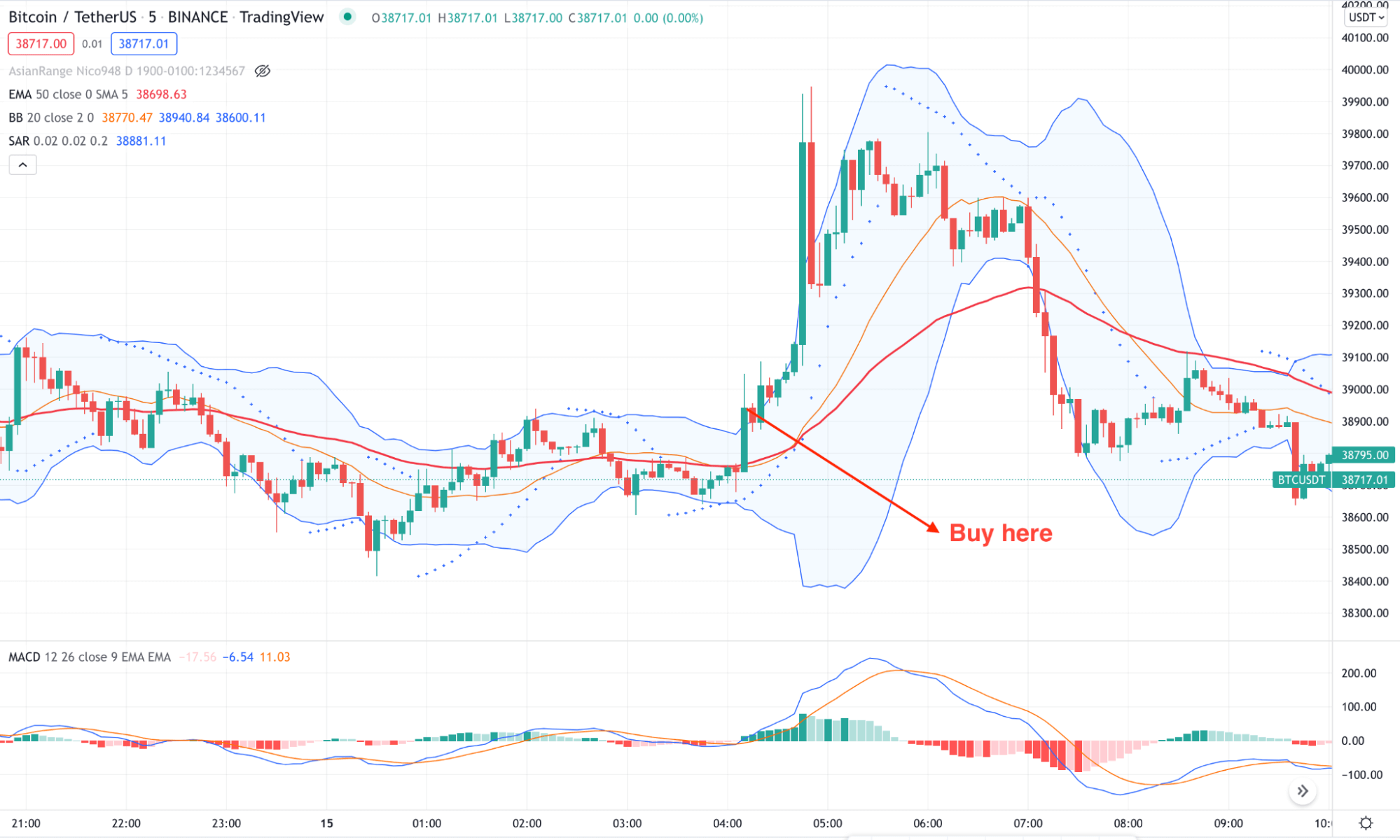

The bullish trading scenario includes an indicator-based trading method where the knowledge of candlestick and price action is needed. You can consider a trade a buy once all indicators show the same direction.

The first indicator is Bollinger Bands which will work as trend director. The primary trend should come from the dynamic 50 EMA. The Parabolic SAR should be below the current price and work as dynamic support for the buy trade.

Short-term bullish trade example

Entry

Before opening a buy trade, make sure to follow these steps on a chronological basis:

- The price is above the 50 EMA level.

- A bullish candle closes above the upper Bollinger Bands, which is the entry point of the buy trade.

- The Parabolic SAR appeared below the current price to confirm the buy trade.

Stop loss

The buy trade is valid as long as the price trades above the Parabolic Dot. Therefore, the stop-loss should be below this level with some gap.

Take profit

The first take profit is based on the 1:1 risk vs. reward ratio, but you can hold the trade for further gains if the price action from the entry price is impulsive.

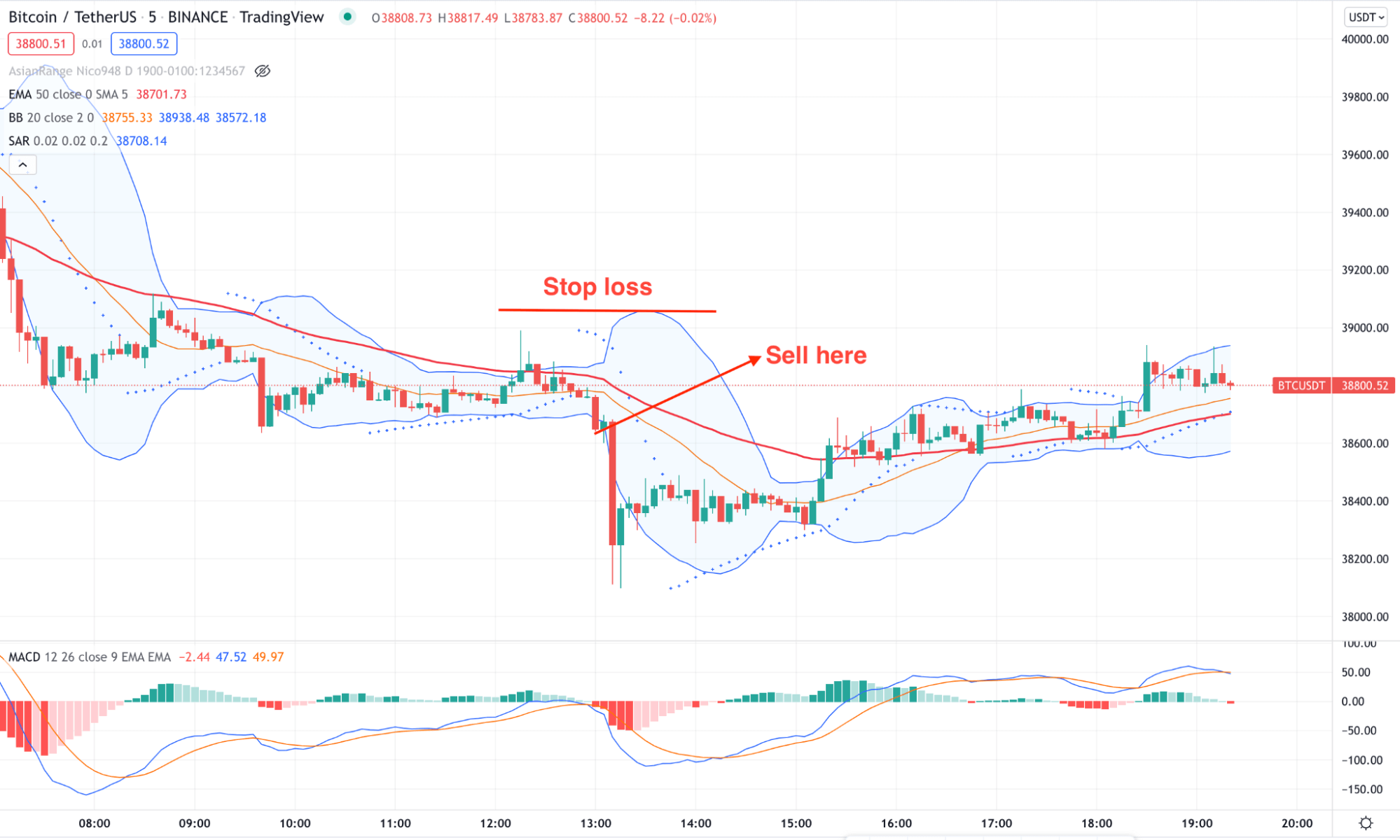

Bearish trade scenario

The bearish trade is the opposite version of the bullish trade shown above.

Short-term bullish trade example

Entry

Before opening a bearish position, make sure to follow these steps on a chronological basis:

- The price is below the 50 EMA level, indicating that the broader context is bearish.

- A bearish candle closes below the lower Bollinger Bands, which is the entry point.

- The Parabolic SAR appeared above the current price as a confirmation.

Stop loss

The bearish trade is valid until the price moves above the Parabolic SAR. Therefore, the stop-loss should be above this level with some gap.

Take profit

The first take profit is based on the 1:1 risk vs. reward ratio, but you can hold the trade for further gains if the price action from the entry price is impulsive.

A long-term trading strategy

Long-term trade defines the position trading approach where traders should find the most reliable price before HODLing an asset.

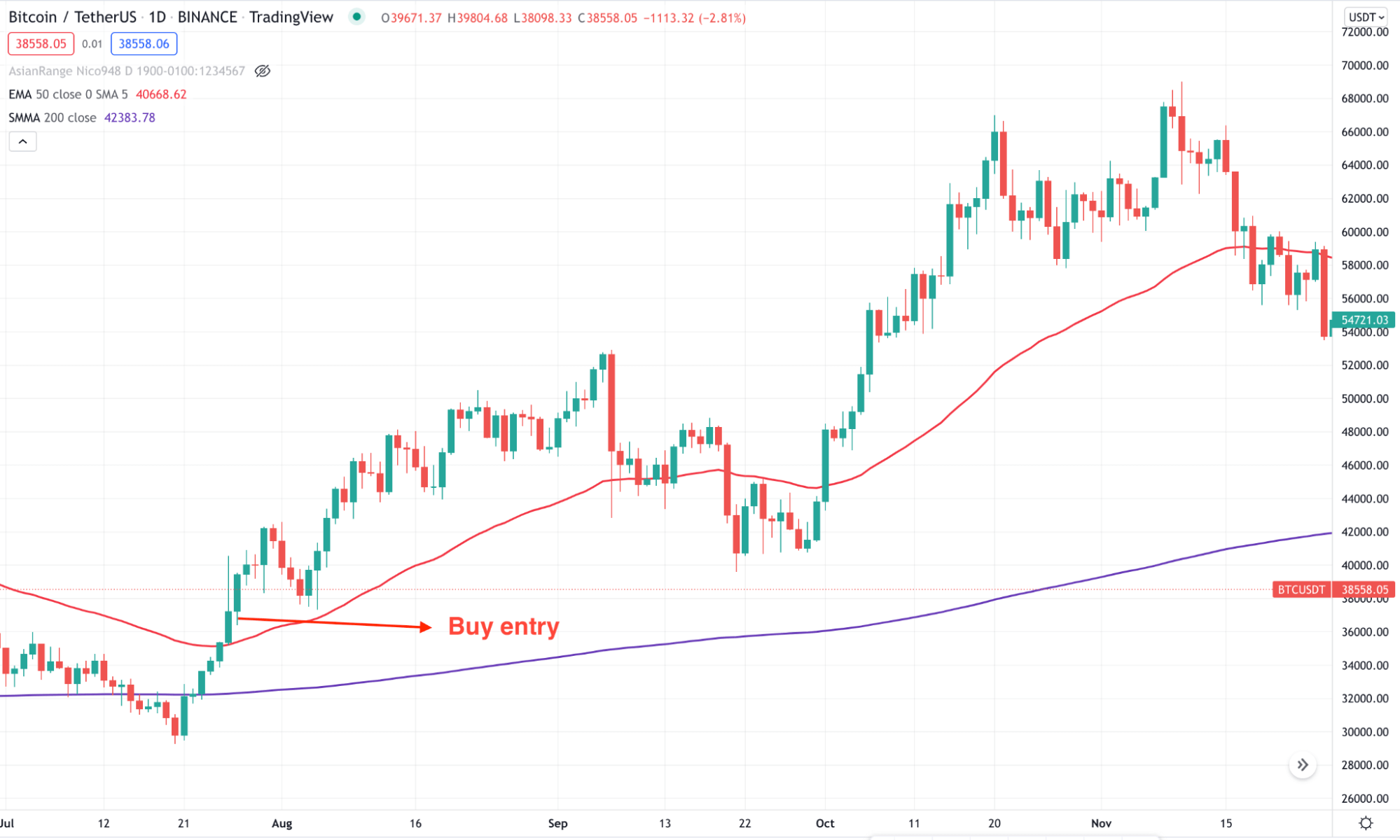

Bullish trade scenario

In the bullish trade, we will use the golden cross method where the 50 EMA should crossover the 200 SMA, indicating both short-term and long-term trends are bullish.

Long-term bullish trade example

Entry

The bullish trade is valid once these three conditions are present in the price chart:

- First, the price is above the 200 SMA.

- EMA 50 moves above the 200 SMA.

- A bullish daily candle appears above the 50 SMA.

Stop loss

The conservative approach is to HODL the trade until it breaches the SMA 200. On the other hand, the aggressive way is to find the price below the bullish rejection candle to consider is invalid.

Take profit

The first take profit is based on 1:2 risk: reward when the trader should close 50% of the position. On the other hand, traders can hold it for further gains if the price action allows.

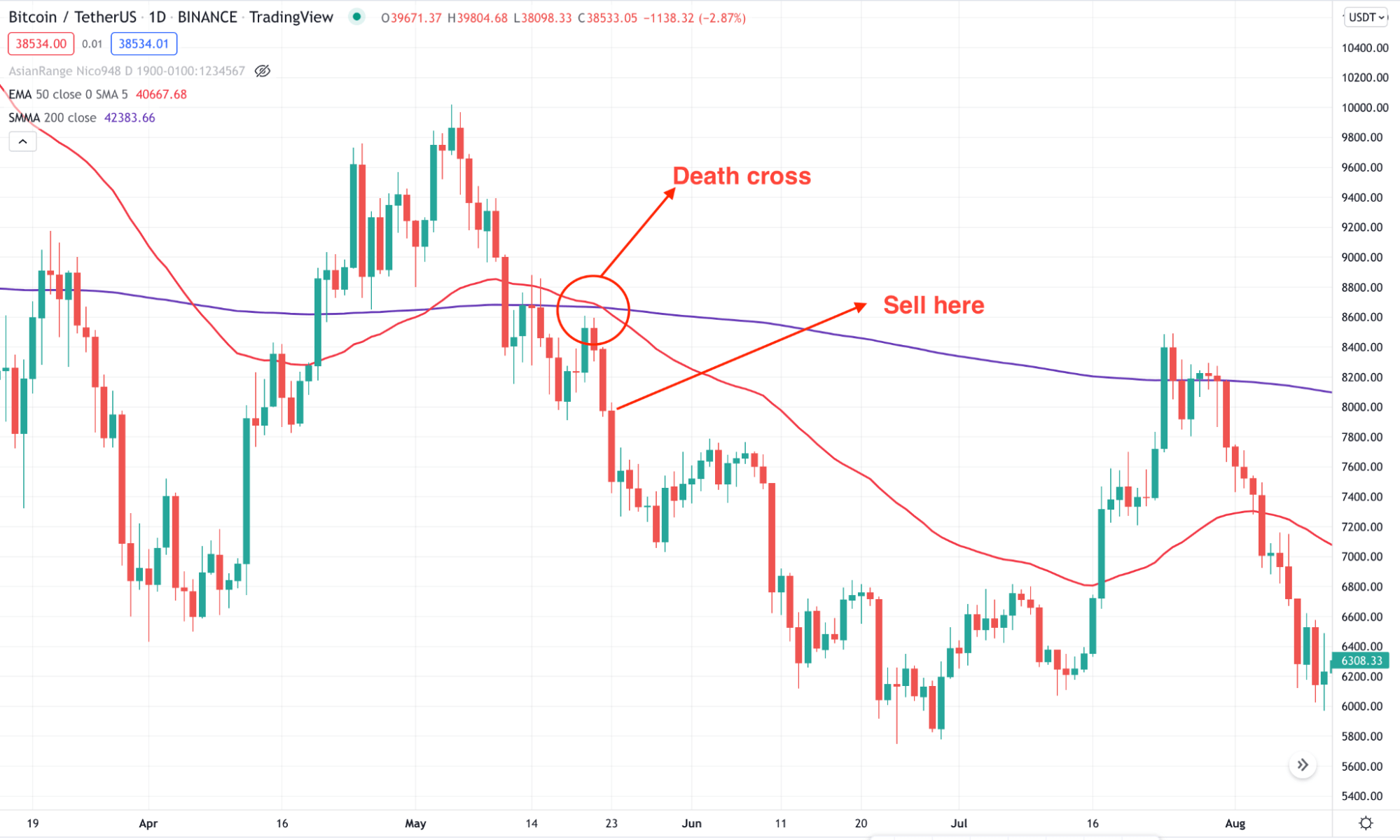

Bearish trade scenario

The bearish trade is the opposite version of the golden cross, which is known as the death cross.

Long-term bearish trade example

Entry

The death cross trade is valid once these three conditions are present in the price chart:

- First, the price is below the 200 SMA.

- EMA 50 moves below the 200 SMA.

- A bearish daily candle appears below the 50 SMA.

Stop loss

The conservative approach is to HODL the trade until it breaches the SMA 200 as a dynamic resistance level. On the other hand, the aggressive way is to find the price above the bearish rejection candle to consider is invalid.

Take profit

The first take profit is based on 1:2 risk: reward when the trader should close 50% of the position. On the other hand, traders can hold it for further gains if the price action allows.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

Cryptocurrency trading provides more reliability than the traditional financial market as people can make more money without taking any leverage. However, there are some risks that a trader should be aware of. A tight risk management system is applicable in this scenario; otherwise, it might eat all profits in a single crash.

Comments