Trading the spot forex market involves speculating on the next movement of currency pairs. Stated another way, you have to predict which direction (up or down) the market will go in the near term and then trade in that direction. If your prediction is correct, you are bound to make money; you will stand to lose money if wrong.

Most trading strategies involve trading with a bias in mind. However, few strategies do not require understanding the current trend or bias to become profitable.

Let’s learn about the hedge-martingale system, which is popular among algorithmic traders.

What is the hedge-martingale system?

As the name suggests, this system uses the concept of hedging to trade the market even without analyzing where the market will go next. The idea behind this system is that markets tend to range for a while before making strong moves in one direction.

When the market is not ready to move, it will usually fluctuate up and down in a defined range. When it breaks out and starts moving in the breakout direction, martingale is used to close the basket of trades as soon as possible in profit.

Hedge-martingale system rules

Here are the rules you should follow to trade the hedge-martingale system, steps to take when looking for trade entries, and managing open trades.

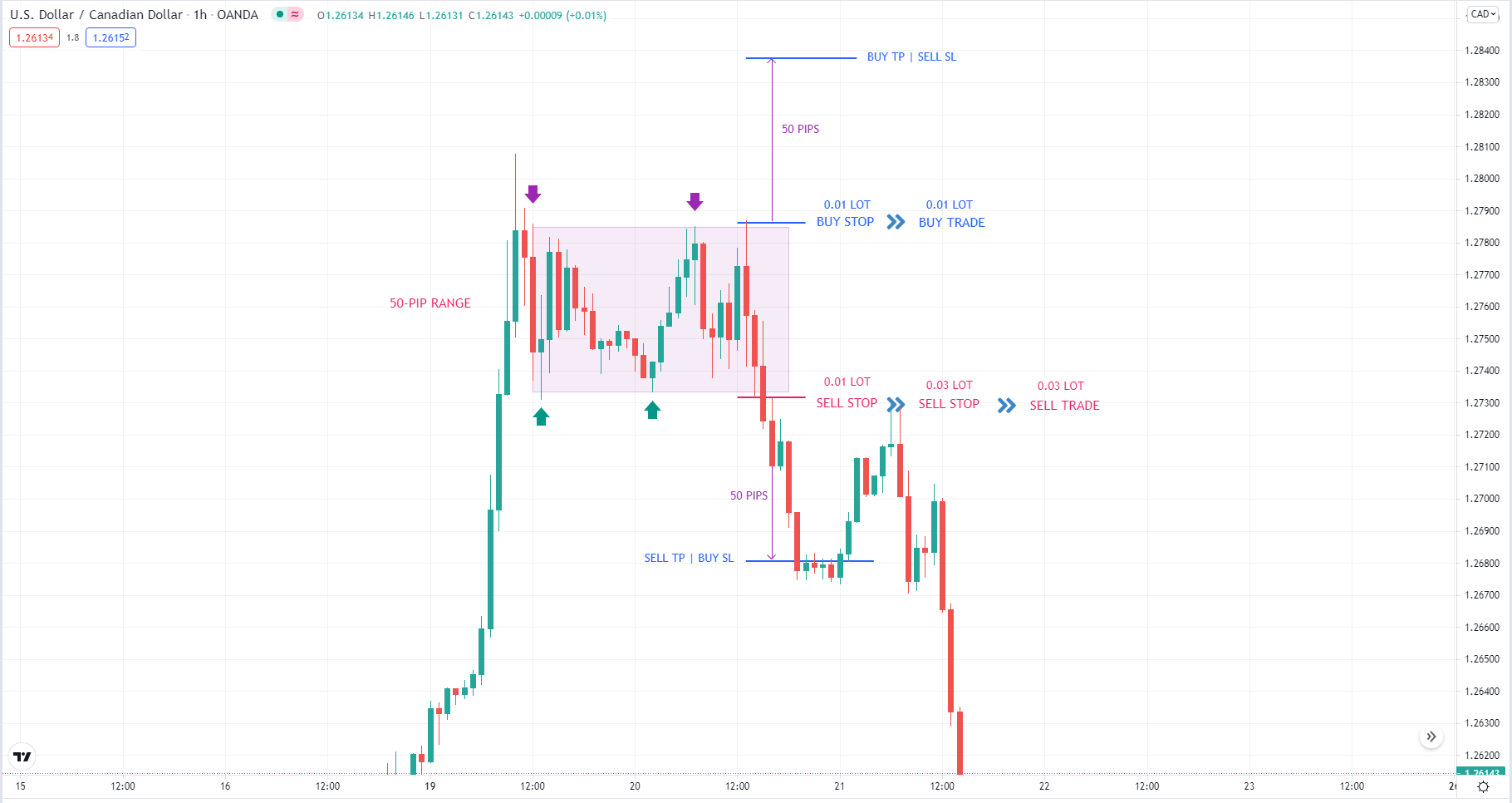

USD/CAD

Find a trading range

Find a consolidation range on the hourly chart. A consolidation range is a tight area on the chart where price moves up and down between upper and lower boundaries. Depending on the currency pair being considered, the range might measure from 30 to 50 pips. To have a valid range, see that price touches the upper boundary or resistance at least two times and the lower boundary or support at least two times.

Consider the above hourly chart of USD/CAD. The moment you have two up arrows and two down arrows, you know you see a range. To see the range clearly, you can use a rectangle, which should touch the upper and lower boundaries of the range. Then extend the rectangle to the right.

Determine the pip range

Please note we have not considered the spread in the discussion and the gap between the entry price and the range boundary. So this is to make the discussion simple. In actual trading, these factors are essential to consider. The 50-pip take profit is the same as the size of the range.

Place pending orders

After defining the range, you can put a buy stop a little above the upper boundary and a sell stop below the lower boundary. One of these stop orders is your potential entry, pending a market breakout. As you can see, the market first broke above the range but did not continue and then eventually broke down with a massive force.

Determine the lot sizes

Your initial pending orders should be small because you expect multiple trades per cycle depending on your account size. In the above example, we use the smallest lot size provided by most brokers and platforms, which is 0.01 lot. If you start with this initial lot size, the lot sizes you will use will be: 0.01, 0.03, 0.06, 0.12, 0.24, 0.48, 0.96, etc.

As you can see, the next lot size is two times greater than the previous lot size, except for the second trade, which has a lot size of two times the previous lot size plus the initial lot size. You can compute the second lot size this way:

0.03 = (0.01 x 2) + 0.01

Determine the stop loss and take profit

For this strategy, the stop loss and take profit of all open positions are the same. Using the above example, since the last trade is a sell, its profit is 50 pips below the sell entry price. The stop loss of the buy trade coincides with the take profit of the sell trade. Therefore, the stop loss is around 100 pips below the buy entry price.

Please note we have not considered the spread in the discussion and the gap between the entry price and the boundary of the range. This is to make the discussion simple. In actual trading, these factors are essential to consider. The 50-pip take profit is the same as the size of the range.

Place a pending order if needed

After the price has touched your last pending order and converted it into a market order, you should put another pending order on the opposite side of the range just in case the price turns the other way before hitting the target. As long as the price does not hit the target, you will keep on adding a pending order. That is what trade management looks like for this trading strategy.

Things to consider when using the system

Apart from the entry and trade management rules, there are other things you must consider. These are critical to the success of your implementation of the trading system.

Spread

We have not considered the spread in the above example to simplify the discussion. In reality, the spread is a significant factor in the success of this system. Therefore, you must find pairs with small spreads such as EUR/USD, USD/JPY, and others. Also, some brokers provide lower spreads than others, so you should implement this system in a trading platform offered by a broker with tight spreads.

Market session

You have to test this system in demo trading to determine which market session will work best. Most often, you can see a lot of movement during London and New York sessions. It all depends on the currency pairs you are going to trade with this system.

Market selection

Some pairs are more volatile than others. This system works better in volatile currency pairs than in inactive pairs. You can easily check which pairs are volatile by looking at the average daily range. Just because a pair has a daily range, for example, of 200 pips, does not mean it is already a good fit for this system.

GBP pairs usually have higher daily pip movements than other currencies, but often that volatility is accompanied by a significant spread. Consider the GBP/NZD daily chart below. The average daily range for this pair for the last 20 candles is 130 pips, and the current spread is 20 pips. Although volatility is good, the pair has an unacceptable amount of spread, so select markets properly then.

GBP/NZD

News trading

You can use this trading system to trade news events provided you can execute pending orders and set take profit and stop-loss orders fast. However, trading during these fast-paced times can be difficult due to the following:

- Slippage

- Widening of stop levels

- Ballooning of spreads

To successfully implement this system for news trading, automating the process using an expert advisor is an option. A good developer could quickly develop a program that will execute the algorithm defined by the system rules.

The worst enemy of the system

If you have used automated trading systems in the past, such as grid and martingale systems, you must have known that these systems work in only one type of market condition. Most grid and martingale systems work in ranging markets but fail in trending markets.

In comparison, the system under discussion will only work in trending markets. When the traded pair enters a range after having multiple open trades, you could subject your account to significant drawdowns. If the price consolidates longer than you expect, you might end up opening too many trades that your account cannot handle. When this happens, you could lose your capital.

Take note that markets can consolidate without warning. Therefore, you have to be careful when using this system.

Follow these guidelines to reduce the risks:

- Select pairs that trend more than the range.

- Trade pairs with low spreads.

- Trade during the times when you can expect the market to make big moves.

- Consider scenarios where you can expect the price to move, such as a highly overbought or oversold reading from an oscillator; the price has drifted too far away from a long-term moving average, etc.

Final thoughts

The concept of trading without considering bias or identifying the underlying trend sounds good. There are few strategies based on this concept. Although you can make quick profits with this system, there is always a risk that your traded instrument transitions into a range phase. When this happens, your account might suffer large drawdowns. Therefore, before you trade real money with this system, try it first in a demo account for a reasonable amount of time and see if it holds water.

Comments