The Pink FX trading strategy for MT4 is mainly a trend reversal trading method built based on many technical indicators. It is the most profitable trading method and has very impressive winning records. The trading method is simple, but a novice trader can earn money from it with proper knowledge.

Moreover, this trading system is developed based on market momentum and price action context. Since we have used many indicators on this trading strategy, we will constantly look for confirmation from the indicators.

However, we will use technical indicators like GMMA Long, GMMA Short, London open, ZigZag pointer, and MACD cross indicators set up to increase our trading likelihood.

What is the Pink FX trading strategy?

The Pink FX trading strategy is the most beneficial trading method. It was specially built to trade on the forex market. This strategy can be applied in a trade on any forex pairs and on any time frame. However, there are restrictions to trade on any specific currency pairs.

The trading system can provide highly accurate trades as it gives signals based on most anticipated technical indicators like GMMA, MACD, Zig Zag, etc. Moreover, the higher the time frame, the higher precise trades you can get from this strategy. So, try to always trade on the higher time frame for better outcomes.

The Pink FX trading strategy for MT4

For higher accuracy, we will use multiple trading indicators to locate the price momentum. However, the forex market is full of incertitude, and there is no 100 percent guarantee that every trade will run on profit. So, you have to develop a trading method that will give you high outcomes and less risky trades.

Let’s look at the indicators that have been utilized in the Pink FX trading strategy for MT4.

Trading indicators that we have used in the Pink FX trading strategy for MT4

GMMA (Guppy Multiple Moving Average)

It is the most anticipated technical indicator. However, it has been designed to identify the trend reversals, breakouts, and trade signals by adding two moving averages (MA) with various periods. The man who has developed this indicator is an Australian trader Daryl Guppy.

Besides, the GMMA indicator uses two groups of MAs, short-term and long-term. Total of 12 MAs, six each. The short-term has inputs of 3, 5, 8, 10, 12, and 15 periods. In addition to this, the long-term has inputs of 30, 35, 40, 45, 50, and 60 periods.

So, when the short-term MAs cross over long-term moving averages, it indicates that the trend is bullish. On the contrary, when long-term moving averages cross below the short-term moving averages, it indicates that the trend is bearish.

London open

It is an MT4 indicator developed to show the London session’s high and low areas. The Aqua line indicates the resistance level of that session, and the Magenta line shows the support level. If the price rejects the Aqua line, bears may probably regain momentum. On the other hand, if the price bounces from the Magenta line, bulls may probably regain momentum.

ZigZag pointer

The indicator marks points on the chart, whether prices converse by a higher rate than a pre-picked variable. Then straight lines are drawn associating those points. This tool is used to help distinguish price patterns. It disposes of irregular price vacillations and endeavors to show changes in the pattern.

When there is a price move between a swing high and a swing low that is more noteworthy than a predetermined rate, ZigZag lines possibly show up. Mostly, the predetermined ratio is at 5%. The indicator makes patterns simpler to spot in all the periods by separating minor price moves.

MACD cross

It is a technical indicator, which provides buy and sell signals as a blue and Magenta arrow. These arrows are developed based on MACD calculation. However, you may not see any visual MACD indicator on the chart.

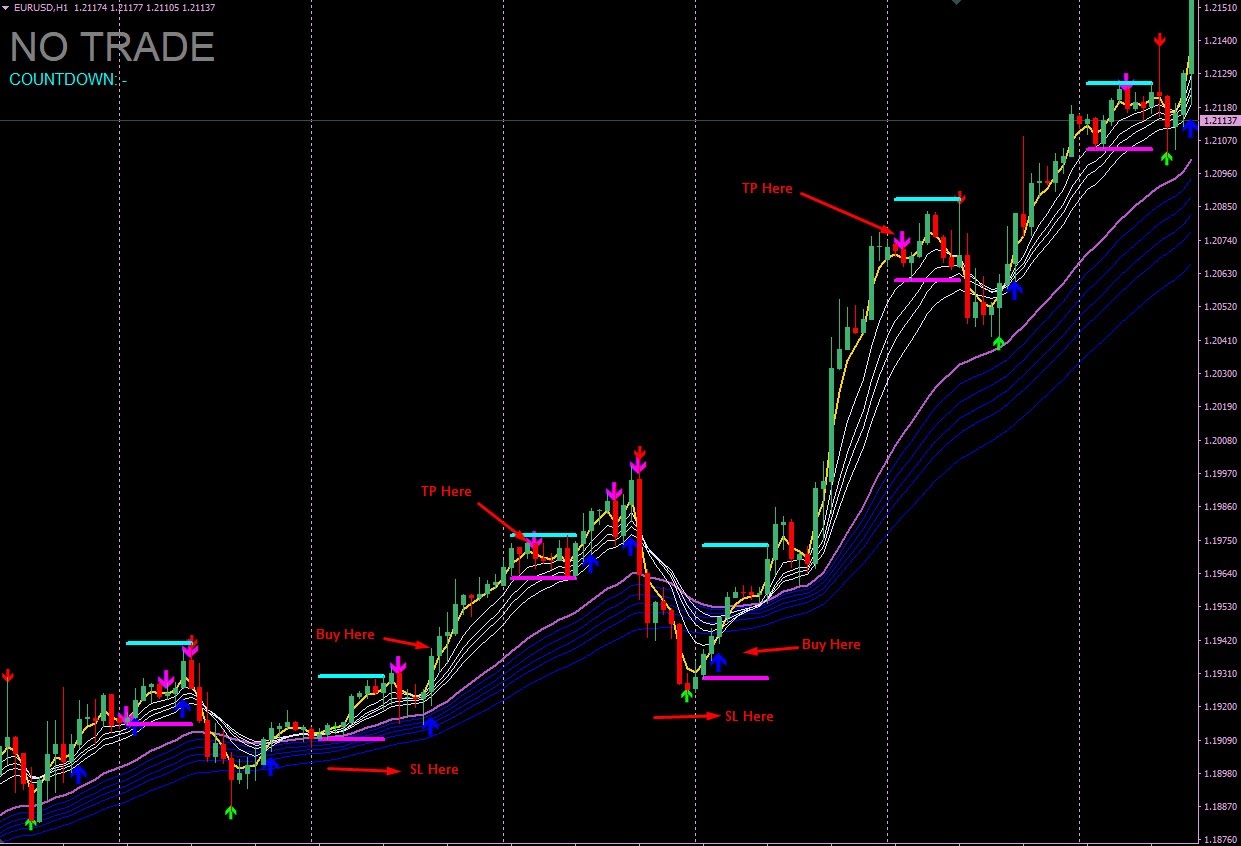

Bullish trading strategy

You can trade Pink FX trading strategy for MT4 on all the time frames from five minutes to daily. However, it works best on the H1 and H4 time frames. Lower time frames risk certain economic events, which may easily take out your stop loss.

Moreover, you can trade on any forex pairs, such as GBP/USD, EUR/USD, USD/ZAR, USD/CAD, GBP/CAD, EUR/CAD, EUR/NZD, USD/NZD, USD/JPY, etc.

Bullish trading conditions

- Candles touch the Magenta line

- MACD cross indicator blue arrow

EUR/USD trading chart

Entry

Open a buy trade after confirming all the trading conditions. Also, you can place a buy-stop order above the running candle with a few pips buffer.

Stop loss

Since this trading strategy is built based on market momentum and short-term market reversal, you can place a stop-loss order below the MACD cross indicator blue arrow with a few pips buffer.

Take profit

It is ideal for targeting the profit based on the 1:5 to 1:2 risk-reward ratio. So, if you are risking 20 pips on a position, you should take the profit of at least 40 pips. Alternatively, you can take the profit when the MACD cross indicator Magenta arrow appears.

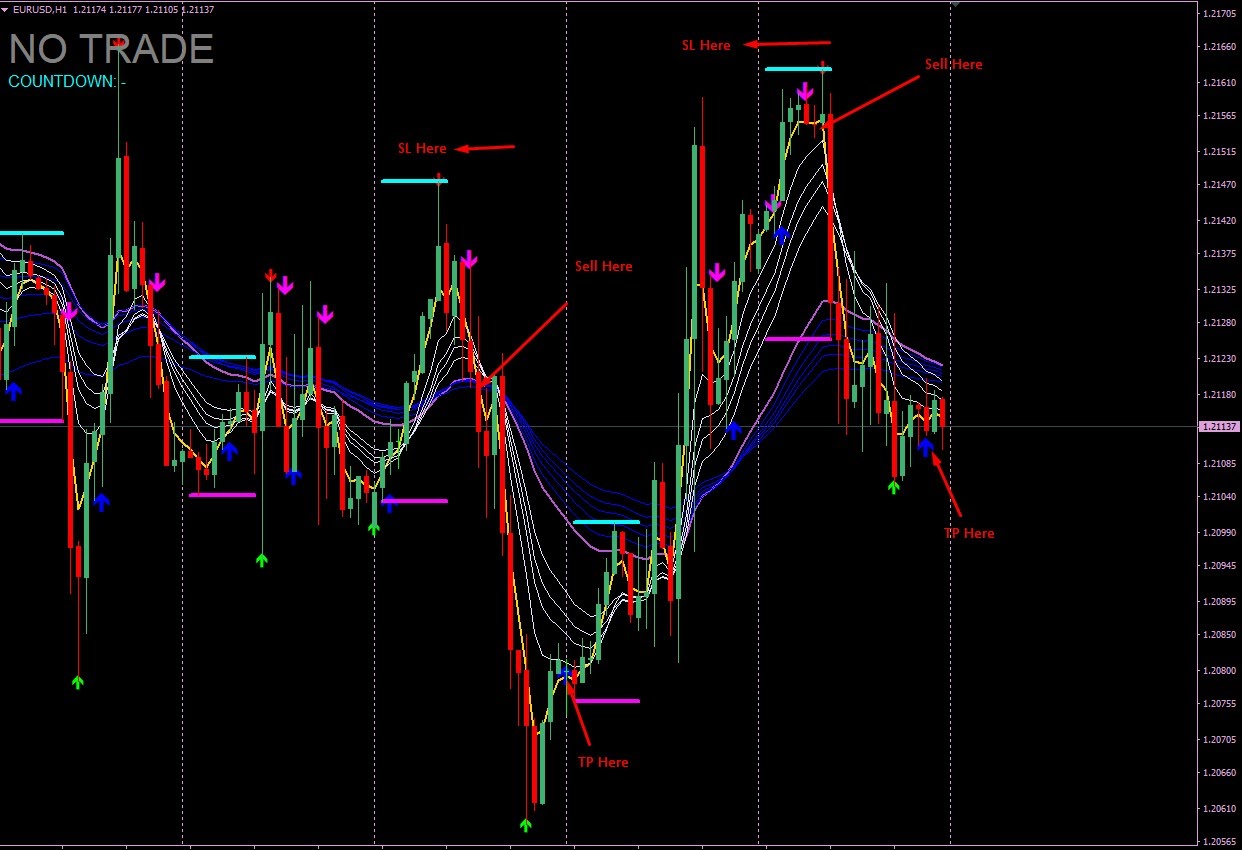

Bearish trading strategy

You can also apply the Pink FX trading system to bearish trading. It also works on all time frames from five minutes to daily. However, it works best on the H1 and H4 time frames. Lower time frames have the risk of certain economic events, which may take out your stop loss easily.

Moreover, you can trade on any forex pairs, such as GBP/USD, EUR/USD, USD/ZAR, USD/CAD, GBP/CAD, EUR/CAD, EUR/NZD, USD/NZD, USD/JPY, etc.

Bearish trading conditions

- Candles touch the aqua line

- MACD cross indicator Magenta arrow

EUR/USD trading chart

Entry

Open a sell trade after confirming all the trading conditions. Also, you can place a sell stop order below the running candle with a few pips buffer.

Stop loss

You can place a stop-loss order above the MACD cross indicator Magenta arrow with a few pips buffer since this trading strategy has been built based on market momentum and short-term market reversal.

Take profit

It is ideal for targeting the profit based on the 1:5 to 1:2 risk-reward ratio. So, if you are risking 20 pips on a position, you should take the profit of at least 40 pips. Alternatively, you can take the profit when the MACD cross indicator blue arrow appears.

Final thoughts

The Pink FX trading strategy for MT4 works best if you can apply it appropriately. However, there is no 100 percent perfect trading method in the world. So, in each trading system, success depends on money management.

Therefore, to achieve better trading results from this trading strategy, you should utilize proper money management.

Comments