A trader needs to apply an efficient strategy in forex trading, where the invested amount is a small part of the system. Trading out of nowhere will give you nothing, and you may go through some extreme risks.

Therefore, before starting trading, you must prepare yourself properly by enhancing your knowledge inside out. Also, to have synchronization of your personality, psychology, and your objectives with the FX market is quite essential.

On the other hand, trading with $1 million is not the same as trading with $100. The small deposit involves some risks that a trader cannot ignore.

Let’s check a complete trading guide applicable to any investment amount from $100.

- What are the basics of the trading strategy?

- How do the basics work?

- Step 1. Identify the market trend

- Step 2. Try to understand the market patterns on the higher time frame

- Step 3. Move to a lower time frame to find an entry

- Step 4. Use technical indicators

- Step 5. Use proper money management

- Final thoughts

What are the basics of the trading strategy?

Traders can use both automated and manual trading strategies to generate FX trading signals. Choose to apply a manual trading strategy. You must be prepared to contribute a lot of time and attention since manual trading strategy requires the trader to be seated in front of the computer screen, finding out and decoding the trading signal to decide whether to buy or sell.

On the contrary, an automated trading system helps you quickly decipher the trading signals with the developed algorithm. It not only finds the signals for you but implements the trades by itself. Therefore, you do not have to constantly sit in front of the screen to monitor the trades, which means it is a time saver. Moreover, the advanced systems keep human emotions out of consideration and pay heed to improve performance.

How do the basics work?

Most traders want to avoid complex strategies and prefer a simple trading strategy. But there are some factors available that require consideration in applying a profitable trading strategy.

First, it is vital to select the market and decide which currency pairs you are willing to trade. Select the market and currency pairs, then practice more and more to become a master at reading your selected currency pairs. Also, you must pay attention to the position size. Position sizing allows you to help control the risk associated with every individual trade.

Then comes the entry and exit points of the trades. A trader should develop some rules to supervise the timing to enter a long or short position for the selected currency pair, and it goes the same for the exit points. Your regulatory rules will help determine when to get out of a long or short position. It will also help you decide whether to stay or leave the trades out of a losing position.

Furthermore, traders must consider creating trading methods in automated programs such as MetaTrader. MetaTrader makes trouble-free automated rules. Besides, these applications allow the traders to backtest their trading strategies to understand how they would’ve functioned previously.

Step 1. Identify the market trend

The most crucial step in trading is identifying the overall market direction, which is the basis for making trading decisions. Identifying the market trend is very simple. There are mainly three types of market trends:

- Uptrend

- Downtrend

- Horizontal trend

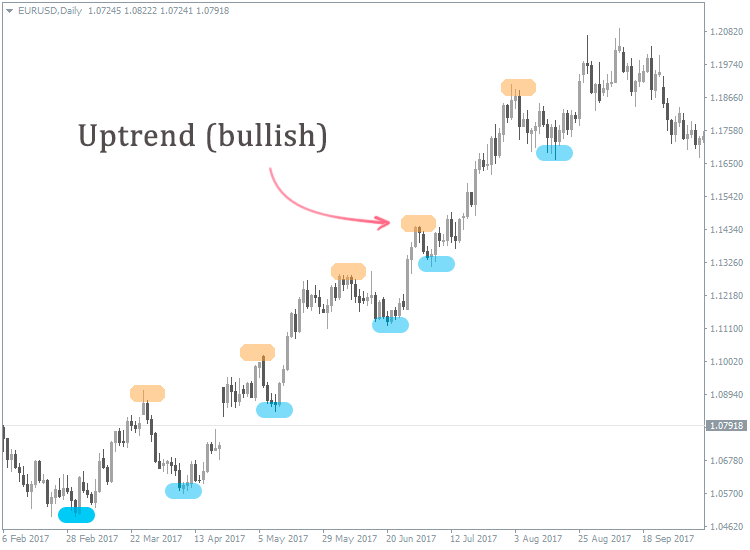

An uptrend is an order of rising highs and lows, where every ensuing high and low is over the past one.

The uptrend on the chart

A downtrend is an order of falling highs and lows, where every ensuing high and low is over the past one.

Downtrend on the chart

A horizontal trend moves sideways, where the price ranges between the resistance level and the support level.

Horizontal trend on the chart

Step 2. Try to understand the market patterns on the higher time frame

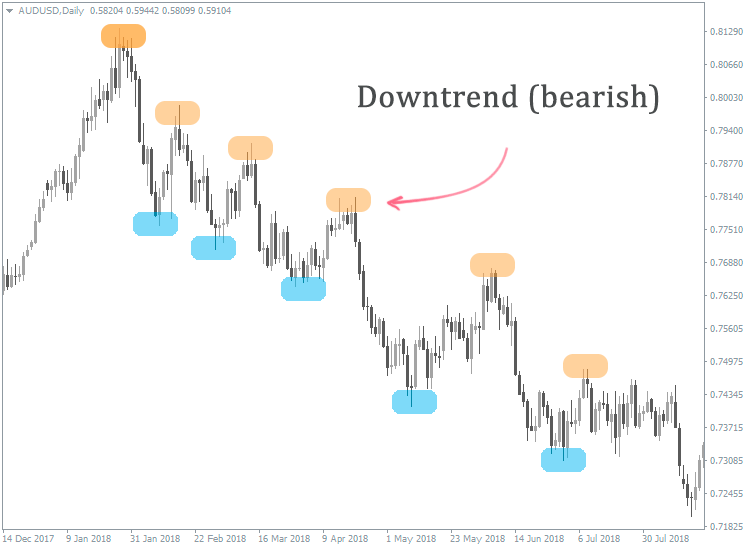

In the technical analysis, alteration into the rising and the falling trends is mainly indicated by the price patterns. A price pattern identifies the structure of the price movements recognized utilizing a progression of trendlines and curves.

Moreover, it is known as the price reversal pattern, when the price pattern indicates a change in the trend direction. A continuation pattern happens when the market moves in its ongoing direction after a brief correction.

Chart patterns

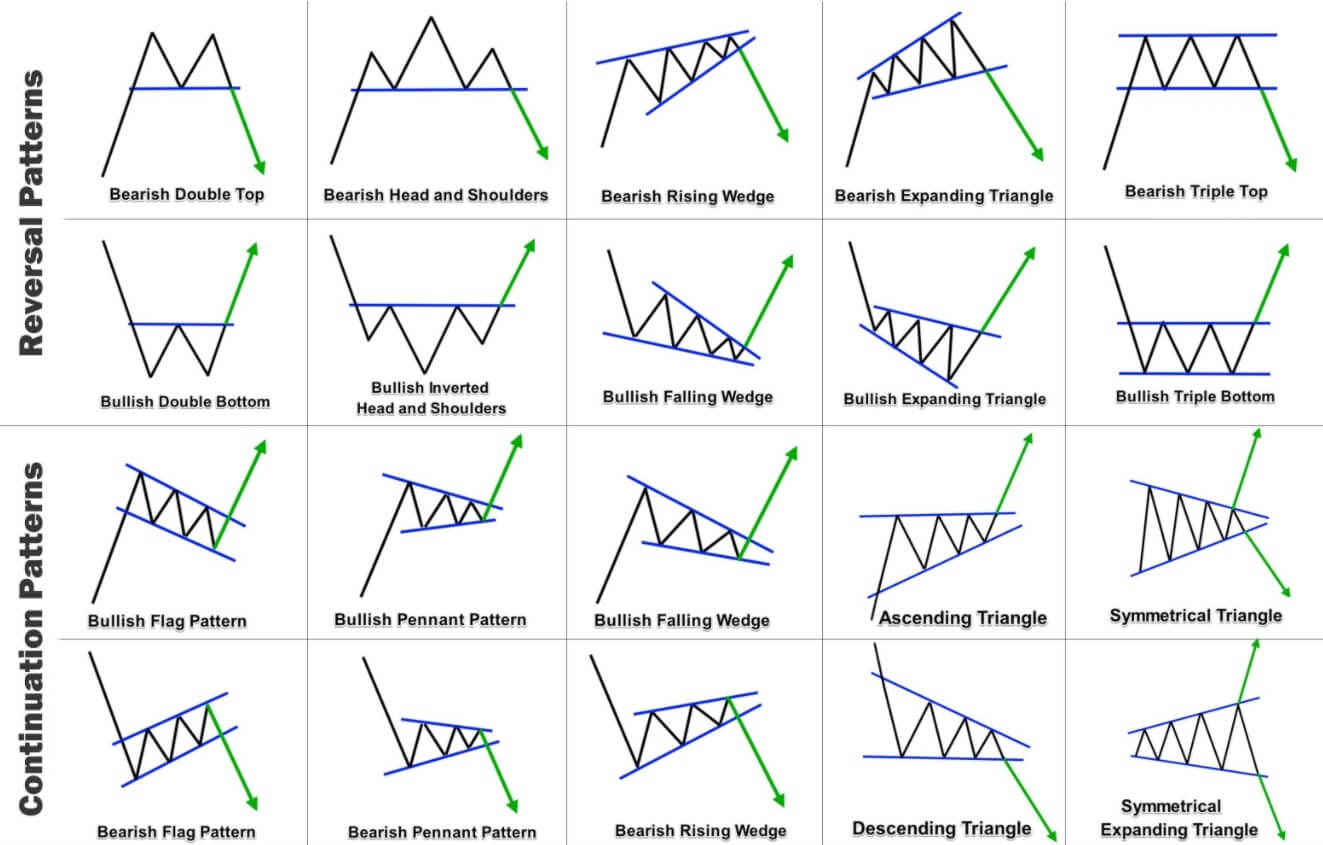

Step 3. Move to a lower time frame to find an entry

After identifying the market pattern on the higher time frames, switch to the lower time frame for a good entry point. Also, the lower time frame will allow you to find a good stop loss level. Moreover, you can manage your trade by observing the shorter reversal in the market.

Pattern trading

Step 4. Use technical indicators

Technical analysis is referred to as a mathematically based pattern that traders use to anticipate future price trends for making trading decisions. Technical analysis is obtained from the past data used by the traders previously, which utilizes a mathematical formula taken from the previous price and volume.

However, technical analysts try to find out the indicators in an asset’s historical price to define the entry and exit point of the trades. Several kinds of indicators that are broadly categorized into two primary categories are oscillators and overlays.

Step 5. Use proper money management

The ultimate fundamental principle of money management in forex trading is preserving the capital. Though money management is used to protect the money, it does not ensure that a trader will never lose the money since that would be absurd. Money management in forex trading follows a few series of systems used by traders to manage their capital or money in the trading account properly.

However, money management in FX leads to a systematic way that is opposed to keeping the trading losses lower to remain in a manageable position. Also, it helps the trader to win the trades even if the other trades are facing loss.

Final thoughts

In short, the majority of the successful traders develop their trading strategies and master them by practicing over time. Some of them may use large-scale analysis, while some may pay heed to one specific calculation or study to define their trades; it depends on the traders.

Comments