The FX is the largest financial market in the world, where investors buy and sell currency pairs. There are opportunities for traders/investors, as you can profit from both ways if the price goes up or down. To make profitable trading positions, you only need to know how to trade based on some methods.

Anyway, it sounds simple but not so easy to do so. A consistently profitable forex trader needs proper analysis, experience, mindset, strategy, trade management, etc. An ideal forex trader checks the target pair’s technical, fundamental, and sentiment before making any trade.

Besides the technical outlook, several fundamental facts such as social, political, and economic data are significant that affect the price movement in the FX.

This article will enlighten why traders should follow the news and financial data and where and how to do so.

Why you should get forex news and economic releases

The technical analysis involves charts, patterns, trends, etc., data to suggest trade ideas. In the meantime, the fundamental analysis focuses on several social, political, economic data and news headlines.

The FX is a decentralized market where retail trading happens with a currency pair. When the financial condition, political power, or simply demand rises for a country or currency, the particular country’s currency becomes more robust against any common demandable currency. Moreover, several macroeconomic data affect the market, like the Economics 101 class.

For example, suppose the USD is doing great and rising against all other currencies because the United States economy is improving. So with the positive growth, the central bank may need to raise the interest rate to control the growth and inflation. We know the higher interest rate will make the dollar-dominant assets more attractive to the investors. So the demand for the USD will increase, and it will start to make a positive move against other currencies.

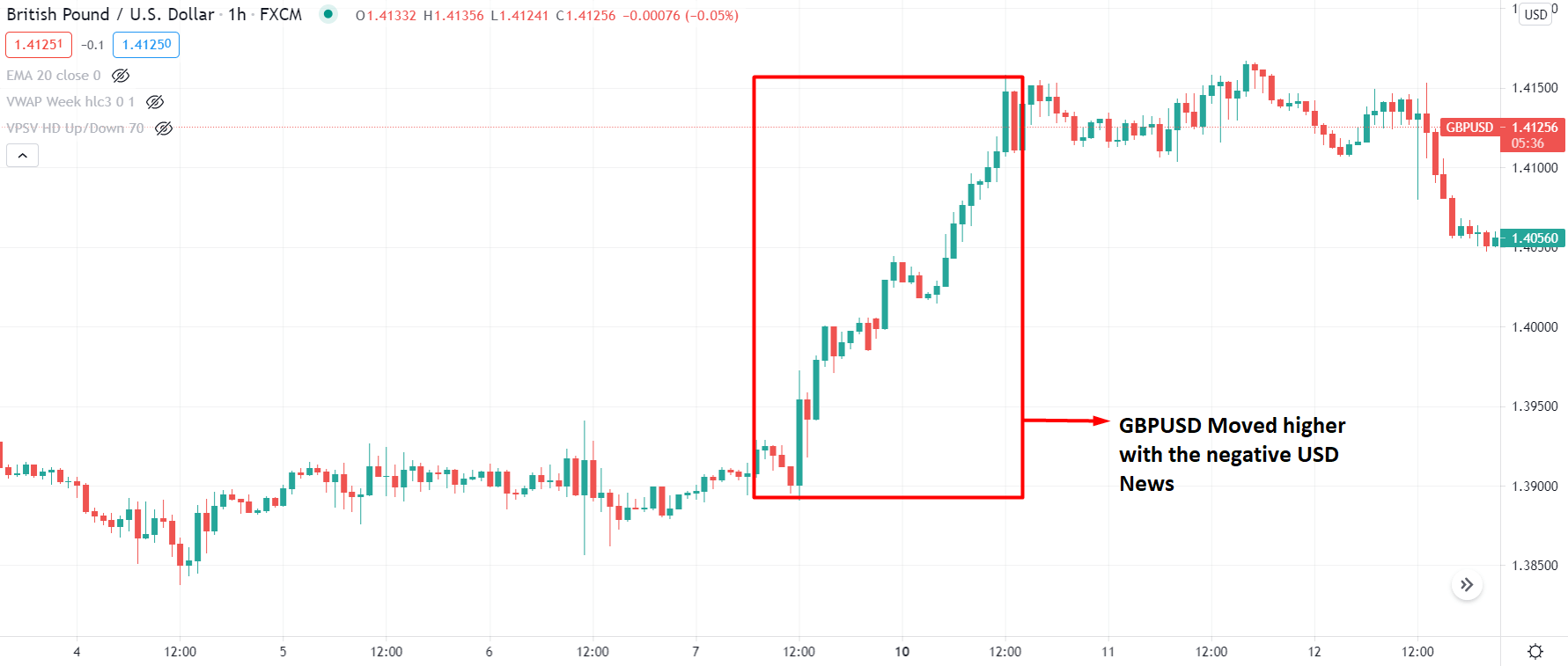

Conversely, the price may move against the USD if any economic event supports it.

The idea of this type of analysis is so simple to shape the country’s current and future outlook. If the country’s economy is in good shape, more foreign investors will invest in that economy to obtain profit. So following the macroeconomic data, social, political, financial, geopolitical news is an essential part of forex trading.

Best way to get forex news and economic releases

Every trader is not similarly skilled with the trading concepts. In this part, we will discuss the best sources to get all fundamental news and events. Those are useful to all types of traders, no matter how experts or professionals. The resources range from the trading chart, technical analysis, and economic data.

These websites also include quality videos, articles, webinars, strategies, education systems, etc. Moreover, some have forums where users can share their experiences and get trade ideas, knowledge, and practical trading methods.

Forex economic calendar

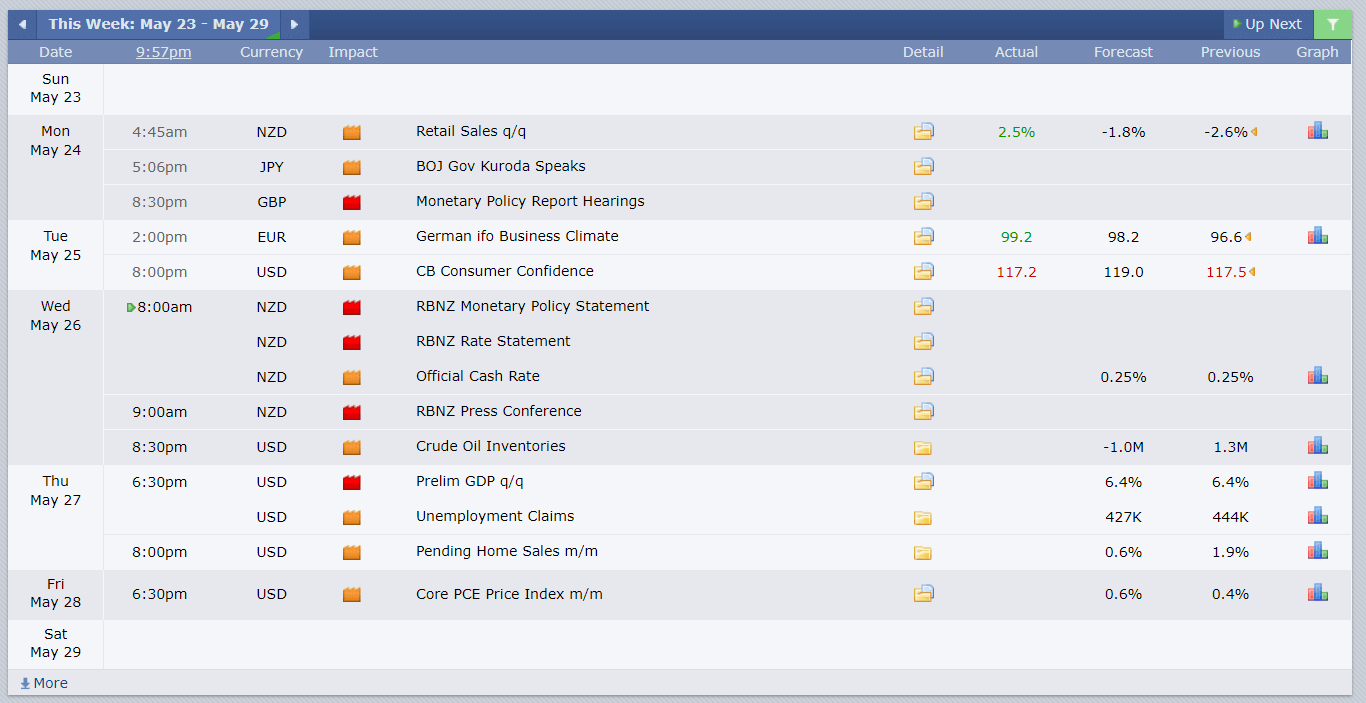

Forex economic calendar is the best way to follow economic events and news. The major currencies, such as the USD, JPY, CAD, Euro, etc., regularly press releases about their macroeconomic data. In addition, all financial data like employment data, GDP, interest rate, housing data, etc., are published periodically, and the forex calendar is the best way to follow them.

For example, Forexfactory.com is very popular among traders, as you can customize time zones and filter out specific currency data. Moreover, users can filter out high, medium, and less effective data of the related currencies.

Let’s see how the forex economic calendar looks like.

Forex broker

Forex brokers also act as a prominent source for current events as they send emails and sometimes make calls to their clients to let them know about specific events. For example, many financial events like interest rate decisions, central bank’s policy changes cause massive moves at the related pairs.

Some brokers stop their deals for a particular time when this time of mass movement happens, so they send signals to their clients before that. Brokers also send signals to their clients about essential data such as DST changes. Some brokers also provide forex education, webinars, etc., to their clients to have more profitable clients.

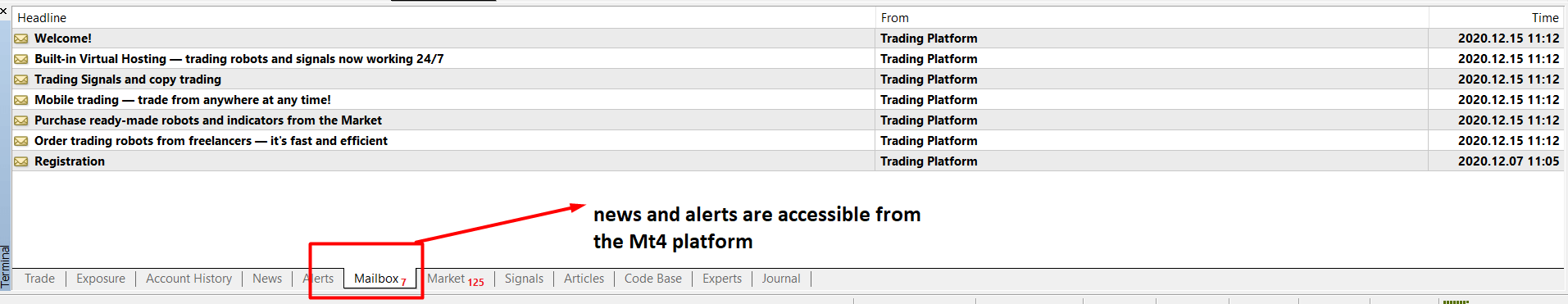

Brokers may send you an email regarding the forex news and updates, or you can directly access them from the MT4 platform.

Forex news providing website

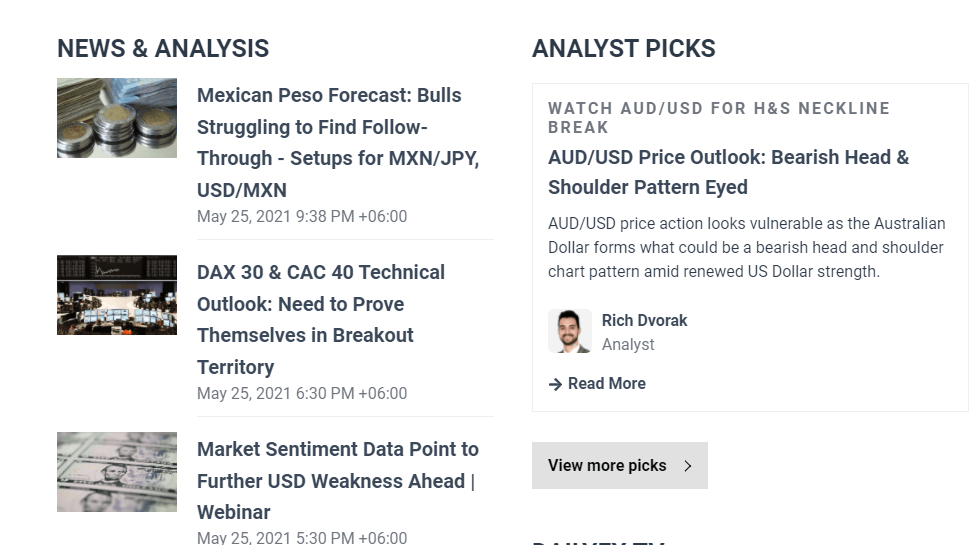

There are some portals and websites that always show forex-related news and press releases. They contain forex, stocks, commodities, bonds, related market data, and information. In addition, they often include technical analysis, economic calendar, and price charts. Such websites are also top-rated among traders for the news releases and historic data about the trading assets.

Thousands of websites like these are beneficial to provide news, information, research, education, etc., to traders for free. In addition, some websites also offer pro services to their clients for some payment.

Let’s have a look at how the forex news providing the website’s interface looks like.

Central banks website

Central banks are the big boys of the FX. They print the money, control inflation, deflation, interest rate, etc. Central banks such as the Federal Reserve, Bank of England, European central bank, etc., major currency-related banks have periodically press releases and policy-related information. They publish that on their websites. If any unexpected changes come up, they also publish that on their websites.

So the central bank’s websites can also be a target place for traders to follow. The big financial corporations follow the central banks more than any individual traders as their trading style is different from the individuals.

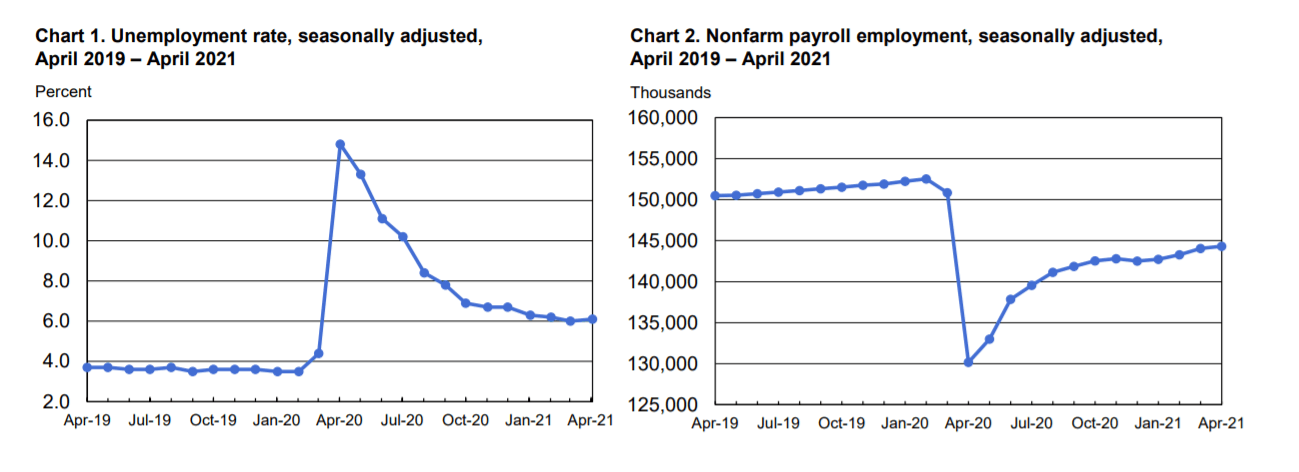

Here we can see the unemployment report of the USA.

Final thought

Finally, now you know why the following economic events and news are important in forex trading, how and where to follow them. Anyway, with some experience, you can easily find out the fundamental impact on the market.

For example, the Brexit back in 2016 caused a big move for GBP-related pairs. You can check that the volatility decreased at any currency just before any significant macroeconomic data release. It may occur as investors wait for confirmation from the related economy to invest their money. It’s better to avoid trading during GDP, interest rate decisions, central bank meetings, etc., for individuals or beginners.

Comments