Heiken Ashi pullback is a trend-following trading system that determines the price direction from the trend and joins it after a correction.

This trading strategy is based on the Heiken Ashi Pullback and exit indicator that works like the traditional candlestick but eliminates volatility. This method applies in any currency pairs, from majors to exotics. Therefore, if you want to build a trend-following strategy, the Heiken Ashi pullback may enrich your trading portfolio.

Let’s start the complete trading strategy using the Heiken Ashi indicator from a simple tool introduction.

What is the Heiken Ashi, and how does it work?

Heiken Ashi is an indicator that works as an alternative to the candlestick, where there are high, low, open, and closing prices in the chart. It looks similar to the candlestick chart, but the significant difference between the Heiken Ashi and candlestick is the calculation method. The candlestick chart uses simple open, high, close, and low, where Heiken Ashi uses the average price.

Let’s have a look at the calculation method of the Heiken Ashi chart:

- The open price: it came from the average price of the previous candle’s open and close.

- The close price: it came from the average price of the previous candle’s open, close, high, and low.

- The high price: it is the maximum price level from the previous candle’s open, close, high, and low.

- The low price: it is the lowest price level from the previous candle’s open, close, high, and low.

Therefore, the core part of the Heiken Ashi is that its price of the current candle depends on the OHCL of the previous candle.

The Heiken Ashi indicator is available for free on most trading platforms, like MT4, MT5, cTrader, Tradingview, and Ninjatrader. However, in some cases, you might have to download and install it from multiple accessible sources.

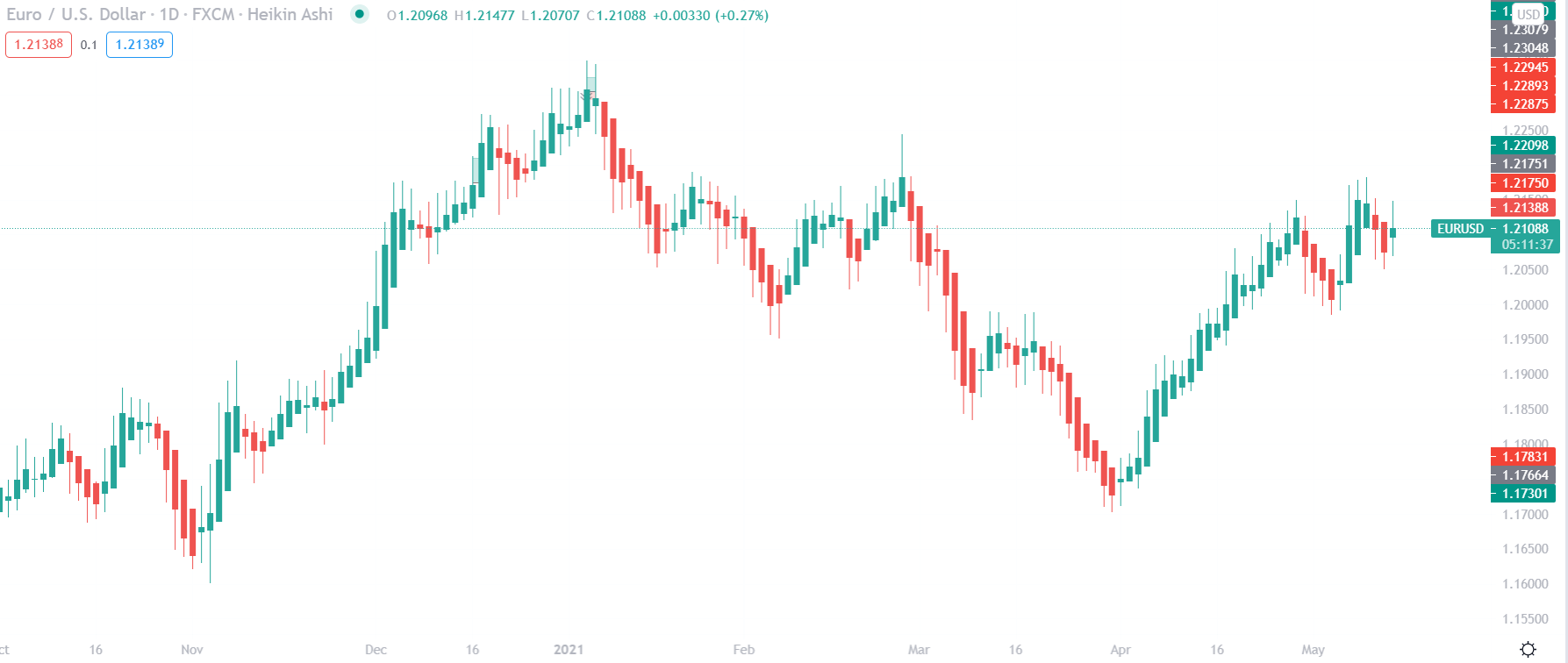

Here is how Heiken Ashi looks like after plotting to the chart.

The red color represents a bearish candle in the above image, and the green color represents a bullish candle. You can change the color at any time according to your choice.

Now move to the core part of the Heiken Ashi trading system.

Heiken Ashi pullback trading strategy

The Heiken Ashi pullback strategy is based on the market context where the market moves within some phases, from impulsive to corrective and consolidation.

Before proceeding further about the trading strategy, let’s have a look at trading tools used for this strategy:

- Heiken Ashi smoothed alerts value: 1-st MA — period 2, 2-nd MA — period 6.

- Heiken Ashi exit value: MA 40 periods.

- MA 2 signal value: 1-st MA — period 5, 2-nd MA — period 7.

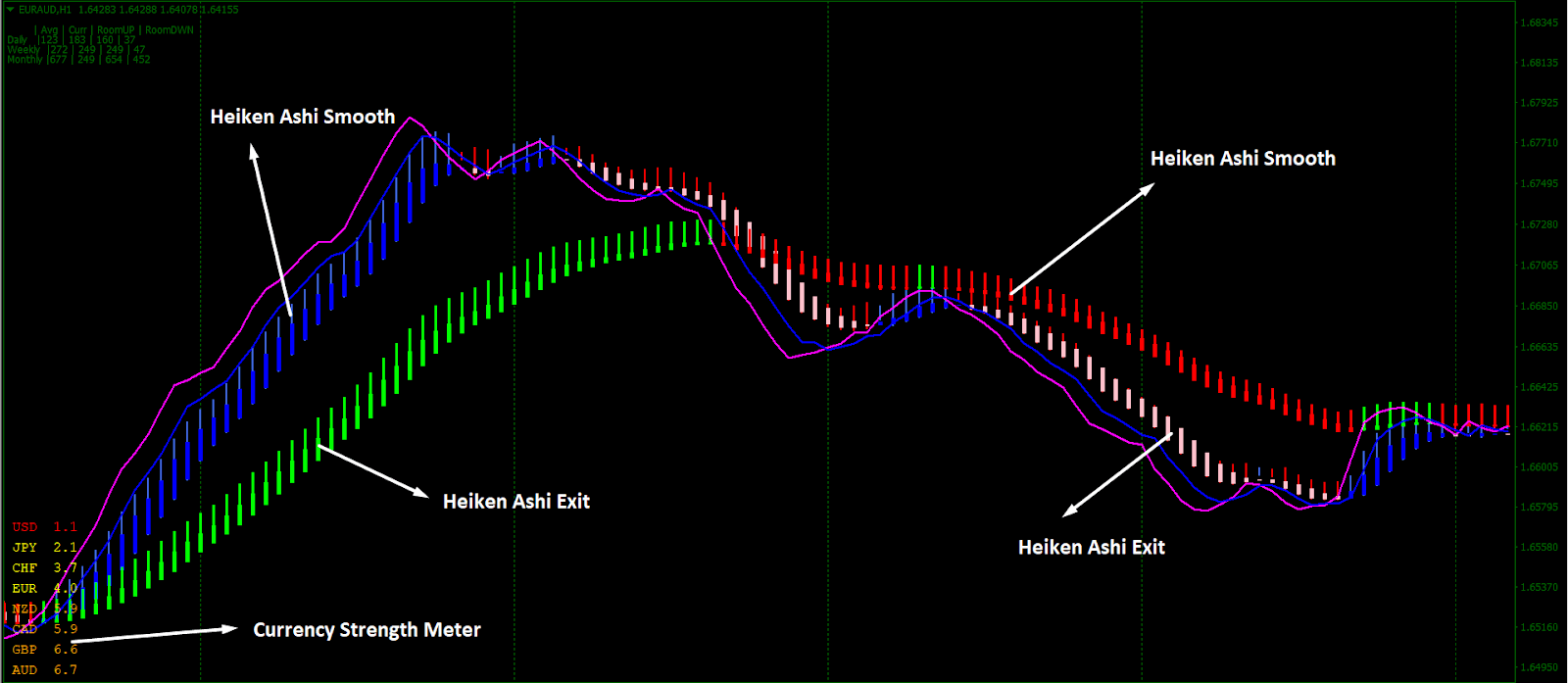

The Heiken Ashi smoothed alerts and the Heiken Ashi exit are two indicators that provide the market direction on Heiken Ashi candles.

The Heiken Ashi smoothed alerts will indicate the current market trend, and the Heiken Ashi exit will indicate the possible market reversal point.

Our main aim is to determine the price direction based on these indicators and get the market’s best output in the Heiken Ashi pullback strategy. Moreover, you should ensure that the market moves within a strong trend by watching the market on a higher timeframe. In that case, if the price is above any fundamental support level, we will focus on buy trades only. On the other hand, if the price is trading below any key resistance levels, we will only focus on selling trades.

Bullish trading system

The Heiken Ashi pullback strategy is a trend-following strategy. Therefore, this trading system works well in all currency pairs that usually move within a trend. Consequently, you can apply it to GBP/USD, GBP/CAD, GBP/NZD, EUR/JPY, GBP/JPY, USD/JPY, EUR/USD, EUR/CAD, EUR/NZD, etc.

This strategy works well in all timeframes, from five minutes to daily. However, moving to a higher timeframe will provide more accurate trades.

Bullish trading conditions

Before moving to the trading entry, make sure to follow these conditions:

- If the major trend is up, focus on buy trades only.

- Heiken Ashi exit — green candle appears in the chart, pointing out that the bullish trend starts at a price.

- Heiken Ashi smoothed alerts moved above the Heiken Ashi exit, indicating that the price is ready to move up after a correction.

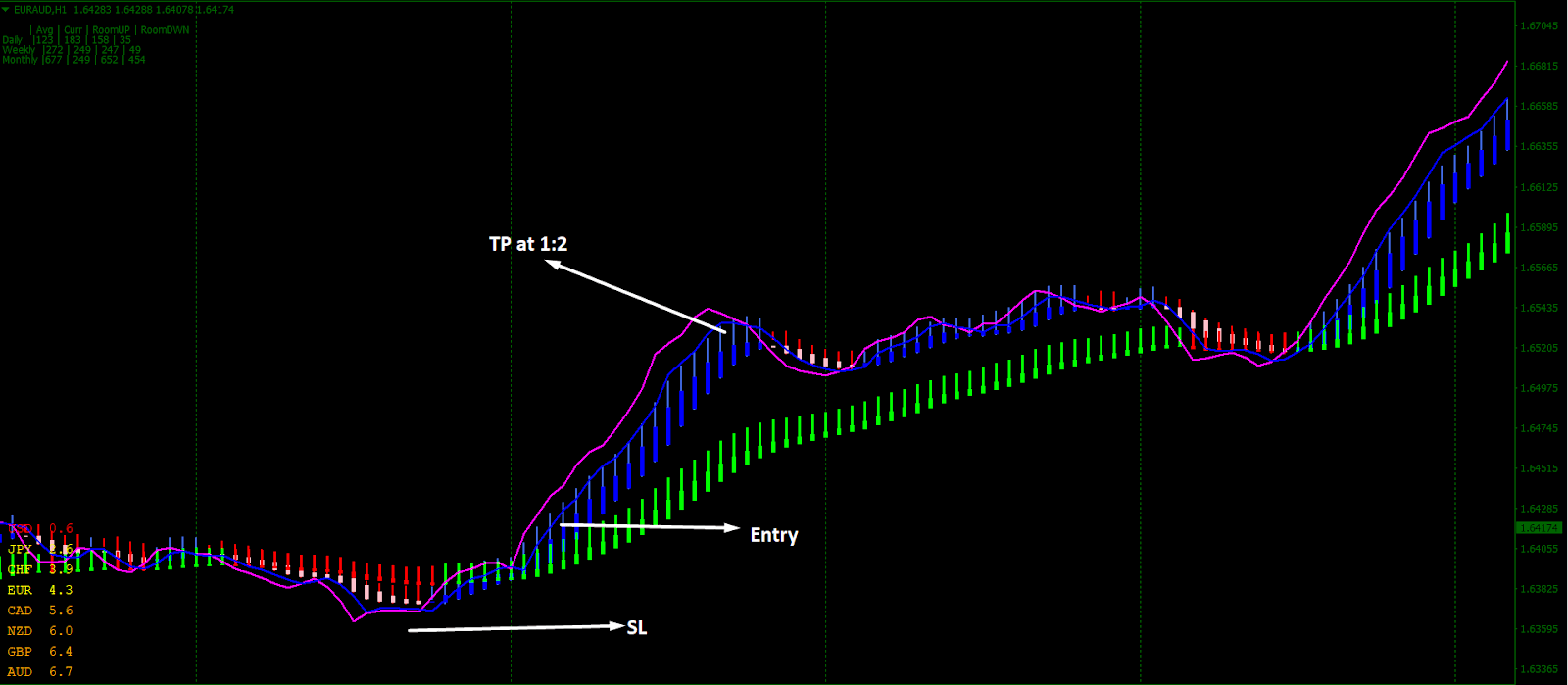

Entry

You should enter the trade as soon as the Heiken Ashi smoothed alert turns red to blue. Make sure to enter the trade after the candle is closed.

Stop loss

As it is a trend-following strategy, the current trend is expected to continue as long as the price is trading above the recent swing low. Therefore, put the stop loss below the recent swing low with a 10 to 15 pips buffer.

Take profit

When the Heiken Ashi exit turns red, it will indicate that the price wants to make corrections. Therefore, you should close the total trade at that time to avoid unexpected market reversal.

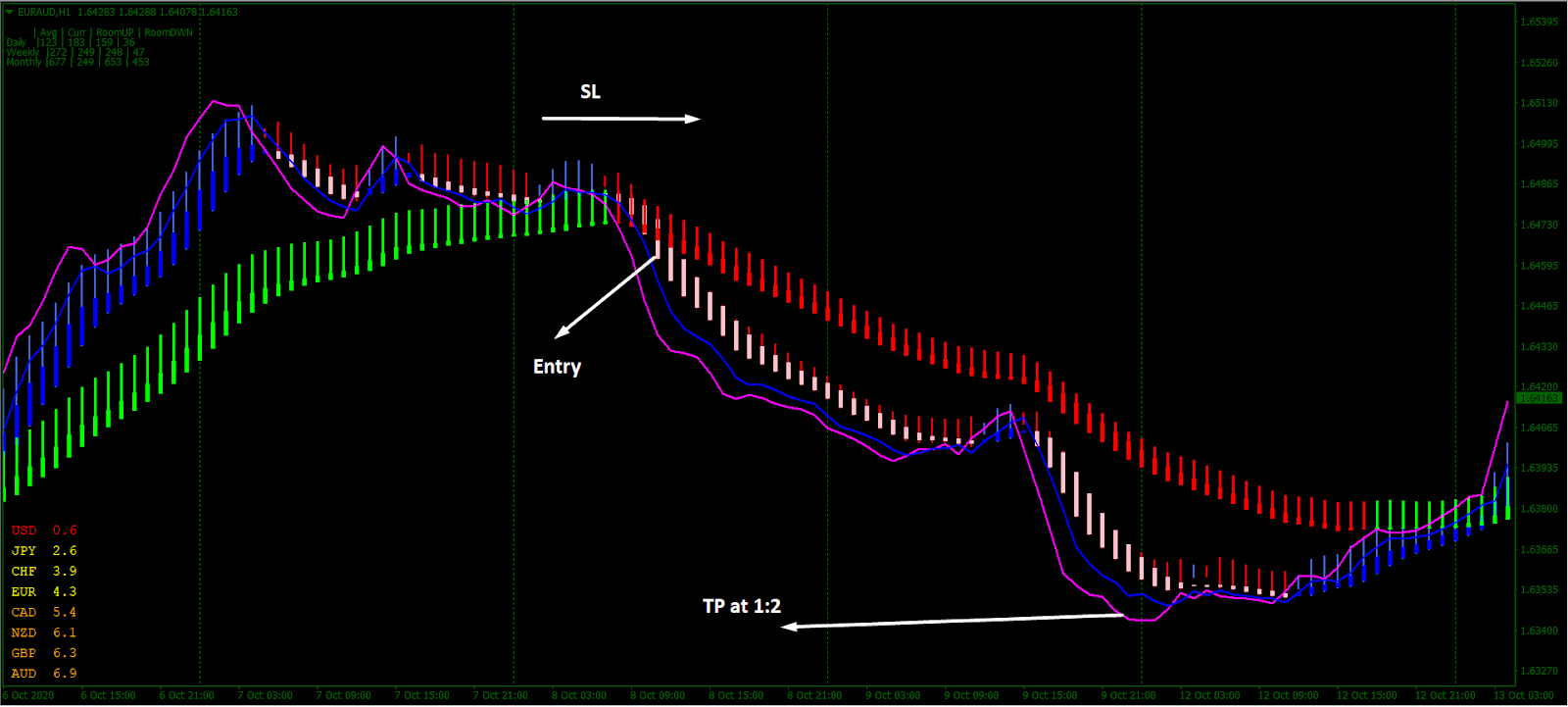

Bearish trading system

The bearish trading system also works well in all currency pairs that usually move within a trend. Therefore, you can apply it to GBP/USD, GBP/CAD, GBP/NZD, EUR/JPY, GBP/JPY, USD/JPY, EUR/USD, EUR/CAD, EUR/NZD, etc.

This strategy works well in all timeframes, from five minutes to daily. However, moving to a higher timeframe will provide more accurate trades.

Bearish trading conditions

Before moving to the trading entry, make sure to follow these conditions:

- If the major trend is down, focus on sell trades only.

- Heiken Ashi exit — red candle appears in the chart, pointing out that the bearish trend starts at a price.

- Heiken Ashi smoothed alerts moved below the Heiken Ashi exit, indicating that the price is ready to move down after a correction.

Entry

You should enter the trade as soon as the Heiken Ashi smoothed alert turns blue from red. Make sure to enter the trade after the candle is closed.

Stop loss

As it is a trend-following strategy, the current trend is expected to continue as long as the price is trading below the recent swing high. Therefore, put the stop loss below the recent swing high with a 10 to 15 pips buffer.

Take profit

When the Heiken Ashi exit turns red, it will indicate that the price wants to make corrections. Therefore, you should close the total trade at that time to avoid unexpected market reversal.

Conclusion

In the forex market, we trade on probabilities. Therefore, there is no exact way to say what the price may head after taking the trade.

As a result, you should follow strong money management and risk management rules to cope with uncertain situations. Moreover, if you can follow the trading rules of the Heiken Ashi pullback strategy, you can make a decent profit every month.

Comments