The financial market involves thousands of strategies to deal with the price movement for individual traders. Some of those trading methods have considerable winning rates, which makes them attractive to any financial investor. The trading method “gap and go” is a popular approach to trade various financial assets such as stocks, currency pairs, commodities, cryptocurrencies, etc.

However, there is no alternative to learning about the complications of any trading method before using that on live trading. We describe the ‘gap and go strategy’ in this article, including trading strategies with this method. Moreover, chart attachments will help you to understand the concept more clearly.

What is the “Gap and Go” strategy?

In this trading method, “Gap” is the difference between different periods’ opening and closing prices. The technique is to seek the gap and place orders according to market context. This strategy works more accurately at the small-cap stocks, so a large number of small-cap stock traders follow this trading technique to make profits. The winning rate is nearly 70-75% of this strategy.

Gap and go concept

You can practice various types of trading through this strategy, such as scalping, day trading, swing trading, or even long-term trading. It’s an effective strategy for trading stocks, penny stocks, commodities, currencies, ETFs, etc.

The “Gap” refers to the previous day closing and current day opening price. Often, the asset opens higher or lower than the last day’s closing due to market context, economic data, participants’ actions, etc. That’s the gap we are talking about and suggest profitable entry positions. There are usually four types of gaps: continuation gap, common gap, exhaustion gap, and breakaway gap.

Continuation gap

You can consider this a runway gap that appears in the middle of any trend and represents massive buying or selling pressure on the asset.

Breakaway gap

This type of gap takes place at the ending of any trend signaling a possible upcoming new trend.

Common gap

Simply declaring an area of the massive price change doesn’t signal anything.

Exhaustion gap

This type of gap occurs at the finish line of any pattern, signaling to create a new low pr high.

How to trade with the “Gap and Go” strategy

It’s simple to trade through the “Gap and Go” trading method. First things first, identify the gaps on the chart, that you can do it by seeking on yourself or using many scanners tools and websites such as pre-market scanner, bar-chart scanner, etc. Then check the market context carefully by conducting technical or fundamental analysis.

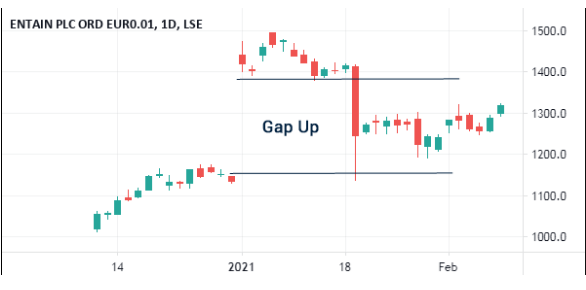

Example of a gap on the chart

Sort out the reason behind making a gap in the price movement to predict the future direction of the price. You can combine the market context with several technical indicators such as volume and momentum indicators. In most cases, the gap relates to the volume data.

Many economic events such as service PMI, CPI data, interest rate, GDP, etc., can cause gaps in the particular currency pairs. Generally, two scenarios occur when a gap takes place. Either the gap fills up quickly as many other traders may want to buy or sell that asset from near the closing price of the last day, or the price never gets back to there and continues as the gap direction.

We share strategies below for gaps that are usually 3-5% of the previous day’s range — otherwise no guarantee of validity. You often find these setups at the stocks rather than the forex market.

A short-term strategy

Here we are sharing a day trading method that will last for a few hours or a day. You won’t need to carry overnight trade with this strategy. You may often find gaps at the opening of the week in the forex market. Seek the gap that takes place at the price chart. You can use 5-15min charts for this strategy.

Gap and go setup on a 15-min chart or Tesla

When there is no sufficient reason to have the gap, the market may prepare to continue in the same direction by filling the gap. The gap may occur due to changing the ownership of the asset. Place buy/sell orders according to volume and price movement. The profit level will be at the gap range and stop-loss above/below the current swing level.

A long-term strategy

Our long-term strategy seeks gaps that have valid reasons to occur on a trendy movement. Place buy/sell. In this case, check the volume info and the news event. If the price covers the gap, your stop-loss level will be below the gap as part of risk management. Close the position when the opposite volume increases against the trend. This strategy works fine on any timeframe chart. We recommend using an H4 or above chart for better results and more profit.

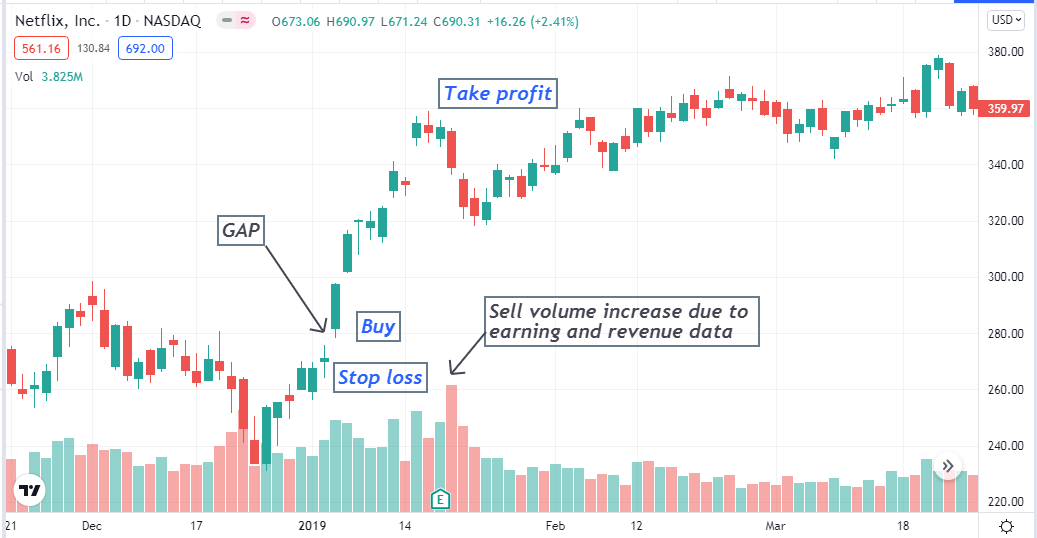

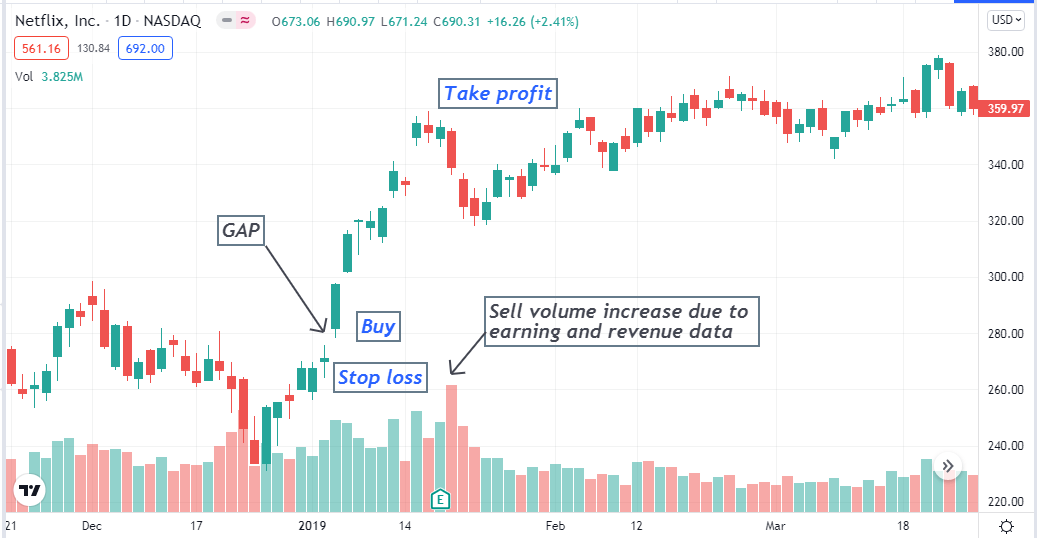

Netflix daily chart gap and go setup on D1 chart

In our example, a daily chart of Netflix has an upside gap due to earning and revenue data. It is a buy suggestion according to our method. You will find many setups on stocks to make appropriate buy/sell orders using this method.

Pros and cons of “Gap and Go” strategy

| Pros | Cons |

|

|

|

|

|

|

Final thought

Finally, both strategies above you can use to trade short-term and long-term depending on market context. We suggest practicing demo charts before using any of these strategies in live trading besides gathering adequate knowledge on affecting factors that cause the price movement.

Comments