CHoCH or change of character is a price pattern that helps trades accurately define a crypto asset’s future price. Although this element comes from the smart money trading concept, it has become a core price action analysis. Finding the right CHoCH would help traders decide whether they should rely on the current supply-demand level.

The following section will discuss everything about CHoCH trading in the cryptocurrency market, including practical trading examples from short-term and long-term perspectives.

What is CHoCH?

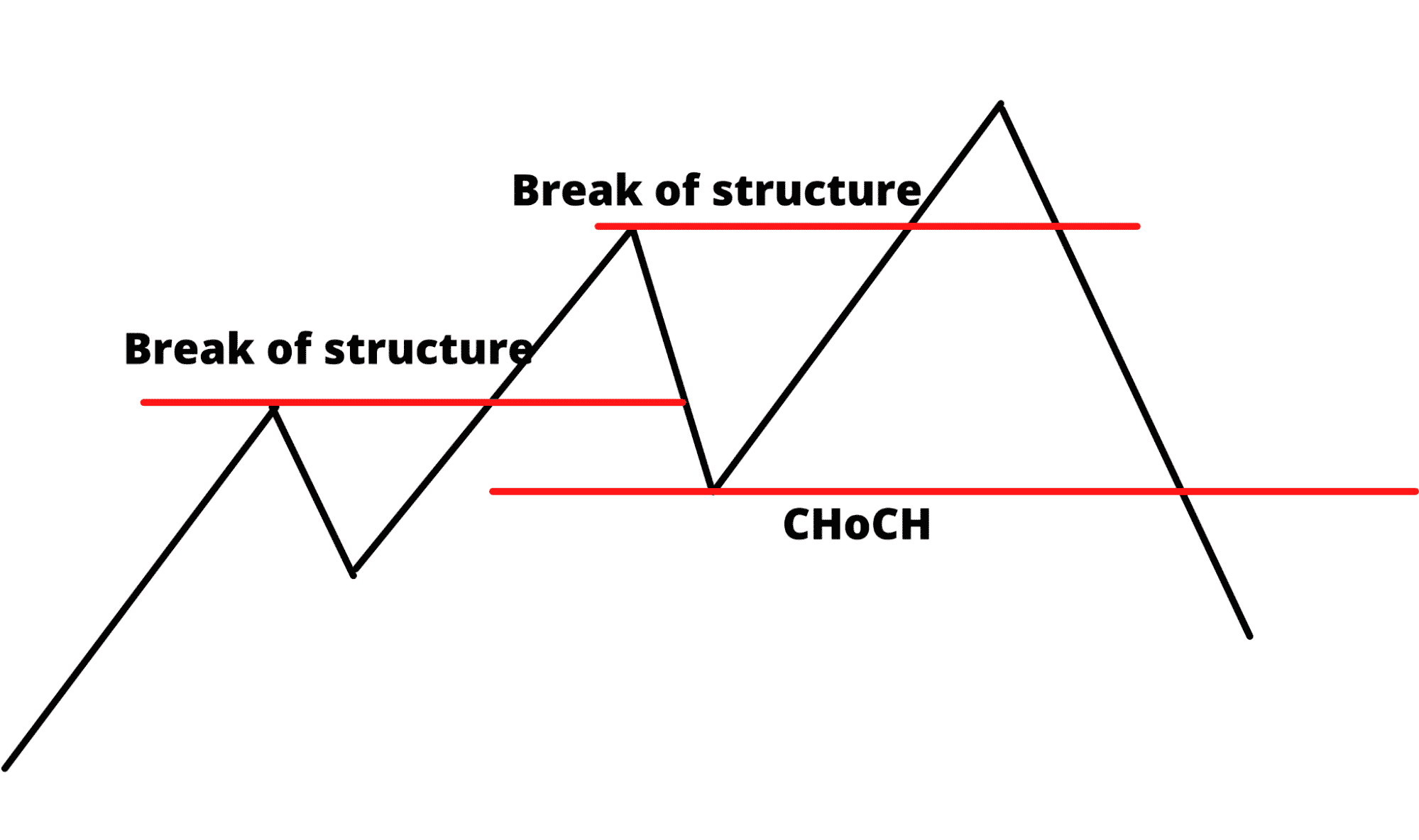

It is a price behavior that happens when the price violates any near-term level in the opposite direction. CHoCH is a vital trading tool used by smart money traders to find the initial signs of a trend reversal. Although it does not provide any trading signal, it shows that reversal traders may have joined the market to change the trend.

CHoCH comes with the basic concept of break of structure where the price shows the trend direction by making new swing highs or lows. In the smart money concept, breaking a high comes from an order block where institutional traders join the market. Therefore, the primary trading approach is to wait for the price to revisit the order block before showing the actual movement.

CHoCH pattern illustration

How to trade using CHoCH in trading strategy?

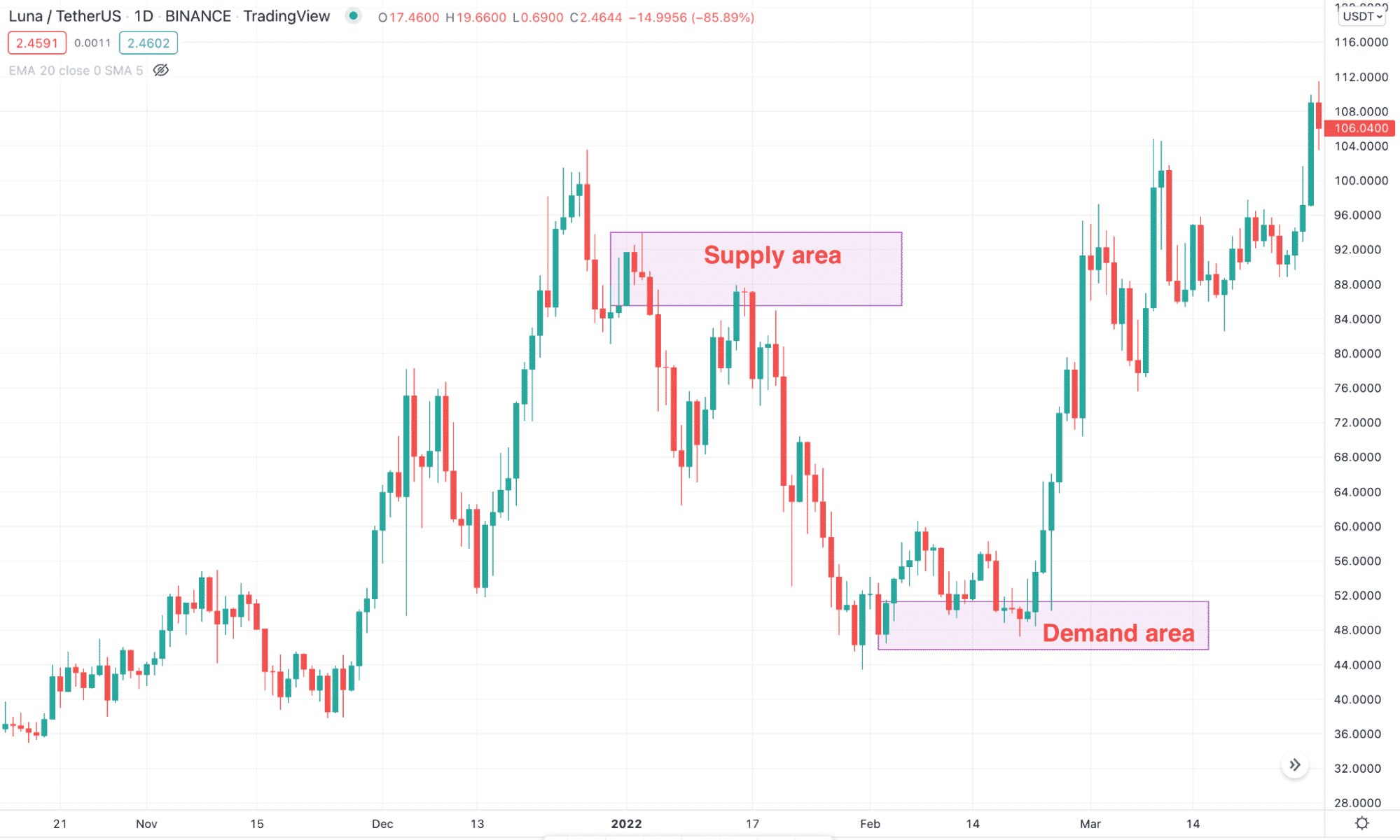

Traders should have the basic knowledge of supply-demand trading before approaching CHoCH. The supply level is the last Bullish candle before the bearish move that made a new swing low. On the other hand, the demand level is the previous bearish candle before a new swing high.

Let’s see the basic structure of supply-demand from the chart.

Supply-demand area

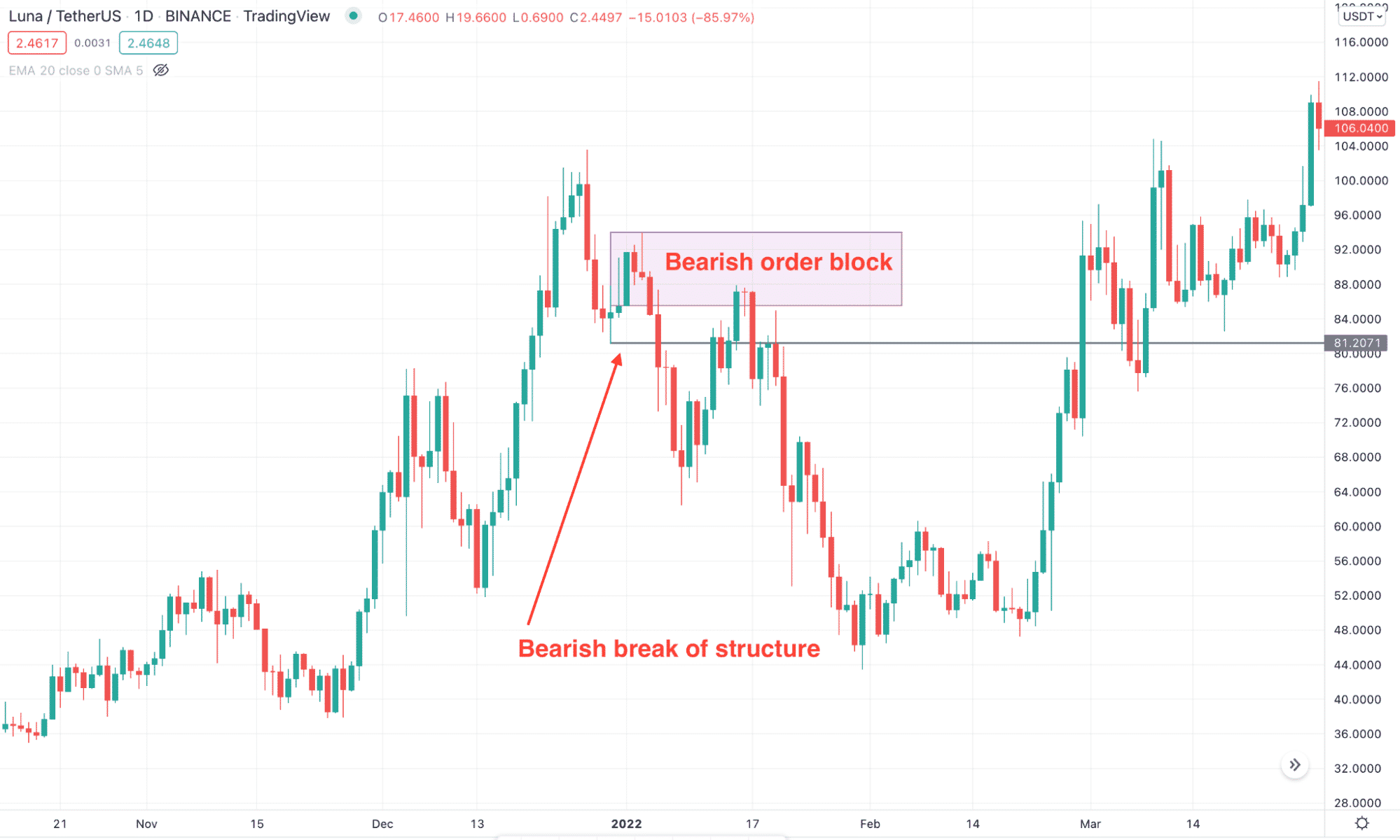

Now, investors should explicitly know the break of structure. It is a price behavior when institutional investors join the market and move the price up or down using their buying power. When a break of structure happens, we should clearly monitor where the pressure came from. Usually, the break of structure occurs after the order building process within the order block. The order block is the supply and demand level from where the movement started.

Bearish order block example

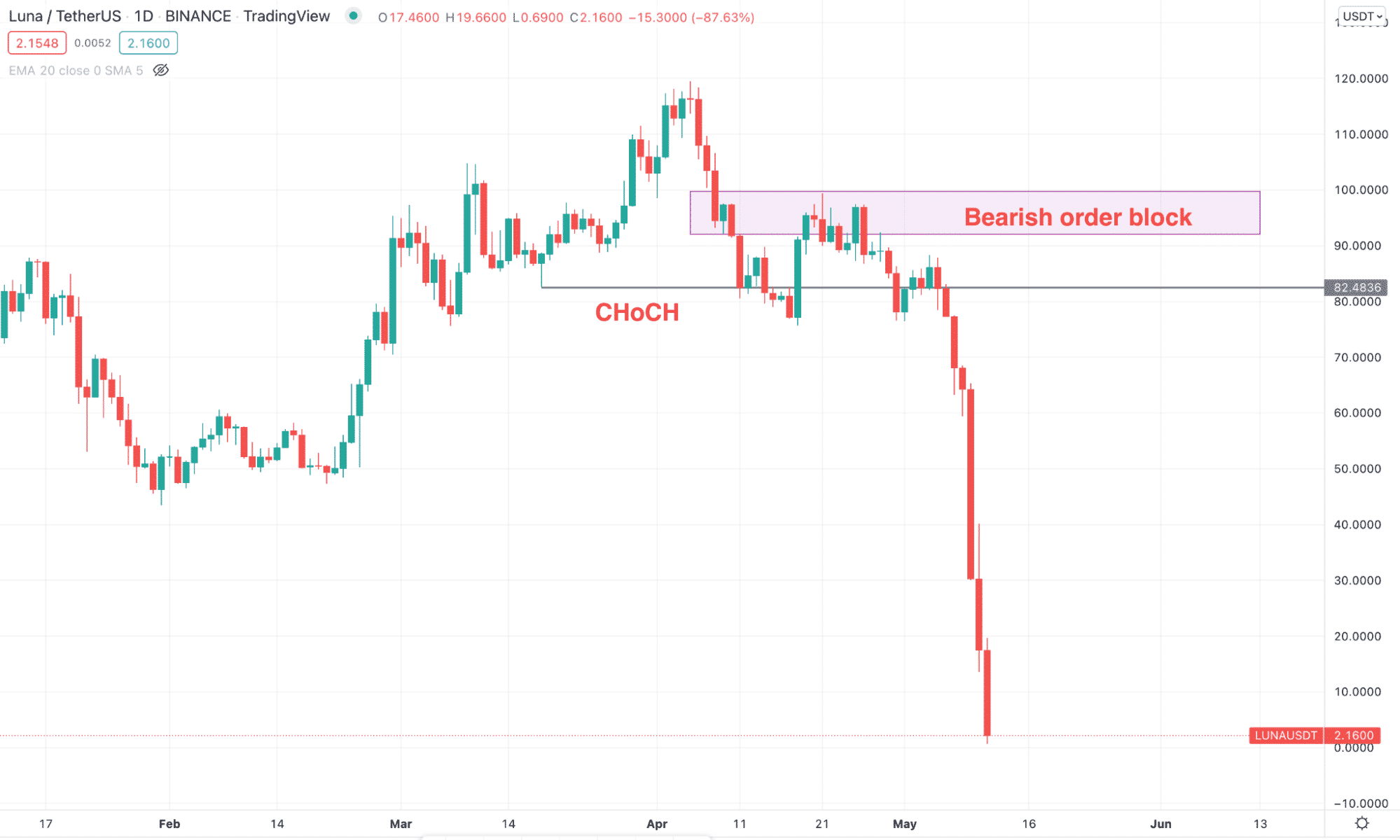

Now comes to the CHoCH trading approach. In CHoCH trading, we should know that the institutional traders need retail liquidity before driving the price towards their desired direction. One of the drawbacks of the institution is that it requires a bigger volume to be filled before making the price move.

Therefore, the price should revisit the order block area to feel orders, which is known as the point of interest. In CHoCH trading, we will find the point of interest after the CHoCH.

CHoCH trading example

A short-term trading strategy

In the short-term trading method, we will open buy/sell trades in the five minutes time frame to catch the trend from intraday volatility.

Bullish trade scenario

Short-term buy trade

The bullish trade applies to all crypto assets where the long-term trend should match the short-term’s direction.

Entry

Find these conditions in the five minutes chart before opening a buy trade:

- The price is moving up from the H1 or H4 order block.

- Price formed a CHoCH on the buy-side in M5.

- After the CHoCH, the price reversed and reached a near-term POI.

- Open the trade when the price reaches the bullish order block.

Stop-loss

The stop loss will be below the near-term swing low with some buffer.

Take profit

The first take profit is the immediate swing high, but investors can hold it if the buying power is strong.

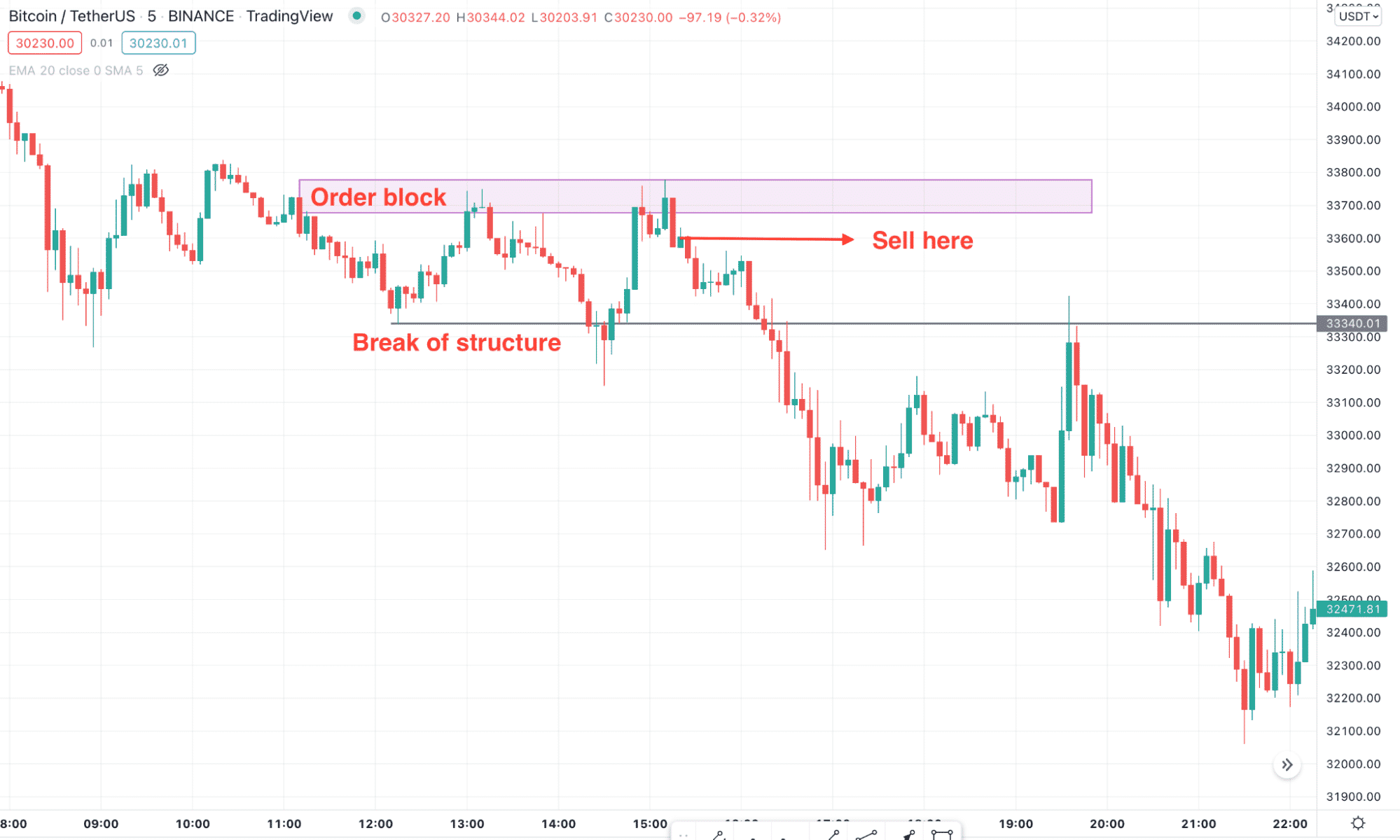

Bearish trade scenario

Short-term sell trade

The bearish trade applies to all crypto assets where the long-term trend should match the short-term direction.

Entry

Find these conditions in the five minutes chart before opening a bearish trade:

- The price is moving down from the H1 or H4 order block.

- Price formed a CHoCH on the bearish side in M5.

- After the CHoCH, the price reversed and reached a near-term POI.

- Open the trade as soon as the price reaches the bearish order block.

Stop-loss

The stop loss will be above the near-term swing high with some buffer.

Take profit

The first take profit is the rapid swing low, but investors can hold it with intense selling pressure.

A long-term trading strategy

The long-term approach is applicable to the daily chart where the main aim is to find the price direction for HODLers.

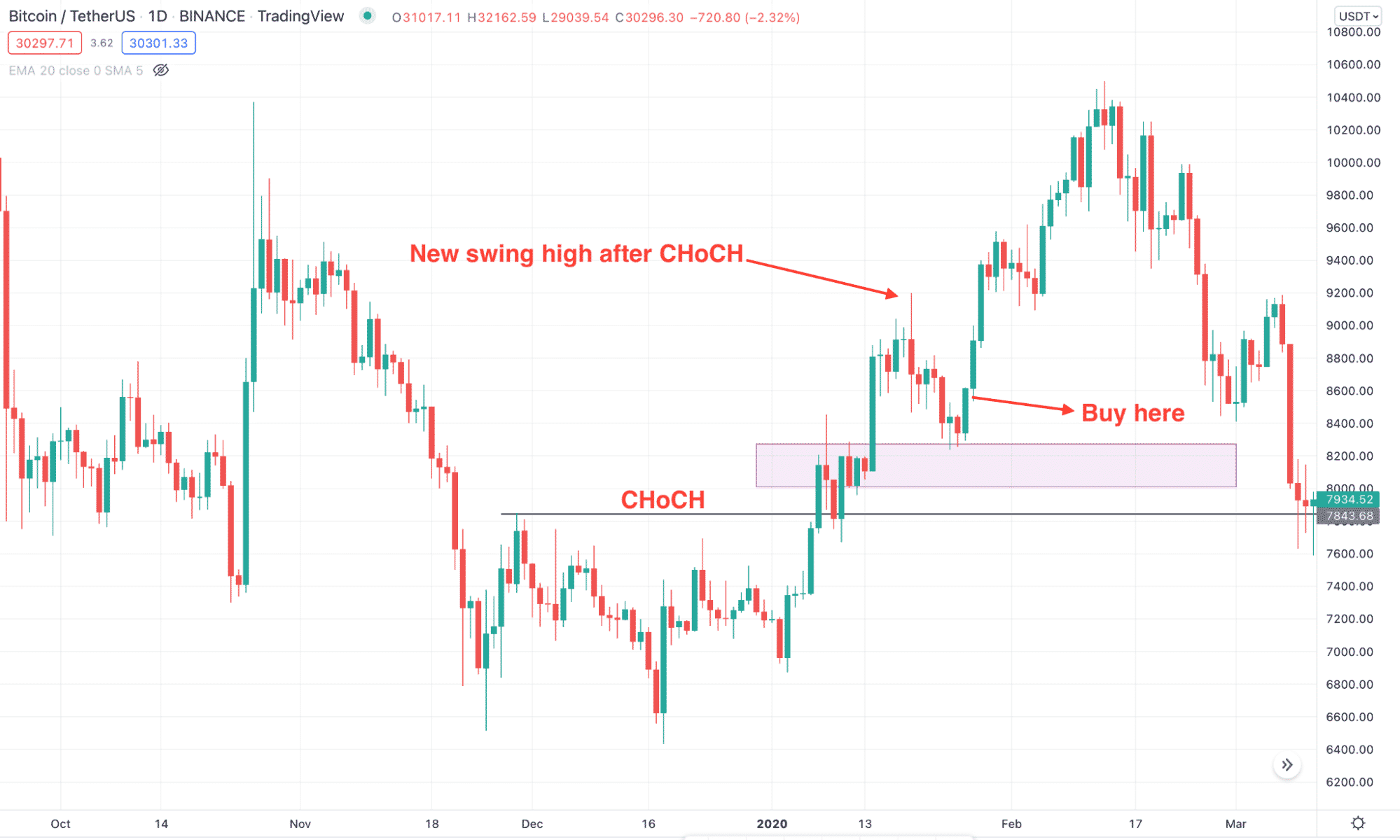

Bullish trade scenario

Long-term buy trade

The long-term buy trade is suitable for finding the HODLing opportunity in the bull market.

Entry

The ideal CHoCH buy trading should come from the following steps:

- The broader crypto market traded lower, but a CHoCH appeared in the daily chart.

- After the CHoCH, wait for a bullish break of structure.

- After the bullish BOS, the price should come lower to the near-term order block.

- Open the buy trade from a bullish rejection at the order block.

Stop loss

Set the stop loss below the order block with a 1% gap.

Take profit

The first take profit is the near-term swing high, but you can hold it for further gains.

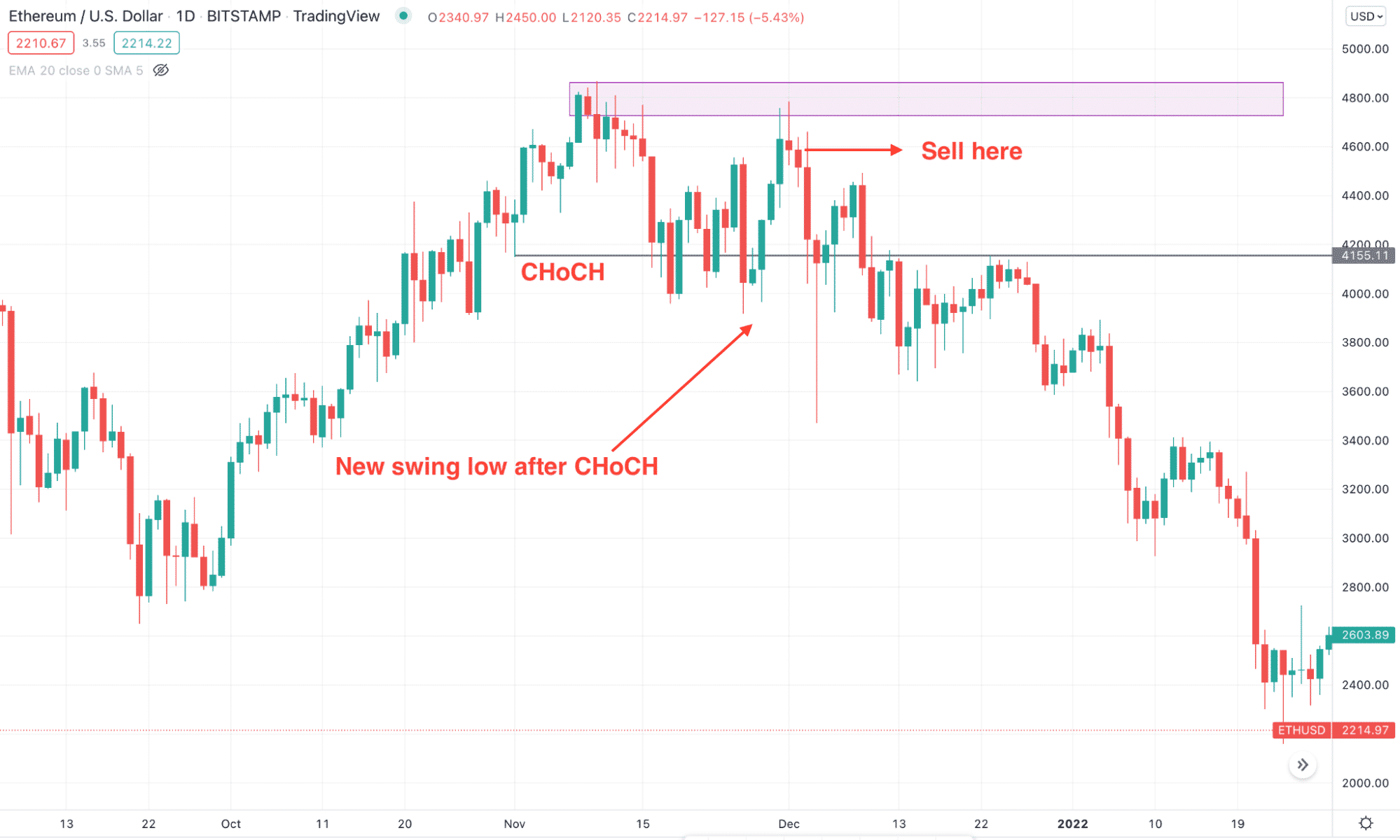

Bearish trade scenario

Long-term sell trade

The bearish trading opportunity is available for crypto CFDs to get the juice from the bear market.

Entry

The ideal CHoCH sell trading should come from the following steps:

- The broader crypto market moved higher, but a CHoCH appeared in the daily chart on the bearish side.

- After the CHoCH, wait for a bearish break of structure.

- After the BOS, the price should move up to the near-term order block.

- Open the sell trade from a bearish rejection at the order block.

Stop-loss

Set the stop loss above the order block with a 1% gap.

Take profit

The first take profit is the near-term swing low, but you can hold it for further gains.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

In the last section, we can say that the CHoCH trading is profitable once used in supply-demand areas. We have seen how to find the CHoCH and take trading entries in short and long-term time frames. Moreover, using a sound trade management system is also essential.

Comments