Trading methods enable making trades involving lower risks, increasing profitability, and constantly catching profitable positions. The arbitrage trading strategy is a unique method that many successful traders choose.

However, this trading technique has some differences from traditional strategies, so it won’t be wise to trade using this method without learning proper functionality.

This article will introduce you to the arbitrage trading strategy. Moreover, it contains trading techniques besides listing the top advantages and limitations of the arbitrage trading strategy.

What is the arbitrage trading strategy?

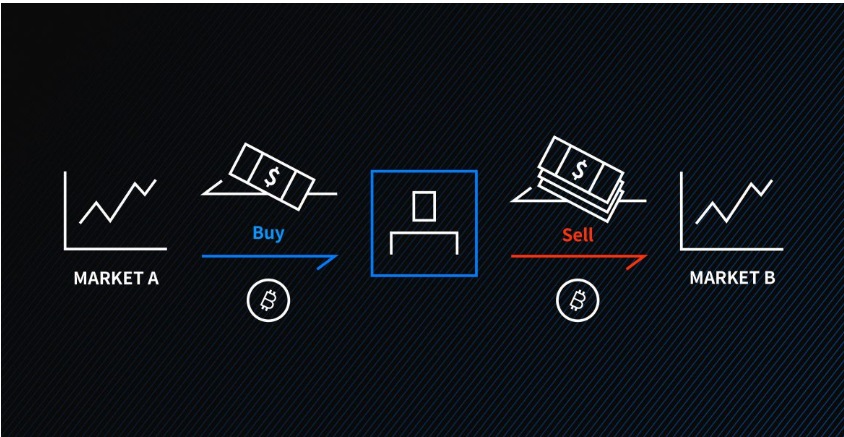

It is a unique way to approach the marketplace to profit from the inefficiency of asset prices in different markets. An exceptional trading approach involves simultaneously buying and selling assets on the same or different marketplace, rather than traditional “buy and hold” trading techniques.

Arbitrage trading suggests making money from the price differences of assets, so the trading idea is to obtain profit from minor changes. You may multiply your investment or increase volume if you want to have impressive returns through this technique. This method is suitable for leveraged by hedge funds investors.

Arbitrage trading concept

For example, Mr. Warren Buffett may purchase a pack of Coca-Cola that has six bottles for 25 cents and sell each bottle for five cents. So he makes a five cents profit from the pack. It is a simple example of arbitrage trading.

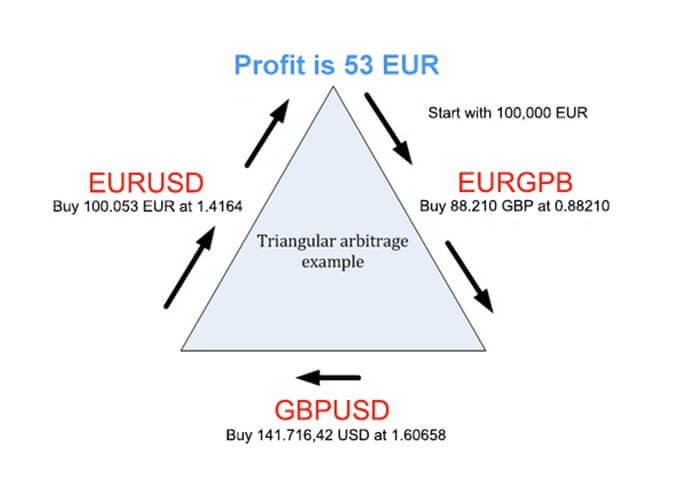

You can define arbitrage technique as three types: pure arbitrage, convertible arbitrage, and merger arbitrage. Global macro investors relate with the arbitrage trading method as it refers to investing in economic changes between two or more countries.

How to trade forex with the arbitrage strategy

The arbitrage strategy is a unique technique that you can use to trade forex, stocks, commodities, cryptocurrencies, etc. In this way, you buy an asset from a market and sell it to another at a little higher price. It requires trading with higher volumes so that you can make sufficient profit, excluding the transaction fees.

So no wonder that this trading technique is suitable for institutions and hedge funds that can afford the trading volume. With this technique, you can use many tools to determine different currencies’ price inefficiencies for forex trading. It is essential to get real-time pricing to trade forex with an arbitrage strategy. It often involves making money with risk-free trading by applying this technique to two or more currencies.

Profit by using arbitrage trading method

For example, banks Q and R offer to trade USD/GBP at a slightly different price. Bank Q may set a rate of 3/2 dollars to pound; meanwhile, bank R may offer 4/3 dollars per pound. Using currency arbitrage, you may want to buy a pound and exchange that for dollars from bank Q.

Then you may go back to pound with bank R. The result is you will get 9/8 pounds while you started with only one pound. In this way, you make 1/8 pound profit despite the fees. Again some other types of arbitrage trading techniques are retail arbitrage, statistical arbitrage, and triangular arbitrage.

A short-term trading strategy

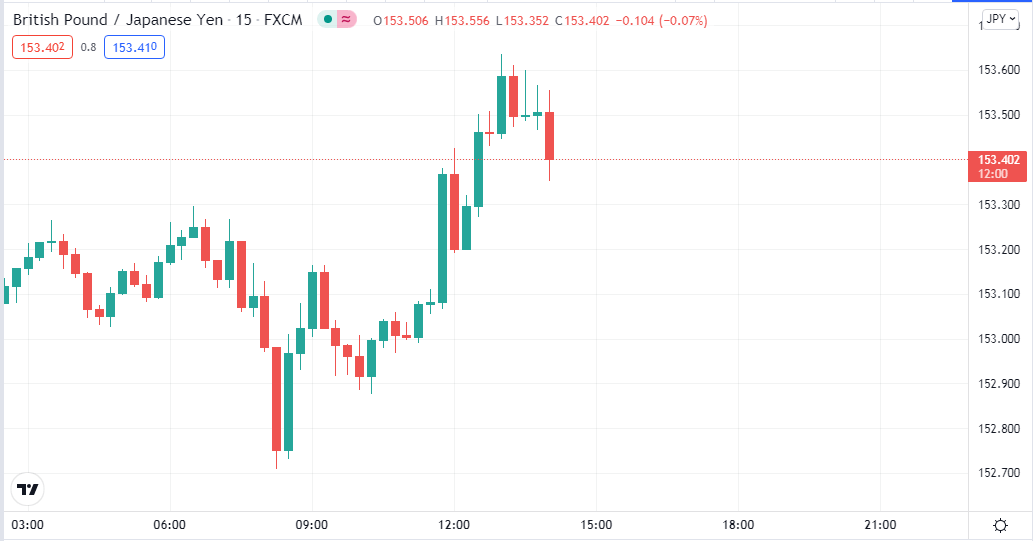

We all know that we are in an era of automatic trading. Although the forex market is a decentralized marketplace, it often involves price inefficiency due to many reasons. The GBP/JPY pair may be floating at 153.402 in a bank in London.

Meanwhile, a bank in Tokyo may offer 153.442 for the same pair. A trader may have access to both banks; he can buy GBP/JPY in the bank of London and Sell the same pair at the bank of Tokyo. Later, the pair GBP/JPY may converge at 153.452, and the trader closes both active trades.

A 15-min chart of GBP/JPY

He loses one pip in Tokyo and gains five pips in London if the trade volume is the same. So the trader has a four-pip profit without transaction fees and more negligible risk. It is a simple short-term arbitrage trading strategy that applies to any currency pair and will take a little time to execute, maybe a minute or a few minutes or an hour.

Many opportunities you will get to trade with this effortless trading strategy during the whole trading day. The volatile market and price quote errors can create opportunities to make profits from this type of trading.

A long-term trading strategy

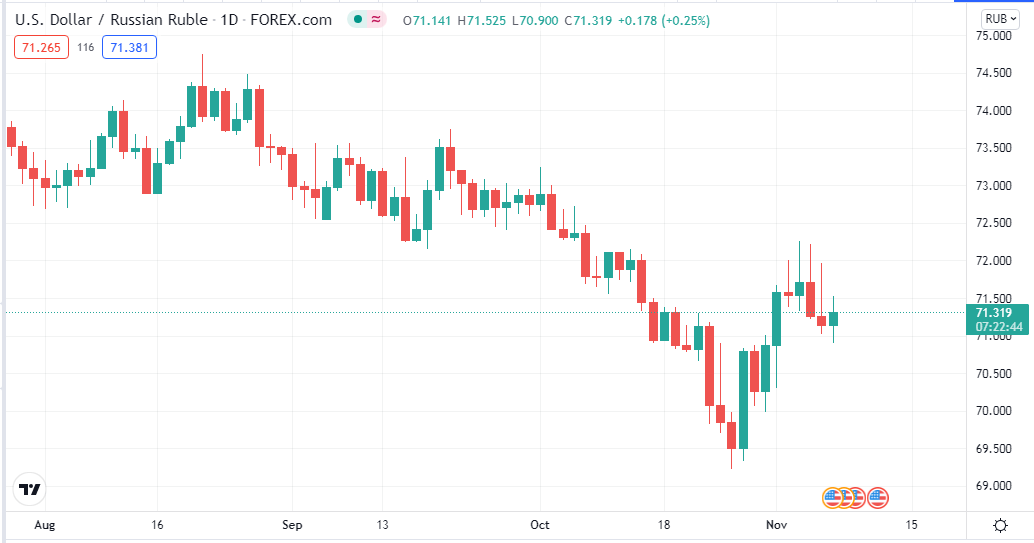

You can make money from interest rate differences in the longer period investments. This trading is to make money from interest rate differences of different currencies. For example, the Federal reserve goals are to keep USD’s interest rate between the range of 0-0.25 percent. Meanwhile, the bank of Russia still holds the interest rate of the ruble above five percent.

In two ways, any individual investor takes advantage of this interest rate difference between the USD and the Ruble. For example, he can put his money on a Russian ruble savings account and enjoy the five percent return yearly. An issue can come up with the exchange rate risk, which he can tackle by buying a forward contract and closing the exchange rate. Then convert his investment to USD when the contract expires.

The daily chart of USD/RUB

Otherwise, a trader may open a sell position in USD/RUB at 68; meanwhile, purchase an option that gives the right to exit from that sell position if the price reaches 68.50. The investment amount is $100,000.

After one year, if the price reaches 65, then the trader gets approx. $4,839 profit from the trade and interest swap of $5,420. So he gets a $10,259 payout in a one-year duration. Otherwise, the price may go up, so he may need to close the sell position at 68.50. In this way, he loses $763 for the exchange rate and gets $7,080 for the interest rate swap. So he gets a decent $6,317 profit.

Pros and cons

| Pros | Cons |

|

|

|

|

|

|

Final thought

Finally, we explain the concept of arbitrage trading in our article. We hope you find this article sufficient understanding and educational. We suggest using these strategies on demo trading before applying them on live accounts, so your capital will be safe, and you can develop sufficient skills to trade using this method.

Comments