Is it irritating when you attempt to discover what forex trading is, but all you read about how much money you can make with it? In addition to everything else, you leave with more inquiries? It may very well be a decent chance for specific individuals, yet they consistently miss out on one crucial piece of data that trading forex isn’t for everybody. Trading forex is hard. Still, it has its prizes.

Consistently, a big group of novice traders begins forex trading interestingly on the forex markets. As a general rule, they were pulled into forex because trading is a simple method to make quick profits. They plunge into it without knowing how it functions. So, try not to commit a similar error. First, gather knowledge and educate yourself about forex trading.

Forex trading is not just about investing or risking your money. It’s essential to get forex trading’s absolute education. Indeed, even most seasoned traders continue learning and bettering themselves.

WHY? Since the forex market is continually advancing, and can generally develop trading information. Here are some mentions of forex trading topics that you may be searching for while trying to be a successful forex trader. An aspiring trader should know and learn and comprehend 100% before trading or investing a single penny.

What is the forex market?

The forex market is decentralized. It encourages the purchasing and selling of various monetary standards or currencies. And it happens over the counter (OTC) through the interbank market rather than on a centralized securities exchange. Traders are attracted to forex for a few reasons, such as 24-hour daily trading during the week, the market’s size, low-cost transaction, contrasting volatility degrees, and a wide assortment of currencies for trading. The forex market functions like most different markets in that it is liable to demand and supply.

Utilizing an essential model, if there is a solid demand for the euros from US residents holding US dollars, they will trade their dollars into euros. The estimation of the euro will rise while the analysis of the US dollar will fall. Remember that this exchange influences the USD/Euro cash pair and won’t cause the euro to deteriorate against the AUD (Australian dollar).

Advantages of the forex market

Forex trading is one of the fundamental types of online trading. It is exceptionally mainstream with its consistently massive trading volumes.

Advantages of forex trading draw the interest of many speculators:

- Probably the most significant benefit of trading forex is high liquidity. Liquidity is the capacity of a specific resource to be immediately transformed into money. Traders are now managing cash in the forex market. It implies enormous amounts of it tends to be moved without such a large number of deterrents.

- Also, the leverage provided by the forex brokers is another advantage of trading forex. Different brokers permit traders to build their trading volumes by whatever the leverage rate is in this market. It implies that even the traders who deposit the smaller amount can still purchase more oversized lots. Thus, expands the potential payout also.

Nonetheless, like some other sort of trading, forex is a highly unsafe and monetarily risky business. That is why numerous traders like to become more educated in the field and afterward get to the trading segment.

Benefits of forex trading

Forex is a worldwide market that is extraordinarily liquid, with a massive day-by-day trading volume. Forex trading isn’t for unpracticed or weak-willed traders, and it has some unique benefits over different other needs after you’ve gotten acquainted with everything.

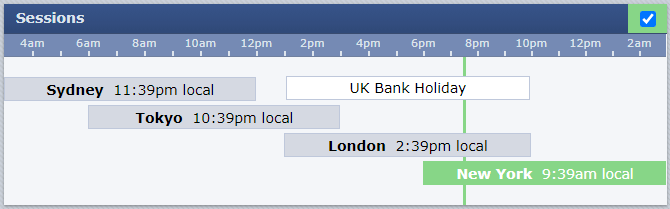

- The forex market is a 24/5 worldwide market. Since it is a global market, trading is consistent as long as there’s a market open somewhere.

Here we can see how the forex market starts with the Sydney session and ends with the New York close.

- Low-cost transactions are another benefit of trading forex. The transaction cost is generally incorporated into the price in the forex market as the spread. Brokers take the spread as their installment for encouraging the trade.

- The forex market is the most significant monetary market on the planet, and it won’t give up on that title at any point shortly. It’s not difficult to perceive why the forex market is utilized as a depiction of worldwide trade and monetary movement.

- Forex isn’t only for the hotshots. Beginning as a forex trader doesn’t cost a great deal of cash. Indeed, even absent a lot of start-up capital, forex trading is available to the average person. Furthermore, with traders of different kinds taking part from everywhere the world, genuinely it is the absolute most available trading market.

The best amount to start forex trading

The minimum deposits for opening a forex account start exceptionally low. Numerous brokers just require a $50 least deposit to open a micro account — some offering opening from just $1.

Nonetheless, some brokers require no base deposit, so this way, you could begin trading with just $1. Lamentably, if you attempt to trade with this much of a small amount, you’ll immediately face a few issues, such as the lowest position sizes and highest leverage.

Fundamental and technical analysis

The analysis is fundamental in the forex market. Indeed, the standard is that you should be an expert first before you become a trader. Notwithstanding, forex markets have varying analysis necessities.

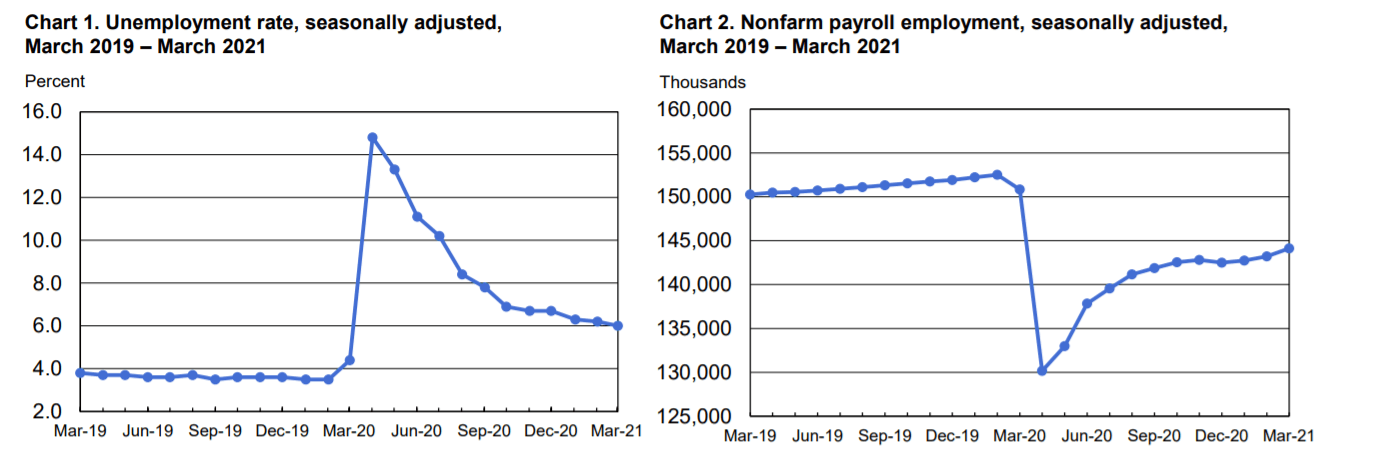

There are two techniques for market analysis. The fundamental analysis is social and financial just as political powers, from influencing the market demand of a monetary resource and the dangers that impact its cost.

In fundamental analysis, investors wait for critical economic events to predict the market based on the result.

Here we can see the example of the US non-farm payroll considered the most effective fundamental indicator.

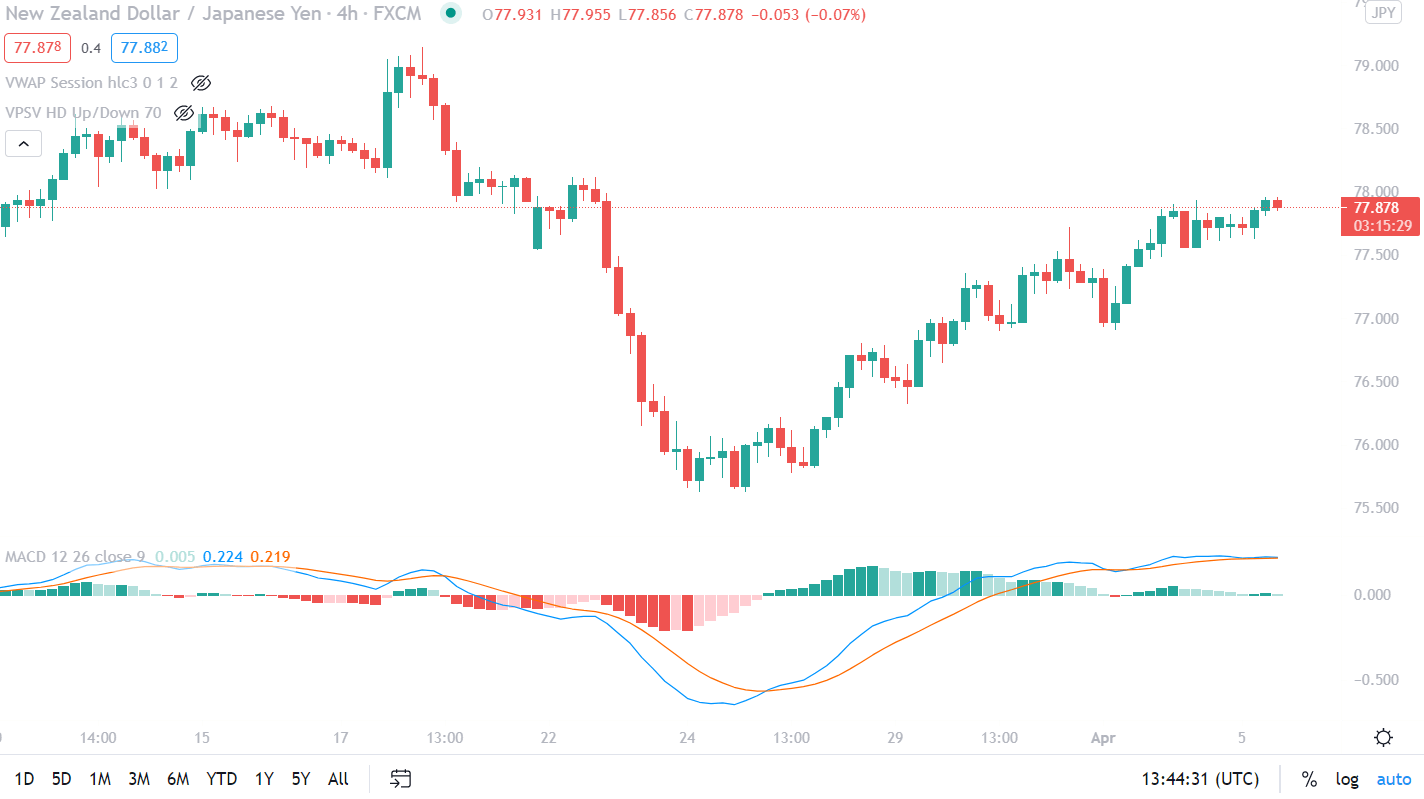

Technical analysis contemplates any resource’s value development, mainly through charts, to decide beneficial entry and exit points.

Here we can see the example of a technical chart where most traders apply their technical analysis method.

Conclusion

At present, if this is the beginning of your excursion into turning into a forex trader, that point it’s an ideal opportunity to pile up them and plunge into a broker-operated forex trading platform and become acclimated to how everything works. Achieve proficiency with the nuts and bolts and comprehend the supply and demand trading. From that point, you will learn the market formation, and it’ll give you an extremity with regards to discovering trading openings.

Anybody can turn into a forex trader; it doesn’t include anything rigorous. All you should be experienced and educated in trading the markets while reliably profiting. The market facilely snatches cash from you. However, with adequate knowledge and experience, the market will handily give you the cashback 10-overlay.

Comments