In forex trading, patterns like W and M works as an essential price reversal tool. Traders can easily combine these tools with the price action to get the ultimate trading decision.

Moreover, these tools explain a story about market participants, which is very important for every trader.

Trading W and M patterns need additional attention on reading the price accurately. You cannot rely on these patterns just by looking at them in the chart. The following section includes everything you need to know about M and W patterns with a complete comparison.

What is the W and M pattern?

W pattern is a bearish reversal pattern available at the top of a swing.

On the other hand, the M pattern is a bullish reversal pattern, available at the bottom of the swings. The ultimate success in pattern trading depends on how you can explain the price during the pattern formation.

In the W and M pattern trading, you need to have strong attention to the price swing. We know that the financial market moves like ZigZag, where any strategy with buy from low and sell from high methodology has a higher possibility of success.

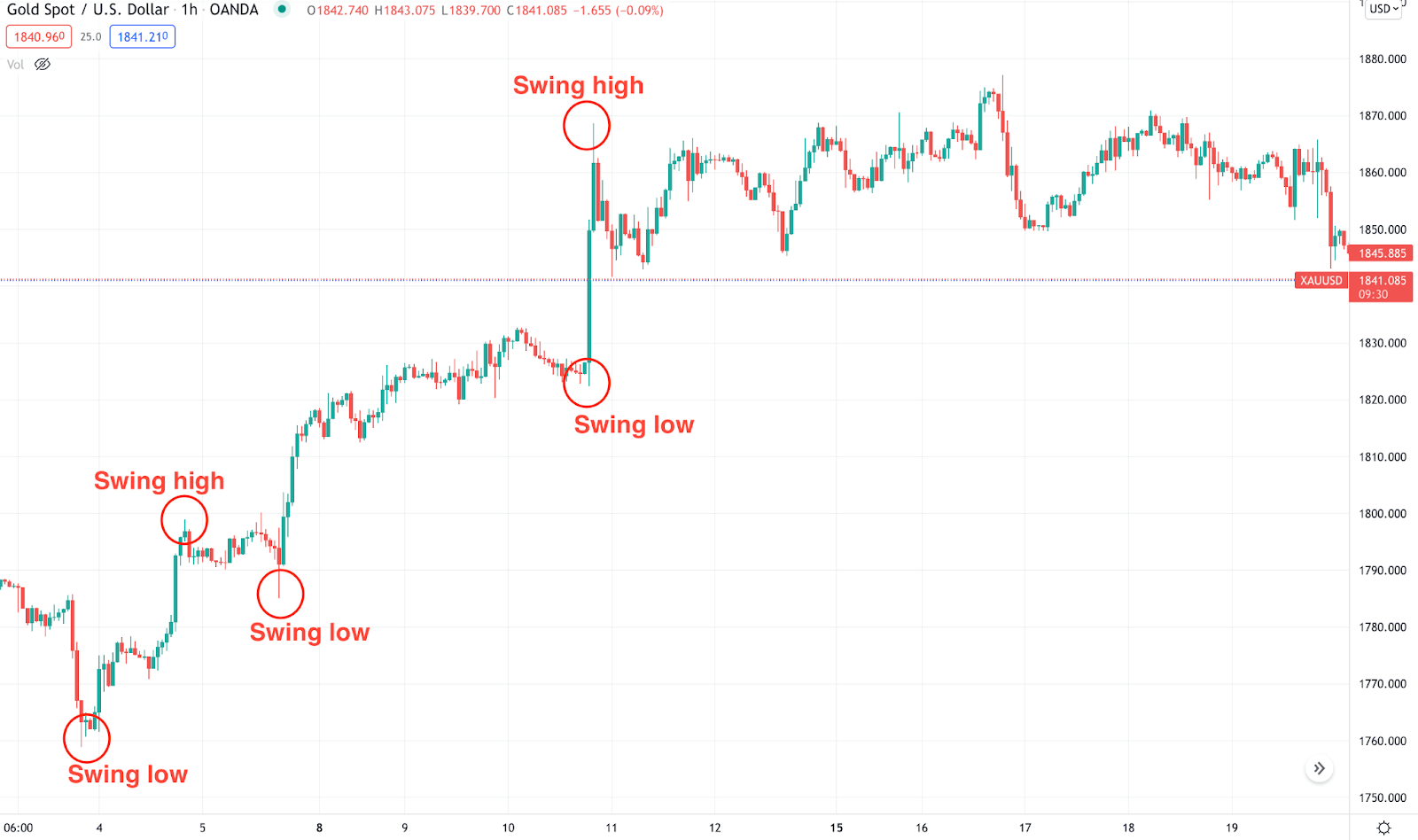

Let’s see how the price swing looks like.

Swing in the price chart

The above image illustrated how to swing low and swing high formed in the price. While taking the trade, make sure to maintain these conditions:

- Use W pattern from swing low

- Use M pattern from swing high

Now move to the core part, where we will see what’s inside the M and W pattern.

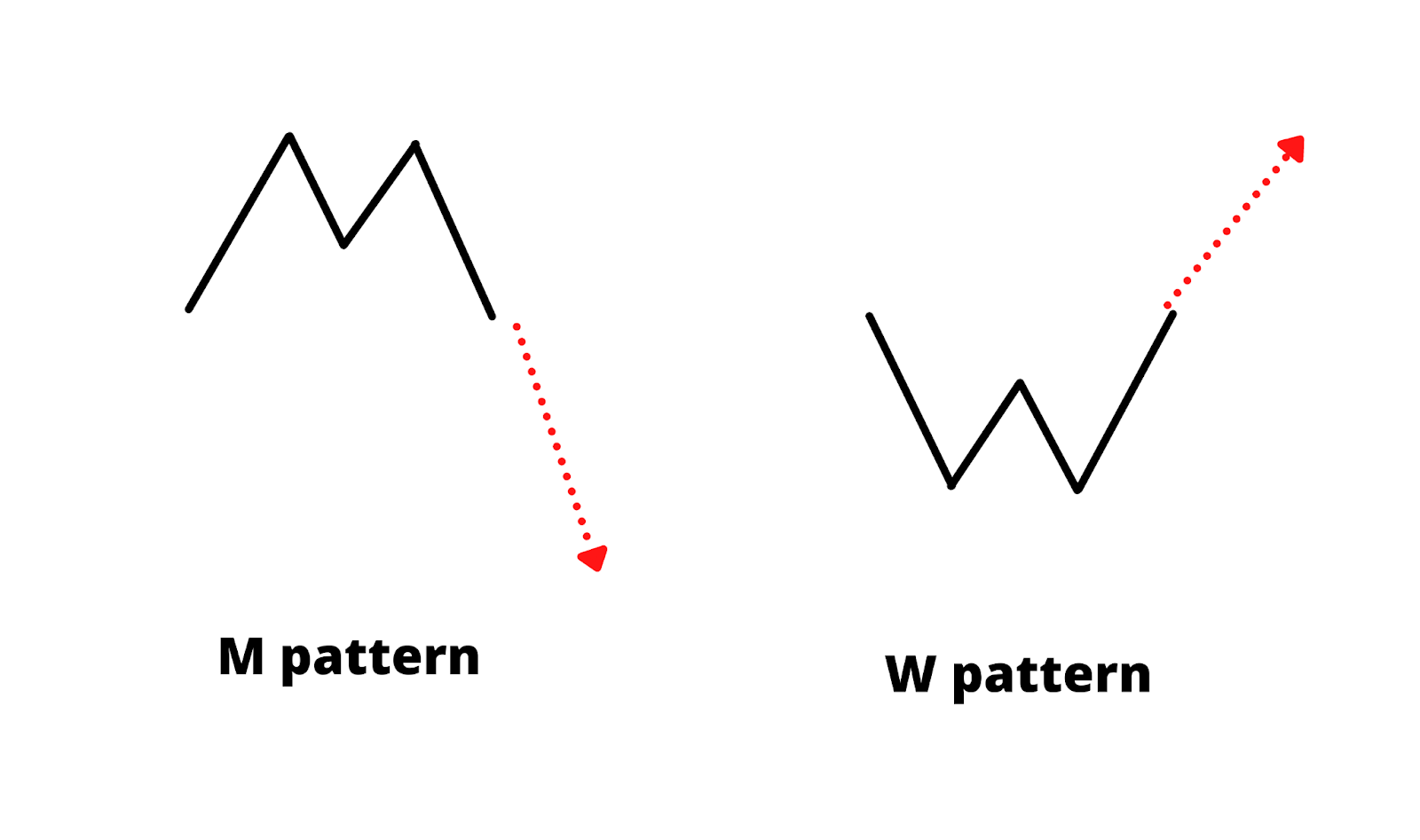

M and W patterns

In the M pattern, a bullish leg appears, indicating buyers’ presence in the price. Later on, sellers tried to make a new swing low but failed.

However, sellers try to gain momentum from the potential double top pattern and make the M pattern valid after breaking below the first bullish leg’s low.

On the other hand, the W pattern is the opposite version of the M patter where bulls regain the momentum and make it valid after breaking the first bearish swing’s high.

How to identify the M and W patterns?

M and W patterns can be formed randomly in the chart. However, you cannot rely on them just by observing their presence. A perfect trading strategy comes with proper risk management and other associated information.

Based on our thoughts over the market, you can follow these rules to get the maximum benefit from M and W pattern trading.

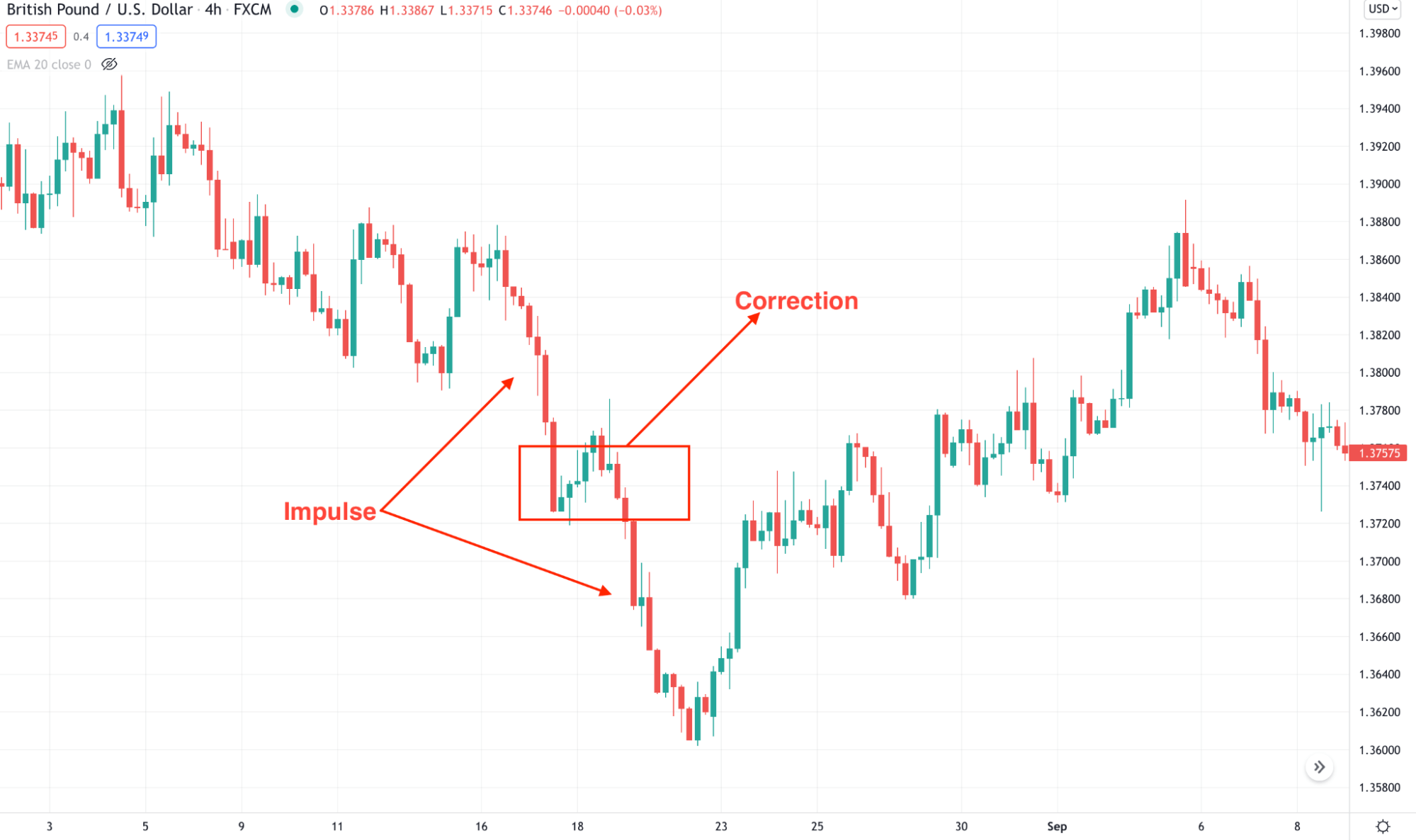

Understanding the market context

Market context is the key in this trading method as it will indicate the proper market behavior for taking the trade. First, identify where the major market is heading and take the trade towards the trend only. Investors should wait until the correction is over and the major trend is ready to begin within the trend.

The M and W pattern is a trend reversal strategy that needs to find the minor price reversal level where the major market is heading towards the trade’s direction.

Impulse and correction

Intraday rules

You cannot take trades every hour even if you found all conditions as present in the chart. The forex market is a 24-5 market where trading on London and New York sessions is highly profitable. Therefore, take trades on the London session starts and avoid trading in the Asian session.

A short-term strategy

The short-term trading method is applicable after the London open and valid until the New York session is closed. Before taking a trade, follow where the major trend is heading and how the Asian session worked.

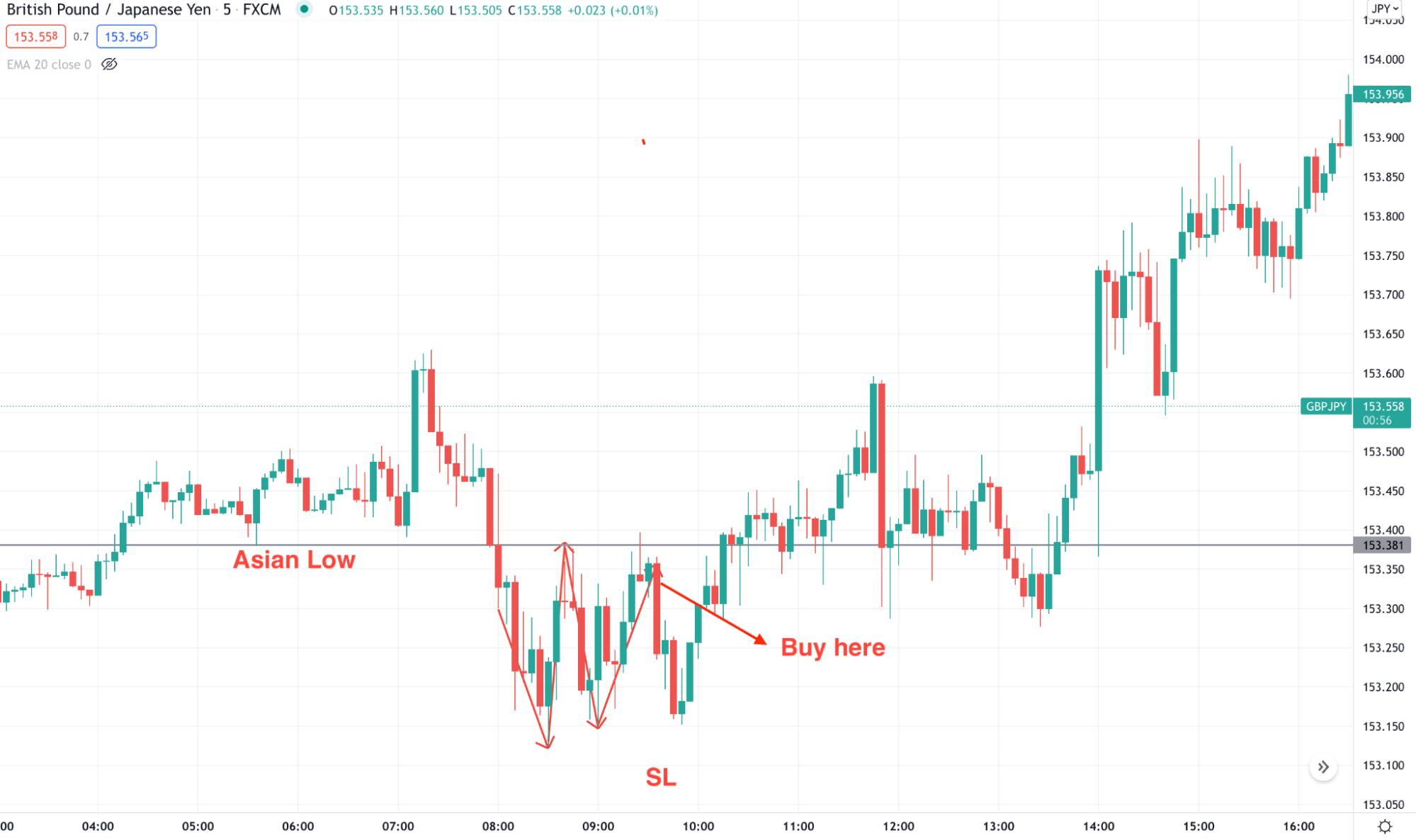

Bullish trade setup

In the buy trade, you should find the W pattern at the bottom of a trend with the following conditions:

- Asian session remained calm where the major trend is up.

- After the London open, the price moved below the Asian low and formed a new intraday swing low.

- A W pattern appeared in the five minutes time frame.

- The trade becomes valid once the price moves above the high of the W pattern.

- The stop loss is below the pattern with some gap, and TP is a minimum of 1:2.

Bullish trade setup

Bearish trade setup

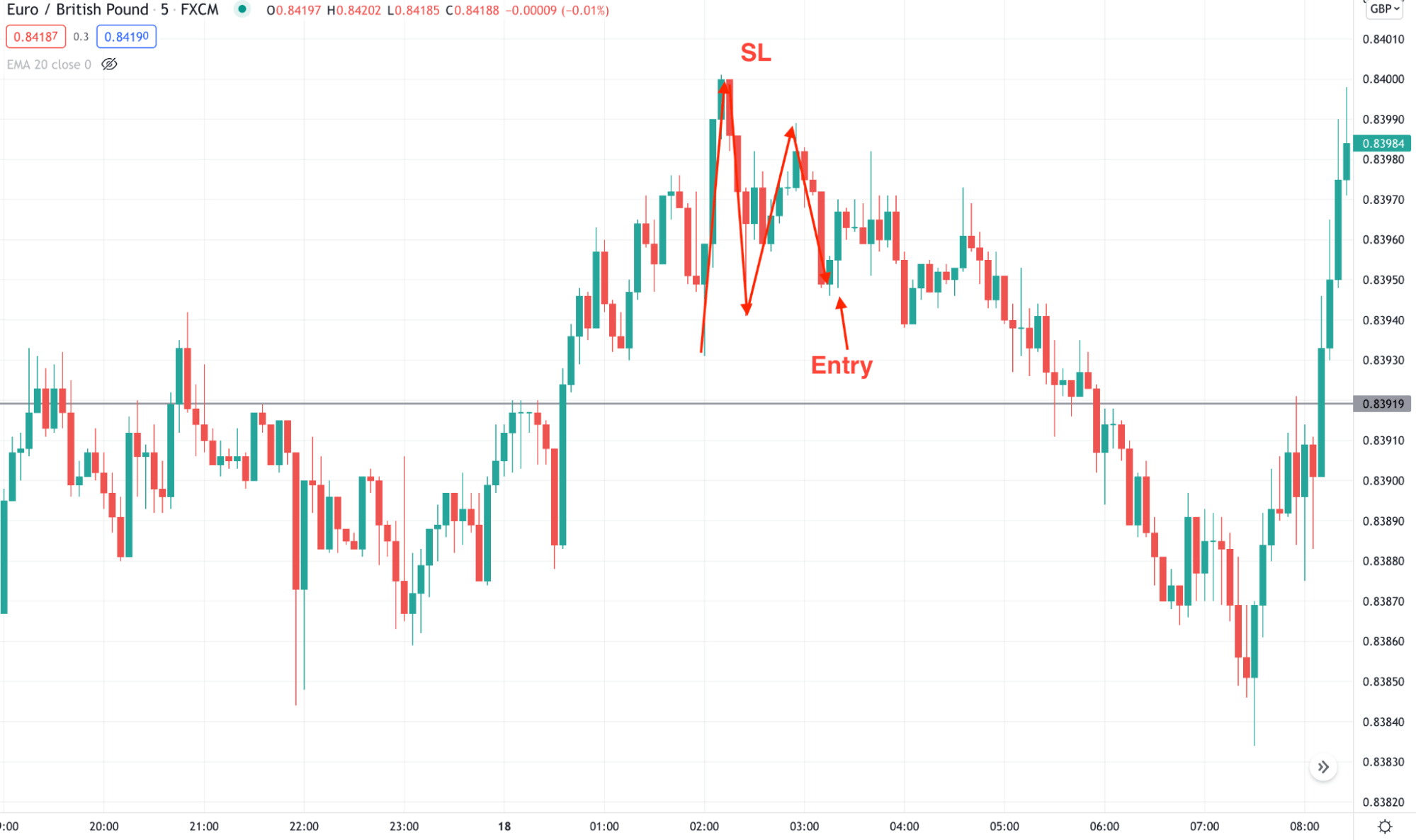

It is the opposite version of the bullish trade setup. Investors should find the M pattern instead of the W pattern with the following conditions:

- The Asian session remained calm where the major trend is down.

- After the London open, the price moved above the Asian high and formed a new intraday swing high.

- An M pattern appeared in the five minutes time frame.

- The trade becomes valid once the price moves below the low of the M pattern.

- The stop loss is above the pattern with some gap, and TP is a minimum of 1:2.

Bearish trade setup

A long-term strategy

The long-term strategy is suitable for a swing trading method where investors should find the M pattern at the swing high and the W pattern at the swing low.

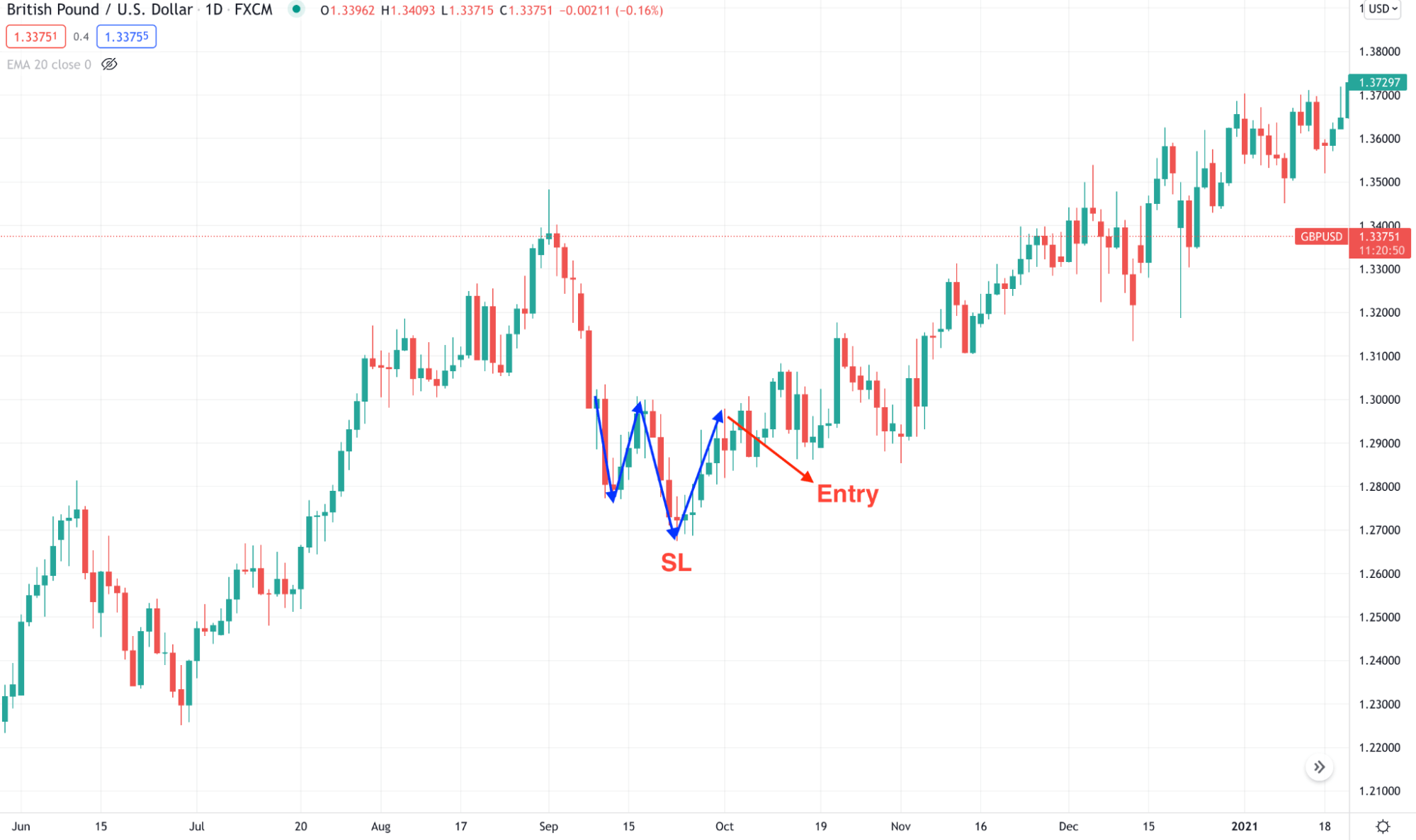

Bullish trade setup

The bullish trade scenario should have the following confirmations:

- Overall market context is bullish.

- The price moves down in the swing low and formed the W pattern.

- The trading entry is valid once the price moves up from the 2nd W swing.

- Stop loss and take profit is based on near-term levels.

Bullish trade setup

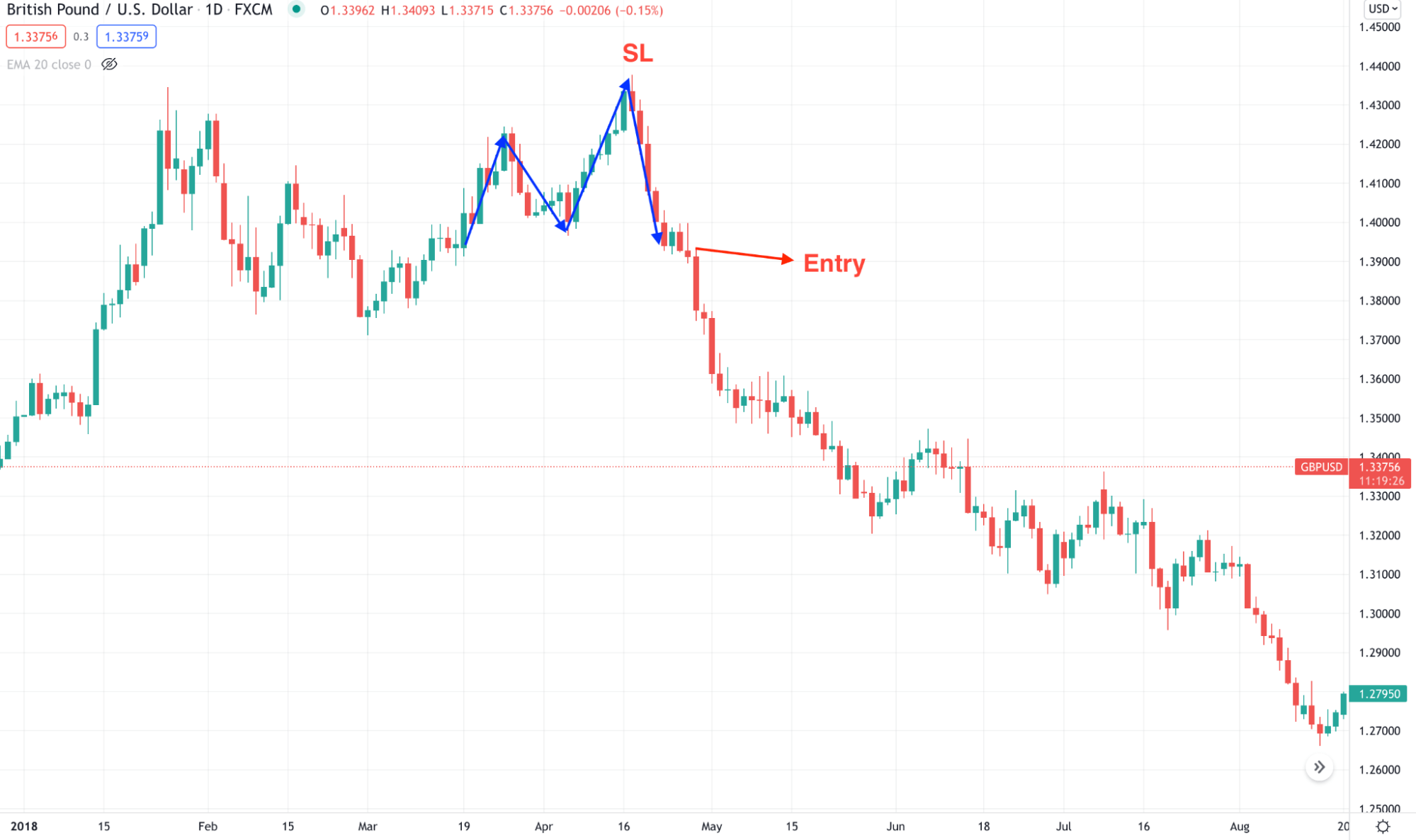

Bearish trade setup

The bearish trade scenario should have the following confirmations:

- Overall market context is bearish.

- The price moves down in the swing high and formed the M pattern.

- The trading entry is valid once the price moves down from the 2nd M swing.

- Stop loss and take profit is based on near-term levels.

Bearish trade setup

Pros & cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

Finally, we have seen how the W and M pattern works in the forex market. These methods are very profitable, and traders from every level can apply this strategy in the price chart. However, investors need additional attention to how major economic releases are coming to eliminate the uncertain market movement.

Comments