What’s the first thing that comes to your mind when you hear the word “momentum trading”? “Seems like we have to go in the direction of the price.”

That’s true because momentum trading follows the popular notion of “buying low and selling high.” However, there’s a slight problem.

How can you use momentum trading in your strategies? Well, this is what we are going to find out. We’ll talk about what momentum trading is and how it can become part of your trading.

Momentum trading explained

Before digging deeper, it’s time for a history lesson. Richard Driehaus, an American businessman, put the idea of buying low and selling high into practice. Though he wasn’t the first to do momentum trading, he put the theoretical aspect into practice.

His concept was that traders could make more money by buying low and selling high rather than buying an undervalued asset and then waiting for it to go further.

He framed that you need to let your winner ride while selling your losers. But things don’t stop there. According to Driehaus, you need to reinvest your losers into buying low. So, the whole idea of momentum trading is to take positions when the market is low and then sell at high.

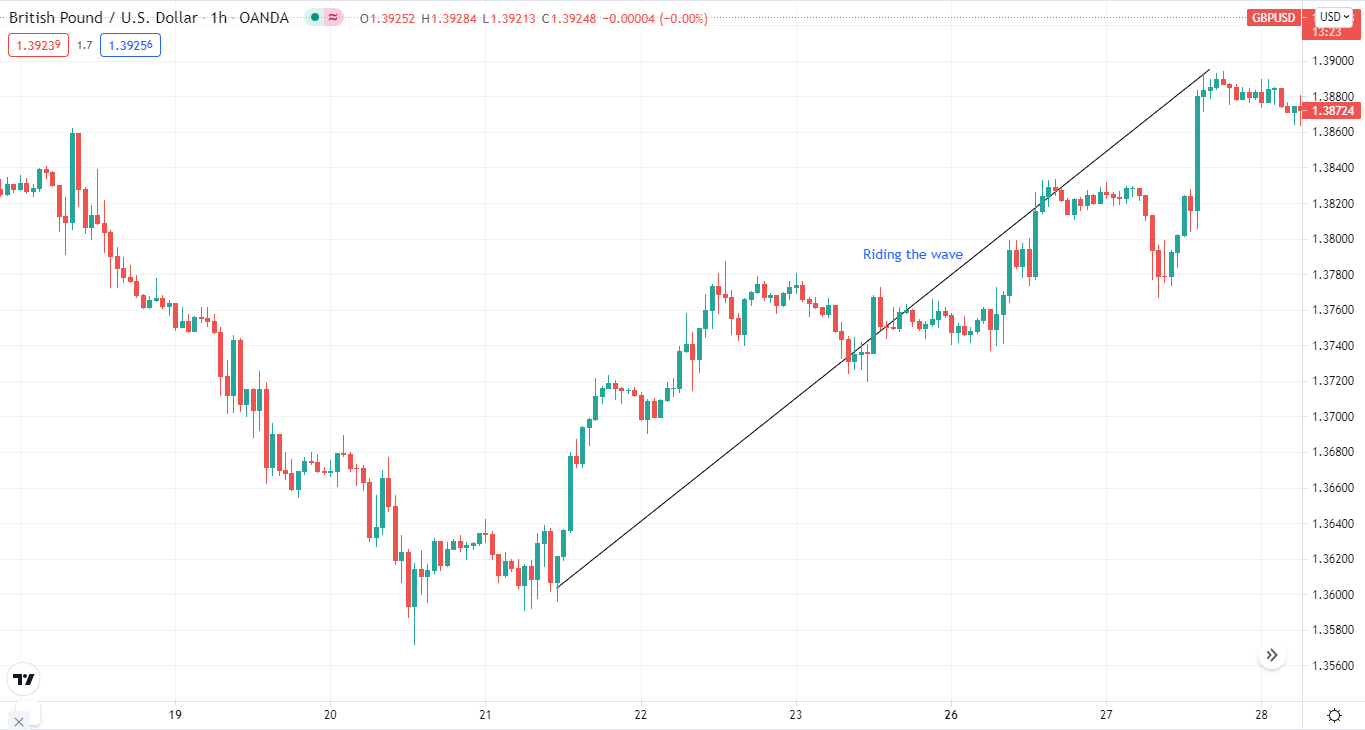

Momentum trading takes advantage of volatility. Think of volatility as waves in the ocean. As a momentum trader, you ride these waves until it goes down.

British Pound/US Dollar

Strategies from momentum trading

Now that you know the idea of momentum trading, the next question is how to use it as a forex strategy. You will not find when the market is low and high, just by looking at the chart. You need to add something.

Well, why don’t you take help from good ol’ indicators? Momentum indicators are ideal for determining when the market is going upwards, sideways and how strong the trend is. This way, you can pinpoint when to enter, exit, and where to put your stop-loss. So, the indicators are part and parcel of your momentum trading strategies.

Let’s find out how to use them for momentum trading.

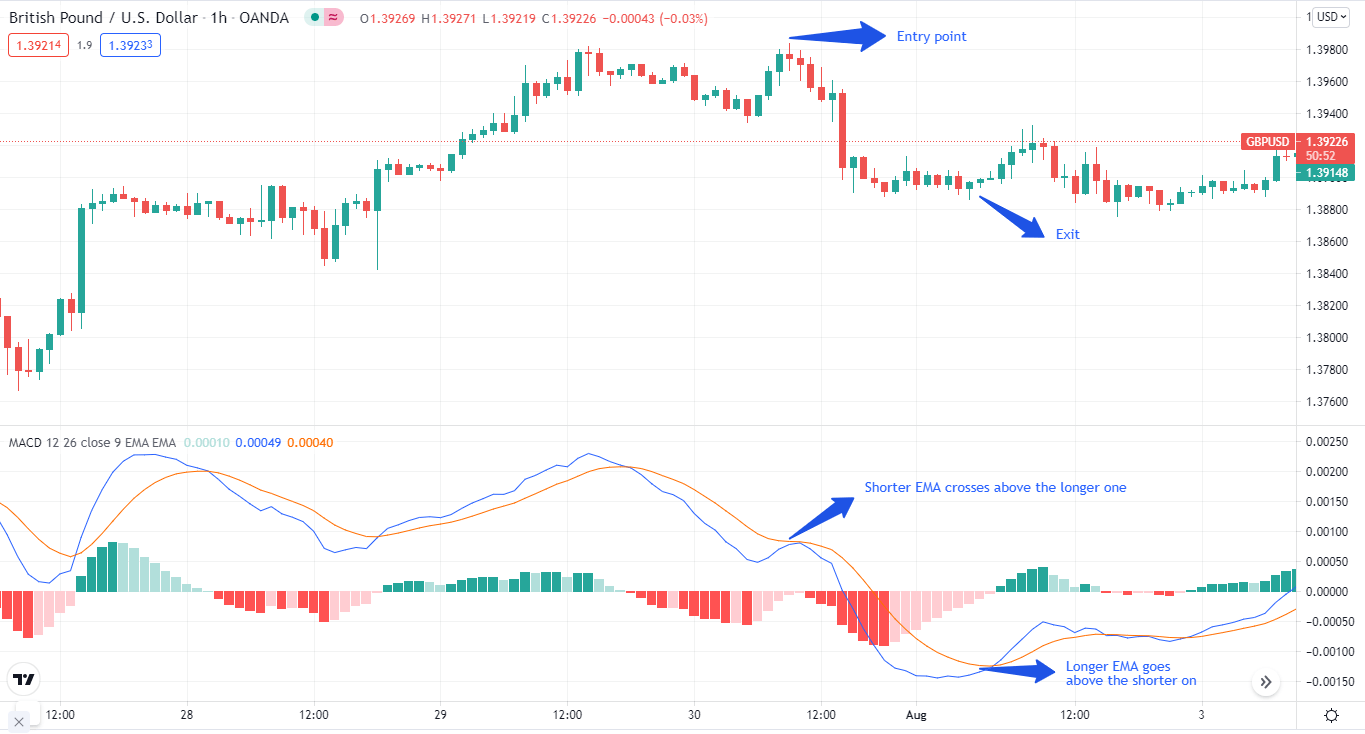

1. MACD trading strategy

MACD, aka Moving Average Convergence Divergence, combines two moving averages to note price movements:

- 26-period EMA

- 12-period EMA

One is longer and the other one shorter.

MACD calculates price movements by subtracting the shorter EMA from the longer one. With these calculations, the MACD displays a straight line of 9-period and a histogram.

The straight line is the signal or zero line, and it acts as a guiding force for you. When the price goes below this line, it’s a sell signal. On the other hand, it’s a buy signal when the price rises above the signal line.

The other thing to note is the EMAs. When the shorter EMA crosses above, the longer one, it’s a sell signal. Conversely, when the longer EMA stays above, the shorter one, it’s a buy signal.

As you can see on the chart, we had a perfect entry point when the shorter EMA goes above the longer one. When the longer EMA rises above the shorter one, we exit the trade.

British Pound/US Dollar

Remember that it’s essential to place a stop-loss. When you are going long, place a stop-loss near the recent low, and when going short, place a stop-loss near the recent high.

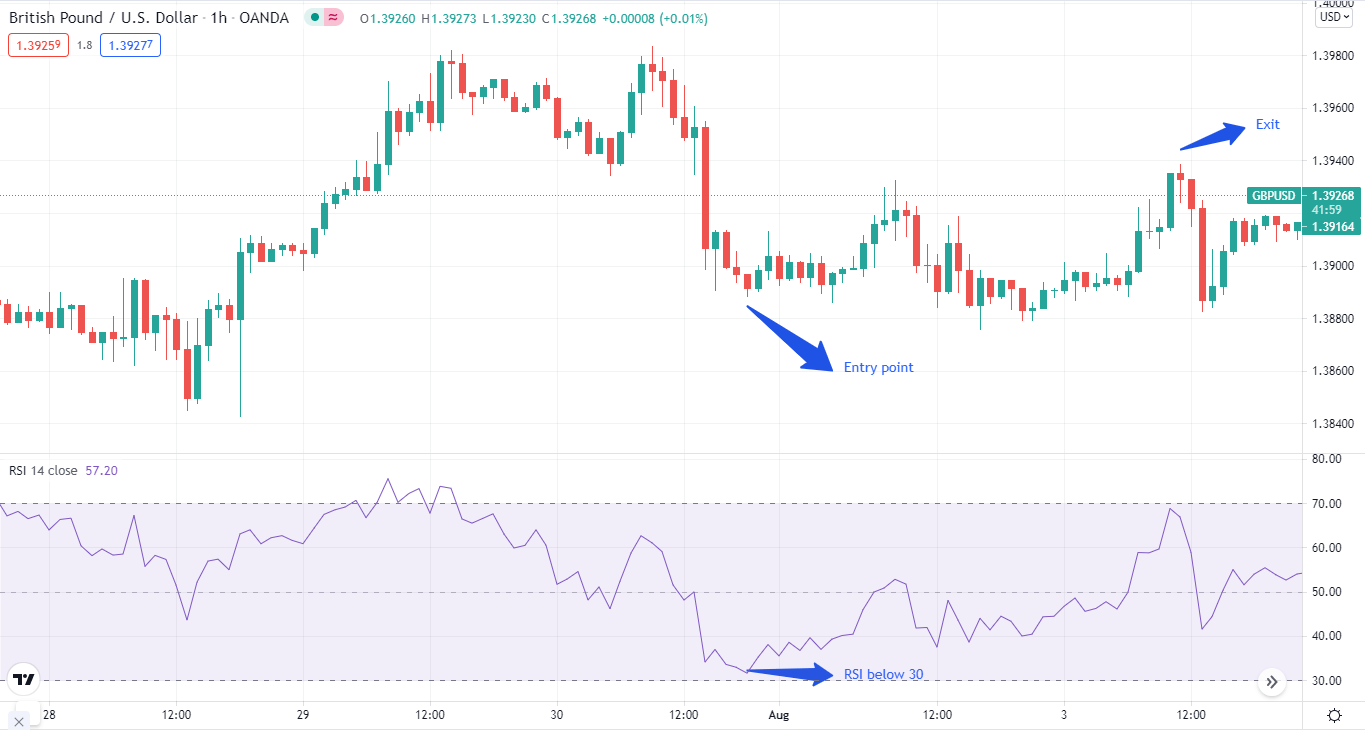

2. RSI trading strategy

RSI or Relative Strength Index is another indicator you can use for momentum trading. It measures price fluctuations by looking at the last 14 days. It levels between 0 and 100 and tells you about overbought and oversold conditions.

- If the price goes above the 70 levels, it’s an overbought condition. When this scenario occurs, there is a chance of price reversal, and you should exit long positions or enter short positions.

- On the flip side, when the price goes below the 30-level, it’s an oversold condition. In this case, the price can reverse upwards and either go long or exit your short positions.

- Now 50 is a neutral level. This means when the RSI is at this level, you should wait for it to go up or down and then take your positions.

The chart below illustrates a buying position. As you can see, when the RSI was below 30, it presented us with a great entry point. We exit the trade when the RSI goes above the 70 level.

British Pound/US Dollar

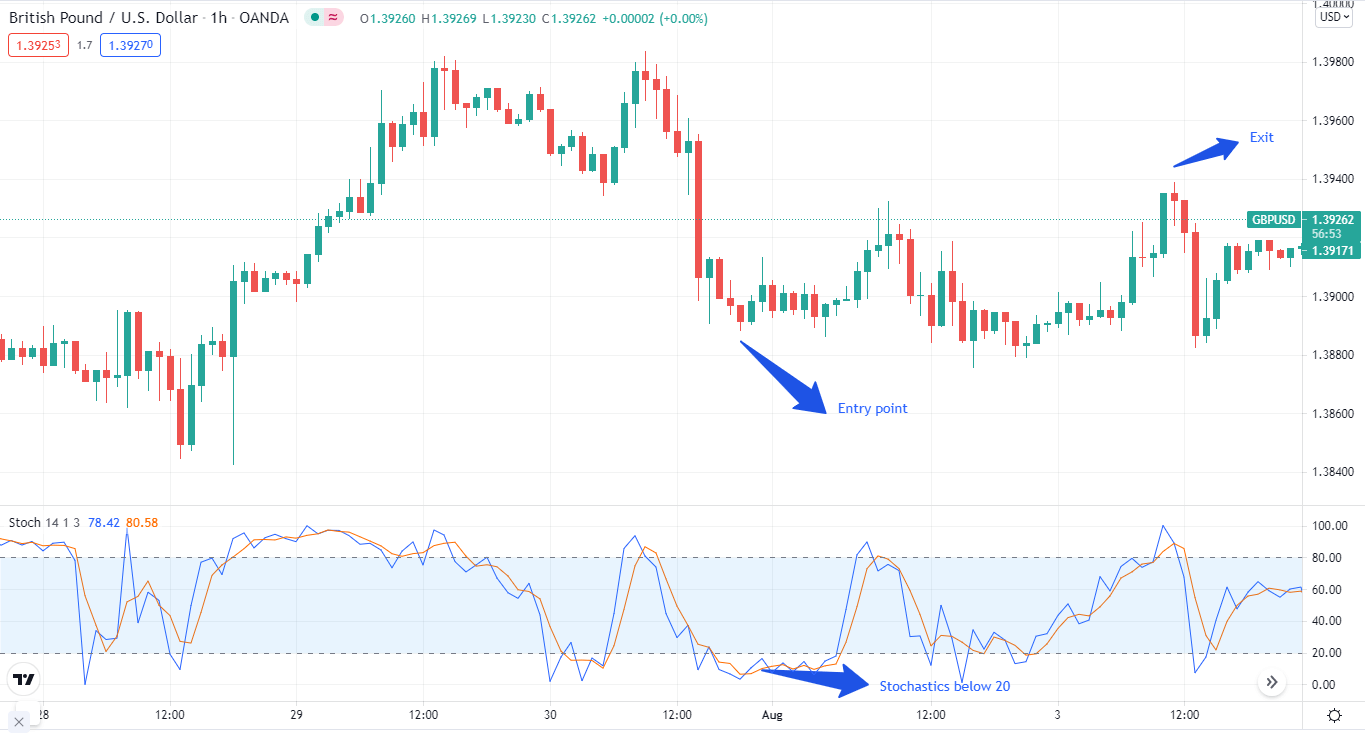

3. Stochastic trading strategy

So the Stochastics work similarly to the RSI. It also fluctuates between 0 and 100 and gives you overbought and oversold signals.

When the Stochastics is below level 20, it’s an oversold condition, and there’s a chance of a price reversal. You can enter long positions or short exit positions.

On the contrary, when the Stochastics is above 80, it’s an overbought condition, indicating a downward reversal. So in this scenario, you need to exit long positions or enter the short ones.

The difference between the RSI and Stochastics is the additional line. While the RSI has only one line (signal line), the Stochastics comes with two lines, a trend line and a signal line. The signal line reflects the indicator’s value, and the trend line consists of a three-day SMA (simple moving average).

As Stochastics is a momentum indicator, it gives us a buy or a sell signal when the two lines cross.

British Pound/US Dollar

The above chart illustrates a buying position. You can see that when the indicator drops below 20, we entered the trade. When it moved above 80, we exited the trade.

Pro-tip for forex momentum trading

The key to momentum trading is to benefit from the volatile trend. A trend is your friend till it lasts. As a momentum trader, you need to remember this. Paste on your trading desk if you have to. This way, you’ll stay ahead of the pack.

Final thoughts

Although momentum trading strategies are famous for their accuracy, you still need to be cautious about the risk. Therefore, it’s essential to stick with your trading plan with forex momentum strategies.

Comments