The golden cross is a way to determine the future price of a trading asset using multiple moving averages, 50 EMA and 200 SMA. The basic idea of this method is that when one MA crosses another, it shows a sign of an increased bullish/bearish momentum. The trading charts and tools are available for free in the cryptocurrency market, making golden cross trading profitable in the crypto context.

If you are keen to build a crypto trading portfolio, the following section would be fruitful. In the next section, we will discuss everything a trader should know about the golden cross strategy in the cryptocurrency market, including exact buying and selling methods.

What is the golden cross crypto trading strategy?

The golden cross is a combination of 200 SMA and 50 EMA. When the 50 EMA crosses over the 200 SMA, it indicates a scenario where short-term bulls become more aggressive than long-term bulls, known as the golden cross. It is one of the popular methods of buying stocks, currencies, or commodities, but the recent surge of cryptocurrencies opened the possibility of using this method to buy crypto tokens like Bitcoin, Ethereum, etc.

Moving Average (MA) is a trading indicator that shows the average price of a trading instrument for a particular time. For example, if the Bitcoin price is trading above the 200-day SMA, it indicates that bulls control the price.

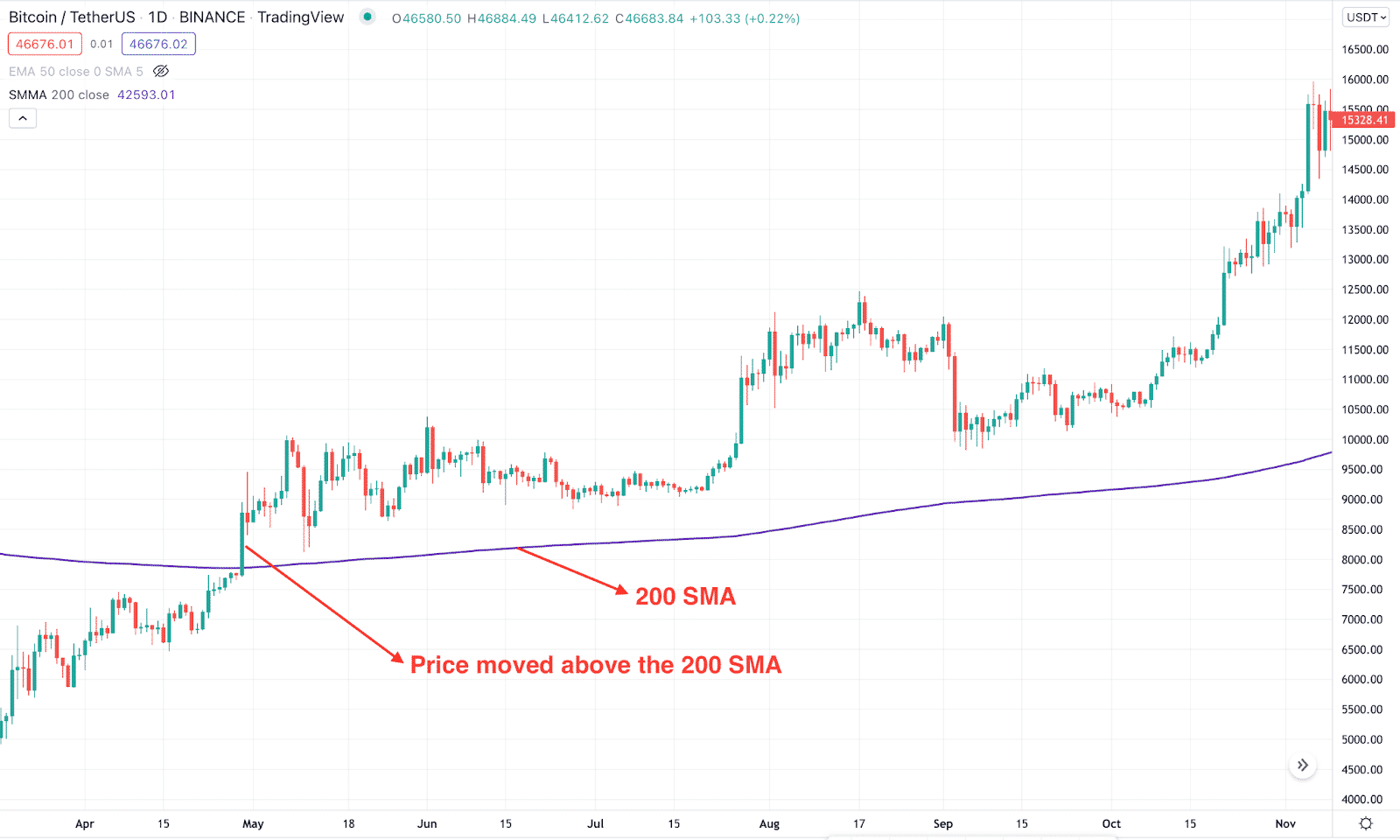

200 SMA is the Bitcoin chart

The above image shows how the price advanced higher after moving above the 200 SMA with a strong bullish breakout.

How to trade using the golden cross in trading strategy?

The golden cross method is easy to spot the trend reversal using moving averages only. However, the market condition in the crypto context is different from the traditional financial market, where the volatility is very high in the crypto market. In that case, the basic idea of buying a crypto asset is to identify the future price direction based on the project’s potentiality and open buy trade from a suitable position.

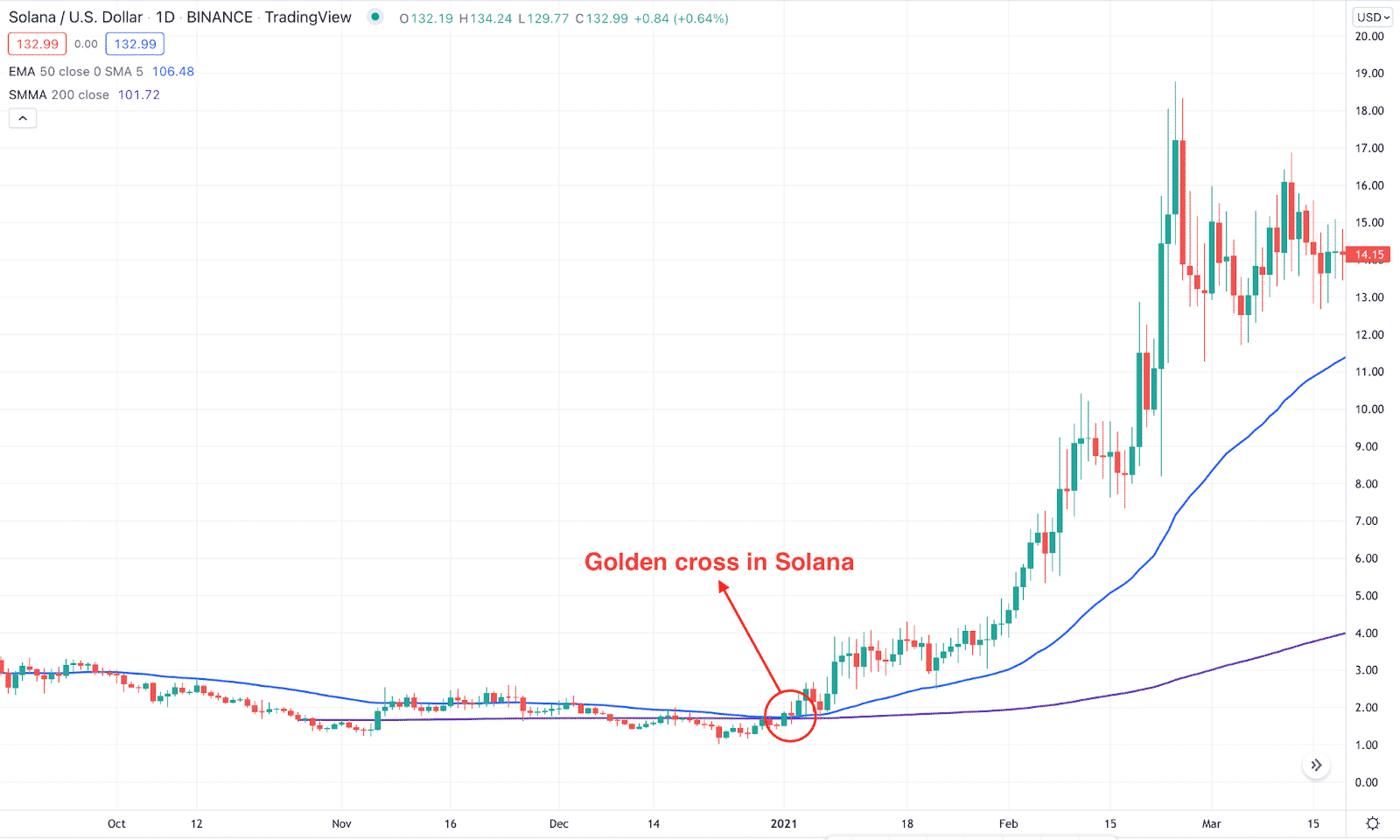

If you believe that the price of Solana will hit a new all-time high, you cannot buy randomly from a price. The best idea is to wait for suitable price action from where the possibility of reversal is low.

Golden cross in Solana

A short-term trading strategy

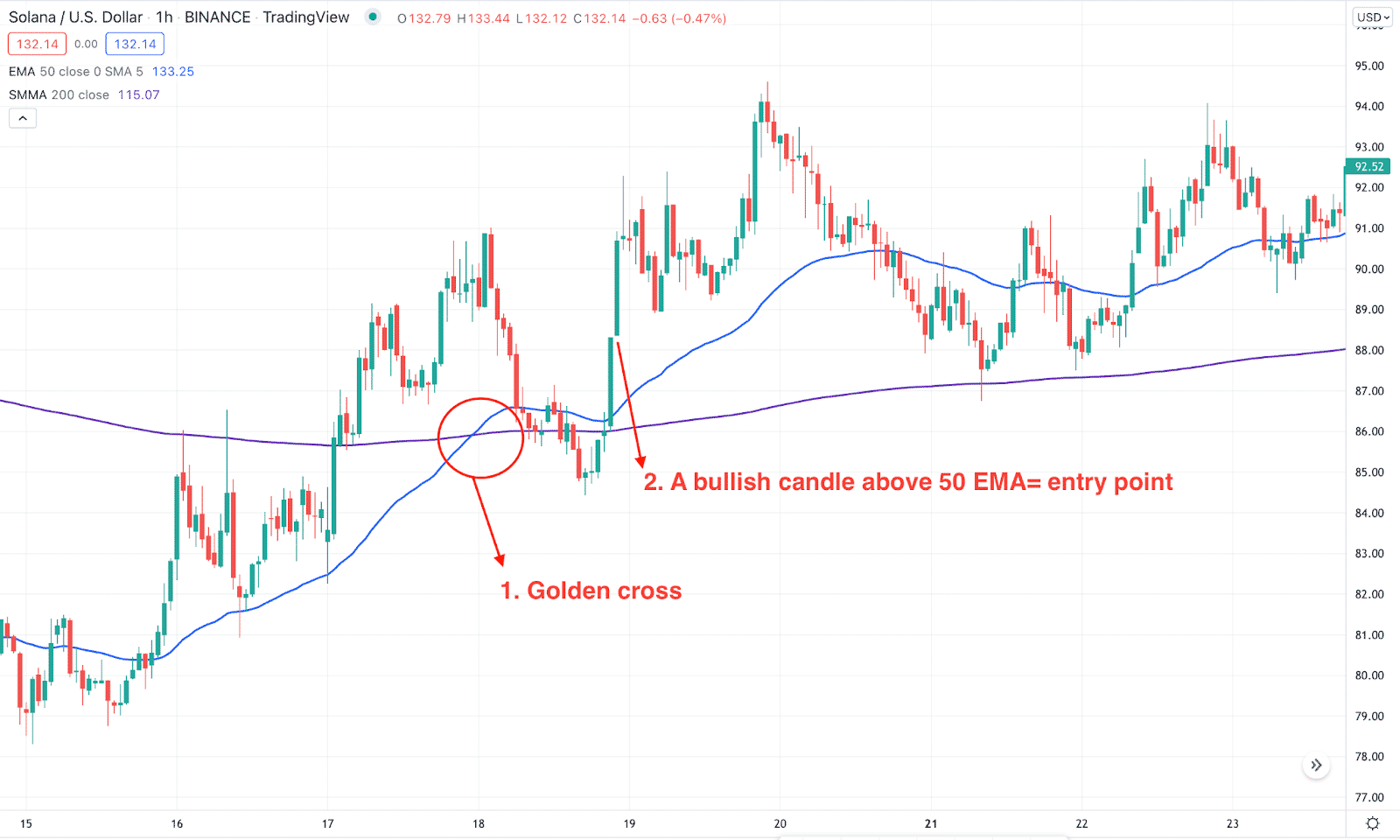

Now moving to the core part of the golden cross. In this method, we will identify a buying approach in the intraday chart where the average duration would be one hour to one week. As it is a lower-time frame trading, find where the long-term trend is heading. When the long-term and short-term directions are the same, the trade is valid.

Bullish trade scenario

In the bullish short-term trade makes sure that the broader market context is bullish by identifying the price above any important support level in H4 or the daily chart. After that identify the golden cross in the H1 timeframe and find the trading entry.

Short-term bullish trade example

Entry

The bullish trade is valid once the following conditions are present:

- The price is trending up in the higher time frame.

- 50 EMA crosses over the 200 SMA, indicating the golden cross.

- The price moved up and formed a bullish H1 candle above the 50 EMA.

- The buy trade is valid once the bullish candle is closed above the 50 EMA.

Stop-loss

If the long-term price trend is impulsive in the intraday method, you can set the stop-loss below the entry candle with some buffer. Alternatively, the conservative method is to set below the near-term swing low with some gap.

Take profit

If the long-term trend is bullish, you can hold the trade for longer-term gains. On the other hand, booking some profits from the near-term resistance level would ensure some gain from the trade.

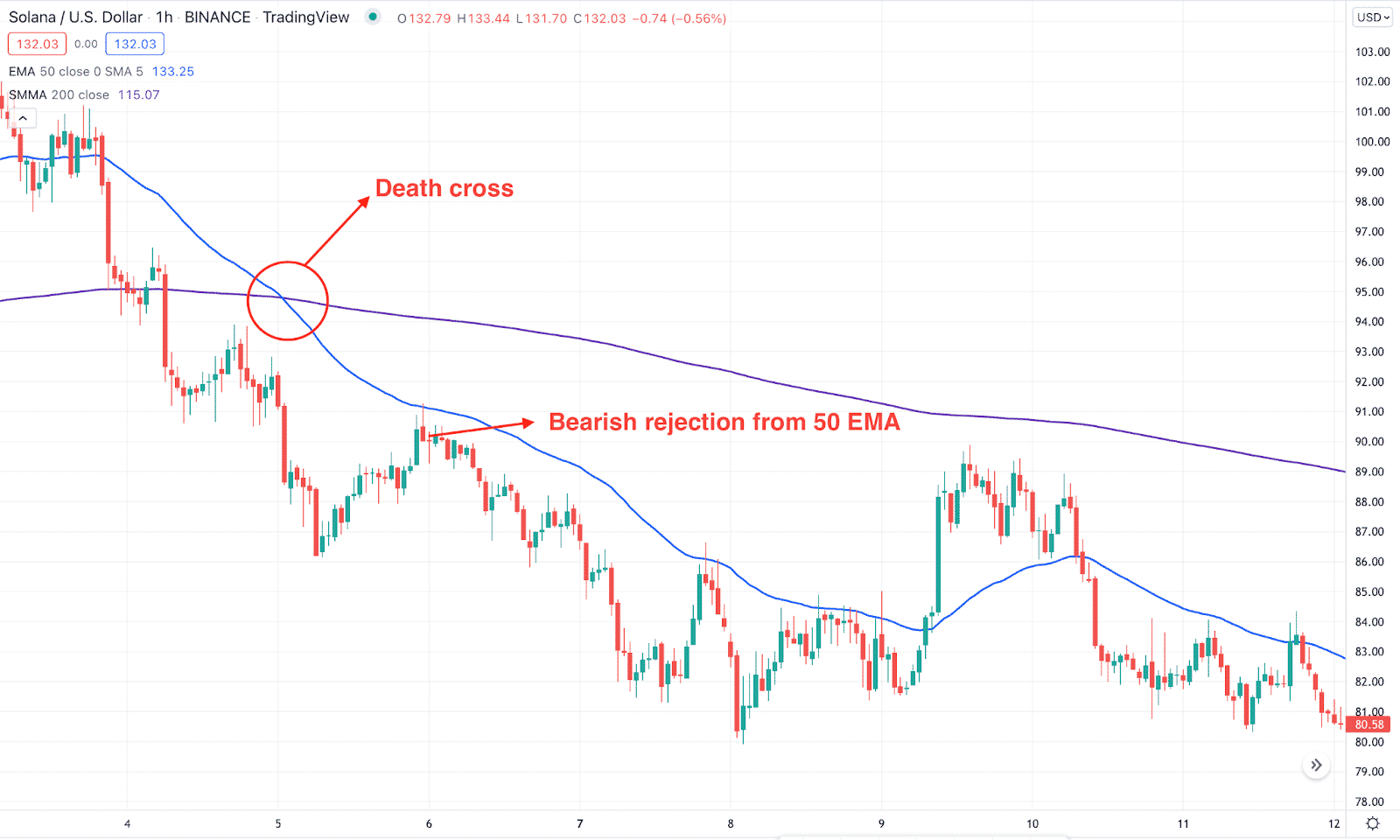

Bearish trade scenario

The bearish version of the Golden cross method is known as the Death cross. We will catch the fish in the short-term bearish method when the price trend is bearish in the H4 or daily chart.

Short-term bearish trade example

Entry

Open a sell trade once these conditions appear in the chart:

- The price moves lower in the higher time frame.

- 50 EMA moves below the 200 SMA, indicating the death cross.

- The sell trade is valid once a bearish candle closes below the 50 EMA.

Stop-loss

The primary approach to setting the stop loss is above the bearish candle, but the conservative way is to set it above the near-term swing high.

Take profit

You can hold the trade until it reaches any significant support level.

A long-term trading strategy

The success rate in the long-term golden cross is higher than the short-term method as it eliminates the intraday volatility and opens the possibility of grabbing higher returns.

Bullish trade scenario

In the buy trade, the best approach is to find the suitable trading condition in the daily chart. Although this method is applicable on any time frame, the daily chart would provide higher returns as most professional and institutional traders use daily charts in their strategy.

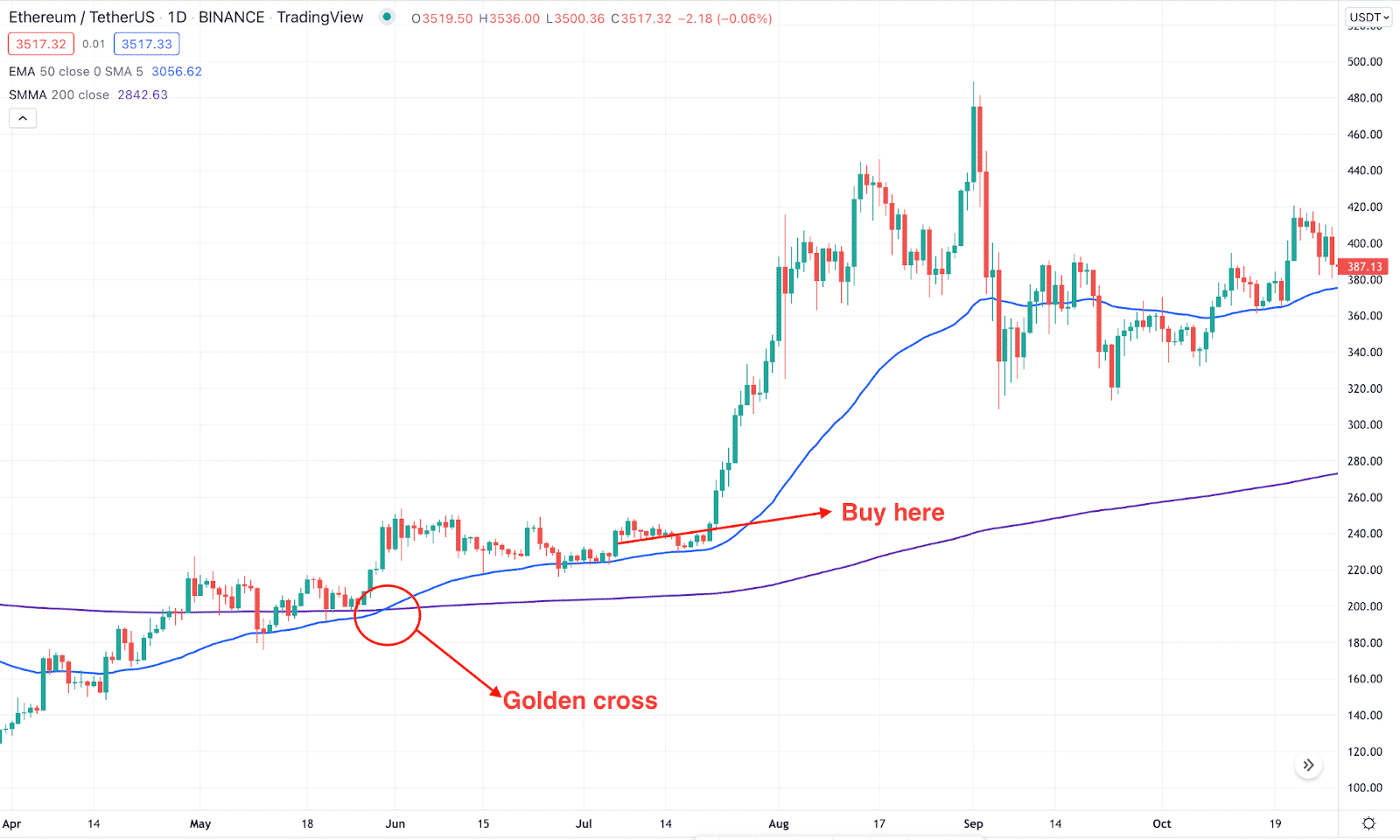

Long-term bullish trade

Entry

The buy trade is valid if these conditions are present in the chart:

- The price formed a golden cross by taking the 50 EMA above the 200 SMA.

- The price shows a corrective pressure towards the 50 EMA and indicates a bullish rejection.

- The buy trade is valid once the candle closes after showing the bullish rejection from the 50 EMA.

Stop-loss

The ideal stop loss is to set below the near-term swing low with some gap.

Take profit

As it is a longer-time frame trade, you can hold it as long as possible. Some cryptocurrencies start a new trend with the golden cross, where multiple positions adding is likely with time.

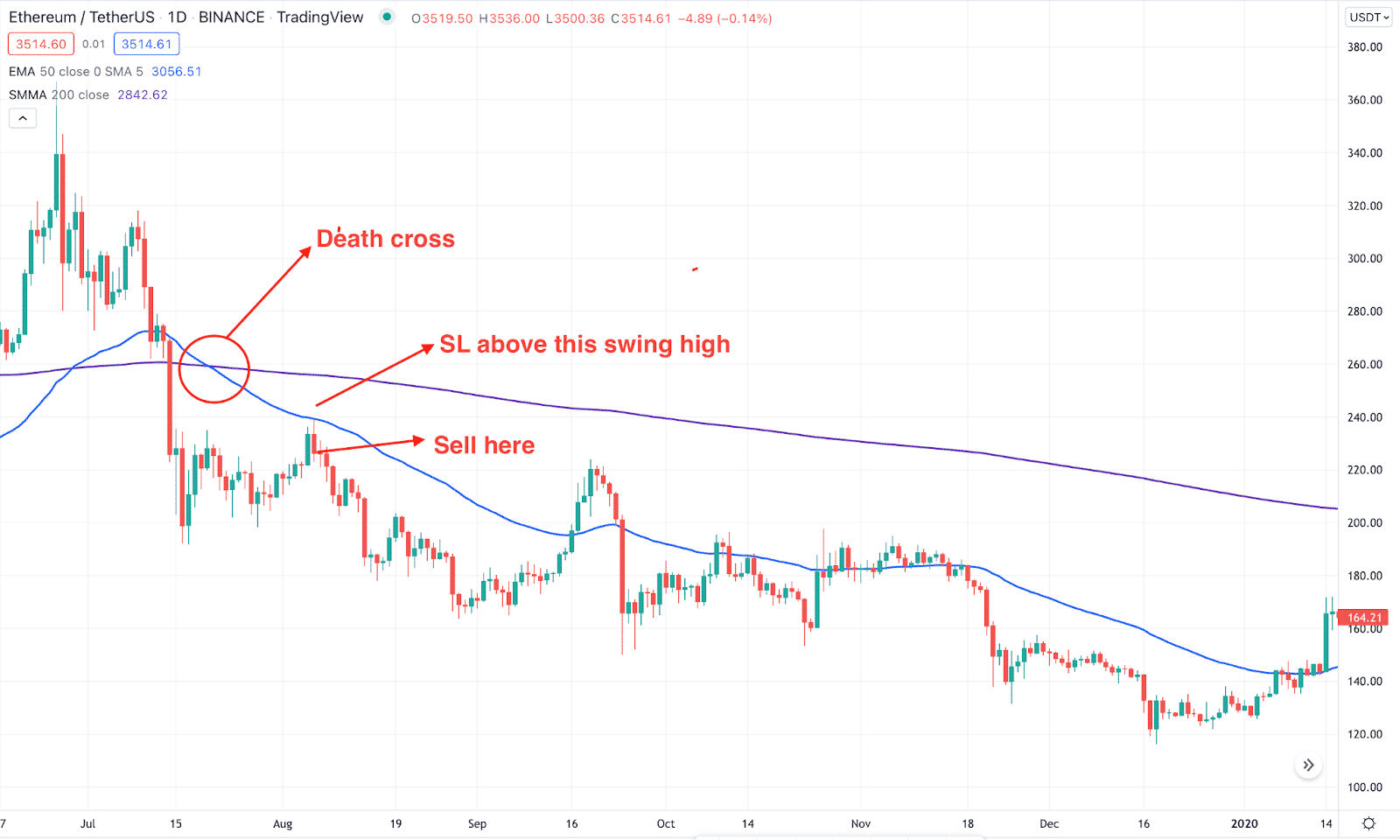

Bearish trade scenario

The death cross approach is applicable when the price trend of a cryptocurrency aims lower within a bearish trend.

Long-term bearish trade

Entry

You can open a death cross-trade if these conditions are present in the daily chart:

- The price formed a death cross by taking the 50 EMA below the 200 SMA.

- The price shows a corrective pressure towards the 50 EMA and shows a bearish rejection.

- The short trade is valid once the candle closes after showing the bearish rejection from the 50 EMA.

Stop-loss

The ideal stop loss is to set above the near-term swing high with some gap.

Take profit

The primary take profit is based on 1:2 RR, but you can hold it for more gains if the price is highly impulsive.

Pros & cons

| 👍 Pros | 👎 Cons |

|

The success rate of the golden cross is low in the intraday chart. |

|

It needs additional attention to risk management and trade management. |

|

The excessive volatility in the cryptocurrency market might make trading difficult. |

Final thoughts

The golden cross is a popular method of making money online from financial market trading. Moreover, the recent surge in cryptocurrencies opened the possibility of extending trading portfolios using this method and making more money.

Comments