Decentralized finance or DeFi is an open alternative to the current financial system, which is global. It is a collective term for financial products and services accessible to anyone using Ethereum. The market is always open, and no central authority is there to block your payment or deny access to do anything with DeFi. The booming crypto-economy out there will allow you to borrow, lend, earn interest, long/short, and more.

However, Ethereum was the first project and largest network to create DeFi; many other cryptos such as Fantom, Avalanche, Terra, etc., compete with Ethereum to run DeFi applications.

Let’s learn the top five Ethereum DeFi that can invest in 2022.

Best DeFi coins to buy in 2022

Look at the top ten ETH DeFi coins that are potential to buy in 2022:

- Ethereum (ETH: $291B)

- Wrapped Bitcoin (WBTC: $9.5B)

- Dai (DAI: $9.6B)

- Chainlink (LINK: $15.6B)

- Uniswap (UNI: $10.7B)

- Fantom (FTM: $6.6B)

- Aave (AAVE: $2.3B)

- Magic Internet Money (MIM: $1.9B)

- PancakeSwap (CAKE: $2.07B)

- Maker (MKR: $1.8B)

Ethereum (ETH)

Market cap: $291 billion

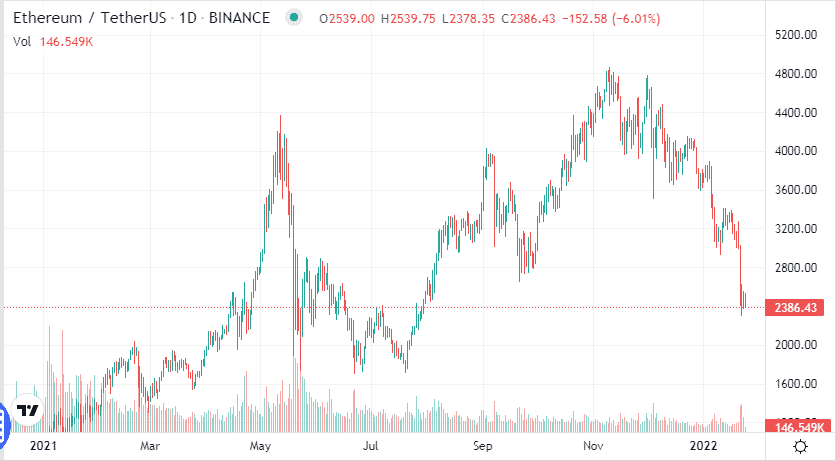

ETH 1Y price char

Ethereum is an open-source blockchain network that has a native coin ETH. It is the second coin after Bitcoin in market capitalization. Vitalik Buterin described Ethereum in 2013, along with other co-founders that have a total of eight co-founders. The official launching date of this blockchain is July 30, 2015.

It is a global platform that allows users to write and run worldwide. It is resistant to fraud, downtime, and censorship. You can do it using the top cryptocurrency exchanges like CopinFLEX, FTX, OKX, Binance, and Houbi Global to buy ETH.

The price of ETH is floating near $2386.43 by the time of writing, with a 24H trading volume of $15,393,267,104. The live market cap of ETH is $286,867,483,063, with a circulating supply of 119,288,259.19 ETH. Meanwhile, the total supply is 119,288,259 ETH, and the max is unavailable.

Does ETH have the potential to grow?

The coin made a recent peak near $4850 in Nov 2021. After the end of the previous year, it has been declining and recently reached below the Sep 2021 low of $2660. It is heading toward a historical price action level near $2050, an excellent dynamic support resistance level. It can bounce back on the upside near the last top of $4850 or above it after reaching that level if no more sanction comes up and the buyer gets back at the support level.

Wrapped Bitcoin (WBTC)

Market cap: $9.5 billion

WBTC 1Y chart

The WBTC is the tokenized version of the most expensive cryptocurrency, Bitcoin, and it runs on the Ethereum blockchain network. You can consider the WBTC as a joint project of Ren, Kyber Network, and BitGo.You can purchase WBTC from HitBTC, Houbi Global, FTX, Binance, and OKX. This crypto asset’s unique feature is that the BTC backs it at a 1:1 ratio.

The price of WBTC is floating near $34,844.12 with a 24H trading volume of $274,684,990. The live market cap of WBTC is $9,549,920,564, and the max supply is not available. Meanwhile, the total supply and the circulating supply are 270,557.44 WBTC.

Does WBTC have the potential to grow?

In Jan 2021, the WBTC made a spike near $253,999, and since then, it’s been ranging between $30,000-$74,000. With the increasing interest in cryptocurrencies, the demand for BTC is increasing, so the WBTC can surge upside from here in 2022 as it is floating near a good support level.

Dai (DAI)

Market cap: $9.6B

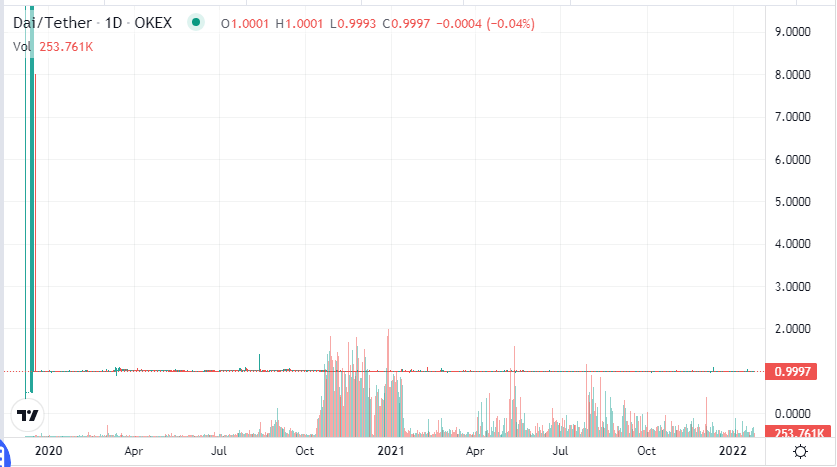

DAI 1Y chart

DAI is an Ethereum based stablecoin. The MakerDAO and the Maker Protocol, both decentralized autonomous organizations, are responsible for the issuance and development of this coin. This crypto coin is soft-pegged to the USD. The remarkable feature of DAI is that the creator of this coin is not a single person or small organization. You can purchase this coin from HitBTC, Gate.io, Houbi Global, FTX, and OKX.

The price of DAI is floating near $0.9997 today with a 24-H trading volume of $391,233,136. The live market cap is $9,618,637,147, and the max supply is unavailable. Meanwhile, the circulation supply and the total supply amount are 9,620,298,603 DAI.

Does DAI have the potential to grow?

This coin becomes a more attractive investment to crypto investors for its positive features. Observing other fundamentals and growth ratios, we list this among the top five potential Ethereum Defi investments in 2022.

Chainlink (LINK)

Market cap: $15.6B

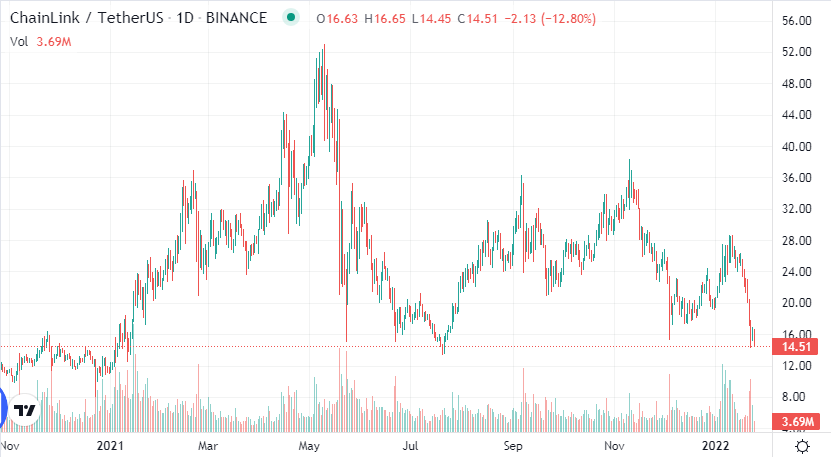

LINK 1Y chart

The Chainlink is a blockchain abstraction layer that enables connecting smart contracts worldwide. It contains many drivers such as smart contract developers, security auditors, data providers, researchers, node operators, and more.

The live market cap of LINK is $7,255,963,473 as of writing, with a 24H trading volume of $1,091,747,370. The circulating supply is 467,009,549.52 LINK. Meanwhile, the total supply and the max supply are the same 1,000,000,000 LINK.

Does LINK have the potential to grow?

LINK is floating near $14.51, near the previous low of July 2021, near $13.40. The price can bounce upward from here near the Jan 2022 high of $28.50 or above it within this quarter. Meanwhile, the next support level is near $8.00.

Uniswap (UNI)

Market cap: $10.7B

UNI 1Y chart

The Uniswap is another popular decentralized training protocol famous for facilitating the automated trading of Defi tokens. The launching period of the token Uniswap is November 2018, and the creator of this platform is the Ethereum developer Hayden Adams.

The current market cap of UNI is $6,728,468,443 with a 24 H trading volume of $283,087,838. The circulating supply is 627,321,717.93 UNI. Meanwhile, the total supply and the max supply are the same 1,000,000,000 UNI.

Does UNI have the potential to grow?

The price of UNI is floating near $10 today after reaching below the long-term support level near $14.12; the top of the previous year is near $45. The unique feature of creating liquidity makes this unique and attractive investment in 2022.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

So these are the top five potential Ethereum DeFi investments in 2022. However, these assets involve volatility and other risks as other crypto assets. So we suggest following fair trade and money management alongside choosing good exchange platforms while investing in these assets.

Comments