Over a few decades, the forex market has been a money-making place for individuals. Before 1990, only banks and financial corporations could participate in the forex market by affording significant capital and research.

Nowadays, the availability of technology makes the forex market more accessible than ever, as anyone can participate in the forex market. Therefore, traders can easily consider forex trading as a profession to earn profits or salaries.

However, many of you may know about trading as an individual participant in the forex market, but you may not know about forex-related jobs or careers. This article will enlighten you about forex-related jobs and an idea about how much you can make through that career. Moreover, the procedure to reach that goal.

What is a forex trading career?

The FX market is always open during any trading day, a 24-hours market. So it reveals many opportunities to anyone who has skills or knowledge of financial trading and many specific factors. In general, two types are common: broker job and financial analyst.

The broker’s job is to act as an intermediary between any exchange and an investor. They often offer many services to clients who can not directly engage with the exchange. Moreover, in some cases, they provide investment plans, research, market intelligence, or even sell products of their brokerage firms. However, the job holder has no direct access to any company’s core operations.

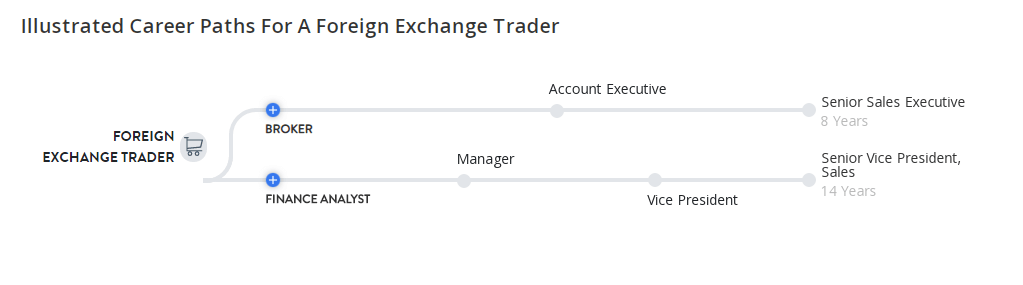

Career paths

On the other hand, financial analysts evaluate the company’s historical reports and financial data to seek investment opportunities that support business strategies and improve performance. They are also responsible for growing the company’s revenues, managing client portfolios, boosting operations, researching current performance, etc. Financial analysts always have excellent analytical and critical thinking skills to determine the best actions to expand the company’s profitability.

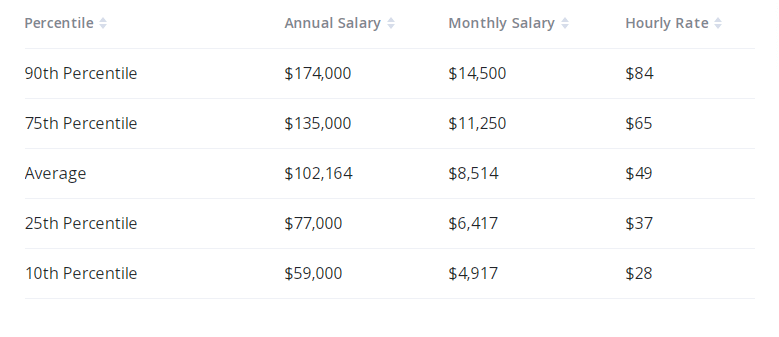

Salary range of forex traders

In the United States, forex traders’ salary is between $28-$84 per hour. So they make a sum between $59k-$174k annually. Many types of traders are available: general forex trader, equity trade, commodity trade, hedge fund manager, etc., and the salary range is also different for each type.

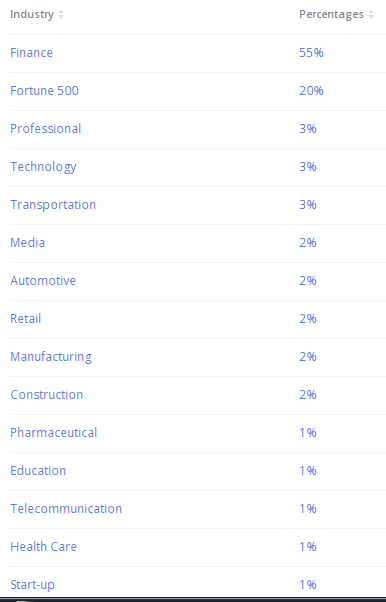

Firms that hire forex traders

Many firms hire forex traders; the financial institutes are above them all.

How the forex trader career work

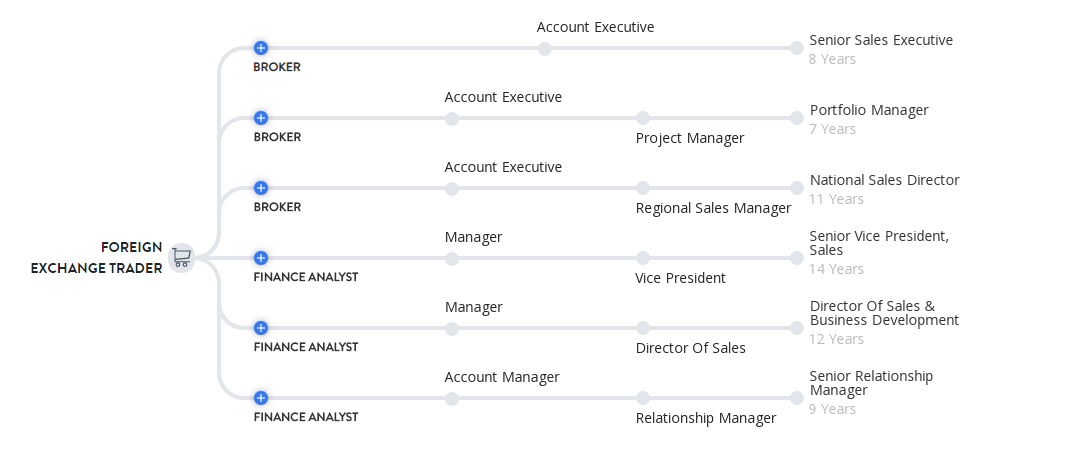

We are attaching a chart below to understand the career of a forex trader while doing any job.

Forex trader career map

Using this career map above, you can select the career path suitable for you. Many opportunities are open for starting a career, such as an internship, broker, sales associate, team leader, operator, research assistant, etc. The forex market or foreign exchange market is where frequent buying and selling occurs for currencies.

A forex trader who is doing a job has a primary goal to increase clients’ investment and maximize profit. To achieve that goal, they do analysis and depth research and check the market context regularly to seek opportunities. They often make trades for clients too. In the US, the average annual salary of a forex trader is $77,000. Moreover, they can enjoy commissions and revenues from their investments too.

To be a forex trader, follow the steps below.

Step 1. Identify your goal

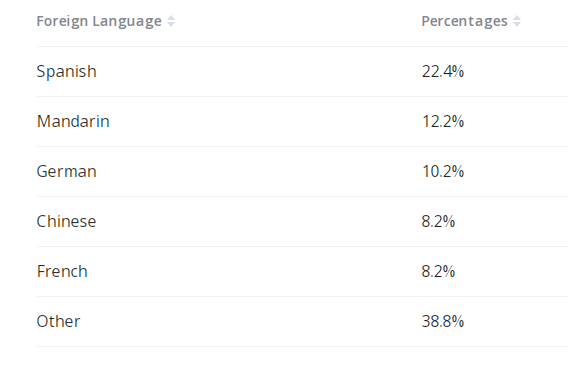

In the initiation step, you need to set a goal for your career. If you want to be a broker, keep developing skills that relate. For example, being a broker requires conversations with clients and companies. So you may learn to speak in Spanish or Mandarin, so the probability will increase for you that many companies hire traders with these skills.

Language efficiency of forex traders

On the other hand, if you want to be a financial analyst, keep the focus on learning technical and analytical skills that are appropriate to apply for those positions.

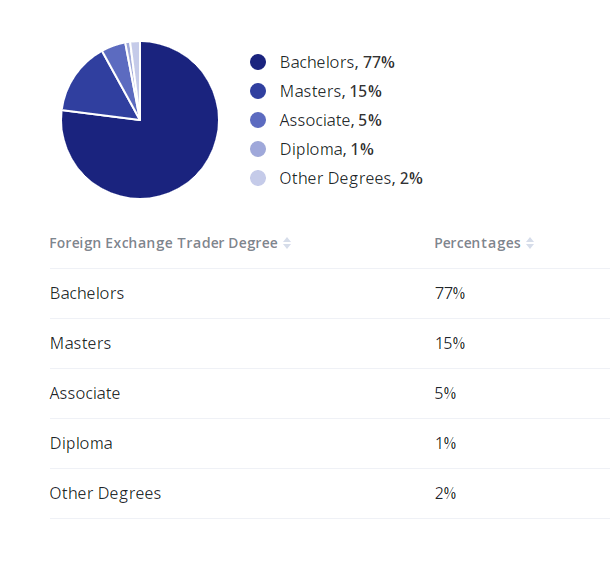

Step 2. Try to complete graduation

Education is another essential factor when choosing a career as a forex trader. According to the survey, approx. 77% of forex traders have bachelor’s degrees, and 15% have master’s degrees. Many companies also hire traders or prioritize traders with degrees in economics, finance, or other relative subjects.

Forex traders educations

Moreover, most of the operations in the forex market occur online, so it also requires some computing skills. Furthermore, computer programmers can also make careers in the forex market as tools developers or strategy makers.

Step 3. Move to other jobs

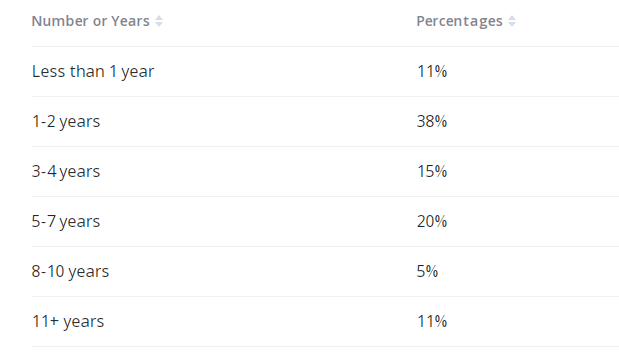

Switching tendencies are common in forex traders. A study shows that nearly 38% of traders remain in the same job for 1-2 years, and then they switch positions for better opportunities. Moreover, traders with sufficient skills may not want to follow a 9 am-5 pm routine, enjoy more flexibility, spend more time with friends and families, and often want to do a remote job or vacation.

Job switching tendencies

However, it is also common among forex traders that they hold positions in a company for a more extended period and reach the top management level after a certain period of service by proving themselves.

Step 4. Use different tools to observe the market

The forex market is a vast marketplace. Use many different assets for research purposes. Meanwhile, use many other tools and indicators to learn potential and develop sustainable trading methods. Try to understand the affecting factors of the forex market that are responsive to changing the price movement.

For example, you can use tools like the Fibonacci retracement to identify the reversal points or use momentum indicators like MACD, MA crossover, RSI, etc., to determine the price shifting points and create unique trading strategies. Besides, different tools try to gather knowledge on other trading assets, such as stocks, commodities, indices, etc.

Step 5. Use trading practice that supports fundamental contexts

Professional forex traders follow fundamental and sentiment info besides technical analysis to predict the future movement of any currency. Learn to know the fundamental impacts on currencies as many fundamental events make the currency pairs move 100-300pips a day.

Research many remarkable fundamental events like Brexit, Swiss unpeg from Euro, 2007-2008 financial crisis, recent corona pandemic, etc., to understand the impact as these events directly impact many relatable currencies. Moreover, learn to study COT analysis to understand the participants’ sentiment and practice more to achieve your successful trader goal.

Final thought

The forex trading job is one of the most attractive jobs globally that has many more positive features than any other traditional 9 am- 5 pm job. Additionally, there have always been opportunities to make more money by investing or switching careers. However, you need to prove yourself to get any job. For example, many institutes see past trading records or graduation subjects before hiring.

Comments