Sometimes trading may become challenging due to wrong decisions that may need to cover immediately. It is not charming to see running trades going red and increasing the negative balance. Hedging is one of the ways to minimize the trading risk if the price direction is not favorable.

In FX trading, we use currency pairs as a trading instrument where profit is possible in bullish and bearish movements. Therefore, hedging in trading needs additional confirmation than stock trading.

The following section is for you to know the exact way to hedge in forex trading. Here we will uncover the best forex hedging strategy that may help you to reduce trading risks.

What is hedging in the forex market?

Hedging is a way to reduce trading risk by taking buy and sell trades together. In this process, the current market sentiment is offset by buy and sell trades that ultimately reduce the risk. For example, we usually face a directional bias in forex trading by relying too much on a trading system. Therefore, if your trading system becomes unfavorable, you may make a loss, but hedging allows you to limit the loss to a certain level.

In hedging, you have to identify multiple instruments that have a negative correlation. Therefore, if you buy in one instrument and sell at another, you are limiting the risk. For example, EUR/USD and USD/JPY have a negative correlation. Therefore, when EUR/USD moves up, USD/JPY moves down. Thus, the approach of hedging is to buy EUR/USD and sell in USD/JPY.

Types of hedging strategies

Hedging strategies depend on which instrument you are using. We can distinguish the hedging strategy in three categories as shown below:

- Multi-currency hedging

In this method, we will use two currency pairs that are negatively correlated and take trades in the opposite direction to minimize the risk.

Some currency pairs are correlated with gold, and we can hedge it to reduce the risk.

It is similar to the gold hedge strategy. We know that Canada is the world’s largest oil export country. Therefore, any change in the oil price directly affects the USD/CAD. Consequently, you can hedge the risk with oil if you trade in the USD/CAD.

What is the best forex hedging strategy?

Finding the best hedging strategy needs to know a better understanding of your trading system. For example, if you are a short-term or intraday trader, multi-currency hedging would be the best option for you. On the other hand, for long-term trading, you can use gold or oil hedging. In addition, there is another hedging system known as options hedging that is also applicable to the forex market.

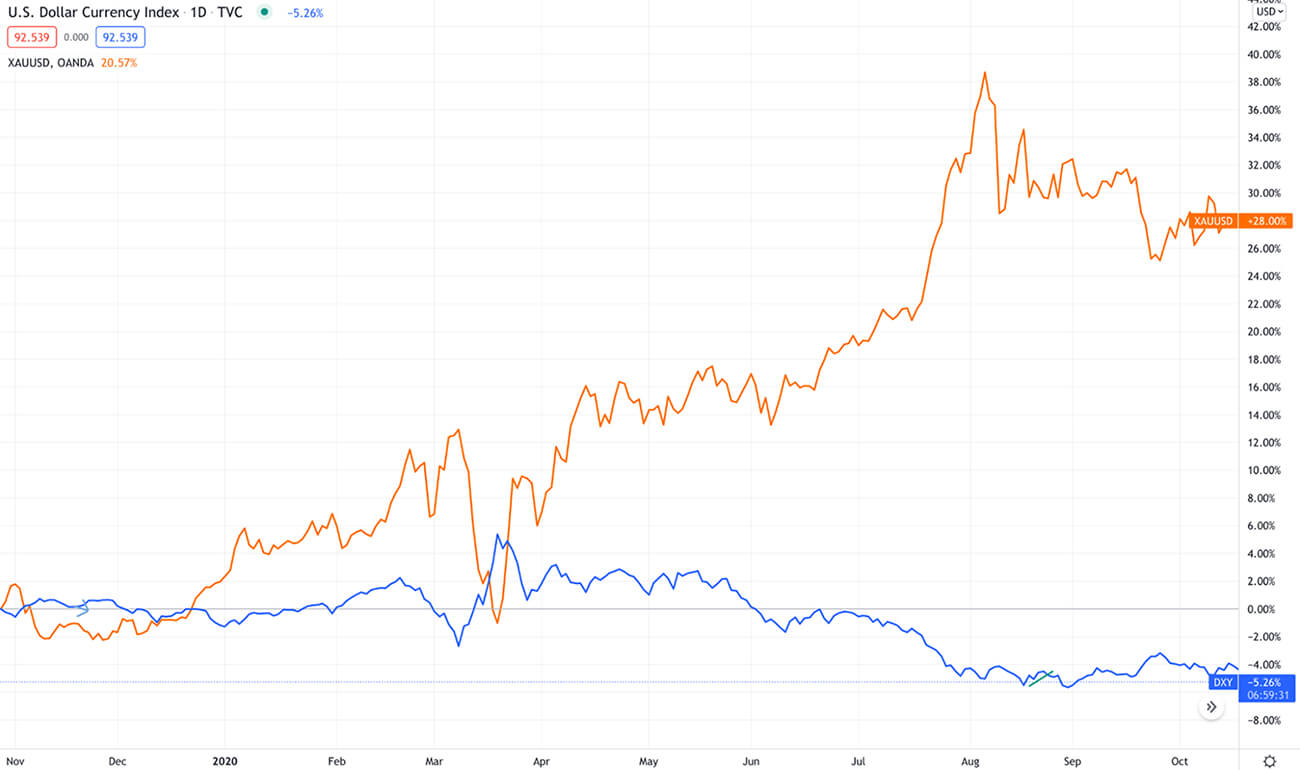

Gold hedging strategy

It is a process to reduce the risk from uncontrollable inflation. If the inflation rate moves beyond the controllable limit, we can use the gold hedging system if some of our trades run with losses. Gold is also negatively correlated with the US Dollar. Therefore, if the USD is moving, bearish gold should move up. In that case, any buy trade in USD can be offset with a buy trade in gold.

Gold and US Dollar correlation

Moreover, in CFDs trading, you can buy and sell gold at a time, which is an effective short-term trading strategy.

A short-term strategy

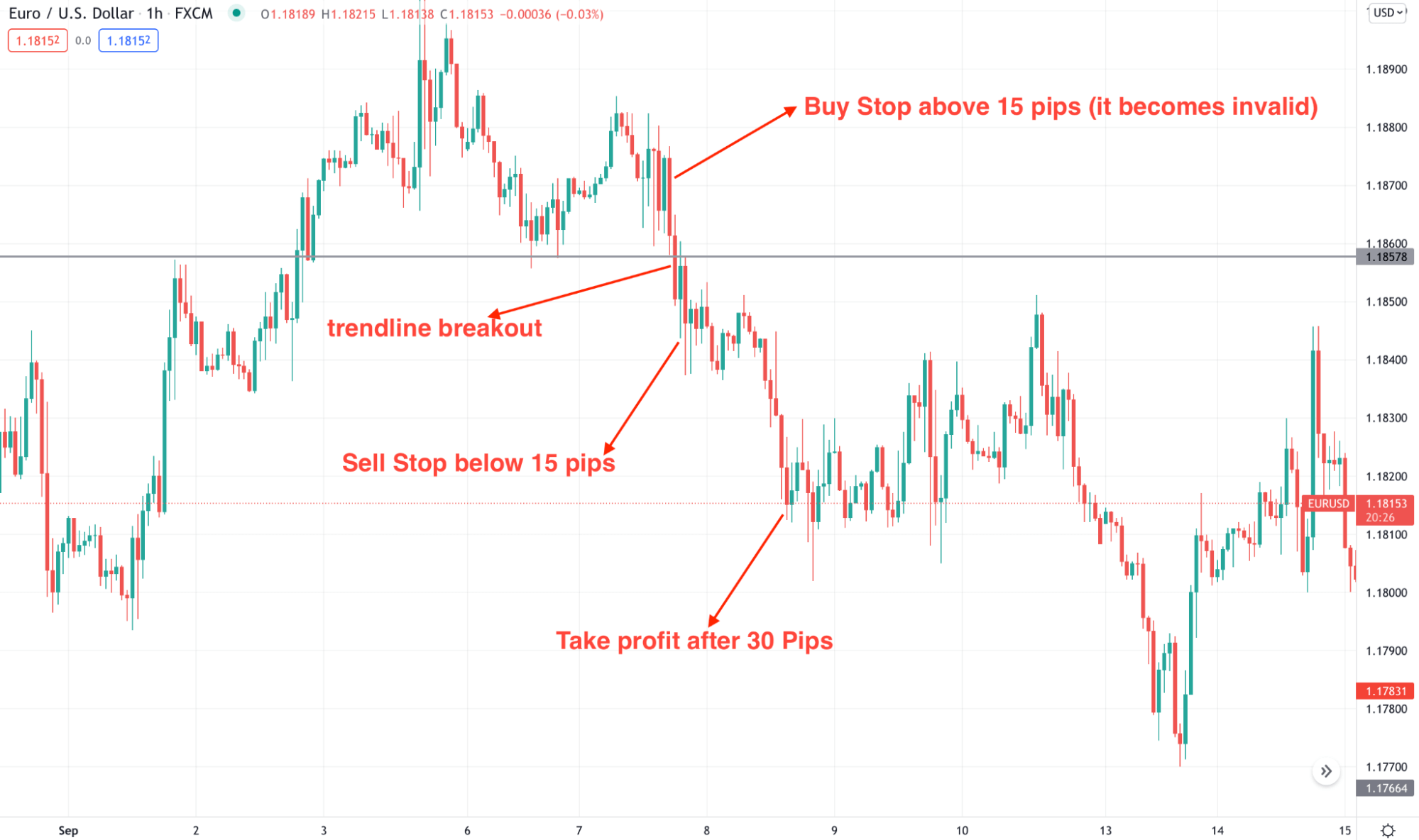

This method will use multiple pending orders in EUR/USD or GBP/USD within a 30 pips gap. We aim to find a breakout with our pending orders and provide profits from either bullish or bearish movements.

The above image shows that the AUD/USD negatively correlates with EUR/AUD by -91.9%. Therefore, if AUD/USD moves up, EUR/AUD should move down 90% of the distance.

Best time frames to use

This strategy is applicable in any time frame, but sticking to H1 would be effective. However, do not move above H1 as our target area is not more than 60 pips.

Entry

Sell stop 15 pips below the current price and buy stop 15 pips above the current price.

Stop loss

The ideal stop loss is 15 pips.

Take profit

You can close the trade after gaining 30 pips of profit. If the price moves 10 pips, set the stop loss at break-even and make it risk-free.

Short-term hedging strategy

A long-term strategy

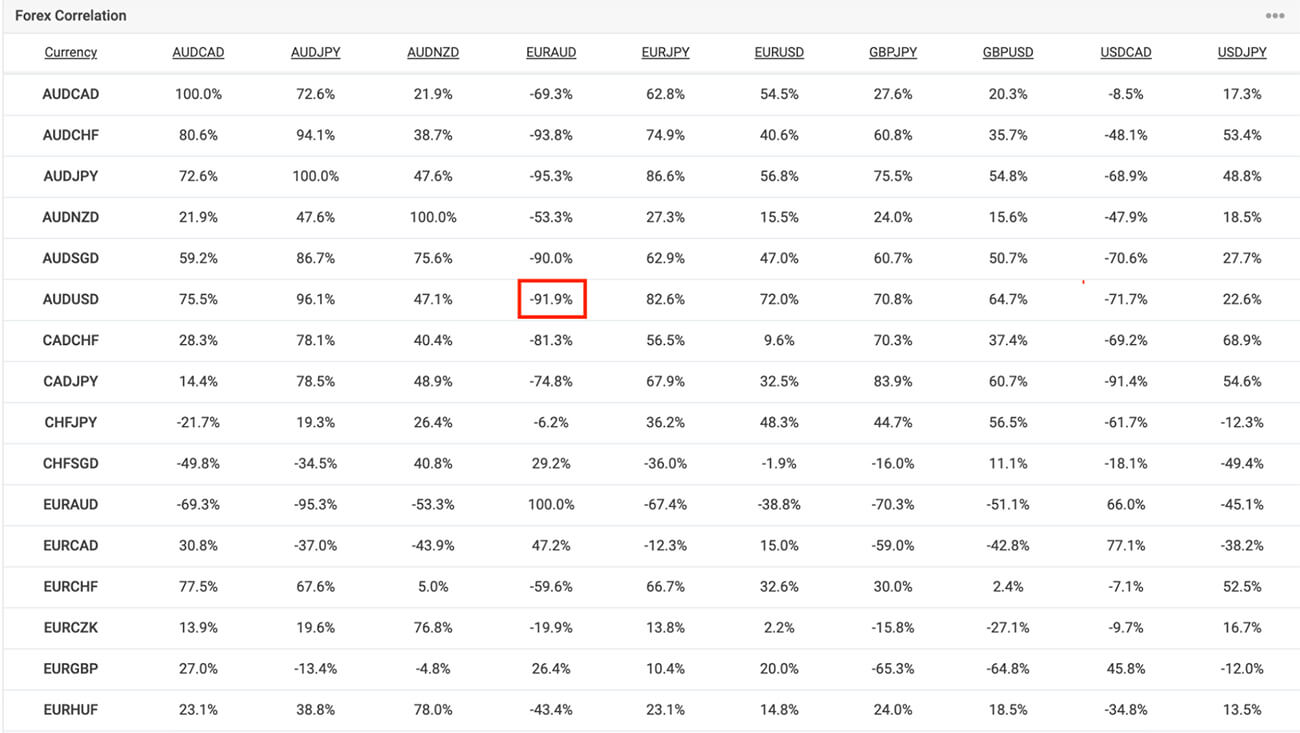

In the long-term strategy, we will focus on multiple currency pairs in trading. First, identify the correlation between currency pairs and find a currency pair that has the maximum negative correlation.

Correlation char

The above image shows that the AUD/USD negatively correlates with EUR/AUD by -91.9%. Therefore, if AUD/USD moves up, EUR/AUD should move down 90% of the distance.

Best time frames to use

As it is a long-term strategy, you can use the H1 daily time frame.

Entry

The primary entry is in any currency pair, but if the trade moves against your desired path, open another trade in the same direction on a negatively correlated currency pair.

Stop loss

You are taking trades in the opposite direction of two currency pairs where the loss is limited. Now, wait for proper market behavior to come and close the second position that is running with profits.

Take profit

The first trade should move in profit and close it according to the trading plan.

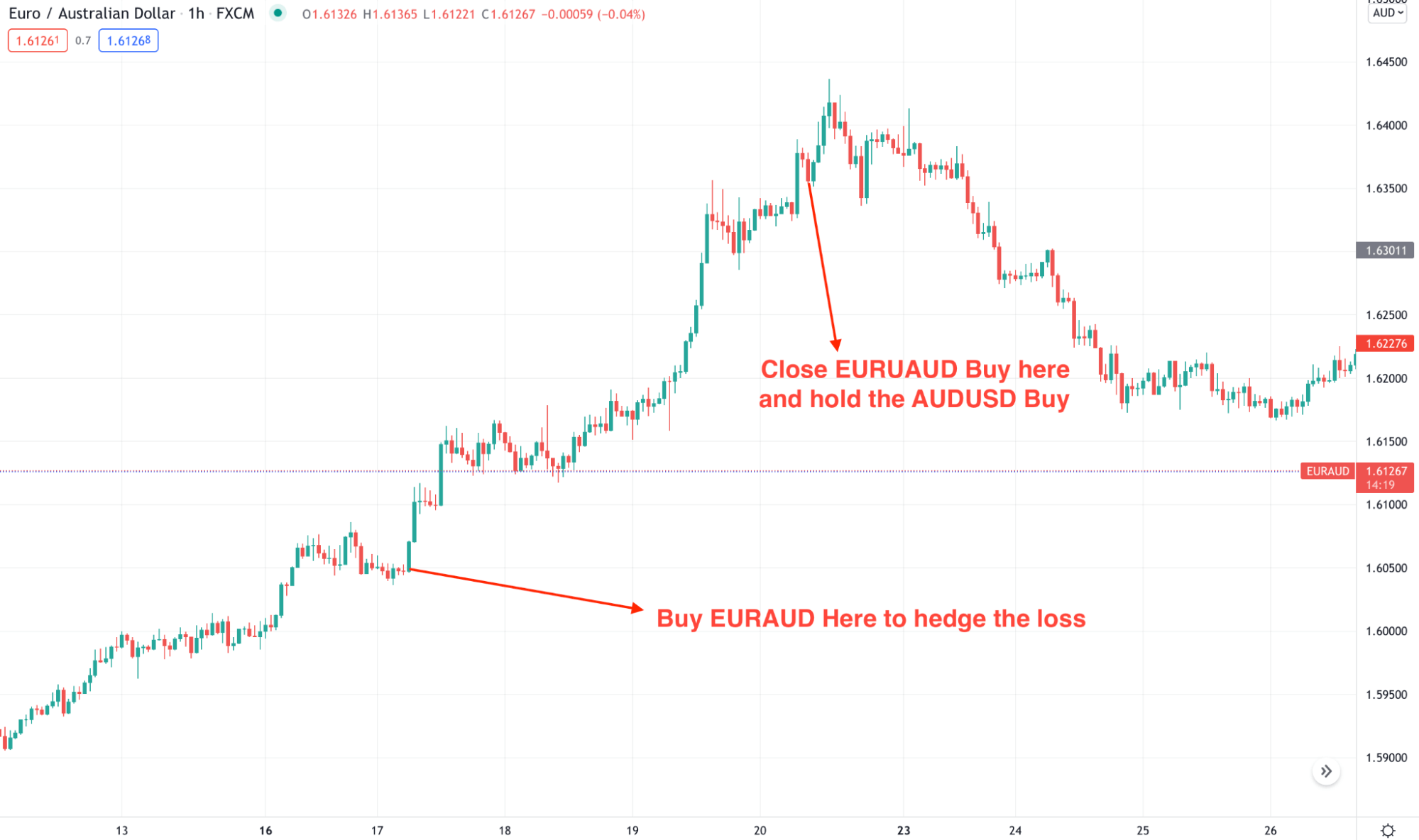

Let’s see the example of a long-term trading system.

AUD/USD H1 chart

We have bought AUD/USD in the above image, but the price moved lower, resulting in a floating loss.

EUR/AUD H1 chart

We have bought EUR/AUD to minimize the loss as it has a 90% negative correlation with AUD/USD. Once the EUR/AUD finds resistance, close the trade with a profit.

AUDUSD H1 Chart

Now close the AUD/USD buy trade with profit.

Pros and cons of the gold hedging strategy

Let’s see the pros and cons of gold hedging strategy.

Pros |

Cons |

|

|

|

|

|

|

Final thought

We have seen a detailed overview of hedging and correlation trading in the forex market. Remember that no trading method can give you profit until you understand it. Therefore, find a profitable trading system and practice it in the demo account before implementing it in the forex chart.

Comments