When it comes to generating passive income from the crypto industry, holding coins for the long term has recently become attractive to crypto investors. Within a short period, DeFi’s market value surged over $200 B, as it provides a much more tremendous amount than typical savings accounts on the banks. Usually, banks offer 2-3% return on interest, whereas these assets offer 5-10% or even a 100% return on particular crypto platforms.

However, all crypto assets are not available for staking, and it requires choosing the best assets for staking as all assets don’t offer investors the same income. This article lists the five most significant crypto for staking in 2022.

The best five crypto assets for staking in 2022

Before proceeding, note that every crypto coin is not available for staking. For example, Bitcoin doesn’t allow staking as it relies on the proof-of-work method for operating or validating transactions. Meanwhile, other crypto coins that apply the proof-of-stake model for validating faster transactions are available for staking. It means these assets allow earning in return holding. Traditional banks commonly offer a 2% annual return, whereas the average offering of these tokens is between 5-30%; some may offer a 100% return.

Many coins are available for staking, and the best five among them are:

- Ethereum (ETH)

- Cardano (ADA)

- Polkadot (DOT)

- Tezos (XTZ)

- Solana (SOL)

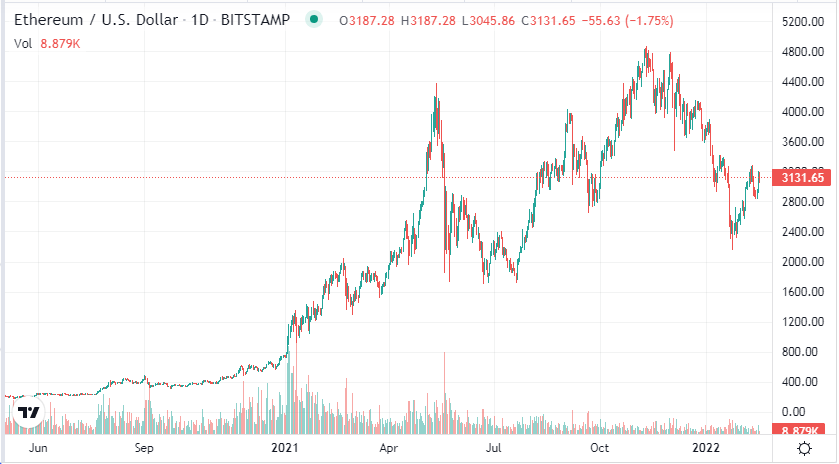

Ethereum (ETH)

Market cap

Fully diluted market cap: $369,511,851,782

Live market cap: $373,788,939,788

ETH price chart

Ethereum is an open-source blockchain system that works as a platform for numerous other crypto assets. It is only next to Bitcoin, the second-largest crypto industry, measured by market cap info. The official launching date of this platform on the blockchain is July 30, 2015. The native token of this platform, ETH, is floating near $3131.65 today with a 24-H trading volume of $11,635,631,420. This token is available on many major crypto exchanges, including CoinFLEX, FTX, Binance, CoinTiger, and OKX.

Other information is mentioned below:

- Total supply: 119,607,084 ETH

- Circulating supply: 119,607,084.25 ETH

- Max supply: not available

- Volume / market cap: 0.03021

Does ETH have the potential to grow?

Ethereum staking pool already has a deposit of $12 billion from investors worldwide. This coin offers an impressive staking reward of between 5%-21% yearly. After a sharp decline, ETH finds support near $2160 and starts bouncing upside.

Cardano (ADA)

Market cap

Fully diluted market cap: $48,999,816,531

Live market cap: $36,605,485,420

ADA price chart

Cardano is a proof-of-stake decentralized blockchain platform that declares the aim of allowing “visionaries, innovators, and changemakers” to bring positive change to the world. They named this platform after the 16th-century famous polymath Gerolamo Cardano, an Italian.

The foundation year of this platform is 2017, and the founder is Charles Hoskinson. The native token of this platform, ADA, is floating near $1.09 today with a 24-H trading volume of $1,055,036,653. This token is available on many major crypto exchanges, including CoinTiger, Binance, Mandala Exchange FTX, and OKX.

Other information is mentioned below:

- Total supply: 34,105,094,650 ADA

- Circulating supply: 33.61B ADA

- Max supply: 45,000,000,000 ADA

- Volume / Market Cap: 0.02813

Does ADA have the potential to grow?

ADA made a high near $3.16 in Sep 2021, has been declining since then and finds support near $0.92. Several platforms, including Coinbase, Binance, Bitfinex, etc., allow staking ADA. Meanwhile, Binance enables individuals to earn up to 24% APY for this token by staking ADA.

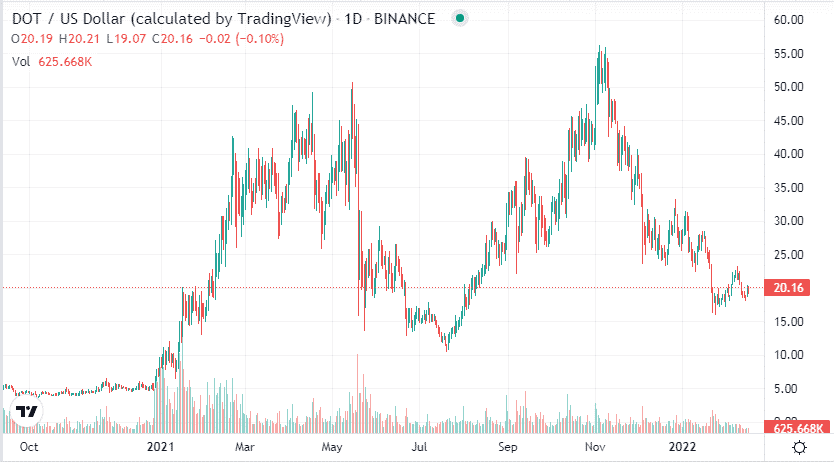

Polkadot (DOT)

Market cap

Fully diluted market cap: $22,191,666,309

Live market cap: $19,903,532,929

DOT price chart

Polkadot is a shared multichain open-source protocol that facilitates the cross-chain transfer of any asset or data type. This platform allows blockchains to be interoperable. This platform’s four core components are Parathreads, Relay Chain, Bridges, and Parachains. The native token of this platform, DOT, is floating near $20.16 today with a 24-H trading volume of $864,971,107. This token is available on many major crypto exchanges, including CoinTiger, Binance, CoinFLEX, OKX, and FTX.

Other information is mentioned below:

- Total supply: 1,103,303,471 DOT

- Circulating supply: 987,579,314.96 DOT

- Max supply: not available

- Volume / market cap: 0.043

Does DOT have the potential to grow?

Many crypto analysts anticipate the price of DOT can hit $58.52 by Dec 2022. The annual staking return rate of Polkadot is 12% currently.

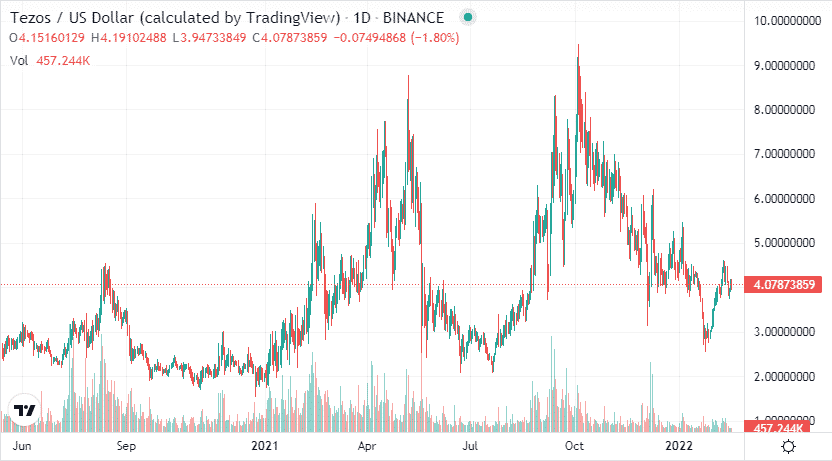

Tezos (XTZ)

Market cap

Fully diluted market cap: $3,721,463,965

Live market cap: $3,608,012,445

XTZ price chart

Tezos is a blockchain network protocol based on smart contracts that do not differ much from Ethereum. The man who wrote the Tezos white paper is Arthur Breitman. The native token of this platform, XTZ, is floating near $4.07 today with a 24-H trading volume of $119,746,791. This token is available on many major crypto exchanges, including Binance, Bybit, Mandala Exchange, FTX, and OKX.

Other information is mentioned below:

- Total supply: 906,315,742 XTZ

- Circulating supply: 878,186,542.26 XTZ

- Max supply: not available

- Volume / market cap: 0.03239

Does XTZ have the potential to grow?

Many crypto analysts predict the price per XTZ can hit above $13.58 by Dec 2022. Tezos allows an annual staking reward of 6%.

Solana (SOL)

Market cap

Fully diluted market cap: $52,628,022,336

Live market cap: $32,789,334,332

SOL price chart

Solana is a highly active open source project that provides DeFi solutions. The official launching period of this platform is March 2020. The native token of this platform, SOL, is floating near $102.70 today with a 24-H trading volume of $2,028,835,970. This token is available on many major crypto exchanges, including Binance, Bybit, Mandala Exchange, FTX, and OKX.

Other information is mentioned below:

- Total supply: 511,616,946 SOL

- Circulating supply: 319,246,059.43 SOL

- Max supply: Not available

- Volume / Market Cap: 0.06184

Does SOL have the potential to grow?

Many crypto experts expect the average price of SOL tokens to reach near $217 by Dec 2022. Staking rewards of SOL annually range between 7–11%.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Staking crypto coins is an excellent approach for crypto investors to generate passive income. It has many advantages as it enables more participation in network governance, validates transactions from community members of the network, and allows blockchain networks to scale throughputs.

Comments