The Solana ecosystem is becoming more popular so rapidly that many think this blockchain system can replace Ethereum. The most positive feature of the Solana ecosystem is it is faster than the Ethereum blockchain. The native token of the Solana ecosystem is SOL, which has provided a 49,000% gain in 2021.

The Tether (USDT) does not have its blockchain. Instead, it runs as a second layer token to top cryptocurrency networks, and the Solana ecosystem is one of them.

Chainlink (LINK) works as a blockchain abstraction layer in universally connected smart contracts through its Oracle network. It allows to sharing of critical off-chain information from the Solana ecosystem to others.

Terra (LUNA) is a fiat-pegged stablecoin that aims to provide a price-stability to global payments systems. It works with seven different blockchain networks, and the Solana ecosystem is one of them.

GRT is the native token of the Graph, where the main aim is to work as an indexing protocol for querying data for ecosystems like Solana or Ethereum.

Besides, other tokens like LINK, GRT, LUNA & USDT are also potentials where processing 50,000 transactions per second (TPS) is available. Moreover, the Current transaction fee is $0.00025 for Solana, comparatively low than others in similar categories.

The good news is that investors may experience Solana DeFi, a huge surge in 2022. The following section is for you if you want to keep yourself at the top gainer from SOL DeFi. Here we will the top 5 Solana DeFi that are potential to show massive growth in 2022.

Best Solana Defi coins to buy in 2022

Before discussing further, let’s check out the top ten Solana Defi coins that are potential to buy in 2022:

- Solana (SOL: $49.5B)

- Tether (USDT: $80.1B)

- Arweave (AR: $2.1B)

- The Graph (GRT: $4.2B)

- Terra (LUNA: $56.6B)

- Chainlink (LINK: $16.3B)

- Ren (REN: $306.6M)

- Audius (AUDIO: $1.02B)

- Injective (INJ: $462.3M)

- Serum (SRM: $23B)

SOL

Market cap: $49.5 billion

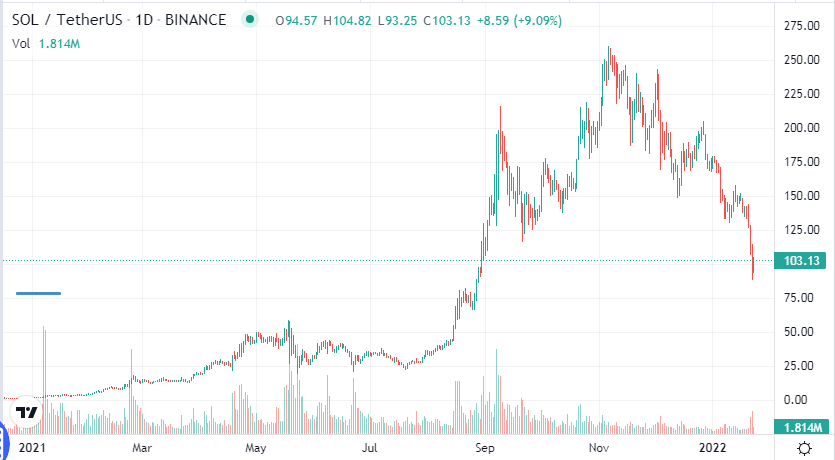

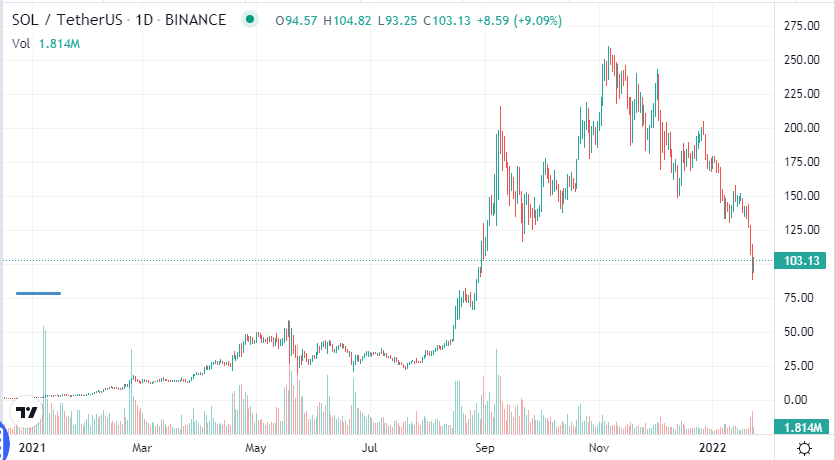

SOL price chart

SOL is the native coin of the blockchain technology Solana. The proof-of-history (PoH) and the proof-of-stake (PoS) features make this coin unique and potential. The project’s initial work started in 2017, and the officially launching period is March 2020. The launching company is the Solana Foundation, headquartered in Geneva, Switzerland. You can consider Anatoly Yakovenko as the most important man behind Solana. The announced amount is 489 million SOL tokens, and 260 million already entered the market after the announcement.

At the time of writing, the SOL price is floating near $103. It has a trading volume of $3,905,795,793.70 with a live market cap of $30,488,615,049.04 USD. Meanwhile, the total supply is 511,616,946 SOL, and the circulating supply is 314,526,062.80 SOL. Note that max supply is not available for this crypto coin.

Does SOL have the potential to grow?

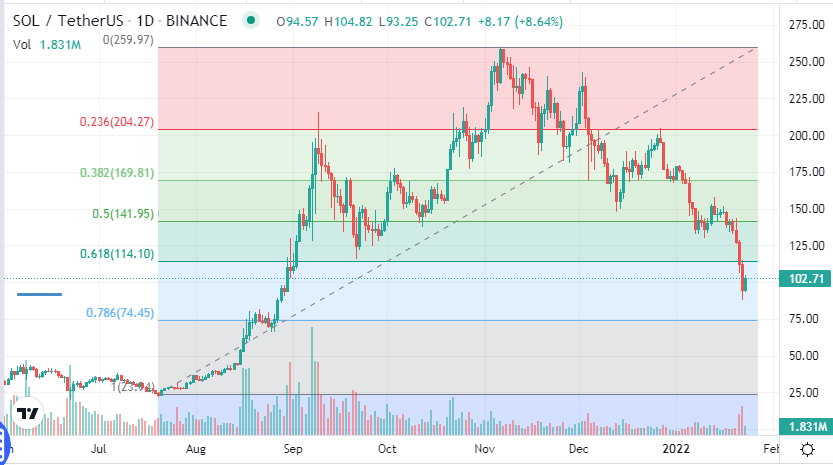

The 1-year chart shows that by the end of the first half of 2021, the SOL price was near $34, which peaked at nearly $258 by the first week of Nov 2021. It is now floating near $103 is below the 61.8% level of the Fibonacci retracement tool, which is a very potent reversal area.

Fibo level of SOL

Additionally, other fundamental info such as low cost, fast transaction offering, etc., can make this coin more demandable in 2022.

USDT

Market cap: $80.1B

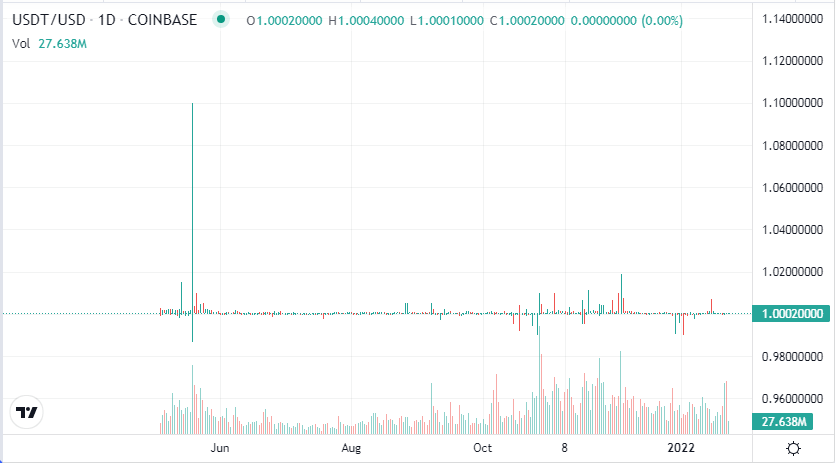

Tether price chart

The USDT is a stable crypto coin with a pegged relationship to the USD. The inception period of this coin was in 2014 by Brock Pierce, Craig Sellars, and Reeve Collins. The launching of this coin was as a real coin, a second-layer cryptocurrency token created on top of Bitcoin’s blockchain through the Omni platform. It was USTether then after rename; it is now USDT. You can purchase USDT using OKX, Coin tiger, Houbi Global, FTX, Binance, etc.

USDT is floating near $1 USD at the time of writing with a 24-hours trading volume of $86,542,356,336 USD and a live market cap of $78,357,068,606.79 USD. The circulating supply of USDT is 78.31B USDT, and the total supply is 80,076,563,060 USDT. Meanwhile, the max supply of this crypto asset is not available.

Does USDT have the potential to grow?

Whether USDT has the potential to grow or not, many platforms will pay you high-interest rates for storing USDT in their platforms. So it can be a good investment for the passive income.

LINK

Market cap: $16.3B

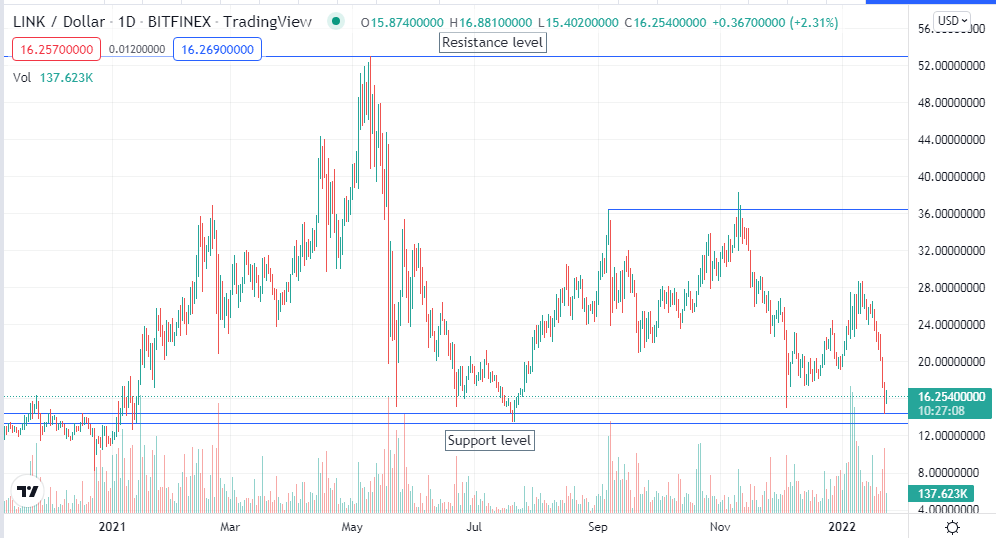

LINK price chart

The foundation year of Chain Link is 2017. The co-founder and CEO of Chainlink are Sergey Nazarov. The Chainlink network contains a large community of smart contract developers, data providers, researchers, node operators, security auditors, and more. You can consider Chainlink as one of the major players in the data processing field with many trusted partners. It allows users to be node operators and earn revenues by running critical data infrastructure that blockchain success requires.

The LINK price is floating near $16.1 by the time of writing with a 24-ours trading volume of USD 1,548,392,309 that has a live market cap of USD 7,540,708,546. The circulating supply of this crypto asset is 467,009,549.52 LINK. Meanwhile, the max and total supply amounts are the same 1,000,000,000 LINK.

Does LINK have the potential to grow?

LINK already made a peak near $53 before the first half of the previous year. Then the price declines near $13 by the end of July 2021 and ends the year near $19 by making a high near $36 twice. The LINK made a smooth high near $28 this month and floating near the long-term support level. The fundamental demand and technical condition declare this crypto asset can be a potential investment in 2022.

LUNA

Market cap: $56.6B

LUNA price chart

Terra is the next potential Solana Defi coin on our list. Terra combines wide adoptions of fiat currencies and price stability censorship-resistance of Bitcoin (BTC), then offers affordable and fast settlements. The initiation of the development of Terra was in 2018, and the launching period of this crypto asset is in April 2019. The native token of Terra is LUNA. The founders of Terra are Do Kwon and Daniel Shin. It is unique for its fiat-pegged feature.

The price of LUNA is floating near USD 68.90 by the time of writing, with a 24 H trading volume of USD 3,245,322,976. The live market cap of this crypto asset is USD 27,798,570,726, and the circulating supply is 403,518,146.19 LUNA. Meanwhile, the total supply amount is 821,482,713 LUNA, and the max supply is not available.

Does LUNA have the potential to grow?

The price of LUNA has been rising smoothly since its inception. The peg feature of this crypto asset with fiat currencies makes it a more stable and potential crypto asset. It made a high near $103 by Dec 2021. LUNA bounces back upside after declining near $54, which is a good dynamic support resistance level. Matching all these fundamental and technical info, LUNA can be a potential investment in 2022.

GRT

Market cap: $4.2B

GRT price chart

The Graph is an indexing protocol that queries data from IPFS, POA, and Ethereum. It powers both the broader Web3 ecosystem and Defi. The Graph team includes professionals from Decentraland, OpenZeppelin, MuleSoft, Orchid, Ethereum Foundation up to the acquisition and IPO by Redhat, Salesforce, Barclays, and Puppet. The native token of this protocol is GRT.

The price of GRT is floating near USD 0.42 by the time of writing, with a 24 H trading volume of USD 107,610,299. The live market cap is $1,984,035,938 USD. The circulating supply is 4.72B GRT, the max supply is 10,057,044,431 GRT, and the total supply is 10,000,000,000 GRT.

Does GRT have the potential to grow?

The price of GRT made a peak near $2.88. Since then, it’s been declining and now reaching near a critical support level of $0.25. It comes to the top five Solana Defi list to buy in 2022 for its potentiality and technical outlook.

Pros and cons

| 👍 Pros | 👎 Cons |

| It can process 50,000 transactions per second. | There are many implementations still waiting to launch. |

| It has a low transaction fee. | Many criticize Solana that it is not decentralized enough. |

| It has a high level of scalability as it provides POF features. | It is costlier to have a satisfactory hardware setup for Solana. |

Final thought

The Solana ecosystem is among the best on the blockchain list. Investors and crypto performers frequently adopt Solana for its low cost and faster transaction features. You can purchase these top Solana Defi from many exchanges.

Comments