Liquidity is a significant factor when you seek to make money from crypto-assets. Investing in Liquidity Provider tokens can be a noble way of earning as it allows individuals to earn passive income from cryptocurrencies. You can “farm for yield” and maximize profits through these tokens.

However, it requires determining the right asset by checking on several factors as there are many tokens in the same group, and each of them doesn’t generate the same income.

This article will list the best five Liquidity Provider (LP) projects worth spying on and buying in 2022.

How to choose the best Liquidity Provider tokens?

Decentralized exchange (DEX) platforms enable an alternative way for investors to earn money by staking or depositing their assets on liquidity pools. In this way, the platform shares transaction fees with the investors. Transaction fees automatically go on the liquidity pool, and when you deposit your asset in the liquidity pool, you will get LP tokens. This sector rapidly gained popularity and is worth over $100 billion now.

With the growth of the liquidity pool, your token holdings will appreciate proportionately. It allows you to withdraw your asset anytime you want. For example, Ethereum-USDC is a liquidity pool on the Uniswap platform that generates a 25% interest rate yearly.

Check on several factors before choosing good LP tokens, such as:

- Select assets with competitive spreads, low commissions, and swaps.

- Choose providers with stable data feed and reliability.

- Select LP tokens with a considerably higher volume.

- Choose Liquidity Providers that allow minimum requotes, slippage, and fast executions.

- Try to select LP tokens that will enable multi-asset liquidity, allowing Fix protocol access and historical data.

The best five Liquidity Provider (LP) Tokens projects

- Uniswap (UNI: 9.2 B)

- PancakeSwap (CAKE: 2.2B)

- Curve DAO token (CRV: 1.4B)

- SushiSwap (SUSHI: 566M)

- Balancer (BAL: 99.5M)

Uniswap (UNI)

Fully diluted market cap: $11,464,742,803

Live market cap: $7,248,604,454

UNI price chart

You can consider Uniswap, the king of the Decentralized Exchange (DEX) platforms, which facilitates DeFi tokens’ automated training. This attractive feature makes this platform so popular among crypto investors. The native token of this platform, UNI, is floating near $11.49 today with a 24-H trading volume of $184,626,138. This token is currently available on many major crypto exchanges, including OKX, Binance, BitCoke, Bitget, and FTX.

- Circulating supply: 632,251,815.70 UNI

- Total supply: 1,000,000,000 UNI

- Max supply: 1,000,000,000 UNI

- Volume / market cap: 0.02568

- Total Value Locked (TVL): $7,633,063,074

Does UNI have the potential to grow?

Uniswap is the first AMM platform, and UNI can be a potential investment. Many crypto analysts anticipate UNI price can hit near $28.35 by Dec 2022.

PancakeSwap (CAKE)

Fully diluted market cap: $2,151,973,862

Live market cap: $2,149,442,154

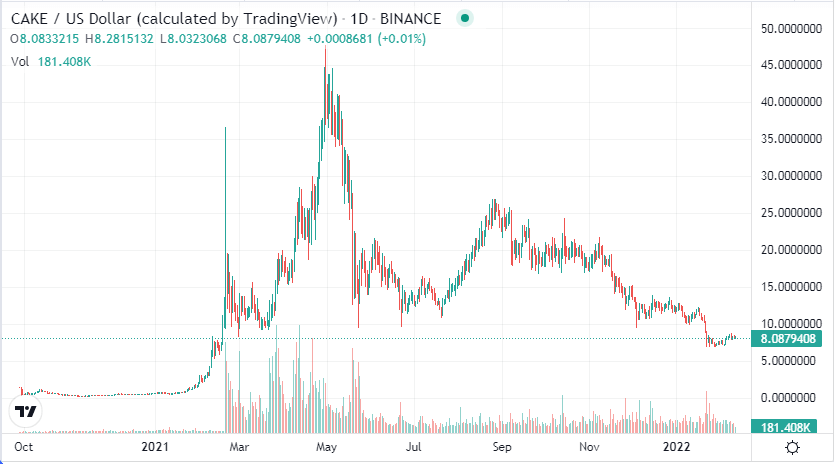

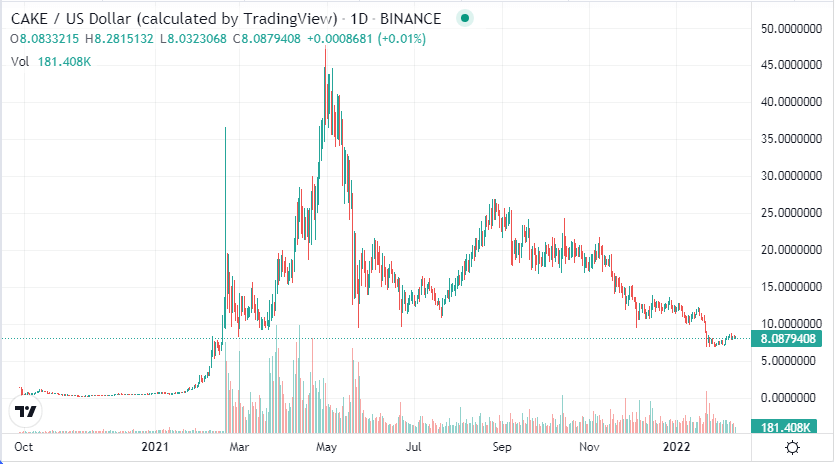

CAKE price chart

Pancakeswap is an AMM platform that allows individuals to exchange crypto and make money by providing liquidity. The native token of this platform, CAKE, is floating near $8.08 today with a 24-H trading volume of $174,001,744. This token is currently available on many major crypto exchange platforms, including Mandala Exchange, Bybit, Binance, Bitget, and CoinTiger.

- Circulating supply: 267,056,467.82 CAKE

- Total supply: 267,088,997 CAKE

- Max supply: not available

- Volume / market cap: 0.0813

- Total Value Locked (TVL): $4,755,016,879

Does CAKE have the potential to grow?

The price of the CAKE token has been declining since the beginning of 2022 and finds short-term support near $6.80. Many crypto experts expect the price to hit $35 per coin by Dec 2022.

Curve DAO token (CRV)

Fully diluted market cap: $10,402,529,081

Live market cap: $1,396,321,442

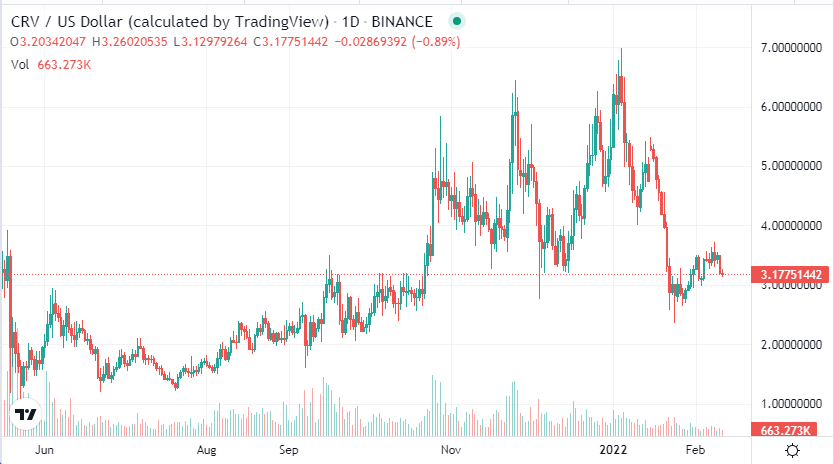

CRV price chart

The Curve is a decentralized exchange (DEX) platform for stablecoins that manages liquidity through AMM. The launching period of this platform is Jan 2020. Michael Egorov is the CEO and founder of Curve. The native token of this platform CRV is floating near $3.17 today with a 24-H trading volume of $279,177,694. This token is currently available on many major crypto exchange platforms, including CoinFLEX, Binance, FTX, OKX, and Bitget.

- Circulating supply: 443,459,606.91 CRV

- Total supply: 1,688,001,663 CRV

- Max supply: 3,303,030,299 CRV

- Volume / market cap: 0.2008

- Total Value Locked (TVL): $19,777,082,916

Does CRV have the potential to grow?

CRV price has been declining since the beginning of 2022, finds support near $2.36, and bounces. According to many crypto analysts, this token can hit $10 by Dec 2022.

SushiSwap (SUSHI)

Fully diluted market cap: $1,113,260,736

Live market cap: $566,614,562

SUSHI price chart

Sushiswap is a modified fork of the popular Uniswap protocol, an example of AMM. The launching period of this platform is Sep 2020. The native token of this platform, SUSHI, is floating near $4.43 today with a 24-H trading volume of $163,037,303. This token is currently available on many major crypto exchange platforms, including Binance, FTX, OKX, CoinFLEX, and Bitget.

- Circulating supply: 127,244,443.00 SUSHI

- Total supply: 240,147,420 SUSHI

- Max supply: 250,000,000 SUSHI

- Volume / market cap: 0.2869

- Total Value Locked (TVL): $4,778,350,939

Does SUSHI have the potential to grow?

Many crypto analysts anticipate an average SUSHI token price can hit $6.54 by Dec 2022.

Balancer (BAL)

Fully diluted market cap: $1,433,943,398

Live market cap: $99,570,606

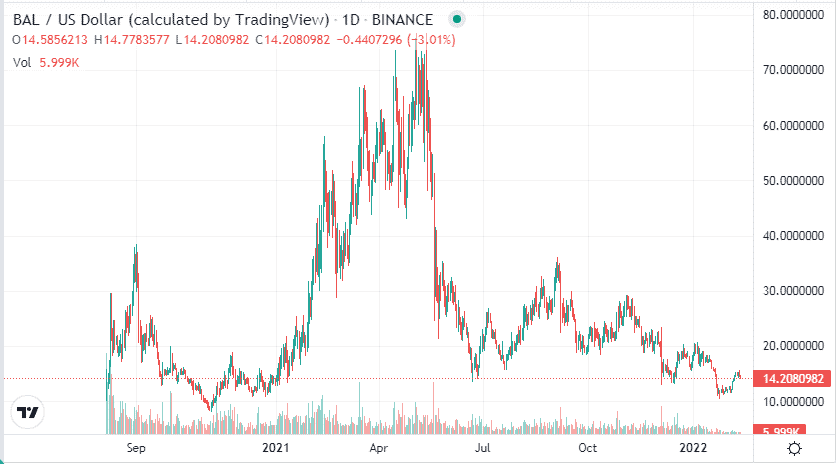

BAL price chart

The Balancer is a price sensor, Liquidity Provider, and non-custodial portfolio manager. The launching period of this platform is Mar 2020. The native token of this platform BAL is floating near $14.20 today with a 24-H trading volume of $18,360,227. This token is currently available on many major crypto exchange platforms, including Mandala Exchange, Binance, Bitget, OKX, and FTX.

- Circulating supply: 6,943,831.00 BAL

- Total supply: 35,725,000 BAL

- Max supply: 100,000,000 BAL

- Volume / market cap: 0.1835

- Total Value Locked (TVL): $3,245,130,827

Does BAL have the potential to grow?

The Balancer is a potential platform to grow. Many crypto experts expect to trade BAL tokens near $18.21 by Dec 2022.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

These are the most potential Liquidity Provider tokens worth keeping on the watchlist in 2022. We suggest checking on several factors as we list above before selecting LP tokens.

Comments