Blockchain is a revolutionary innovation that is already challenging the traditional financial system. The invention of blockchain introduces us to new financial technology, products, and services. The booming crypto-economy out there enables many attractive investment opportunities.

DeFi (decentralized finance) is an emerging financial technology that contains many potential attractive projects to investors worldwide and allows individuals to make money.

However, DeFi is a new concept in the financial world. So without having a certain level of understanding and knowing the best projects/products, it won’t be wise to start.

This article will introduce you to the best five Defi projects to follow in 2022.

What is decentralized finance?

Cryptocurrencies are becoming a popular payment method that enables borderless payment with low transaction costs. Decentralized finance is a concept of financial service built on a public blockchain that involves transparent financial services without involving any intermediary. It enables peer-to-peer transactions within a shorter period. DeFi introduces many attractive projects, products, and platforms that have shown rapid growth recently and are worth keeping on the watchlist. The primary goals of DeFi are:

- Eliminate the third party as it doesn’t require any intermediary like a lawman to complete any agreement or transaction.

- Although many opportunities are still available for financial institutions, banks, or hedge funds, Defi aims to reduce the gap between individuals and financial oligarchy.

- Transactions occur in blockchain ledgers, so DeFi doesn’t need any paperwork or clearance. So it will ditch the paperwork.

- DeFi aims to deliver faster transactions worldwide at a lower cost.

Top ten DeFi projects to watch in 2022

Decentralized finance (Defi) already contains many projects, and many more are coming. The top ten projects of Defi worth following are:

- Avalanche (AVAX: $21.6B)

- Terra (LUNA: $21B)

- Uniswap (UNI: $7.1B)

- Chainlink (LINK: $8B)

- Aave (AAVE: $2.3B)

- Wrapped Bitcoin (WBTC: $11.2B)

- PancakeSwap (CAKE: $2.1B)

- Dai (DAI: $10.2B)

- Tezos (XTZ: $3.6B)

- Fantom (FTM: $5.3B)

Avalanche (AVAX)

Fully diluted market cap: $35,082,015,420

Live market cap: $21,672,231,238

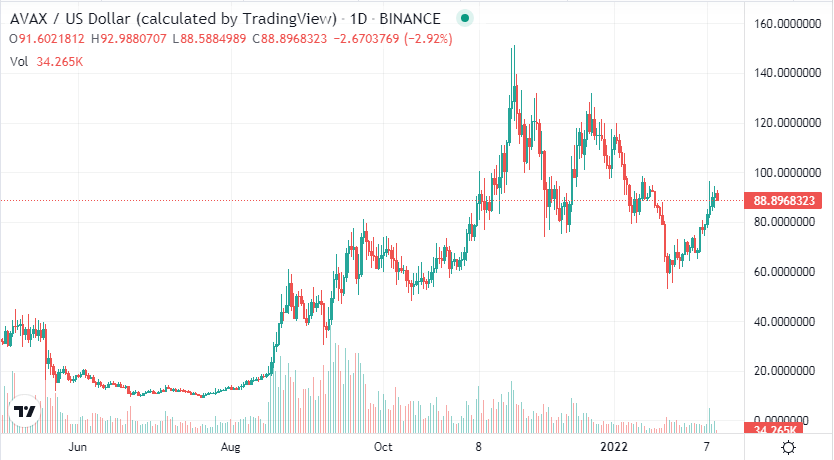

AVAX price chart

You can consider Avalance as the fastest smart contracts platform in the blockchain industry that is eco-friendly, low cost, and blazingly fast. The launching date of this platform on the mainnet is Sep 21, 2020. Now, this platform contains 400+ individual projects. This token is available on many major crypto exchange platforms, including Bitget, FTX, Binance, Bybit, and OKX.

Circulating supply: 245,278,266.06 AVAX

Total supply: 395,891,290 AVAX

Max supply: not available

Volume / market cap: 0.07832

Does AVAX have the potential to grow?

AVAX token becomes so popular within a short time. It made a peak near $151 in the second half of Nov 2021. The price has been declining since the beginning of 2022; it finds adequate support near $53 and bounces back upside. Many crypto experts predict the price of AVAX might reach $189 after one year.

Terra (LUNA)

Fully diluted market cap: $42,912,314,235

Live market cap: $21,151,686,468

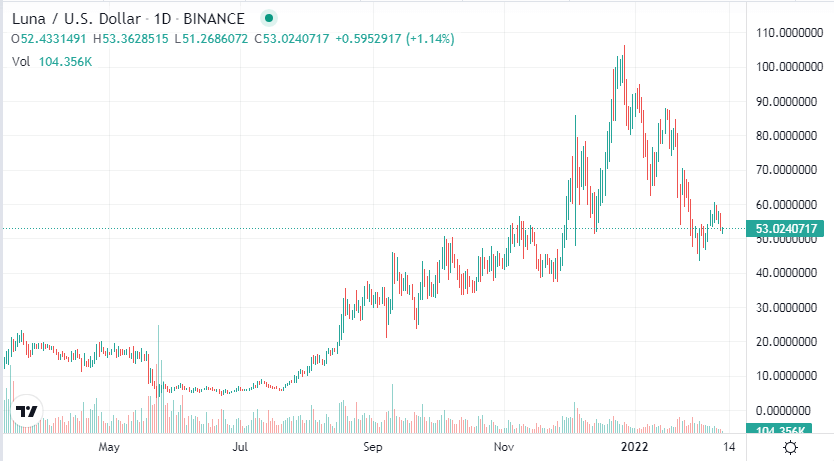

LUNA price chart

This platform tends to power price-stable global payments systems using fiat-pegged stable coins. The development of this platform began in Jan 2018 and the official launching period on mainnet is Apr 2019. LUNA is currently available on many major exchanges, including Bitget, Binance, OKX, and Bybit.

Circulating supply: 401,341,212.96 LUNA

Total supply: 818,452,636 LUNA

Max supply: not available

Volume / market cap: 0.1001

Does LUNA have the potential to grow?

LUNA shows a sharp rise in 2021 and made a high near $106 in the last week of Dec. It finds support near $43 after a sharp decline. Many crypto experts expect to trade this token near $200 after one year.

Uniswap (UNI)

Fully diluted market cap: $11,303,793,790

Live market cap: $7,146,844,148

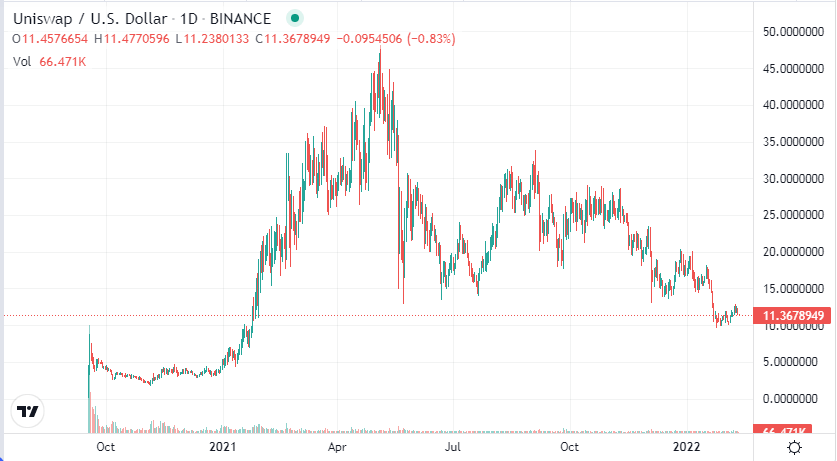

UNI price chart

Uniswap facilitates automated trading of Defi tokens. The launching period of Uniswap is Nov 2018 as an example of AMM (automated market maker) and become considerably popular. Hayden Adams is the creator of this platform. This token is currently available on many major crypto exchanges, including Bitget, Binance, OKX, Bybit, and FTX.

Circulating supply: 632,251,815.70 UNI

Total supply: 1,000,000,000 UNI

Max supply: 1,000,000,000 UNI

Volume / market cap: 0.04046

Total Value Locked (TVL): $7,633,063,074

Does UNI have the potential to grow?

The popularity of this platform grows rapidly, and the native token made a high near $48 in May 2021. The price finds support near $9.5 after declining since the beginning of 2022. Many crypto experts anticipate the price of UNI can reach near $28 by Dec 2022.

Chainlink (LINK)

Fully diluted market cap: $17,329,721,488

Live market cap: $8,093,145,425

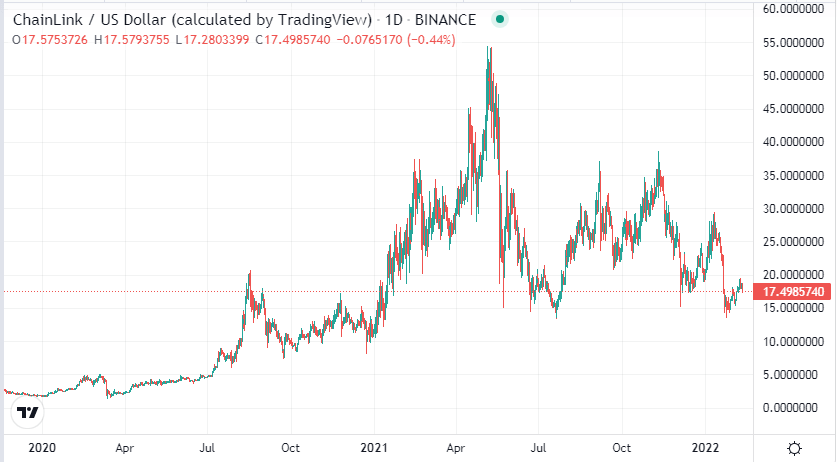

LINK price chart

Chainlink is a blockchain abstraction layer. This platform enables connecting smart contracts globally. The foundation year of Chainlink is 2017. The native token of this platform LINK price is floating near $17.49 today with a 24-H trading volume of $940,131,200.

Circulating supply: 467,009,549.52 LINK

Total supply: 1,000,000,000 LINK

Max supply: 1,000,000,000 LINK

Volume / market cap: 0.116

Does LINK have the potential to grow?

LINK price made a peak near $54 in May 2021. The price bounces back from the previous support level, near $13.5. Many crypto experts anticipate the price of LINK can reach near $29 by Dec 2022.

Aave (AAVE)

Fully diluted market cap: $2,838,508,577

Live market cap: $2,397,376,352

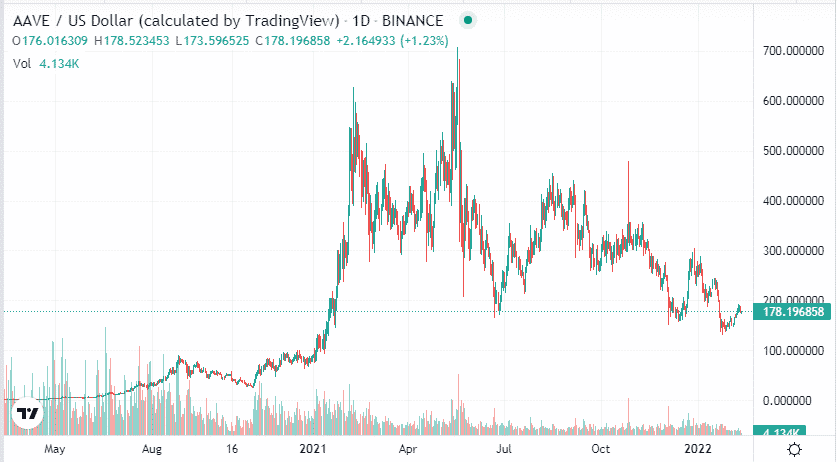

AAVE price chart

Aave is a well-established decentralized blockchain protocol that allows individuals to borrow and lend crypto. The launching period of this platform is Nov 2017. The native token of this platform AAVE price is floating near $178.19 today with a 24-H trading volume of $210,681,608.

Circulating supply: 13,513,442.21 AAVE

Total supply: 16,000,000 AAVE

Max supply: 16,000,000 AAVE

Volume / market cap: 0.0879

Total Value Locked (TVL): $13,753,621,228

Does AAVE have the potential to grow?

Many attractive features make this platform attractive to investors. The native token price made a peak near $707 in May 2021, and many crypto experts predict the price of this token can reach near $305 or above by Dec 2022.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Finally, colossal hype is going around DeFi and crypto-assets. We suggest checking on risk factors besides reward expectations when you decide to invest in any of these assets.

Comments