MyForexPath comes with a drawdown control feature that protects the account from loss in case of an unusual market event. The developer claims that robots have a 65-70% win rate and can generate stable profits. The expert advisor is not broker-sensitive and can work on all types of accounts. The vendor provides a 30-days refund policy and free updates with the purchase. Our review will help you decide if this system is worthy of your investment by analyzing its characteristics.

The developers offer other algorithms as well such as Vigorous, The Comeback Kid, and Ranger EA. They are not transparent about their whereabouts or market experience.

MyForexPath strategies and tests

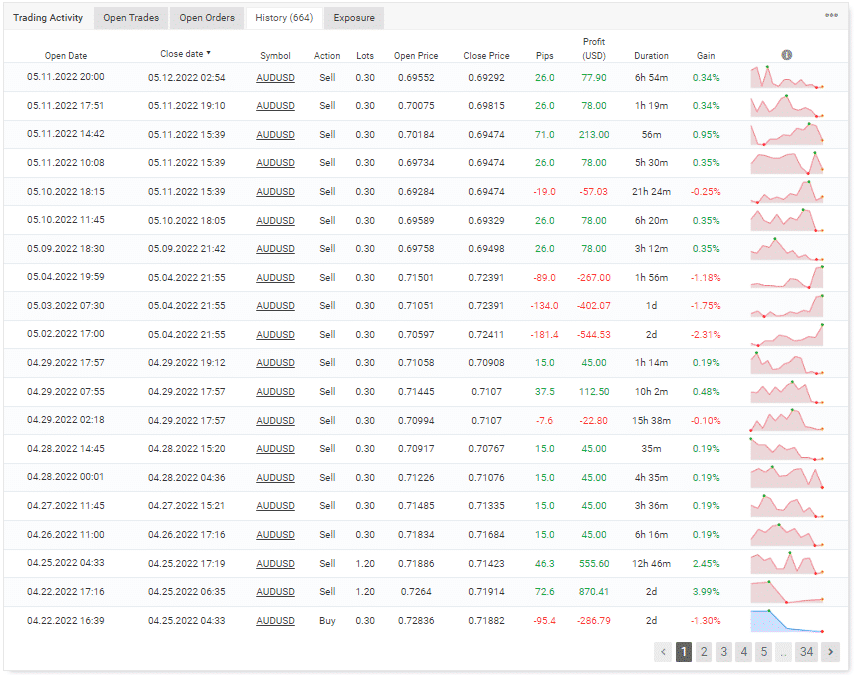

The expert advisor uses unique indicators such as Parabolic and MA to place executions by identifying trends and open orders in its direction. The history on Myfxbook shows us that it has an average trade length of 4 days, qualifying it as a swing trader. The robot uses grid and martingale strategies to recover from losing trades on AUDUSD.

Trading history from Myfxbook

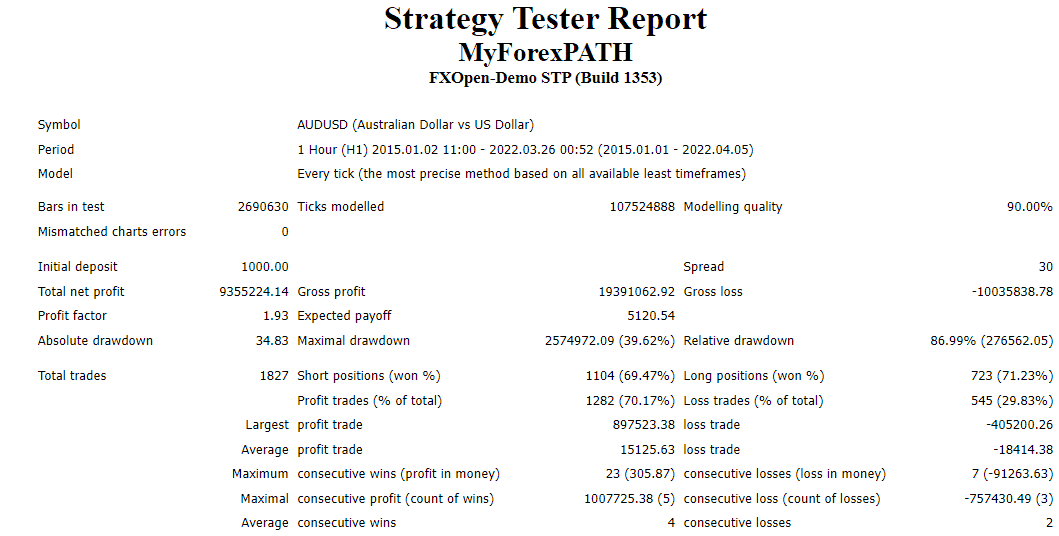

The developers of MyForexPath provided the backtesting records of eight years for the AUDUSD symbol on the H1 timeframe.

The developer deposited the initial amount of $1000, where the algorithm gained a net profit of $9355224.14. The backtesting records were tested in every tick model with 99.90% quality consisting of 107524888 ticks. The system placed 1827 trades, out of which 1282 were winners.

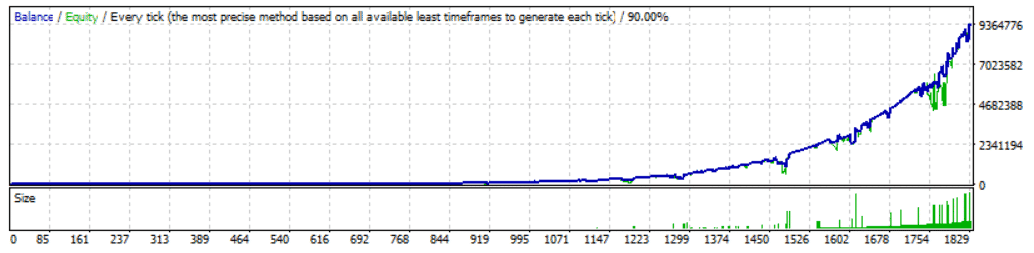

Backtesting records of EA

The relative drawdown value was shown as 86.99%, and the profit factor was 1.93. The high value of drawdown exhibits the high-risk strategical game plan, and the profit factor shows the poor profitability.

Backtesting records of EA

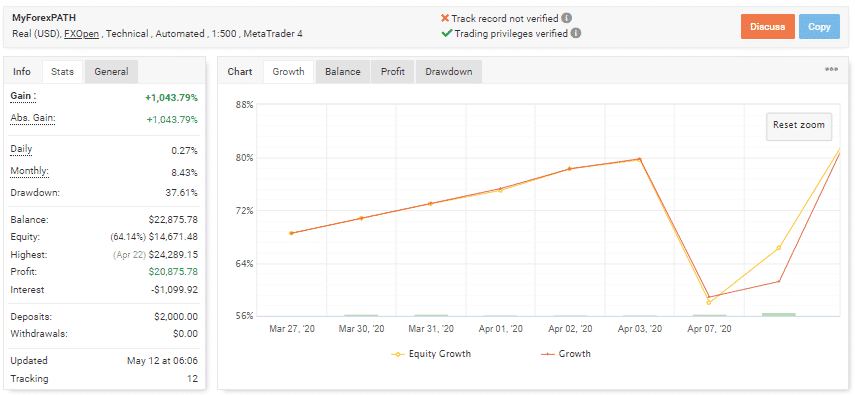

Live trading account review

Live trading stats and records from Myfxbook are available on their official website. The algorithm was added on Apr 21, 2022, when the developer funded their account with $2000. The algorithm data exhibits a total gain of +1043.79% with a drawdown value of 37.61%. It took part in 663 trades with a winning rate of 65%. The balance of the system stands at $22,875.78, with the standard deviation at $354.43.

The Sharpe ratio was 0.13, with a profit factor of 1.64, and the net profit of the system can be seen as $20,875.78.

Live trading records from Myfxbook

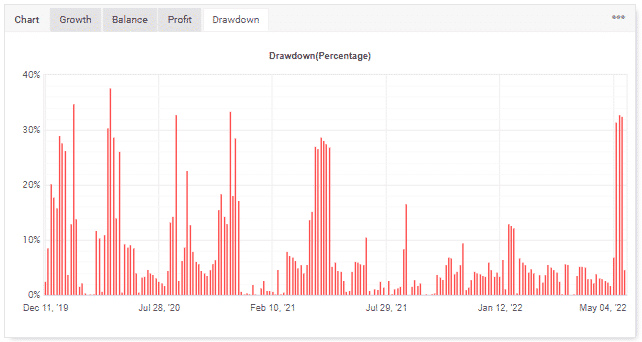

The vendor claims to use the drawdown control system in its EA, but the fluctuating drawdown chart on Myfxbook and backtesting records contradict his statements.

Drawdown value chart from Myfxbook

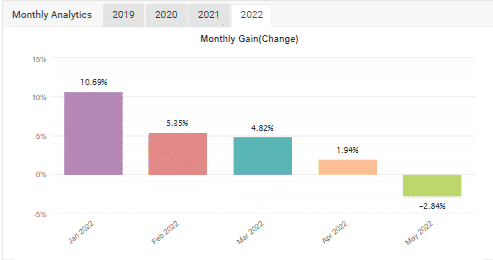

The monthly analytics doesn’t convince any extraordinary trading approach of the robot. Instead, the account is deficient this month.

Monthly analytics report from Myfxbook

Pricing

MyForexPath is listed for purchase at $285. The plan comes with one copy of the robot, both versions for MT4 and MT5, a user guide manual, free updates/upgrades, and 24/7 technical support. Visa, MasterCard, JCB, Discover, UnionPay, and PayPal can carry out the transactions using the 2Chekout payment gateway. The expert advisor does come with a 30-days moneyback guarantee, but there isn’t an option for more flexible pricing plans and renting options.

Is MyForexPath a good system to rely on?

Following are the red flags and cons we found while reviewing the expert advisor:

- High drawdown

The fluctuation drawdown chart in live records and a dangerously high relative drawdown in backtesting stats indicate the risky strategical approach of the EA.

- Vendor transparency

The developer keeps the traders blind in terms of sharing details of their whereabouts and personal information.

- Verified live trading data

The track records available on Myfxbook are not verified, which contradicts the vendor’s statement.

- User testimonies

There are no investors’ feedbacks present on any third-party websites such as Forexpeacearmy, Trustpilot, Quora, etc., which can give us a better insight into the profitability of the robot.

Comments