Leverage is the feature that makes the financial market more accessible to individual traders. It allows traders to borrow money from brokers to participate in trades worth more than the invested amount. It is not mandatory to use leverage on trading. In most cases, brokers allow individuals to change leverage anytime.

However, misusing leverage is one of the principal reasons that novice traders lose first deposits. So it’s undeniable that any trader should know the use of leverage and special procedures to benefit from leverage. This article contains a complete guideline to choosing suitable leverage; besides, you will have a clear concept about it after finishing this.

What is the leverage?

It is a term that brokers offer to their clients. Traders can borrow money for trading by using this term. Participants can make trades worth more prominent by implementing leverage. It allows achieving a lot of profit from small price fluctuations.

Suppose you are using a leverage of 75:1. It means you can participate in trade on a standard lot account worth $75 by using your capital of $1.

So what’s the odd part of it?

It magnifies your profits or trading capabilities and increases your losses. You can count leverage as a double-sided sword as it can lead to both favorable and unfavorable consequences.

Leverage feature

You may participate in a trade worth $50 if it goes positive five pips using leverage, and the price may start to decline. If it drops five pips against your direction, you will lose $50. The broker will lend you money for making positions but won’t hesitate to empty your account when the price movement goes against your trading direction.

Forex brokers offer 1:1-1000:1 leverage for their clients. This term “leverage” is available for many other financial assets besides currency pairs, such as CFD products, commodities, etc.

How to choose leverage?

Brokers allow traders to select suitable leverage to execute trades. Traders can change the leverage anytime they want to at the desirable figure according to the broker offerings. However, you need to check on some factors before choosing leverages to have a suitable trading environment and experience.

Now we list the checking elements or steps to choosing appropriate leverage.

Step 1. Identify the trading object

When you seek to select suitable leverage, you have first to decide what assets you will trade. The leverage offerings vary for several assets. For example, brokers may allow 15:1 for future market assets, and a 2:1 offering is standard for equity trading.

Meanwhile, you can enjoy up to 1000:1 leverage in FX assets. Currency pairs involve comparatively higher leverage than other financial assets. So selecting trading assets are before choosing suitable leverage as all trading objects don’t include the same leverage offerings.

Step 2. Try to minimize the leverage

Now you have a clear concept about leverage, so it won’t be wise to use higher leverage on trading as it causes you to lose money. For example, you may have $100 in your MT4 trading account that has high leverage. You may place a sell order in EUR/USD pairs worth $400 using leverage.

Unfortunately, the price may start to increase or go against your; the broker will close your order when your floating loss is at -$100. Most experts recommend using leverage between 1:1-10:1 for forex trading. You will be safer by using low leverage than traders with a high one.

Lot sizes

The above image shows how lot sizes are present in the MT4 platform. You can open trades with any lot size based on your requirement.

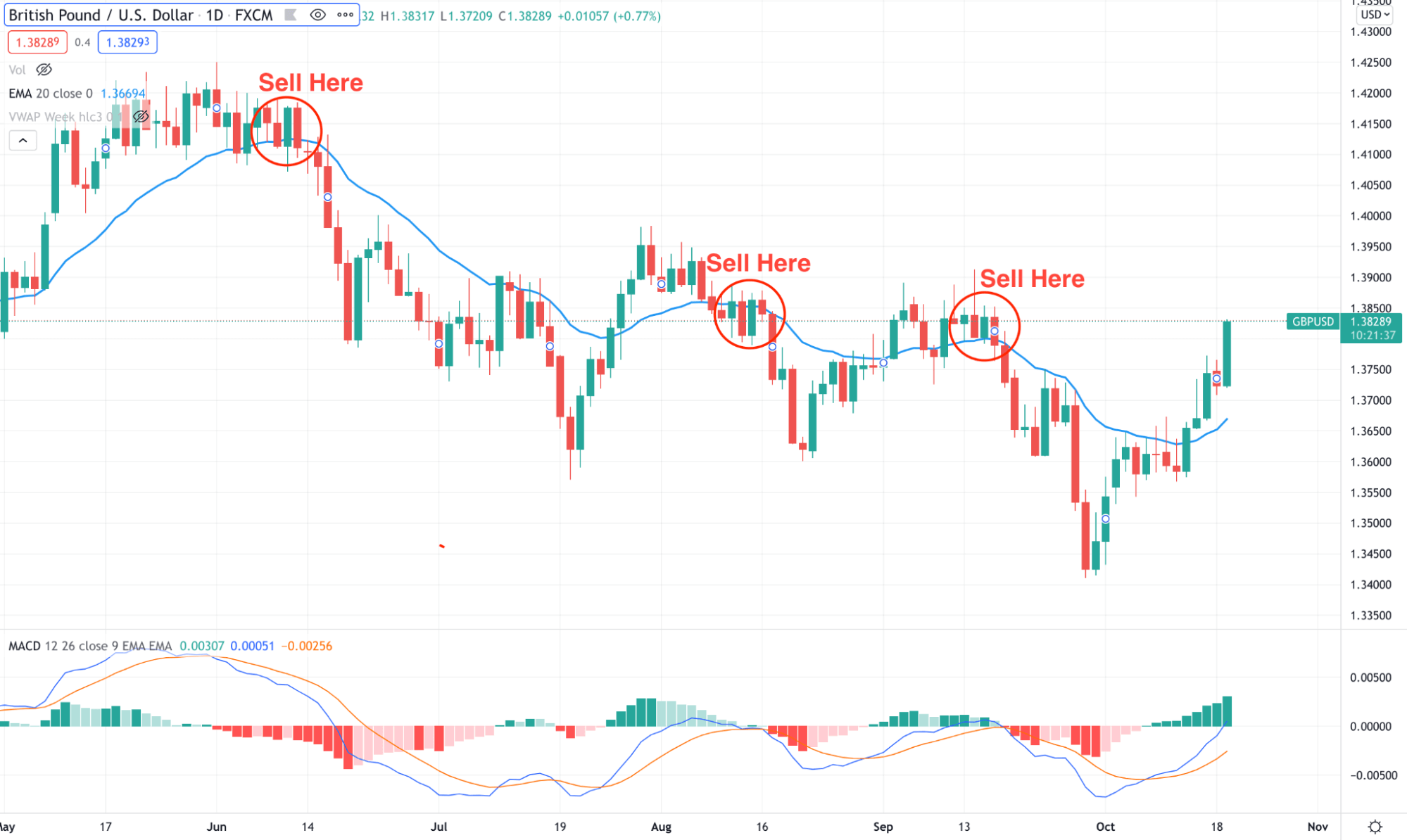

Step 3. Move to a higher time frame trading

Another top suggestion is to choose higher time frames for trading. Choosing higher time frames for trading will help you control tendencies of making huge profits from tiny price movements.

Besides, using higher time frames will enable you to have a birds-eye view of the trading asset; you can easily avoid misusing leverage and fake swing highs/ lows that appear at lower time frame charts.

New traders with high leverage trades with scalping strategies can’t survive for a long time in the forex market. Successful traders always check higher time frame charts while making trade decisions as they know it’s the best way to obtain the best results.

Higher time frame trading example

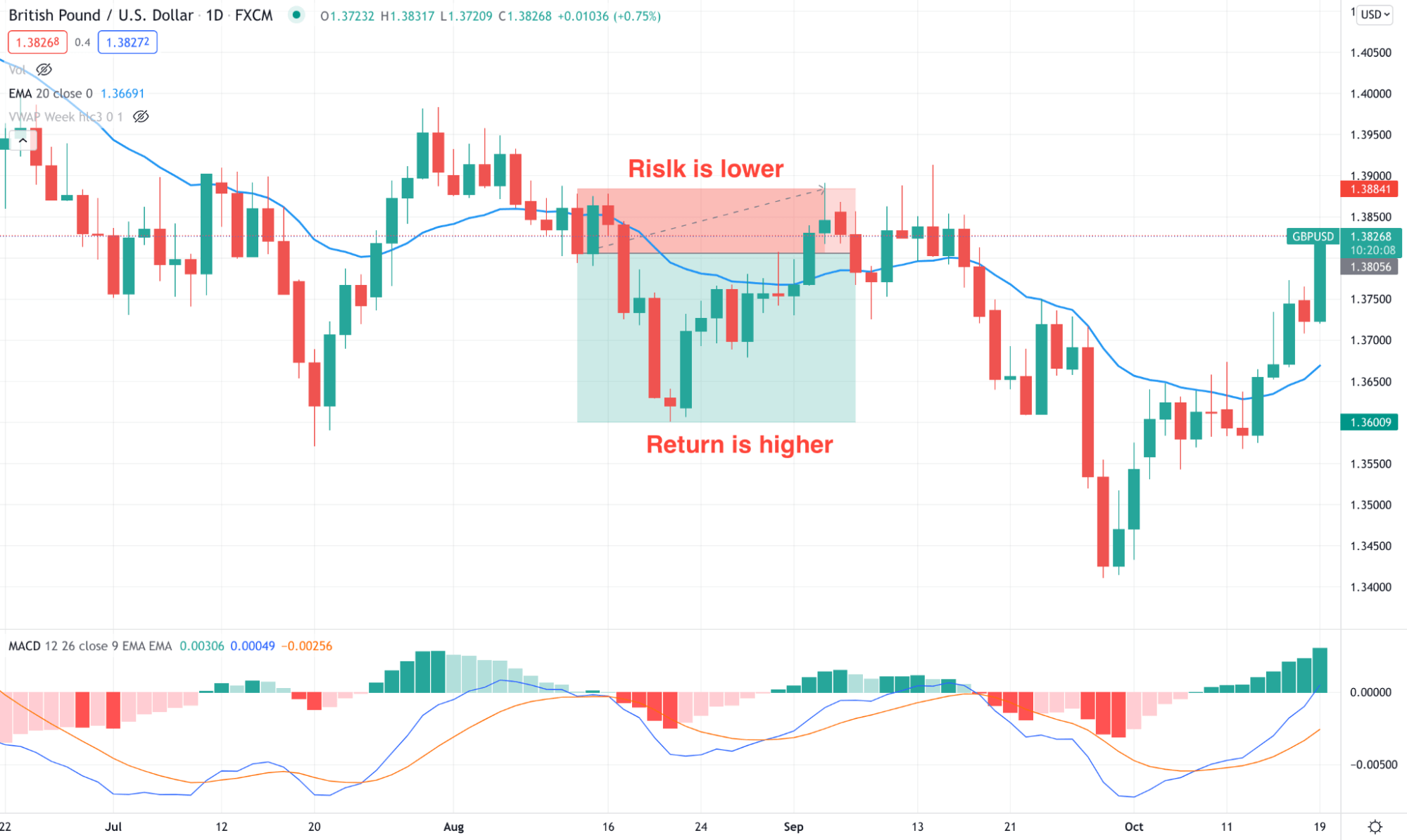

Step 4. Use trade management system

Leverage may help you to make more profit by performing larger trades. It would be wise if you choose proper trade management plans while choosing to trade with leverage. Use good stop loss while making trade decisions. Professional traders use not more than 2% capital in risk in trading orders.

For example, you may have a $500 trading account; don’t risk more than $10 for any trading order. Trade management is essential for a successful trading career besides choosing proper trading methods.

Risk and reward example

Step 5. Increase the leverage gradually

In the last part, the flexibility of your leverage. You can raise the leverage with experience, and you are getting a lot more winning trades than losing ones. You may start trading with 5:1-10:1 in your trading account and get good results on your trading. So as you improve day by day, you can gradually increase your leverage to 50:1-100:1 after having satisfactory trading results.

Final thoughts

These are the checking factors of choosing leverage. If you have an account with $10 trading capital, there is no boundary for using leverage; you may use 100:1 to get the best outcome. In this way, your losing amount will be tiny.

Meanwhile, when you are trading forex like any other traditional business, you have to follow the above guidelines to reduce risks on trading and obtain better trading results. Most losers of the forex market lose capital by ignoring this term, so choose leverage wisely.

Comments