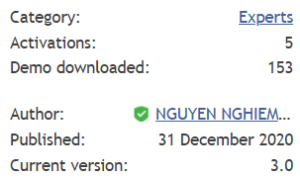

Gold Miner is an advisor that was released over four months ago, on December 31, 2020. Its developer is Nguyen Nghiem. The current version is 3.0 without info when it was released. The system was activated five times and downloaded for demo usage – 153 times.

Gold Miner Strategies and Tests

It’s awkward, but the presentation is six lines long. It’s hard to tell something for sure about the system:

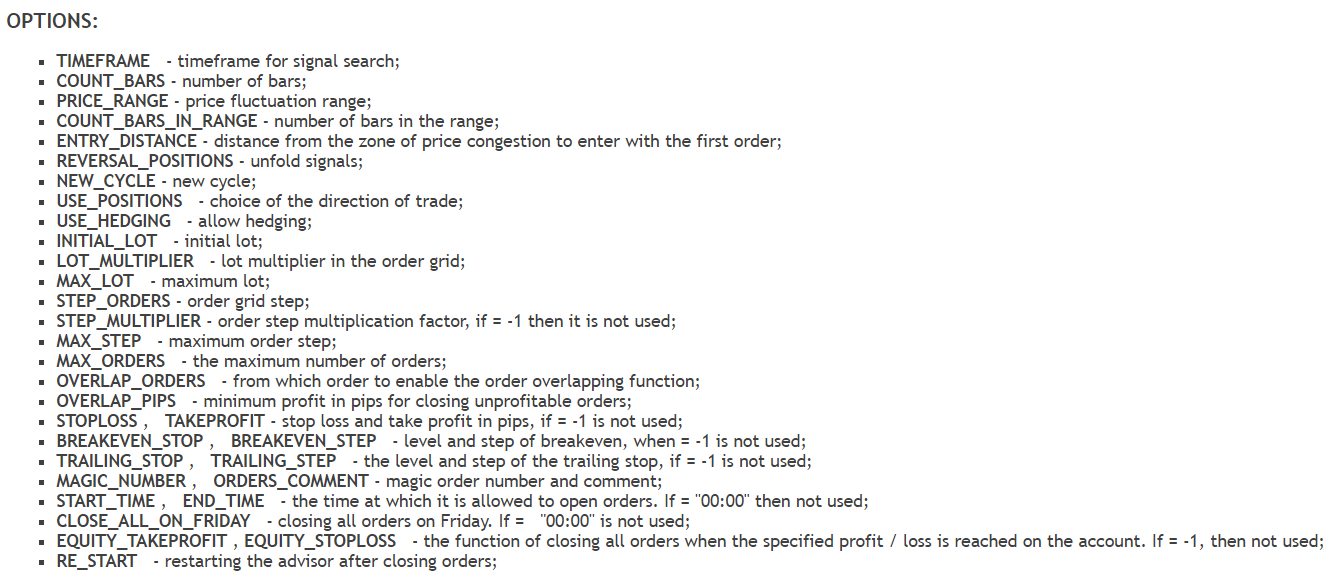

- The advisor can trade on the charts automatically.

- The strategy is based on the search for areas of concentration of prices of large buyers and sellers.

- The robot is a Grid-based expert advisor.

- It can recover the account.

- The system doesn’t keep orders on the market for a long time.

- The robot can use Martingale to recover after losses.

- Gold Miner trades the following currency pairs: XAU/USD, GBP/USD, USD/CAD, EUR/USD, USD/JPY, USD/CHF, AUD/USD, and NZD/USD.

- There’s a Friday exit feature to close deals before Monday’s wild moves.

- The system works with Take Profit and Stop Loss levels.

- There’s a mention about the BUY/SELL signal indicator. The developer suggests we use it for trading manually.

- The robot is released in MT4 and MT5 versions.

- The robot can work with a Hedge feature.

- The settings allow us to use Martingale in a Grid of orders.

- We can decide how many orders in a Grid can be opened.

- The Trailing Stop Loss feature lets you make more from the decisive market moves.

- The MT4 or MT5 terminal can be automatically restarted.

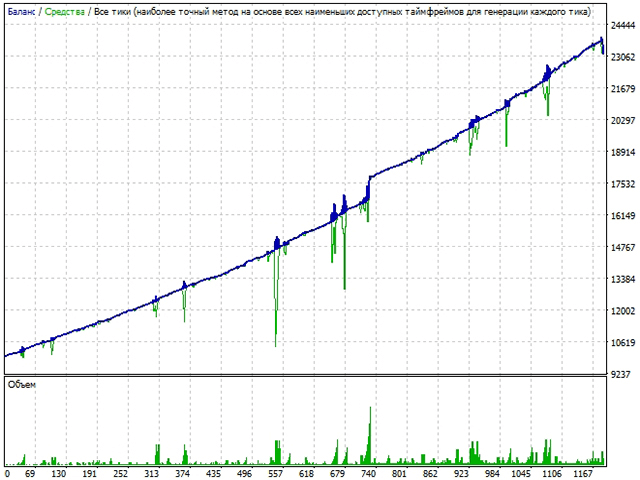

Instead of a real backtest report with details, we have this screenshot of something. From the Value chart, it’s noticeable that the robot used aggressive Martingale to recover. At the end of the balance chart, we can see how the profitability went down.

Gold Miner Live Trading Account Review

We have many unnamed signal accounts. It’s a scam, not to name them. How should we decide which account is under Gold Miner management?

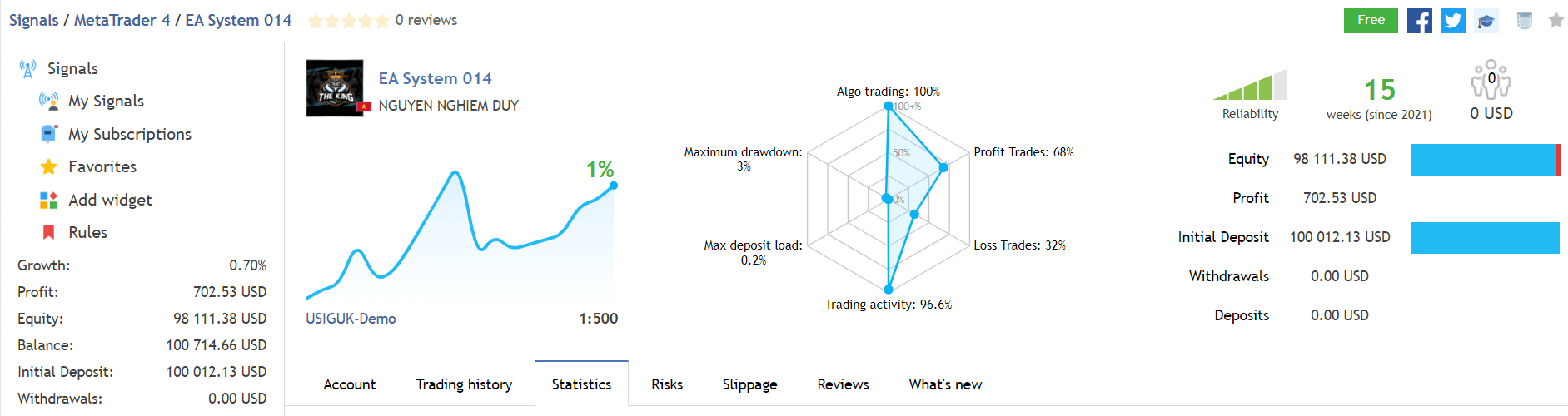

This system trades Gold. So, most likely, the Gold Miner robot works on it. It’s a demo USD account on USIGUK. The leverage is 1:500. The maximum drawdown was 3%. The maximum deposit load is 0.2%. The accuracy rate is 68%. The account is live for 15 weeks. The absolute growth is 0.70%.

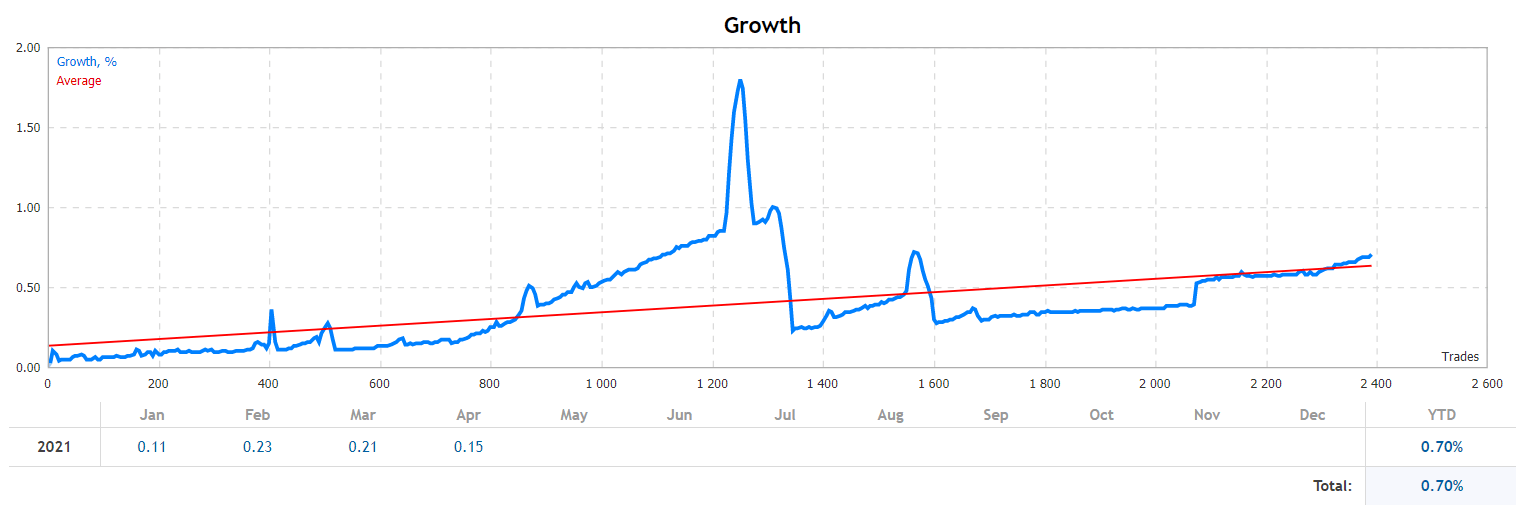

The system makes little profits, but it’s noticeable how, after the series of losses the profitability has fallen.

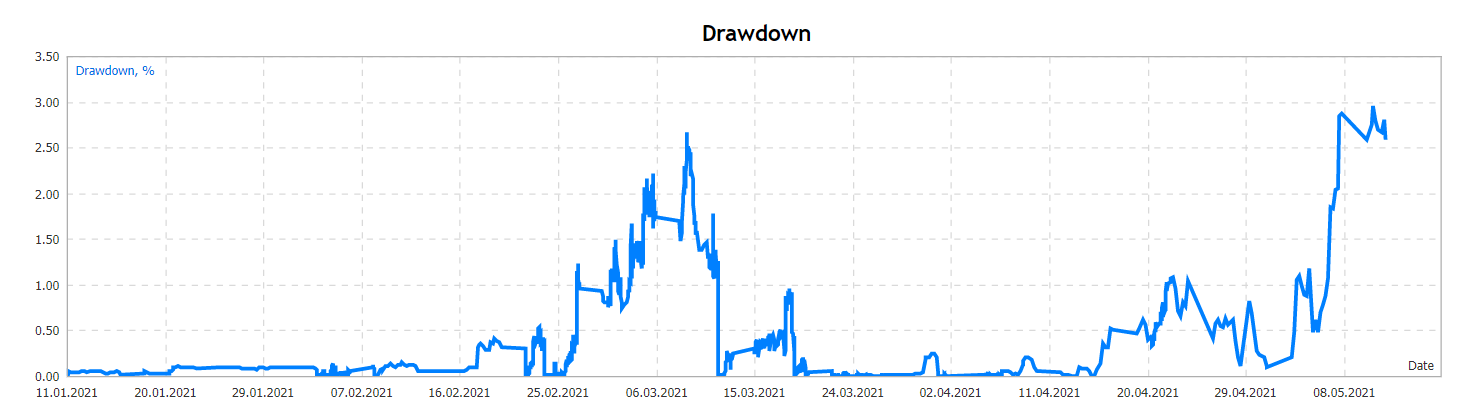

The robot trades with little, but consistent, drawdowns.

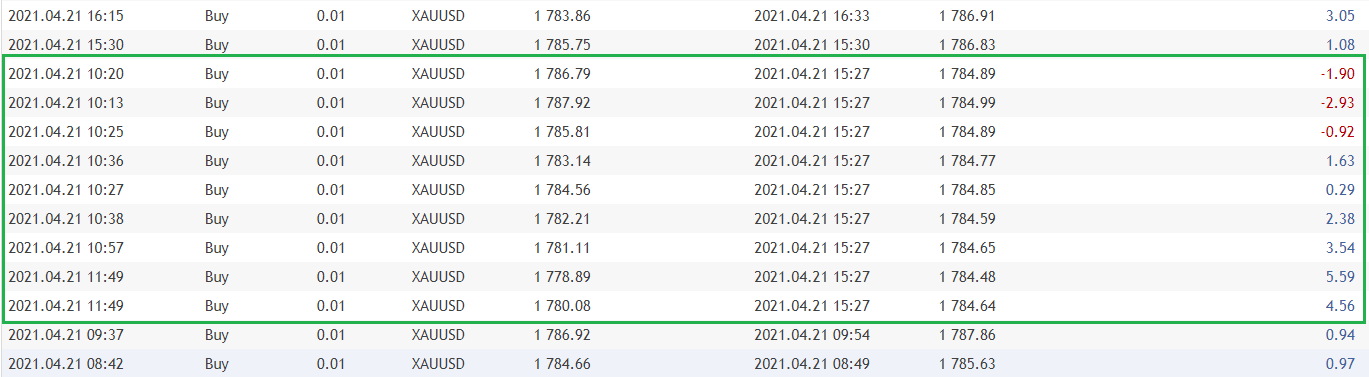

The EA uses Grids of various sizes from several to up to ten deals.

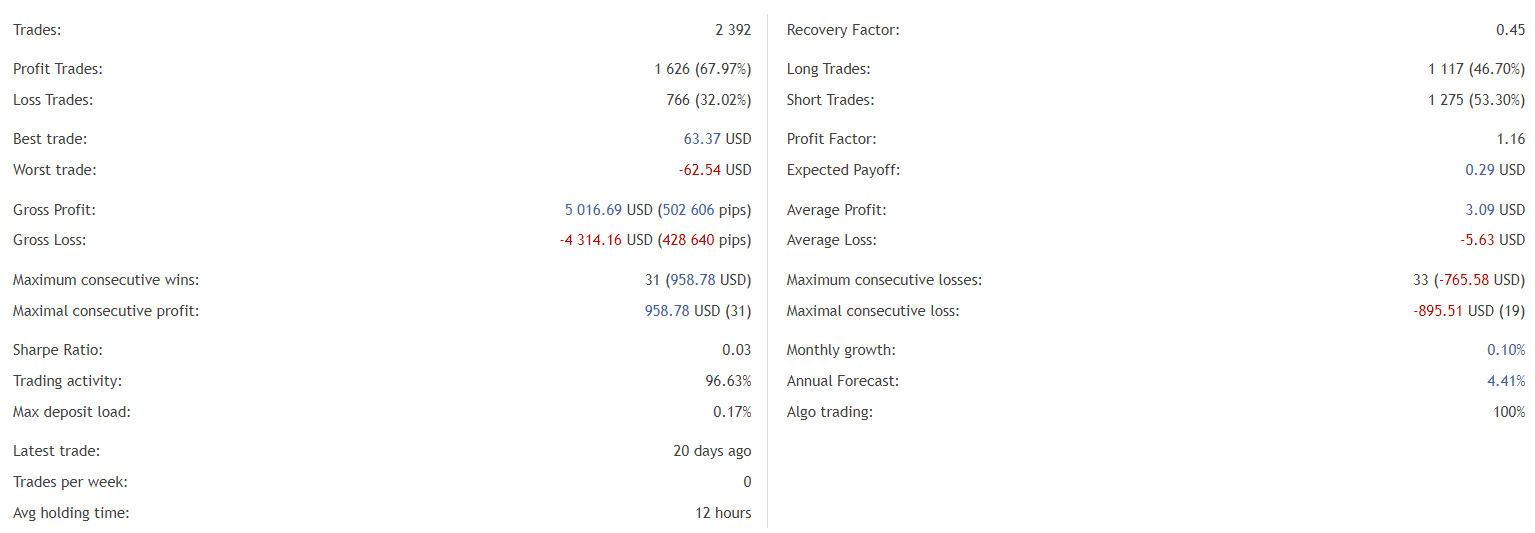

Gold Miner has traded 2392 deals. The best trade is $63.37 when the worst trade is -$62.54. The Gross Profit is $5,016.69 when the Gross Loss is -$4,314.16. The maximum consecutive win is – 31 deals. Trading activity is 96.63%. An average trade length is twelve hours. The Recovery Factor is 0.45. The Profit Factor is only 1.16. An average monthly gain is 0.10% when an expected annual profit is 4.41%.

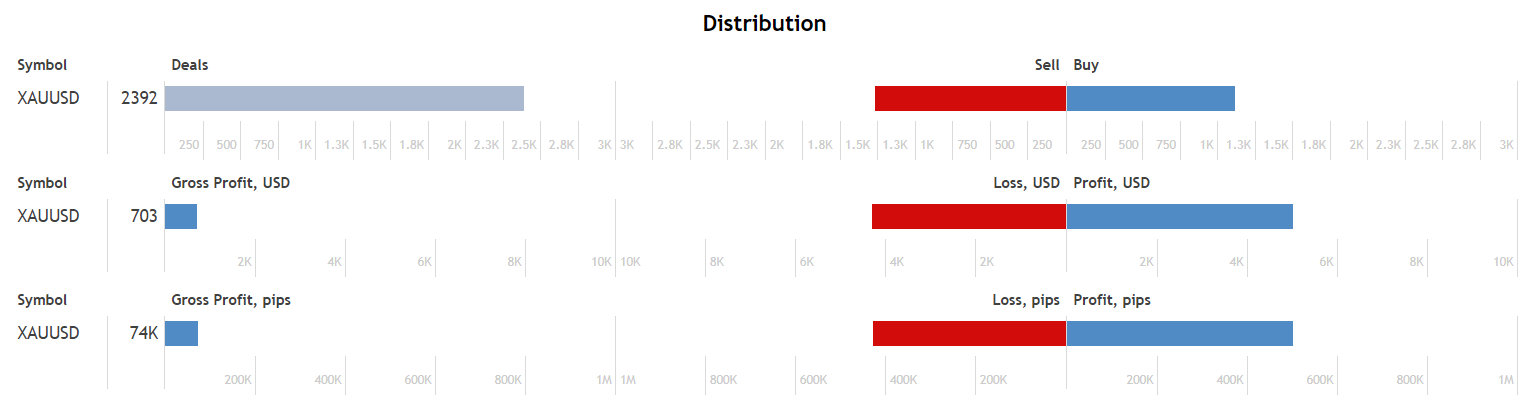

There’s nothing special shown on the distribution chart.

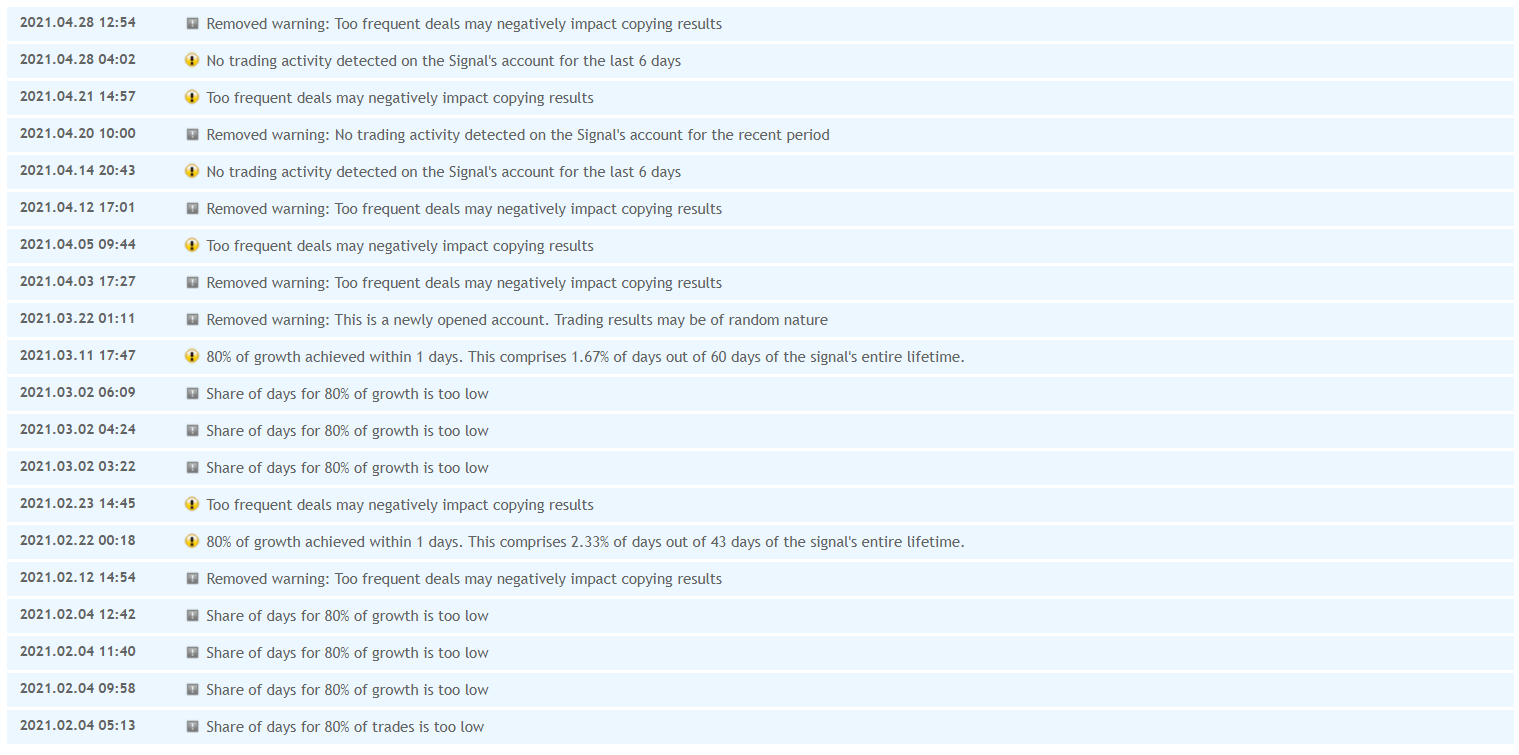

There were many warnings from the MQL5 system. As soon as trading stopped in May 2021, there were no warnings any more.

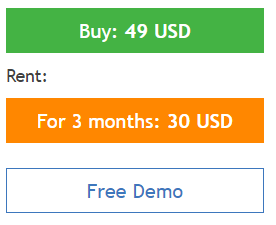

Pricing

The Gold Miner costs $49 for a lifetime copy. The offer is low-priced. A well-designed system has to cost much more. The common price for a Grid robot is from $150 to $350. So, we shouldn’t have high expectations about it. There’s a possibility to download a demo version of the robot.

Is Gold Miner a scam?

Most likely, yes. The system is cheap and has no verified trading results. We have no testimonials from clients of how the system is working on their terminals under various brokers.

People feedback

We’ve got this review. Probably, the only review looks like a paid one.

Comments