Position size is a trading decision that a market participant takes before opening a position in the financial market. It is a trading strategy component that helps traders minimize the risk and keep the trading account alive for the long run.

The risk within one day should not exceed 3% of the trader’s deposit. The risk in one trade should be less than 1% of the total deposit on the account.

Many traders invest a lot of their time finding profitable strategies, but they don’t know that a simple method can give profits by implementing it in a calculative way. The position size, drawdown, risk, and reward are common considerations that a trader should take besides trading.

If you have a profitable trading strategy, it might be useless until you implement it with the appropriate position size. Let’s see various ways of calculating position sizing in FX.

What is the position size in forex trading?

The risk per trade is the difference between the trading entry and the stop loss level. If you convert the pips to money, you will get the exact amount of risk that should match the trading balance.

In trading, you are your boss. Here no one will ask you to change the trading decision. You can decide how much risk you should take per trade, but it does not mean you should take illogical risks per trade. The position size should be logical and tolerable. If the market condition is favorable, you can alter the risk slightly, but risking all money in a single trade is not a good idea.

What should you consider in calculating position size in FX?

- Amount of investment available in your account

- Percentage of risk you are taking per trade

- Distance between the entry price and stop-loss

- Monetary value of pipe taken as a risk

Let’s look at an example of the position size in FX trading

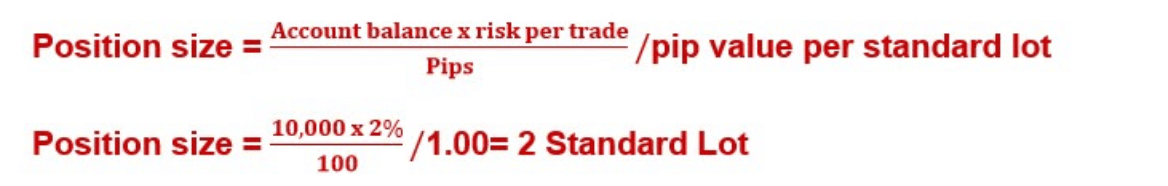

We can calculate it by the following formula.

Position sizing calculator

As part of preparing to trade, it usually makes sense for a trader to create a position sizing calculator if his plan requires more than a fixed lot position sizing.

It will be used to calculate the lot size for each trade and can usually be easily programmed into an Excel spreadsheet. This is generally more reliable than using a handheld position sizing calculator. Once a decision has been made to trade and the appropriate lot size has been calculated, a trade can be opened.

Calculate the position size in FX

Let’s see some ways to calculate the position size that you must know.

Equity-based calculation

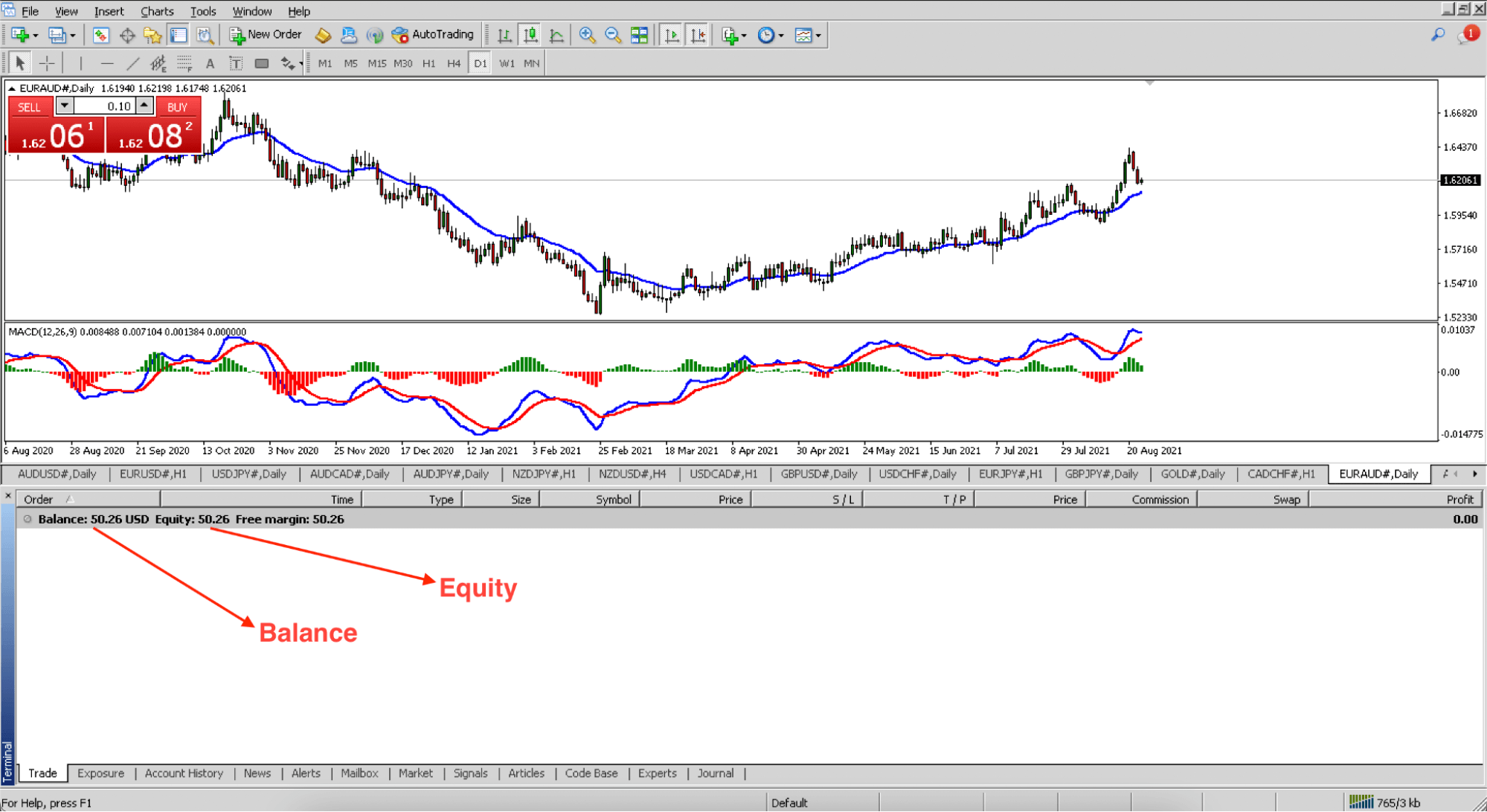

This model considers the trading balance and the value of floating profit or loss. If your trading account has a floating loss, you will see the equity lower than the trading balance. Moreover, a positive floating will show a higher proportion than the investment. You can find the equity from the trading terminal on your MT4 or an MT5 platform.

MT4 platform

If you have $500 in your trading account with a floating profit of $150, the equity should come at $650 ($500+$150). If you want to take a 2% risk per equity-based model, the risk for your next trade should be $13 (650×2%). Therefore, you should take a lot size that should not exceed the risk of $13 for the next trade.

Core equity-based calculation

The free margin-based calculation uses the total balance of your trading account to calculate the lot size of your next trade. The core equity comes from deducting the amount on the open position with the total trading balance.

Reduced equity model

We know from the previous method that equity is the addition of investment and floating profit/loss. In this method, we will use equity with an amount as a protecting stop loss.

We can implement the formula as below:

Reduced equity = total equity +/- protected profits

For example, if you have $12,000 in your trading account with a floating profit of $400, your equity should be $12,400. If you use a protected profit of $2000, you can use $10,400 in your next trade.

Risk per trade

This process is straightforward. Instead of calculating the total risk in percentage, you can use a fixed amount of risk in every trade. However, the amount of risk should be logical according to your trading style and strategy.

For example, if you invest $10,000 in your trading account to follow the fixed risk per trade, you should identify how much risk you want to take per trade. Let’s say it is 2% of the invested amount or $200. Therefore, in every trade, you can risk around $200, whether your equity is lower or higher than your trading balance.

Pips risk per trade

It is adequate for an indicator-based system. Moreover, you can use it in intraday trading or scalping. Some trading strategies simplify the system by using a fixed stop loss level in every trade.

For example, if your strategy has a 1:2 risk vs. reward ratio with 20 pips of stop loss and 40 pips of taking profit, you are taking a fixed stop loss in every trade. However, the amount of risk you take in a trader can be changed by altering the lot size.

Final thoughts

Using the proper lot size in trading is a core part of the trade management system. The FX market has some uncertainties that a trader cannot ignore. The only way to sustain here is by following a system and repeating it over and over again. Using an appropriate trading position will ultimately boost your profit and increase the potentiality of sustaining in the market in the long run.

In financial trading, any adverse situation may come where you may face multiple losses at a time. If your trading position is conservative, you have less possibility of blowing up your account than an average trader.

Comments