The decentralized exchanges have become a popular platform for crypto investors recently. It enables transactions between two parties without involving a third party. DEX took mainstage in 2020 and may be on the way to becoming mainstream in the recent future. DEX ecosystem is as strong as ever with emerging composability, deeper liquidity, and optimized usability.

However, DEX is still not the first option for most investors, and DEX projects are comparatively new products in the financial world. This article will introduce you to the best five DEX projects that are potent to invest in and worth keeping on the watchlist in 2022.

What is DEX?

Decentralized exchanges are cryptocurrency exchanges that enable peer-to-peer transactions between users that don’t need an intermediary, banks, or brokers. DEX allows secure online transactions which have no way to revert transactions and has lack o KYC process.

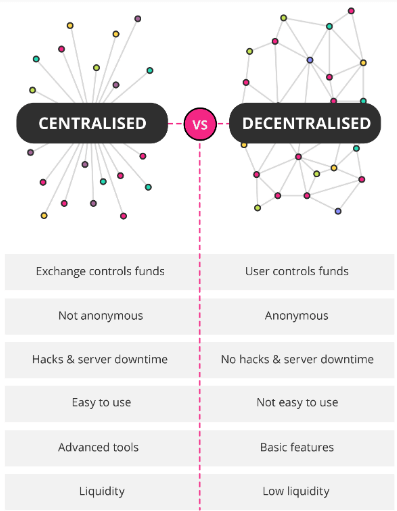

Key differences between CEX and DEX

There are no regulatory authorities available for DEX as it operates in a highly distributed blockchain. In decentralized exchanges, liquidity is a significant concern. This sector fulfills crypto’s core possibilities, including many projects or crypto assets.

Best ten DEX projects worth watching in 2022

It isn’t easy to sort the best crypto asset among many DEX crypto coins. We list the best ten according to market cap, liquidity, potentiality, etc.

- Uniswap (UNI)

- Curve (CRV)

- MDEX (MDX)

- PancakeSwap (CAKE)

- SushiSwap (SUSHI)

- BurgerSwap (BURGER)

- Balancer (BAL)

- JustSwap (JUST)

- Bisq (BISQ)

- OpenOcean (OOE)

In the following section, we will highlight the best five.

Uniswap (UNI)

Fully diluted market cap: $11,050,337,261

Live market cap: $6,957,942,507

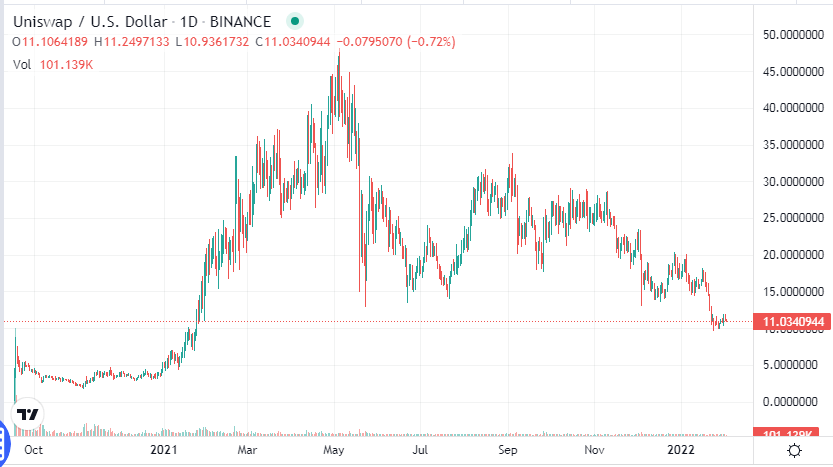

UNI price chart

Uniswap is a decentralized trading protocol that facilitates the automated trading of DeFi tokens. This platform aims to keep token trading automated and open for any entity holding tokens. Hayden Adams creates this platform using the Ethereum blockchain. The launching period of Uniswap is Nov 2018. This platform continues gaining considerable popularity for the recent DeFi phenomenon.

The native token of this platform UNI price is floating near $11.03 today with a 24-H trading volume of $214,521,310. The circulating supply is 630,797,406.74 UNI. Meanwhile, the max and total supply are the same 1,000,000,000 UNI.

Does UNI have the potential to grow?

The price is now floating on a good support level, after a sharp decline from a peak near $20 since the beginning of 2022. Many crypto experts anticipate that the price of UNI can gain to the recent top $20 or above it by Dec 2022.

Curve (CRV)

Fully diluted market cap: $11,080,447,410

Live market cap: $1,535,011,649

CRV price chart

The Curve is a DEX liquidity pool on Ethereum that has designing purposes for low risk, low slippage, stable coin trading, free income for liquidity providers, and an extremely efficient exchange platform. Michael Egorov is the CEO and founder of this platform. Curve Decentralised Autonomous Organization (DAO) decides the fees and other parameters.

The native token of this platform CRV price is floating near $3.37 today with a 24-H trading volume of $384,531,779. The circulating supply is 457,579,897.23 CRV. Meanwhile, the max supply is 3,303,030,299 CRV, and the total supply is 1,681,826,013 CRV.

Does CRV have the potential to grow?

The price finds support near $2.36 after a sharp decline from the recent top near $5.49. Many crypto analysts expect to trade this asset near that top of $5.49 or above by Dec 2022.

MDEX (MDX)

Fully diluted market cap: $229,292,251

Live market cap: $227,241,452.29

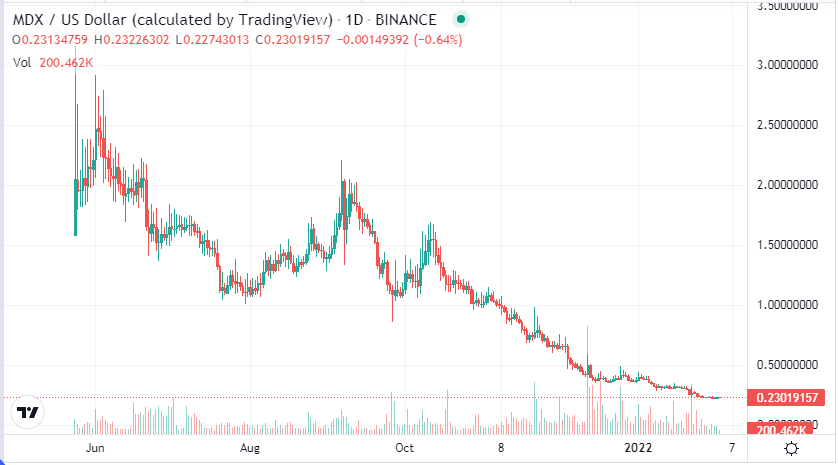

MDX price chart

MDEX is a decentralized exchange protocol that has become so popular quickly. The launching period of MDEX is Jan 2021, with a transaction speed of three seconds alongside having an estimated cost for token swaps at $0.001 for each trade.

The native token of this platform MDX price is floating near $0.23 today with a 24-H trading volume of $6,992,480. The circulating supply is 842,869,402.59 MDX, and the total supply is 1,000,000,000 MDX. Meanwhile, the max supply is unavailable.

Does MDX have the potential to grow?

The price still continues to decline since Oct 2021 from a peak near $1.69; many crypto analysts expect to trade this coin near $0.40 by Dec 2022.

PancakeSwap (CAKE)

Fully diluted market cap: $2,187,491,493

Live market cap: $2,187,491,493

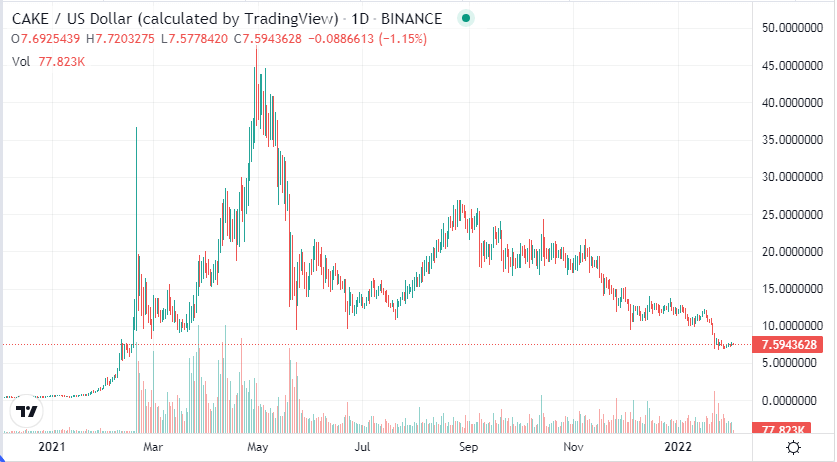

CAKE price chart

PancakeSwap is a blockchain exchange protocol that allows users to provide liquidity and exchange tokens. Users provide liquidity via farming and earn fees in return from this platform.

The native token of this platform CAKE price is floating near $7.59 today with a 24-H trading volume of $111,552,824. The circulating supply is 263,960,935.95 CAKE, and the total supply is 263,960,936 CAKE. Meanwhile, the max supply is unavailable.

Does CAKE have the potential to grow?

The price has remained on a downtrend since Aug 2021 from a peak near $26.83. Many analysts anticipate that the CAKE price can reach nearly $12.49 or above by Dec 2022.

SushiSwap (SUSHI)

Fully diluted market cap: $1,095,366,543

Live market cap: $557,788,342

SUSHI price chart

The launching period of this popular crypto exchange platform is Sep 2020 s a form of Uniswap. The native token of this platform SUSHI price is floating near $4.38 today with a 24-H trading volume of $167,259,443. The circulating supply is 127,244,443.00 SUSHI. Meanwhile, the max supply is 250,000,000 SUSHI, and the total supply is 239,894,343 SUSHI.

Does SUSHI have the potential to grow?

SUSHI price reaches a low by remaining on the downtrend since the beginning of 2022. The previous support level is near $5.09; if the price crosses above that level, it can gain to the Dec 2021 top or above that level by the end of 2022.

Pros and cons

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thought

Still, many central exchanges are available, and DEX is not the only option to trade crypto assets. Many DEX platforms are available with relatively new and positive features. You can try out any one of them. So many people are keeping faith in DEX, so many projects are coming, and we may be going to live in a decentralized financial world sooner than we think.

Comments