The recent surge in cryptos and computer intervention in the market increased the need for an algorithmic platform. Algorithmic trading has become a reliable way to make money online, where the core part of any algorithm-based system is an API. It is a trading platform that allows investors to buy or sell a crypto asset using an algorithm rather than manual trading.

The following section will see everything a trader should know about the API and how traders can use this platform.

What is the API?

Algorithmic execution is a process to automatically open orders for buying or selling using software or an online program. In general, traders usually buy or sell their assets using manual execution, or some brokers often limit orders. On the other hand, algorithmic trading is entirely different from them.

How does algorithmic trading work in the crypto market?

Algo or black-box trading is a process to use a computer program to set rules or instructions for placing trades. While taking the trade, the rules come from timing, technical tools, or any mathematical formula. This process can make more trading decisions in a second than a human brain cannot think.

If you are keen to use algo trading in the crypto market, you should find a platform that supports algo trading. An algorithmic execution platform (APIs) is any broker that allows an algorithm. There are many crypto brokers from which investors can operate their executions through such trading in the modern world.

How to find the API?

API allows investors to connect the market with an algorithmic trading strategy. Therefore, any crypto brokers that will enable the Application Programming Interface (API) in taking trading decisions are suitable for mathematical traders.

Therefore, if you find any API-based platform, you can consider it an algo-friendly platform. Before opening an account on the trading platform, you can contact the support agent or find the details about brokers’ services in the about us section.

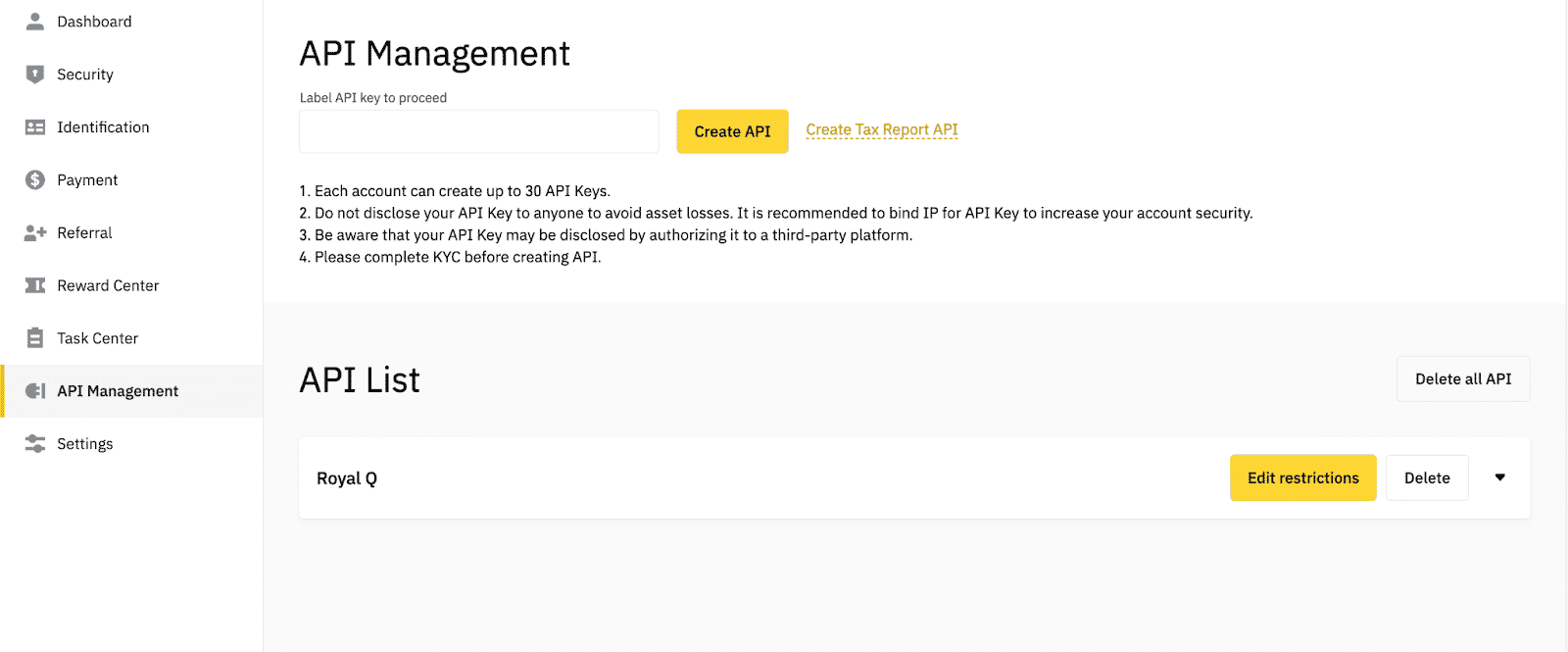

Binance API

The above image shows the webpage of Binance API that allows algorithmic programs to connect orders through the Binance platform. If you set any orders in your program, it will instantly affect the Binance platform through the API.

How does an API work?

There are two ways to join algorithmic trading:

- The first is to build an algo-based software

- The second is to buy an algo-based software

You can build software based on your trading strategy if you have a programming language. After that, you can apply this strategy to the crypto trading platform using the API. The programming language and the connection system between platforms differ from platform to platform. For example, Binance API uses a language that might not work in the Coinbase API. Although there are some expectations, choose the right platform for you before going with the algo trading strategy.

How to choose the right algo trading strategy?

You can make huge money through the algo-trading method but follow these conditions.

Data

Algorithmic trading uses the market data and price quotes and takes trading decisions based on these. Therefore, your algo-trading software should have the capacity to read real-time feed and data.

Connectivity

Traders who work on various platforms should know that each trading platform uses a separate mechanism in the data feed like TCP/IP, FIX or Multicast. Therefore, if your algo-trading software wants to focus on multiple platforms, it should have the ability to read different types of data feeds.

Latency

It is an essential metric, the time duration between the execution and receiving of the direction. Therefore, you should use software with lower latency in the algorithmic execution platform.

Functionality

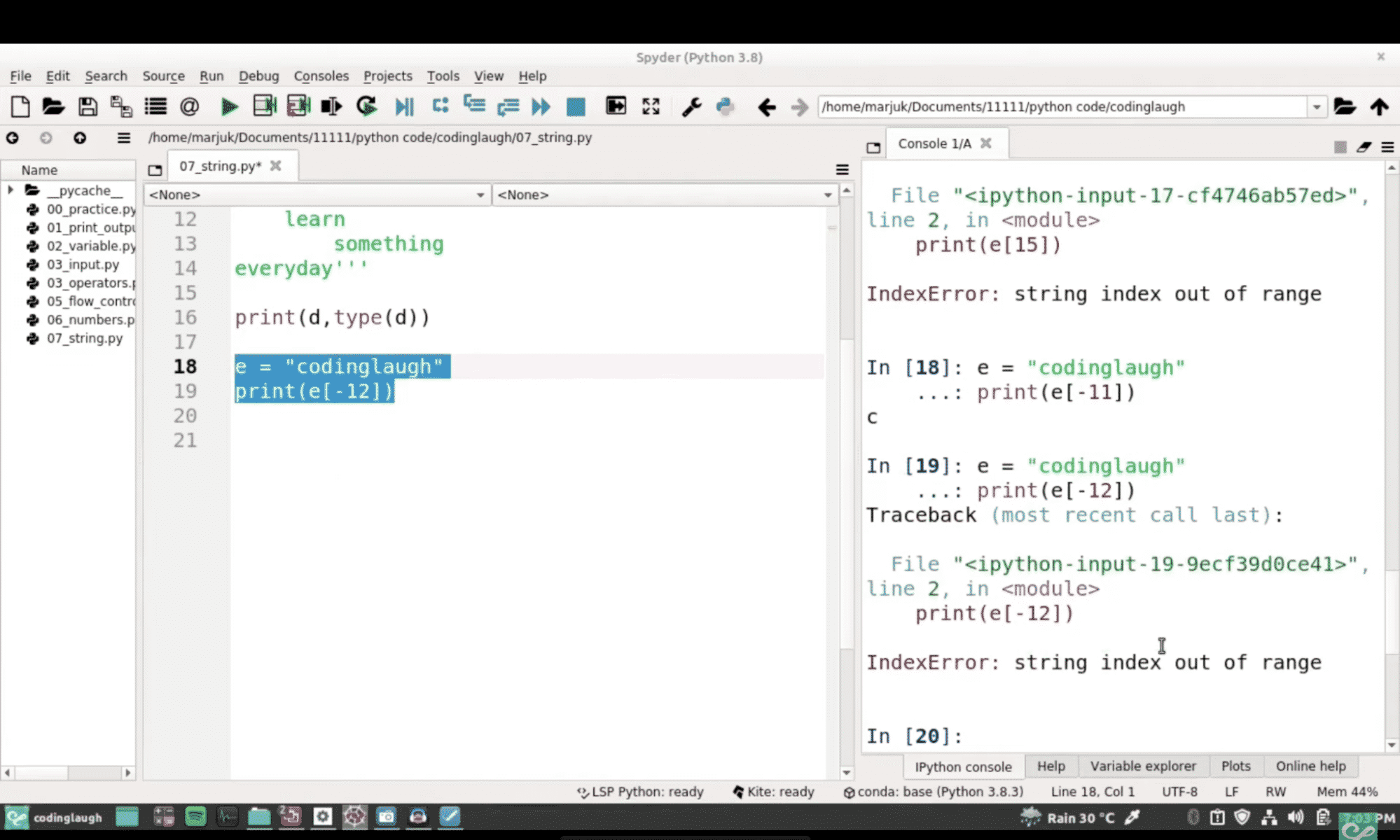

Many programming languages like Python, MatLab, JAVA, and C++. Most of these languages are acceptable by API-based platforms, and if you want to build an automated trading software, you should learn any of these languages.

Python programing

Basic algo trading strategies

After learning the writing language, you should have a proper strategy that is potential and profitable for the crypto market. There are many algo-based strategies available in the world. Among them, the following are profitable:

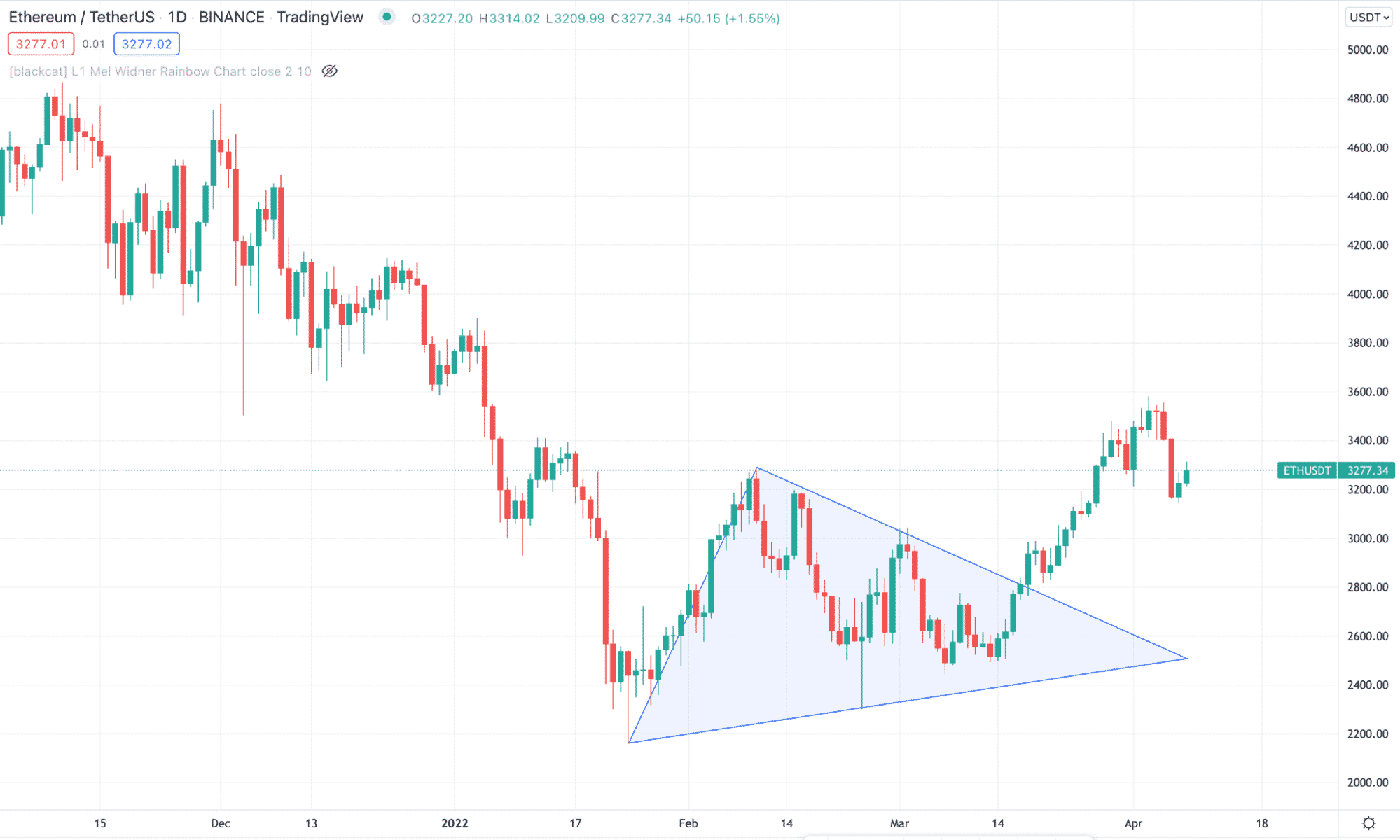

Trend following strategies

It is a profitable and the easiest algo trading method globally. It tracks the performance of an instrument over time, usually in the last 50 to 200 days. Later on, it anticipates the future price direction based on past performance. The common way to perform trend trading is by using price patterns like falling or rising wedge, triangle, bullish/bearish channel etc.

Triangle breakout

Arbitrage trading

It is a process to make money by using the price difference of an instrument on different assets. You can use your algorithmic software to track the prices of different assets and make money.

For example, if the current BTC price is $40K on a platform in South Africa and $41K on the platform in the UK, you can buy BTC in the South African broker and sell it at the UK broker to make a $1000 profit. The whole situation happens within a second that needs software to perform.

Index fund rebalancing

It is a process to follow how the pros rebalance their portfolios for gaining higher profits. The trading software tracks the index funds or investment vehicles that track the benchmark to rebalance their portfolio from time to time.

Final thoughts

API allows algorithmic-based traders to operate with their strategies in the crypto market. In the above section, we have covered both methods and platforms so that traders can have a clear idea about the path.

However, the crypto market is very new, where making money through an algorithm is highly possible. Therefore, you can build your trading strategy and apply it to your desired API.

Comments