Several crucial factors affect the US economy. Recently it has been facing the coronavirus pandemic issue with the rest of the world. The pandemic response was not the same for all the nations. Several regions took various types of steps to deal with the pandemic and recover from the crisis. As a result, vaccination for coronavirus comes up, and the world starts to recover from the disaster.

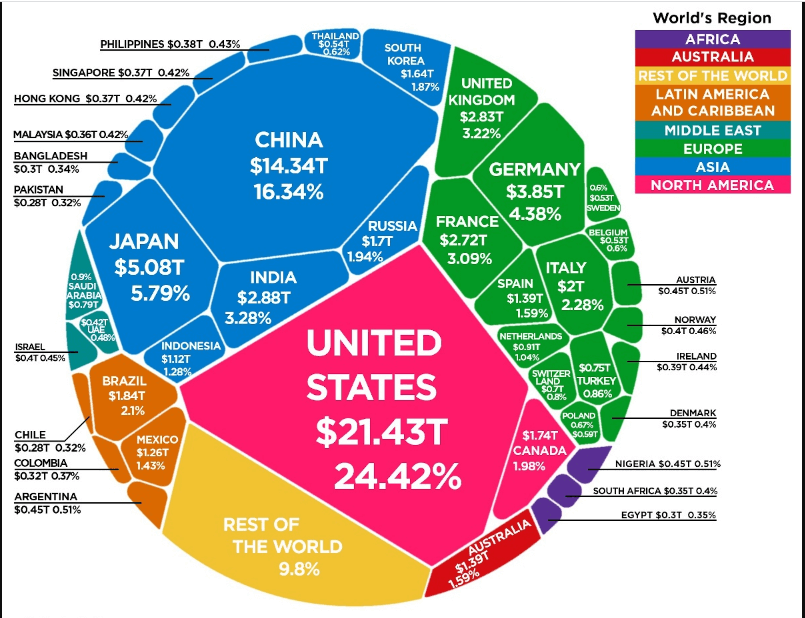

The United States economy is the largest national economy in the world. The region contains only 5% of the global population that generates nearly 20% of the worldwide income. Moreover, the United States is a leading trader of the globe, expanding trades since the end of the Second World War. Nowadays, the US economy has become a role model for the rest of the world.

In this article, we predict the future direction of the US economy by observing several crucial factors and the Covid-19 pandemic response.

How pandemic affected the US economy

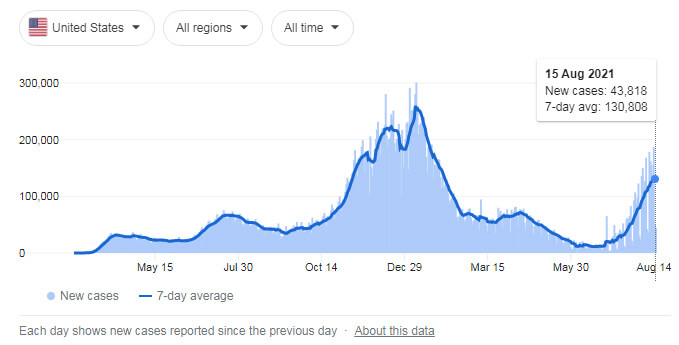

The world has been suffering since the beginning of the Covid-19 pandemic in March 2020, along with the United States. It came with a health crisis for the nation, and the hospital system was entirely at capacity. As of writing, the United States confirms more than 37 million Covid-19 cases or positive patients and more than 637K+ deaths, according to world meters. So the disease already took American lives more than ten times more than the Vietnam war.

Covid-19 death statistics

The figure above shows the corona cases of the US. The rapid growth of Covid-19 issues drives the US government to take several actions such as lockdown, quick test, patient isolation, etc. The federal government announces a relief package worth billions of dollars to deal with the pandemic situation.

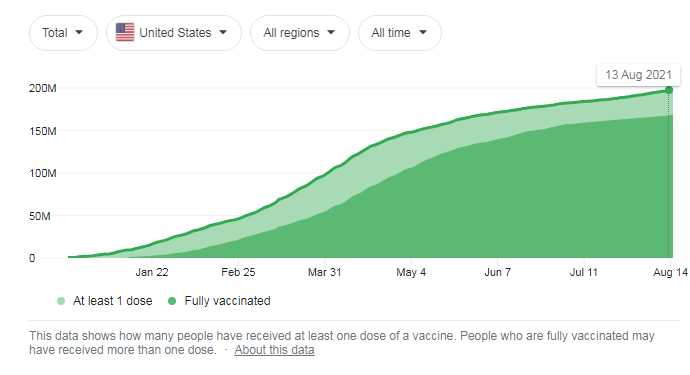

However, a lot of people lost their jobs during the pandemic. The excellent news is vaccination comes up as several nations invent vaccines for the coronavirus. Western countries started to vaccinate their citizens before the end of 2020.

US vaccination rate

The figure above shows the vaccination of the US nation. The US vaccines such as Moderna and Pfizer/BioNTech successes, several European and many other countries accept this vaccine and approve of using it. More than 51% of Americans completed the vaccination, and more than 60% took at least one dose of the corona vaccine.

As soon as the nation completes the vaccination process, the reopening and boosting of the economy will occur. The odd fact about the virus is the mutation. If the vaccine fails and the virus changes its genre, the nation may face the worst situation. Due to rapid vaccination and sooner reopening expectations, job data and other business data improve the US economy.

Inflation and interest rate

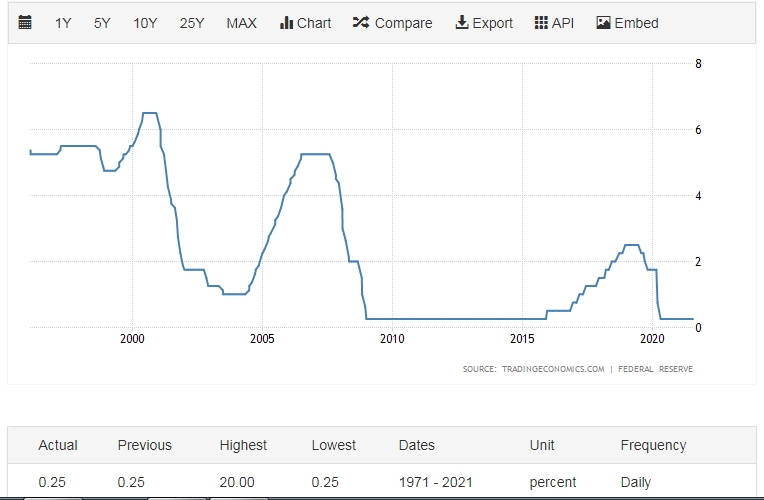

The central bank of the United States, the Federal reserve system or Fed, is the USD producer. The policymakers take various steps to have a stable economy for the United States. They do periodic meetings to make the inflation and interest rate decisions.

The world’s most powerful bank controls the currency by taking several actions such as inflation, deflation, etc. According to Fed Chairman Jerome Powell, the Federal Reserve may hike the interest rate soon until 2023.

Federal funds rate

The figure above shows the interest rate of USD. Recently the economy faces stress from the pandemic, so the policymakers of the Fed may remain soft.

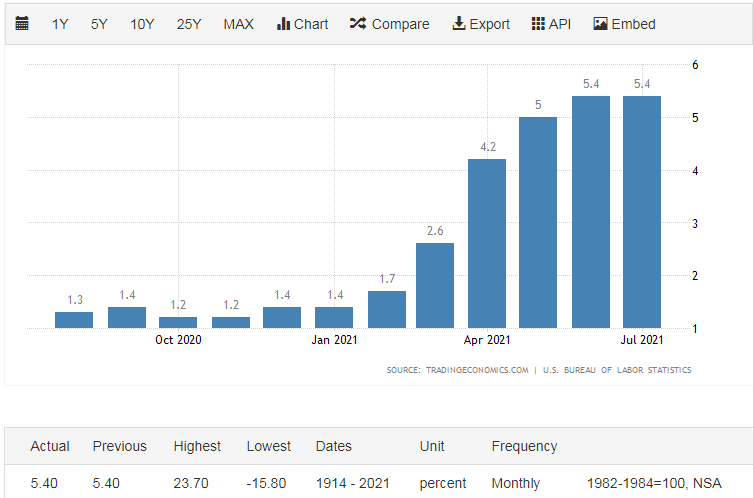

US CPI

The figure above shows the inflation rate of USD. It has been increasing for a few months. The inflation rate below 2% is tolerable for any currency. Whereas the figure is climbing, the result will be a devaluation of the currency.

The theory is simple: when you print more money, the demand will fall for the currency. Inflation is increasing for the full employment goal of the whole United States. However, the recent pandemic causes several economic issues to grow, but the recovery plans to help normalize the nation. Anyway, to win the battle against rising inflation, the Fed can decide on a rate hike to boost the economy.

US fiscal policy

President Donald Trump has a $900 billion fiscal bill sign during his last days in office. Now in January 2021, Joe Biden becomes the president of the United States. Now it is time to execute the fiscal policy properly.

There are no more options to modify the deals. Despite the unemployment data, the new government of the United States can take action to improve other broken economic infrastructures to boost the economy. Moreover, Biden and democrats may add between 1 or 2 trillion dollars as government spending.

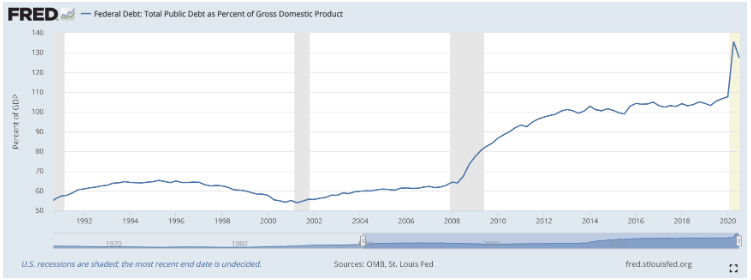

US debt-to-GDP data

Another major factor is the senate floor. Joe Biden can’t achieve more if the upper chamber is full of the republicans. Recovery of the world economy and the USD will slow down if the Senate doesn’t cooperate.

Trade relations

The United States President Donald Trump and the Chinese President Xi Jinping clashed over the tech sector in 2019 and the virus issue in 2020. Now Joe Biden has become the president of the United States. The change in the white house means the change in the relations between the world’s largest economy and the others.

Joe Biden’s TPP or Trans-Pacific Partnership deal as vice president is remarkable. The deal encloses the largest ocean globally, which relates to many other nations. Not just the US, other western economies such as the EU also put some sanctions against China. So the tension is not coming so soon.

Domestic economy

The domestic economy of the United States suffers from the recent pandemic similarly to the rest of the world. Several macroeconomic indicators such as household spending, GDP data, employment data decline for the handful effect of the pandemic.

However, as rapid vaccination takes place and effective decisions from the policymakers and government boost the economy. It is not recovering overnight, and the virus effect is still there.

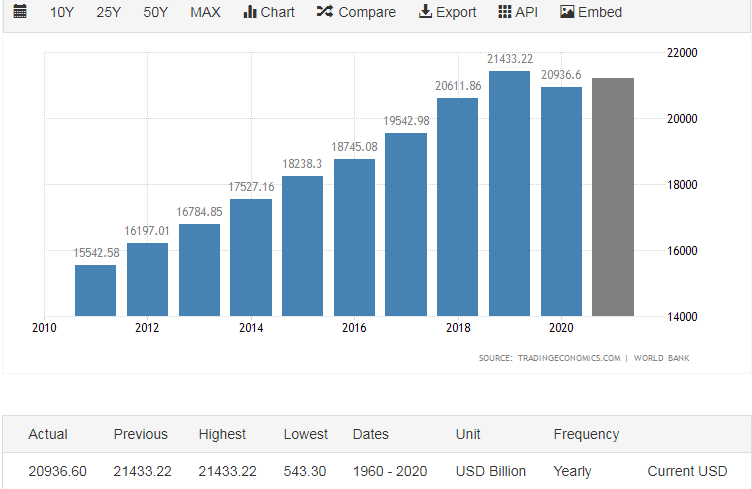

Declining GDP data of the USA

Final thoughts

Finally, we list the current situation of the USD as it is still suffering from the pandemic. The recovery plans from the policymakers are precious. The United States may recover soon as the virus impacts doom.

In this situation, investors should closely monitor how the Fed is fighting the problem. The consecutive better economic reports and hawkish tone may lead the US dollar to the leading position of the forex market.

Comments