Volatility Factor is a volatility-based algorithm that is presented by FXAutomater. The company has many algorithms in the market and makes many promises on the performance. The EA comes with backtesting and live results however the latter is only available on a demo account which does not guarantee good results.

Volatility Factor 2.0 strategies and tests

It is simple to install the algorithm and make it run. The whole process is as follows:

- After you receive the robot, place it in the experts’ directory

- Enable auto trading button on MT4

- Attach it onto the charts to start trading

Strategy explanation

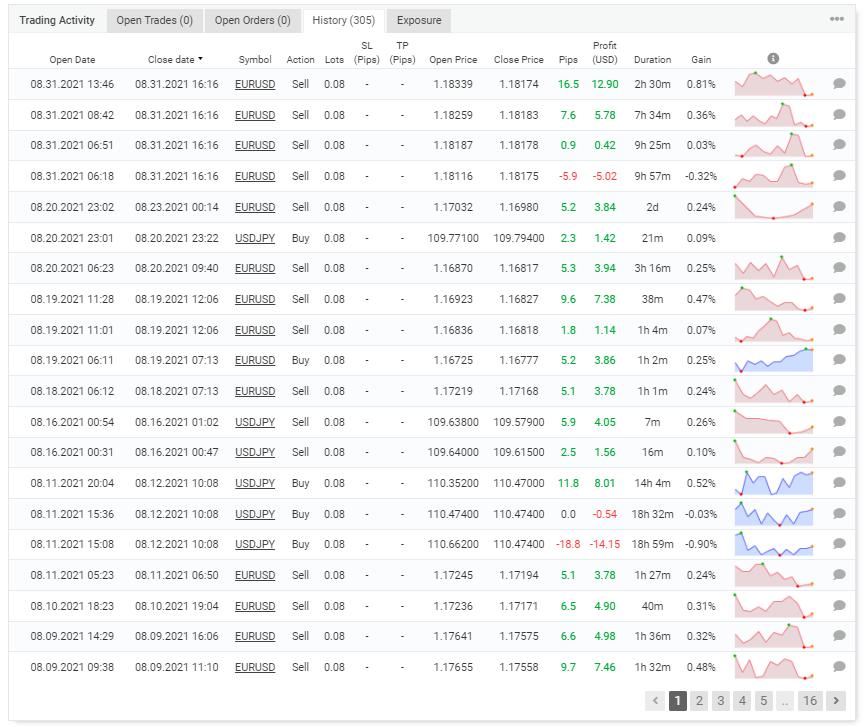

The developer explains the strategy in a complex manner. The whole information is scattered on a single webpage where they explain the risk management and profit-taking functions of the EA. The robot works on EUR/USD, USD/JPY, GBP/USD, and USD/CHF. It trades on the direction of medium-term market impulse and utilizes price oscillations around a certain point. Through the history of Myfxbook, we can see that the robot uses a grid strategy. The developer does not mention this openly on the website. They are hiding the fact that the algorithm implements a risky approach.

The trading activity of the robot on Myfxbook

Features

The robot has the following features:

- It has a built-in news filter to protect itself from volatile conditions

- It can work with 4 and 5 digit brokers and trade on micro, mini, and cent accounts

- It has spread and price slippage protection

- It manages all the trades and uses risk management functions

- It has a unique broker spy protection module

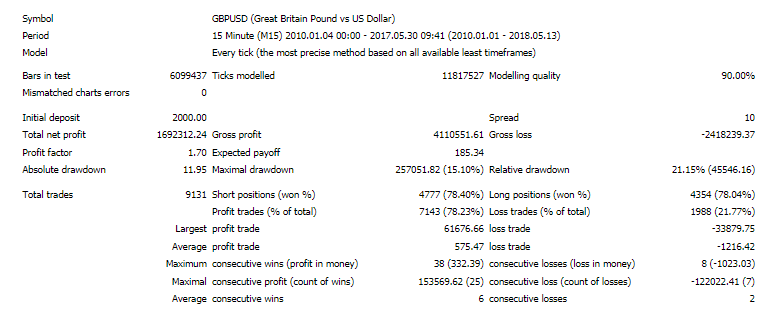

Backtesting

Backtesting results are available for GBP/USD only. For the pair, the robot had a maximum drawdown of 21.15% and turned an initial deposit of $2000 into $1692314.24. The drawdown value was quite high and states that the EA losed a quarter of the trading capital. It had a winning rate of 78.23% with a profit factor of 1.7 0. The average amount of profitable trades was $575.47, while the average loss was $1216.42. There were a total of 9131 trades executed during this period.

Backtesting records

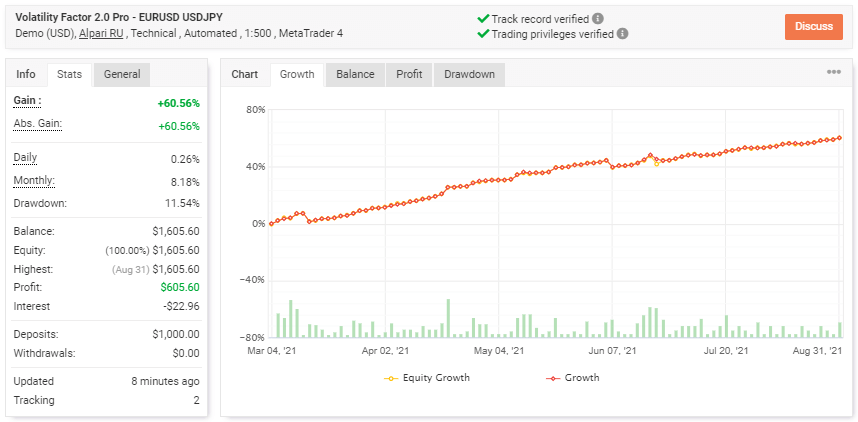

Volatility Factor 2.0 live trading account review

Verified trading records show performance from March 04, 2021, till the current date for EUR/USD and USD/JPY currency pairs. The system made an average monthly gain of 8.18% during the period, with a drawdown of 11.54. The winning rate stood at 82%, with a profit factor of 2.61. The best trade was $13.45, while the worst was -$33.37. There were a total of 304 trades. The records are on a demo account which is not sufficient to prove the performance as virtual portfolios do not respect real market liquidity.

Records on Myfxbook

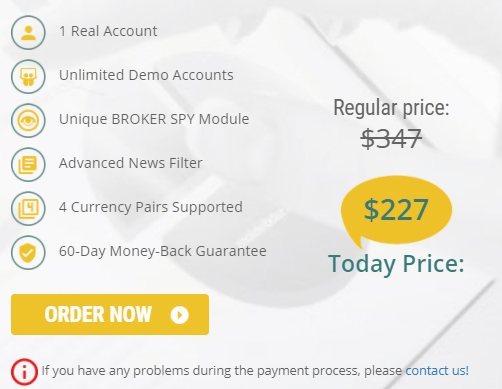

Pricing

The robot is available for an asking price of $227. There is a 60-day money-back guarantee. The license is only available for one real and for an unlimited number of demo accounts.

The pricing plan of the service

Is the Volatility Factor 2.0 robot a scam?

Volatility Factor 2.0 does not present its results through a live account, making it highly risky to invest. Most robots perform well on the demo account but fail on the live as the trading conditions are quite different between real and virtual portfolios.

Comments