The forex is a massive exchange where you earn money by buying and selling currencies. Every day in the forex market, about four trillion US dollars are turned over. Naturally, its liquidity is very high. Here, traders from worldwide buy and sell currencies to capitalize on the difference in rates.

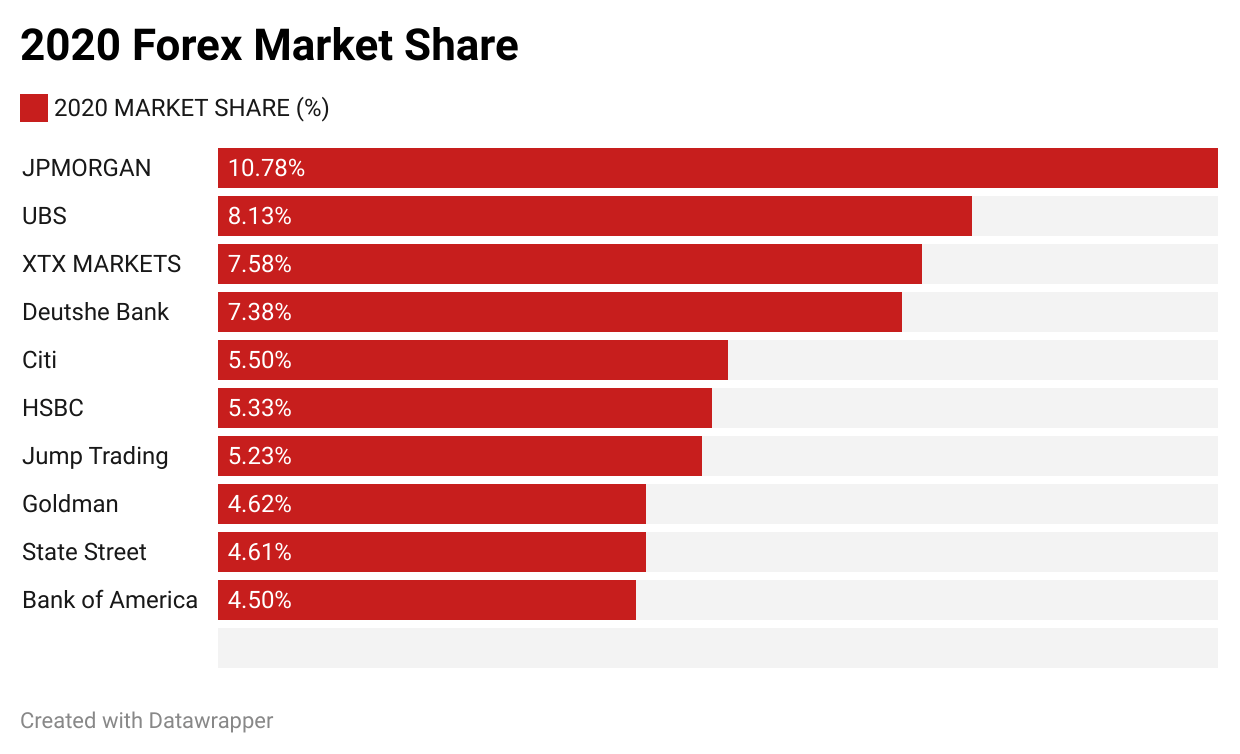

In one of the most comprehensive qualitative and quantitative outlooks of the market, the Euromoney FX 2020 survey unveiled that ten key players maintain the forex market, with JPMorgan leading with 10.78%.

Like in economics 101, analyzing price and demand is crucial in enabling forex traders to determine the foreign exchange rate and, by extension, make money. The idea behind demand and supply is that it is straightforward to indicate where the foreign exchange rate could be headed.

Technical vs fundamental analysis

Forex fundamental and technical analysis are two methods of market forecasting, on the combination of which all trading strategies and trading systems are built. While technical analysis involves economic patterns and trends, fundamental analysis is more insightful and analyzes the economy’s social factors.

Given that the forex market can move upwards, sideways, or downwards, fundamental analysis, coupled with technical analysis, is instrumental because the economy is vulnerable to factors like politics and natural calamities.

| Comparison | ||

| Technical analysis | Fundamental analysis | |

| Definition | Forecast price movements using chart patterns | Various economic data used to establish value/target price |

| Time horizon | Short, medium, long-term | Medium, long-term |

| Data considered | Price action | Inflation, GDP, interest rates, economic conditions, etc |

| The main area of application | Designed to help determine market conditions based on these price and volume indicators | Designed for helping to choose the most promising possibilities |

As the COVID-19 pandemic, for instance, continues to shake the world to its core, data published by Ourworldindata epitomize how global economies are on their knees. WHO estimates that the virus exceeds the global GDP by 2%. So if the trend continues, international trade could fall from 13% to 32%, which has had a terrible impact on the forex market.

Given that the forex market is an utterly volatile scene, here are the top 5 fundamental analysis factors that traders must consider making money in the FX.

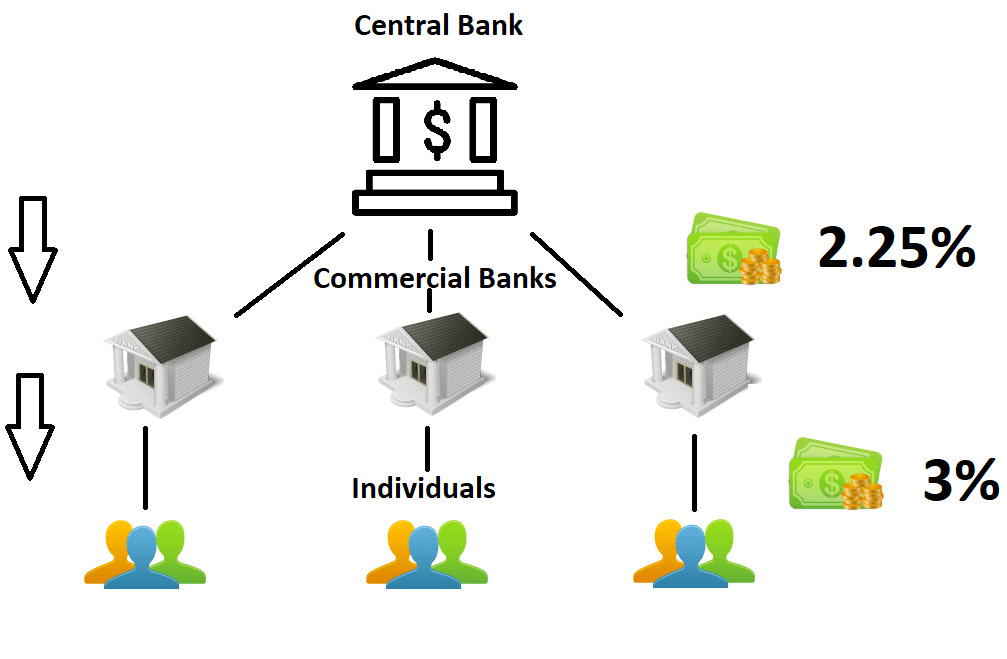

Central Bank role in FA

Central banks strive to maintain healthy fiscal sustainability, strike an optimal balance between exports and imports, minimize inflation and stimulate growth within their respective jurisdictions.

Given that central banks have a profound impact on financial markets, their effect on foreign exchange markets is colossal. From setting lending rates to monetary policy, acting as a last resort lender in times of financial crisis, like the COVID-19 pandemic, central banks will strive to ensure their respective economies’ stability.

When there is a financial crisis, central banks conduct regular monetary decisions to achieve a stable business environment and target inflation.

The US Federal Reserve, for instance, is undoubtedly the most influential central bank globally. With over 85% of currency transactions done with the US Dollar, interest rate changes can significantly impact the forex market.

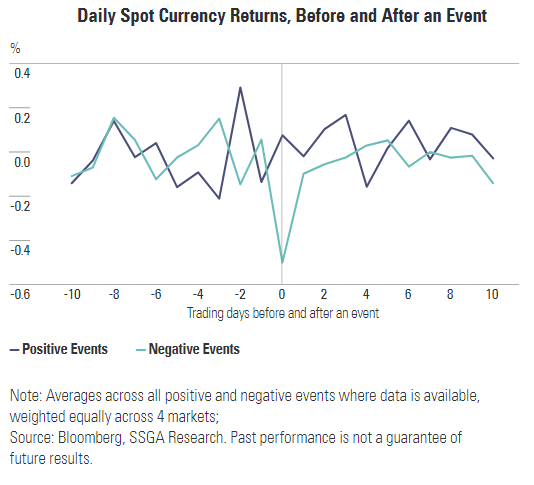

Geopolitical tension

Geopolitical tension and economic disruptions may plummet the FX, so traders should be up to speed on the possible financial turmoil that may plunge the forex price.

Some of the most noticeable risks that have affected the forex market in the recent past include the financial feud between China and the US, the North Korea crisis, the ongoing NAFTA Negotiations, and Brexit.

When trading during a geopolitical event, you must have a broader view of the possible political proceedings worldwide as you keep up to date. Going by the past, current, and future events, you can plan a short, medium, and long-term strategy to manage the repercussions of geopolitical tensions.

Economic indicators

At a glance, these are statistical reports released by private financial organizations or governments that show the state’s economic performance. Economic indicators are a measure of a country’s performance and directly impact the financial system.

They help investors to understand the economy’s state, whether there is an upward or downward growth. While indicators like employment, GDP growth rate, government debt, trade balance, inflation rate, current account, and credit rating can work to a country’s leverage, the slight deviation can have a spiral effect on the forex market.

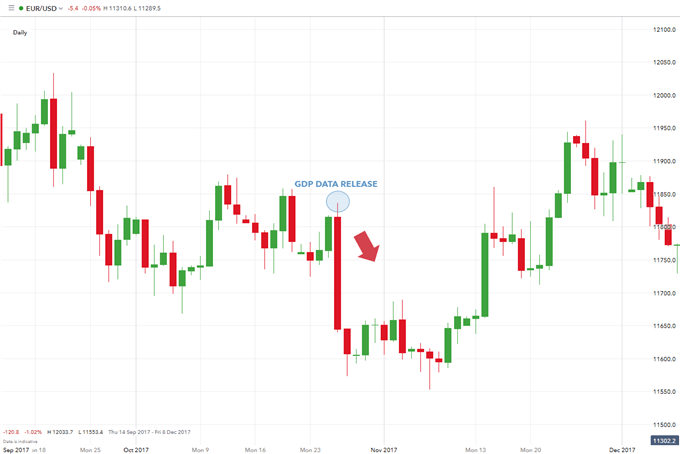

Gross Domestic Product

GDP is considered a lagging indicator by economists and represents consumable goods and services in a calendar year. Most of the forex traders major on the last two months before calculating the GDP because it means the current economic trends.

Given how 2020 was a terrible year for all the economies worldwide, in a press release published by CNBC, the USA realized a GDP of 32.9%, the worst ever economic plunge since the great depression of 1947. As a result, approximately 30 million Americans were liable to unemployment packages from the government.

Several elements determine a country’s GDP, but the bottom line is that it gives an outlook on its economic growth. By looking at the cumulative value of consumption, government spending, investments, and net exports, forex traders must be aware of the GDP metrics before investing big to avoid running losses.

The COVID 19 outbreak was a red light, and the traders who ignored it ran losses because of the plunge in GDP arising from reduced economic activity due to lockdowns and restrictions.

Industrial production

Data shows the changes in the manufacturing sector, minerals, and other utilities within a state. The data is a measure of capacity utilization of different factories and investors on the available resources.

A positive capacity utilization, where factories come to a near-perfect utilization of resources, leads to sporadic economic growth, leading to increased forex trading. Therefore, traders must be mindful of any changes because industrial production is a volatile utility. After all, it affects the market chain.

Conclusion

It is crucial to have a proper projection of the expected economic curve and keep track of all economic indicators to succeed in the forex market.

However, aside from fundamental analysis, technical analysis is crucial to making more money in the forex trade. With a holistic analysis of industrial production, GDP, economic indicators, geopolitical tensions, and central bank decisions, traders are better positioned to prepare for any economic downturns and avoid losses.

Comments