Tip Toe Hippo trades on multiple indexes and comes with backtesting records to showcase its performance on historical data. The developers claim that the algorithm aims to provide a consistent upward trading curve under all market conditions. Let us see if we can get a good return from the algorithm and the output is worthy of investment.

Tip Toe Hippo strategies and tests

It is simple to install the algorithm. The whole process is:

- After you receive the algorithm from the developer, you have to place it in the experts’ folder of the MT 4 platform.

- Enable the auto trading tab and attach the system to respective index charts to start trading.

Strategy explanation

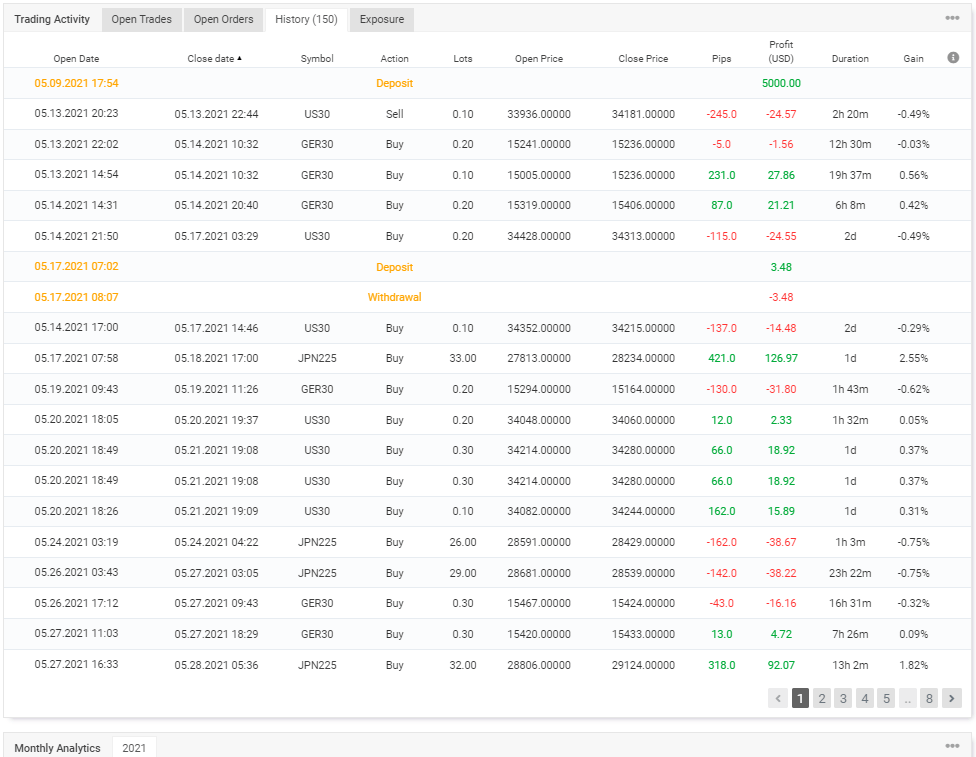

The developer does not provide a single hint on the strategy that the algorithm uses. We had to use Myfxbook records to get an idea. Through the trading history, we were able to know that the expert trades on indexes such as GER 30, US 30, and JPN 225. The robot uses a virtual stop loss and take profit where trades can be closed for a loss of up to 200 pips. The average trade duration is 15 hours and 45 minutes which states that the algorithm uses a day trading methodology.

History on Myfxbook

Features

The robot has the following features:

- It has a white paper that shows the detailed backtesting idea.

- The company provides an education section and a blog to educate traders.

- There is a discord channel available to contact for support.

- There are multiple subscription packages.

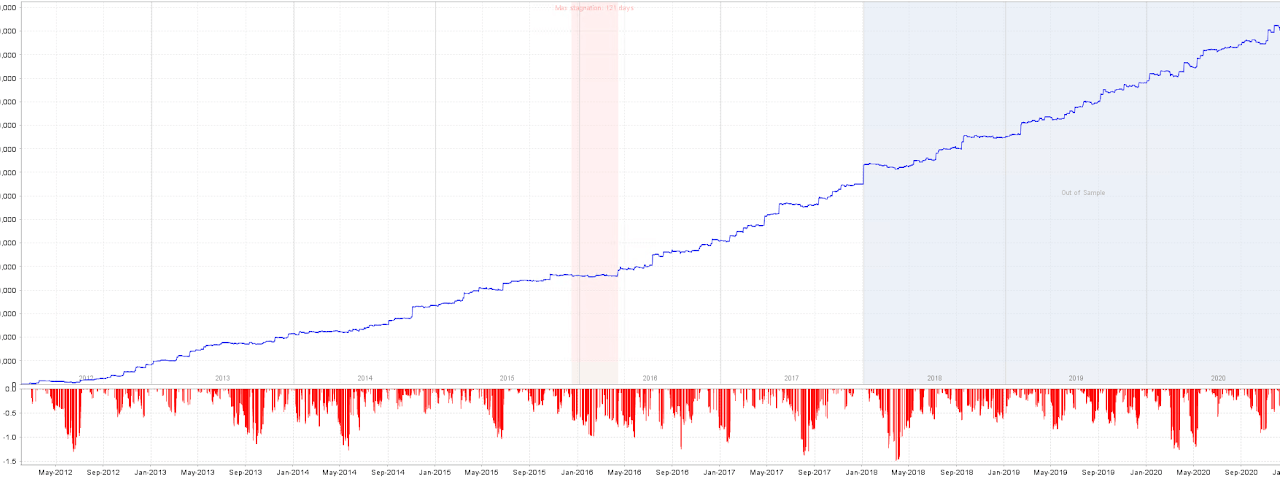

Backtesting

The developer doesn’t share backtesting results through MetaTrader testing but provides them through a white paper and a separate historical testing section on the website. They only share a curve where they claim to have tested the system for 9 years using true tick data. The maximum historical drawdown is 15%.

The company mentions a few bad points. They state that the EA provides a slow growth on the account and has a stagnation period of 4 months or so.

Backtesting records

Tip Toe Hippo live trading account review

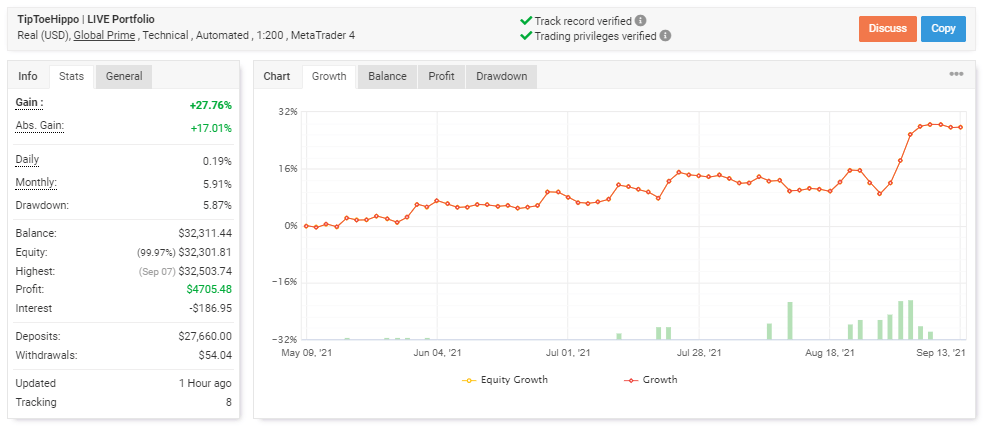

Verified trading records are available on Myfxbook that show performance from May 06, 2021, till the current date. The system made an average monthly gain of 5.91% during the period, with a drawdown of 5.87. The winning rate stood at 53%, with a profit factor of 1.73. The best trade was $1081.41, while the worst was -$668.42. There were a total of 137 trades.

The ratio between the drawdown and monthly output is 1:1, which gives us a similar risk/reward. This shows that the performance of the algorithm is average.

Records on Myfxbook

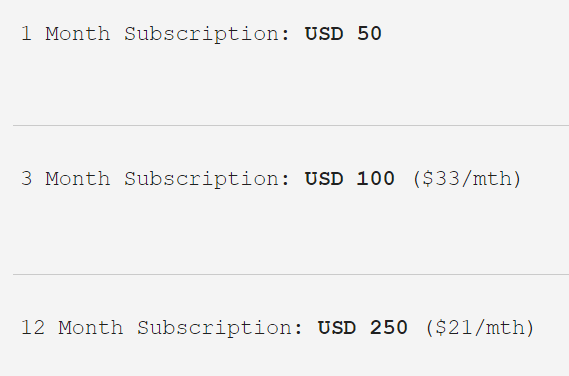

Pricing

The robot is available for an asking price of $50 per month. Traders can also get it for three months at $100 and for a year at $250. There is no information on the money-back guarantee proided. The developer doesn’t say if the license is for unlimited accounts or not.

The pricing plan of the service

Is the Tip Toe Hippo robot a scam?

Tip Toe Hippo does not share proper backtesting results with use that is done through real history data on MetaTrader 4. The company is not transparent on the algorithm’s strategy, which raises many concerns about its genuineness. This is a poor approach and puts the EA under red flags for use.

Comments