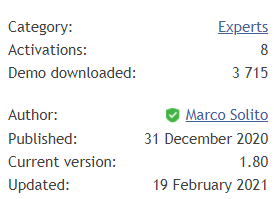

Redshift is a trading advisor that was designed by Marco Solito and released on the MQL5 forum on December 31, 2020. The robot has a current version of 1.80. The update occurred on February 19, 2021. As we can see, the robot was demo downloaded 3715 times.

Redshift Trading Strategies and Tests

The system has a not so big list of features and settings explanations:

- Redshift is a fully automated trading advisor.

- It uses the MACD indicator to spot the best Entry Points of upcoming trades.

- The system doesn’t include risky strategies like a Grid plus Martingale combo.

- It can be used on the five charts: USD/CAD, AUD/USD, EUR/USD, GBP/USD, and USD/JPY.

- The system can execute orders on the M15 time frame only.

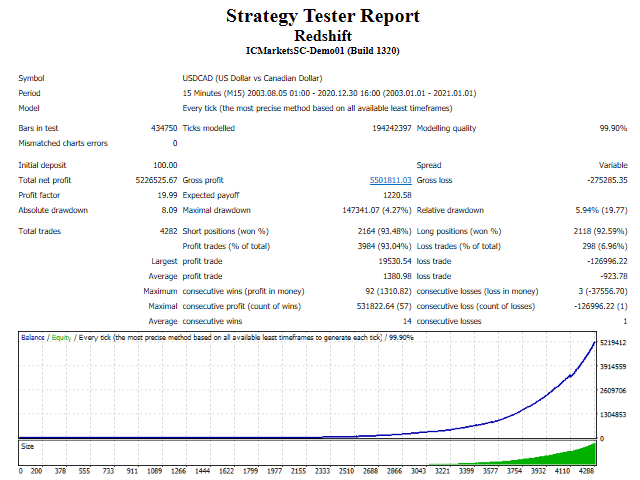

- It was backtested with 99.99% of the data quality.

- The robot works with placing SL and TP levels for each deal.

- The system is broker-free.

- We have to use it on an ECN account for low spreads.

- It also requires a high execution speed that can be obtained by using a VPS service.

- The system can be used with various leverage. The developers mentioned it l should start from 1:10.

- The minimum balance requirements are $100.

- If we decide to write feedback after purchasing, we can get another copy for free.

- The robot is delivered with an MT5 copy of the product.

- There is a list of parameters with explanations: Redshift Settings, Money Management Settings, Indicators Settings, Trading Hour, Trading Days, Trading Directions, and Trading Settings.

We have got a USD/CAD backtest report on the M15 time frame. It unites a seventeen period of the data. The modeling quality was 99.90%. The spread level was variable. An initial deposit was $100. It has amounted to $5,226,525 of the total net profit. The maximum drawdown was 4.27% ($147,341). There were 4282 trades performed with a 93% of the win-rate for Shorts and 92% for Longs. The win-streak was 14 deals.

Redshift Live Trading Account Review

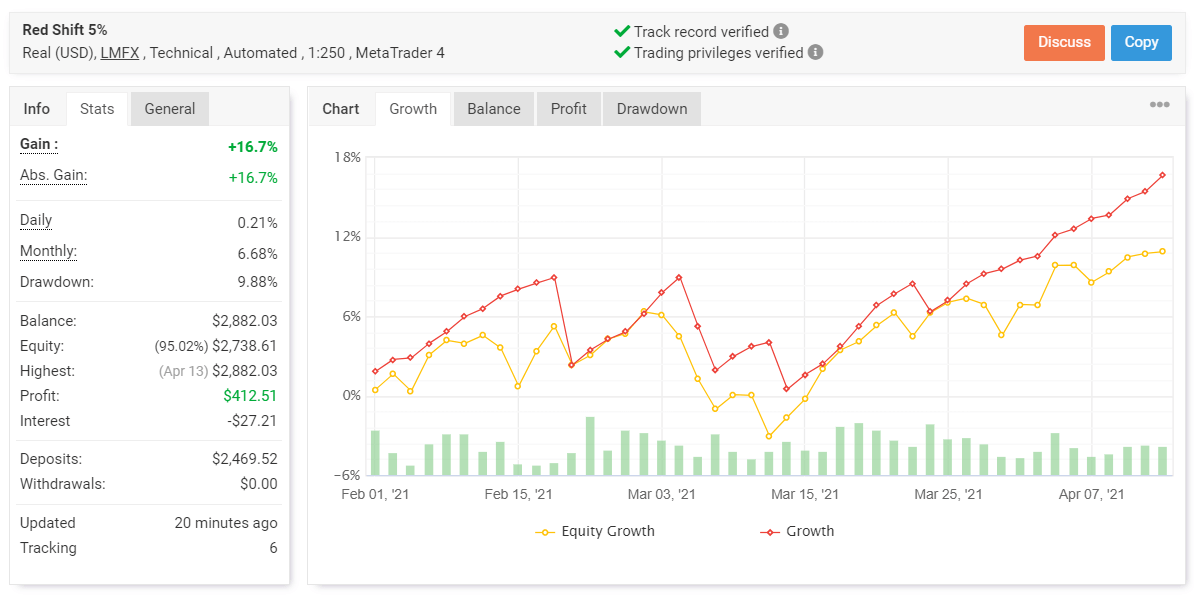

We have a Redshift EA running on the real account.

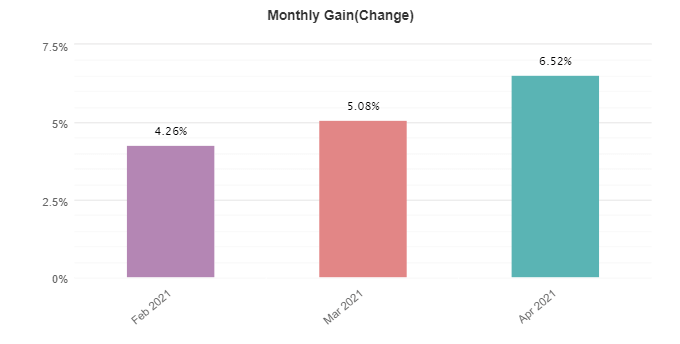

The system executes deals on the real USD account with a 5% risk automatically. The broker is LMFX. It’s not quite known. It uses technical indicators data to spot trading opportunities on the MetaTrader 4 platform. The leverage is 1:250. The account has Verified Track Record and Trading Privileges Verified icons. It was created on February 01, 2021, and funded at $2,469.52. Since then, the absolute gain has become +16.7%. From the chart, it’s easy to notice that the system performs unpredictably. An average monthly gain is +6.68%. The maximum drawdown is 9.88%.

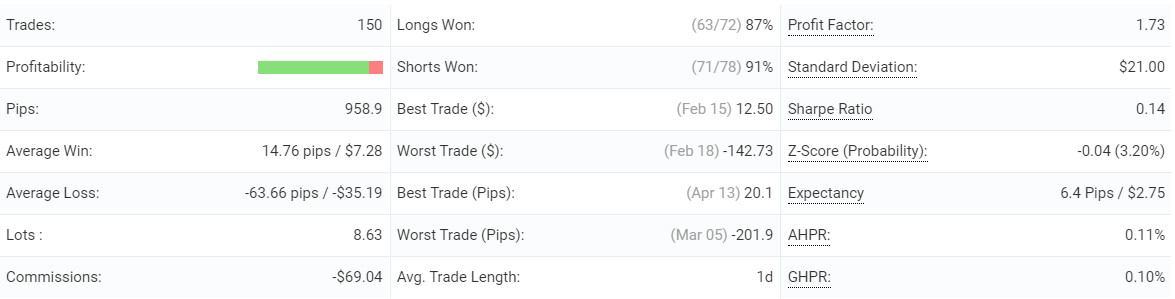

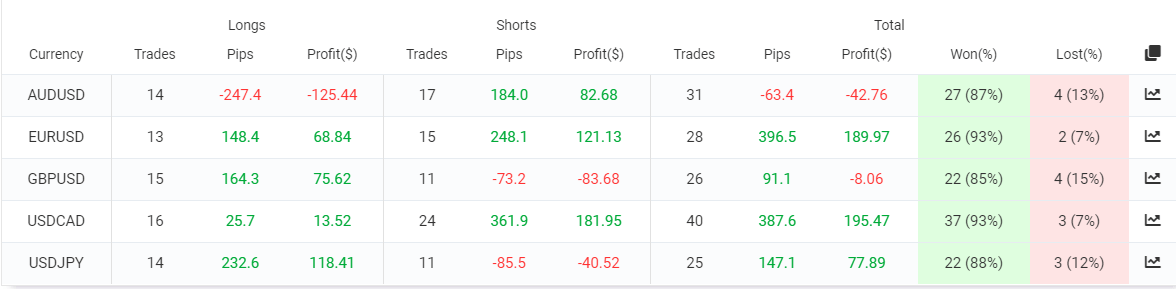

Redshift has traded 150 deals with – 958.9 pips. An average win is 14.76 pips when an average loss is -63.66 pips. The win rate is 87% for Longs and 91% for Shorts. An average trade length is a day. The Profit Factor is 1.73. It’s a good one for a trend system.

Two symbols still aren’t profitable. The most traded and most profitable symbol is USD/CAD with 40 deals and $196.47 of profit.

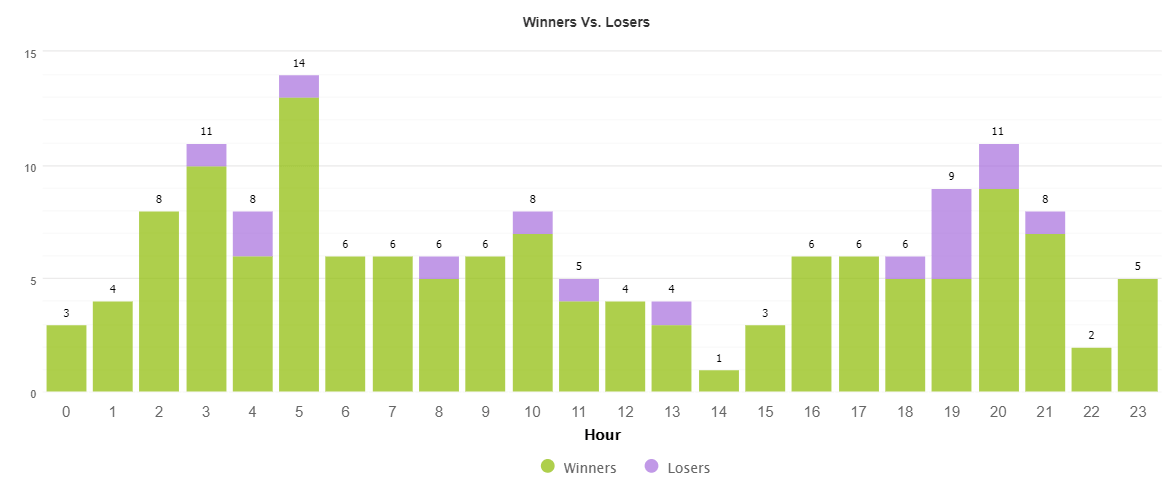

The system trades all day long, focusing on the high-impact news during Asian and American sessions.

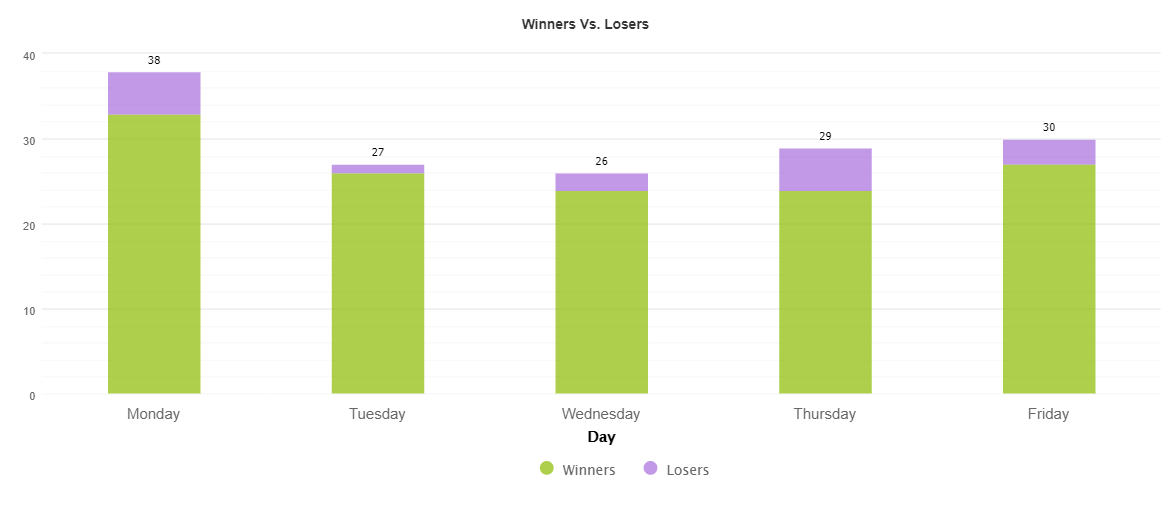

Monday (38 deals) is the most traded day.

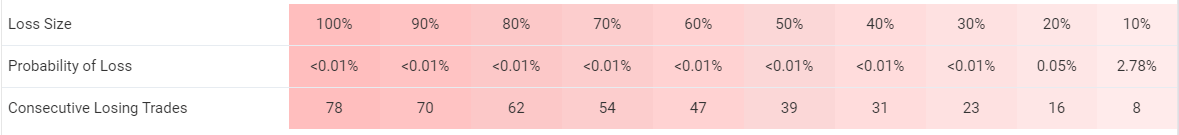

The expert advisor runs the account with acceptable risks to the balance.

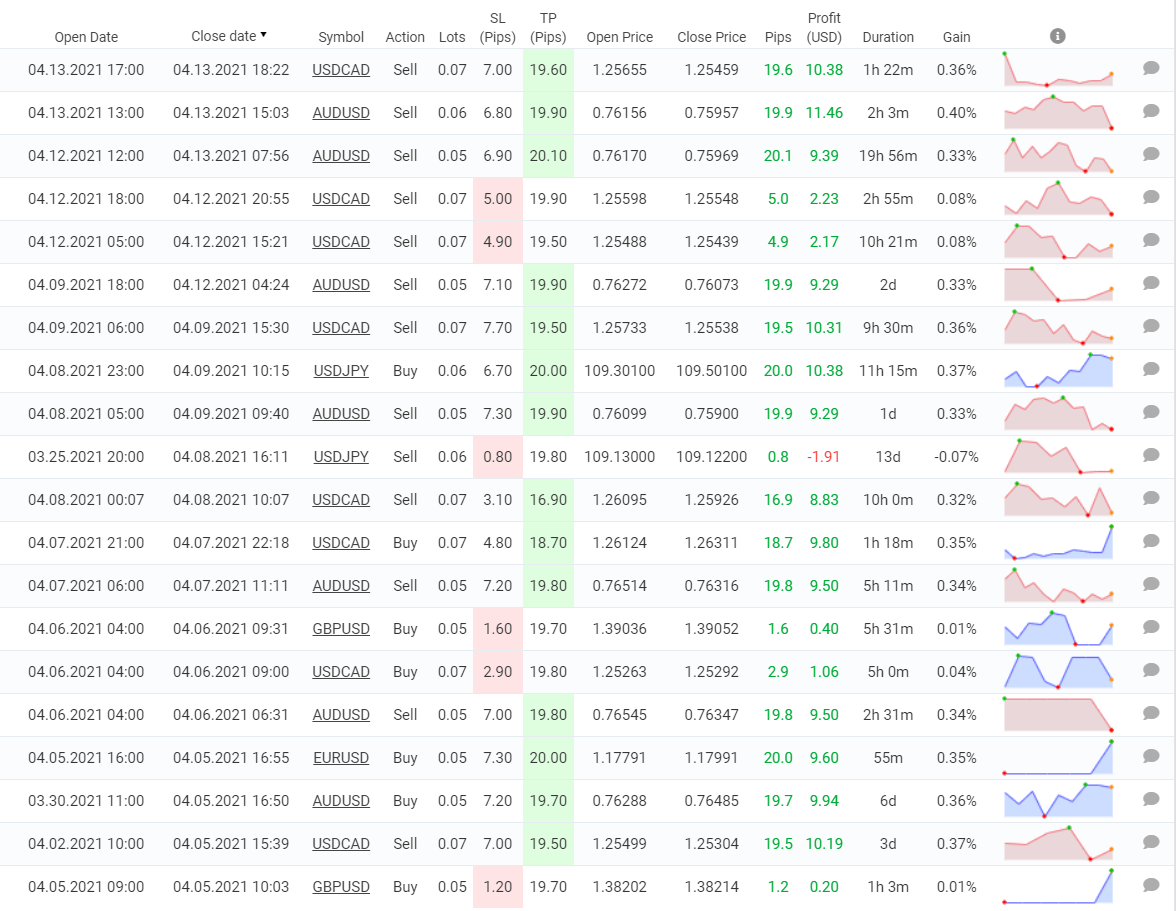

We can see that some deals are profitable, much even closing after reaching SL levels. So, there’s a trailing stop loss feature.

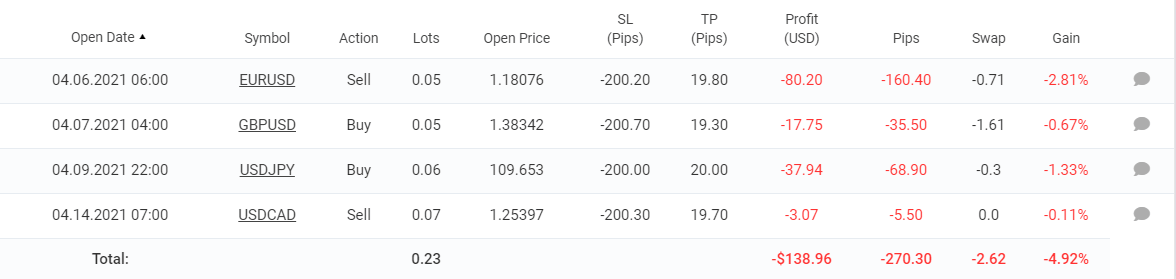

We can even notice open deals floating on the market.

The robot works closing months with profits.

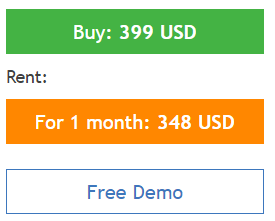

Pricing

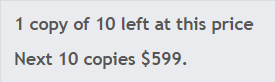

There’s still the last copy for $399 available. The next price should be $599.

Redshift costs $399 for a digital copy. We can follow a rental option to get it for a month for $348. The rental price is sky high compared with other similar products. We can demo download the system to test it on the MT4 terminal. The developer doesn’t support a deal with a refund policy.

Is Redshift Trading a scam?

Probably, it’s not. The system is far from running the charts smoothly and predictable. There are only two symbols that can make significant profits. The other three are useless to use. We can’t be sure that the system will be profitable in the future.

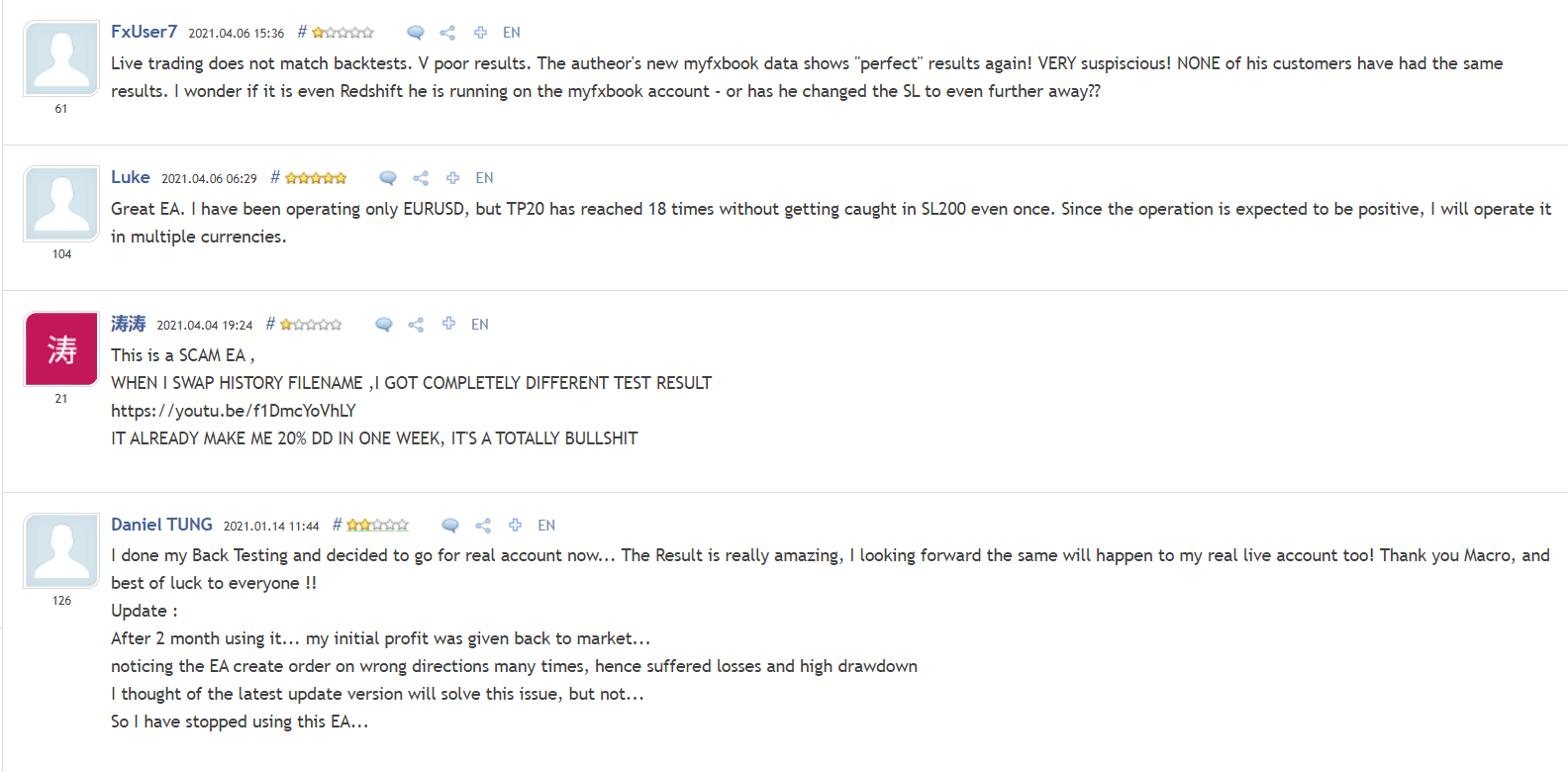

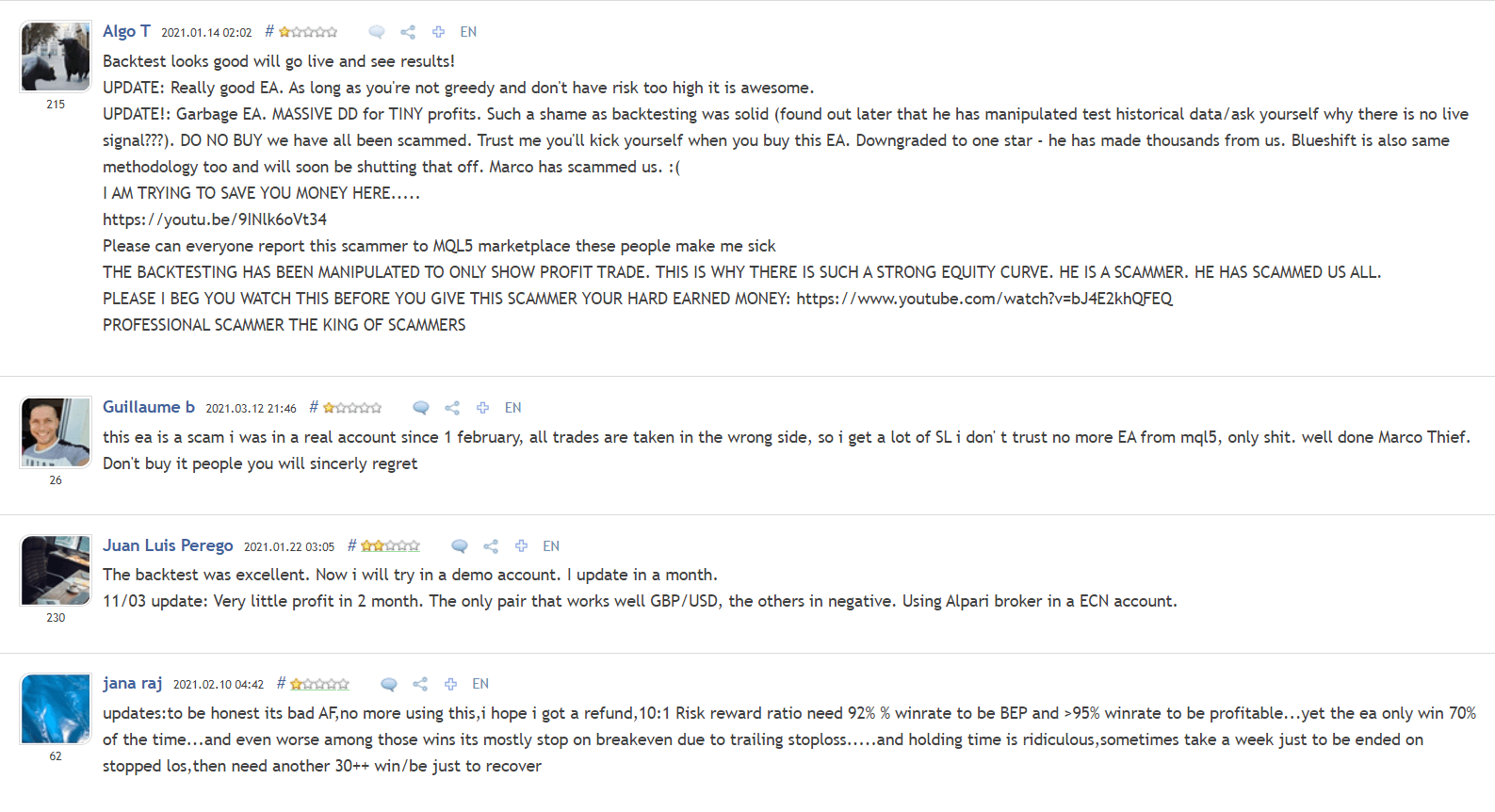

People feedback

The presentation includes many negative feedback. It’s obvious that these posts were written when the system experienced losses.

Comments