Naragot Portfolio is an expert advisor that makes use of multiple strategies. This MT4 tool comprises a professional portfolio of trading systems that work on multiple currency pairs. Volatility breakout and support/resistance breakouts are the basic principles used by the robot.

Alexander Mordashov is the author of this FX EA. He published the system on October 12, 2020. Since then, he has made several updates and the current version of the software is 1.27. The developer has one year of experience in developing FX products and has created 10 products and 1 signal. He is based in Russia.

His other products are Naragot Portfolio Lite, Naragot Telegram VPS, Naragot Sentiment market outlook, and more. A website address and the messaging option on the MQL5 site are the methods of support available.

Naragot Portfolio strategies and tests

As per the author, the ATS trades rarely but executes accurate entries. It leverages big trends and is not a curve fitting system. It uses fundamental principles that work on many popular pairs. The main features of the FX EA that make it competitive are:

- It trades only in the direction of the trend.

- The FX robot uses the best strategies from a pool of several methods.

- It is based on price action and does not use an indicator.

- The ATS uses two different trend trading methods.

- The EURUSD, XAUUSD, GBPUSD, and USDJPY are the main currency pairs the EA works on.

- It uses TP and SL for each position with TP being higher or equal to SL.

- The FX robot does not use toxic money management methods like Martingale, curve fitting, grid, etc.

- A risk customization feature is present inside the strategy.

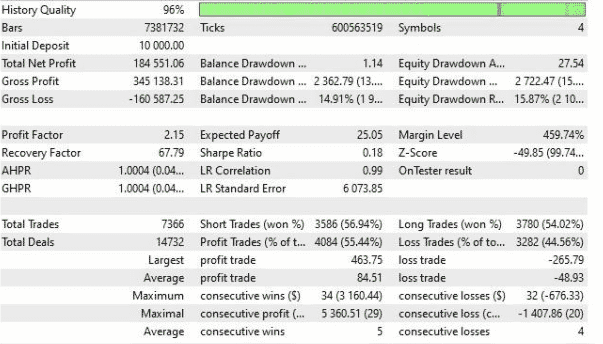

A few backtesting reports are present on the official site. Here is one of the backtests done from 2000 to 2021.

Backtesting report of Naragot Portfolio on the MQL5 site

From the above strategy tester report, we can see that a total net profit of $184,551 was generated from an initial deposit of $10000. A total of 7366 trades were executed with profitability of 55.44% and a profit factor of 2.15. The maximum drawdown is 14.91%. From the low drawdown, it is clear that the risk used is low.

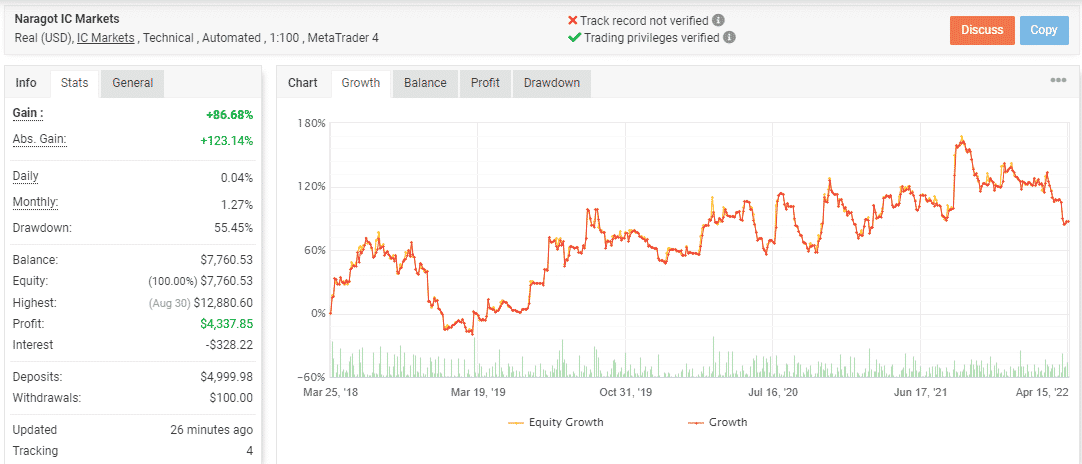

Naragot Portfolio live trading account review

A live real USD account using the IC Markets broker and the leverage of 1:100 verified by the myfxbook site is present. The MT4 account has verified trading privileges but the track record is not verified by the site.

Growth curve of Naragot Portfolio on the Myfxbook site

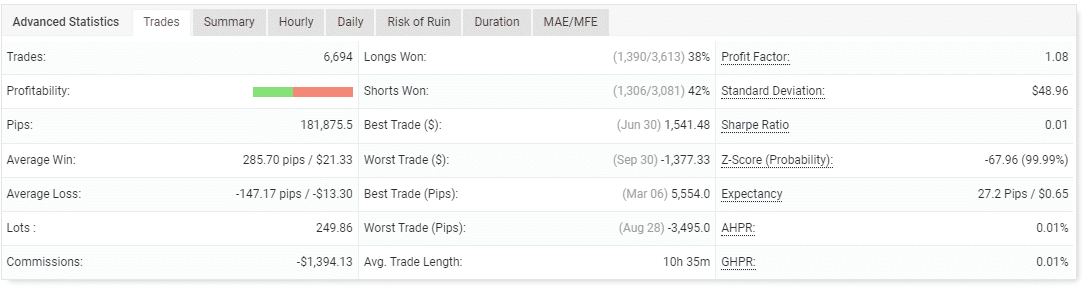

Trading stats of Naragot Portfolio on the Myfxbook site

From the above stats, we can see the system has generated a profit of 86.68% with a daily profit of 0.04% and a monthly profit of 1.27%. The drawdown for the account that started in March 2018 is 55.45%. From the growth curve, we can see the growth is inconsistent with numerous upturns and downturns indicating poor risk management. For a deposit of $4,999.98, the account has completed 6,694 trades with 40% profitability and a profit factor value of 1.08. The high drawdown and low profits indicate a risky approach and poor performance. Further, comparing the backtesting report with real trading data, we find the drawdown is higher and the profits are lower in the real trading results.

Pricing

You can purchase this FX EA for $333. A free demo account is available with the package. There are no further details on the features you get with the package. No refund offer is present which makes us doubt the reliability of the FX robot. When compared to the market average, we find the pricing is expensive.

Is Naragot Portfolio a good system to rely on?

From our evaluation of the MT4 tool, here are some crucial factors we identified that can influence the reliability of the system:

- Real trading results show a risky approach and poor money management

- The product is expensively priced

- There is no money-back guarantee

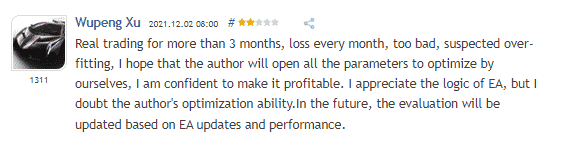

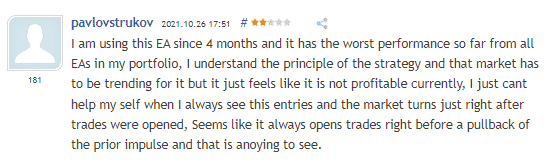

We found 22 reviews for this FX EA on the MQL5 site with a rating of 3.95/5. Here are a few of the recent testimonials:

User review for Naragot Portfolio on the MQL5 site

User review for Naragot Portfolio on the MQL5 site

From the above feedback, one user claims that the system is not profitable and incurs losses every month. Another user complains about the bad performance.

Comments