If you are doing FX trading, you must be familiar with MetaTrader 4 or MetaTrader 5. They are the most popular platforms, which allow you to trade many financial assets such as currency pairs, commodities, cryptocurrencies, indexes, ETFs, etc.

Although the developing company is the same for both trading platforms, there are some differences between them. Moreover, there are many trading platforms besides these two, such as C-trader, Ninja trader, etc.

Knowing the differences will help you to choose the best platform to execute trades and manage funds. In this article, we differentiate these two popular trading platforms by comparing them in every possible way.

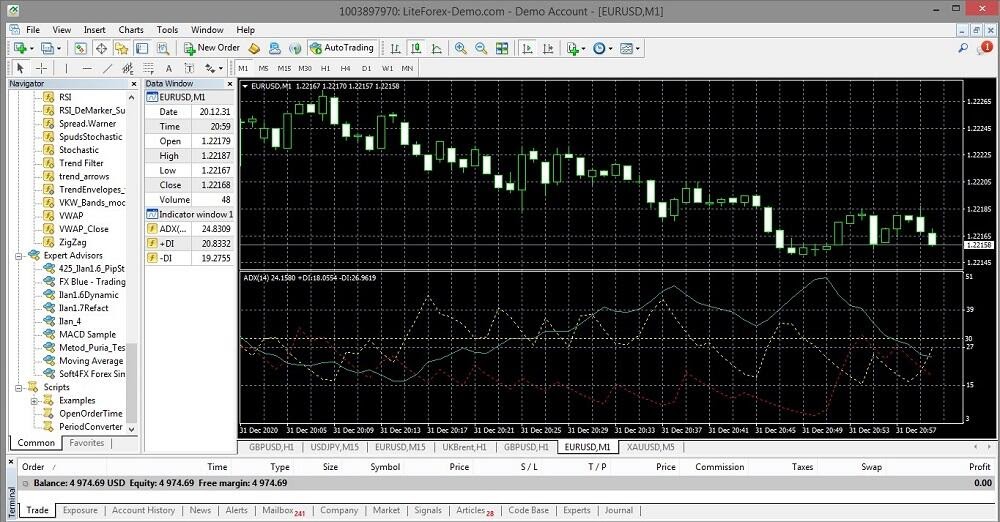

MT4 platform

The developing year of this platform is 2005. It is a trading platform that is a product of Metaquote Corp. Before MT4, MetaQuotes created other trading platforms in 2001, 2002, 2003 for trading CFD and forex currency pairs.

Due to less capability, capacity, and functionality, other platforms were far behind achieving popularity as this one. Later on, it came in 2005 with more functionality, flexibility, capability. So it has become so popular among traders as it has an intuitive interface.

MT4 platform

You can trade currencies, cryptocurrencies, bonds, stocks, indexes, and commodities on this platform. It works fine on the 32-bit operating system as it is mono-threaded to this. You can face some compatibility issues while using this platform on a 64-bit operating system. This platform supports more than 30 languages to use.

Another reason behind the popularity of this platform is technical support from MetaQuotes, its developer. A team of software developers is constantly working to improve and upgrade the platform code. Individuals can practice with this platform by demo trading.

MT5 platform

It is the latest multimarker trading platform by Metaquote Corp. The first release date of this platform was in June 2010. The developer thought MT5 would completely replace previous versions of the MT4.

The developer Metaquote Corp also decided to promote the new platform and stop service for MT4, but ‘something went wrong’ as the adoption process didn’t work.

MT5 platform

MT5 couldn’t achieve popularity as her ancestor, although this latest platform has more upgraded and updated versions than MT4. Although MT5 involves more functionality, the 4 version remains the most popular trading platform.

MT4 vs. MT5: which one to choose

New and existing traders both become confused in choosing the right platform. It is a dependable term, as different traders may feel comfortable using different platforms. MT5 is a trading platform that allows trading FX and non-forex assets and an upgraded version of MT4.

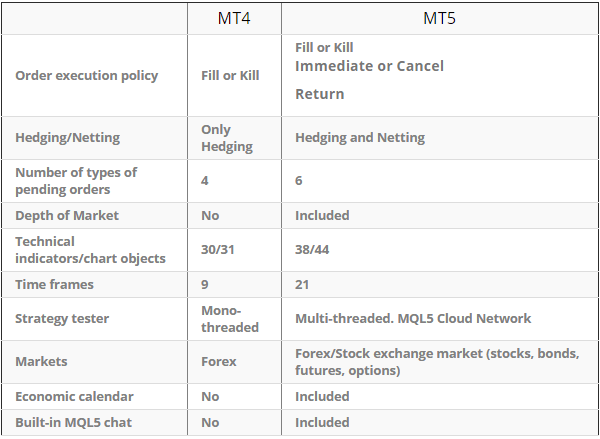

Both platforms differences at a glance

MT5 is a multi-asset trading platform that allows you to frequently trade FX currency pairs and non-forex assets such as stock, bonds, futures, etc. It enables taking trading positions simultaneously. Now look at the chart below that will show you the primary difference factors:

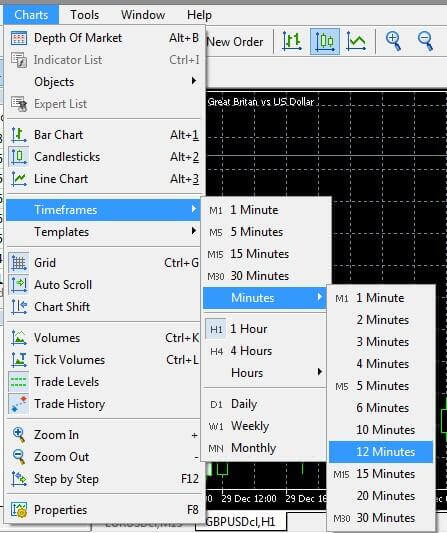

Time frames

The MT4 platform offers nine different time frame charts for trading assets. Meanwhile, MT5 offers 21 various charts for trading assets. You can change the time frames from the toolbar, or you can right-click on the chart and select the time frame tab to select time frames.

MT5 time frames

However, MT4 involves the simplicity that is useful for casual and novice trades, so it offers common and standard time frames. The availability of many time frame charts of MT5 may be helpful for CFD assets analysis, but it is not so advantageous for most traders of the financial market.

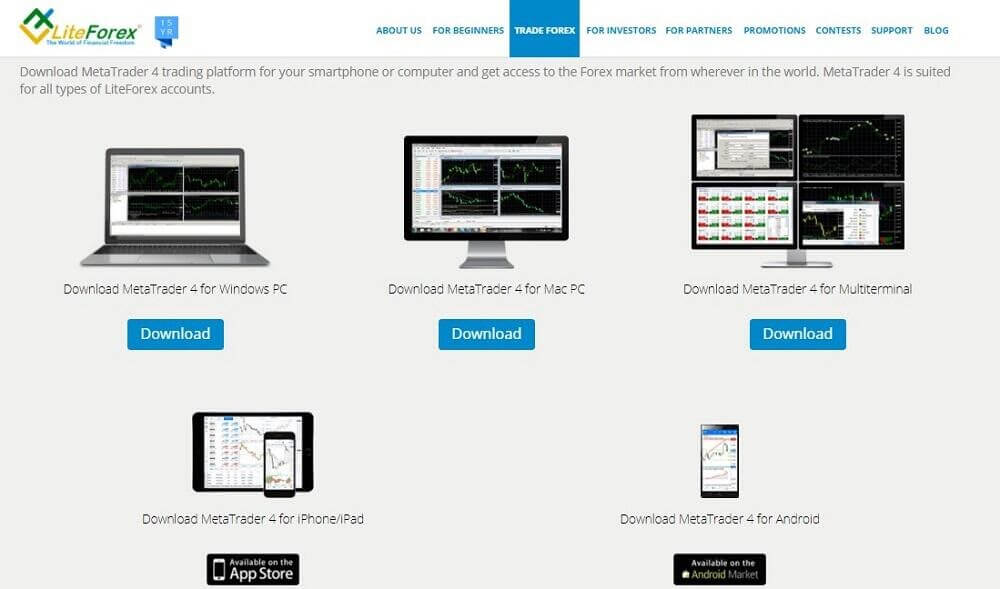

Available devices

Both platforms are available and offer mobile platforms, computer platforms in various operating systems such as android, windows, ios, etc.

Available platforms for MT4

MT4 is suitable for 32-bit operating systems and may cause compatibility issues in 64-bit operating systems. Meanwhile, the multimarket platform MT5 is appropriate and works fine on 64-bit operating systems.

Technical indicators

MT4 has 33 analytical objects and 30 built-in technical indicators. However, it offers only seven trend indicators. Meanwhile, the latest MT5 has 44 analytical tools and 38 built-in technical indicators. Besides it offers 13 trend indicators.

MT5 offers two types of Elliot wave to apply on charts while MT4 doesn’t. However, MT4 is suitable for newbie traders as it provides simple, standard, and straightforward technical tools and indicators. You can also create custom indicators similar to the MT5 platform and use them on the MT4 platform when you become an advanced trader.

Economic calendar

MT4 doesn’t have an option to check the economic calendar. On the other hand, MT5 enables checking the economic calendar by using the terminal.

Order types difference

The MT4 platform allows three types of order executions. Those are instant execution, request execution, and market execution. In instant execution, generally, traders request to execute an order, then the platform inserts an order for the current price; otherwise, requote occurs.

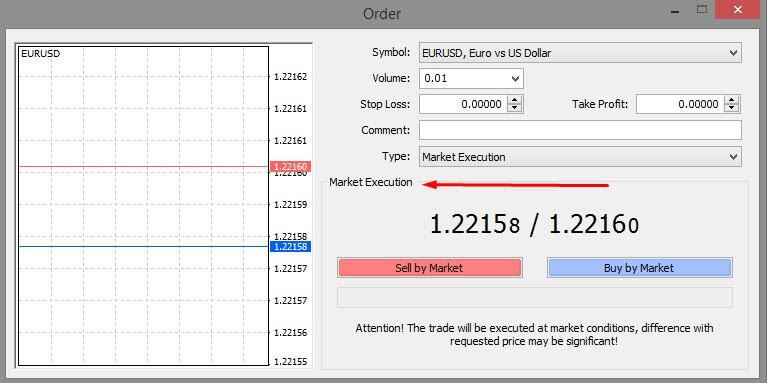

MT4 order window

On request execution orders, traders can reject or agree with executing orders at the offer price. Meanwhile, in the market execution orders broker decides to execute an order that may not include coordinating with traders. MT4 offers to buy stop, sell stop, buy limit, and sell limit types of orders.

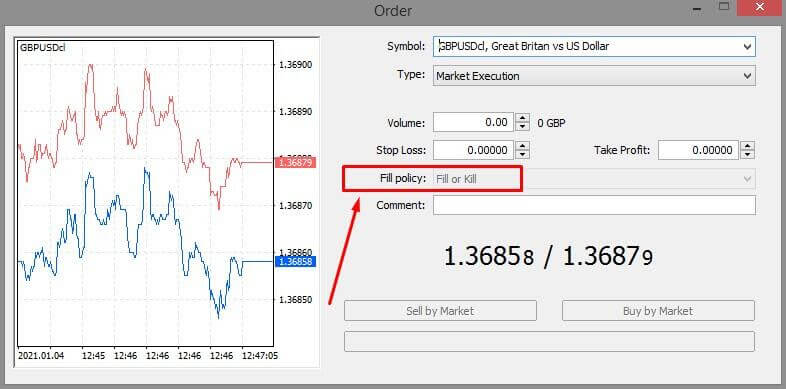

MT5 order window

MT5 offers some more order types that traders can choose from the order window. Alongside those four order types of MT4, the 5-th one offers sell stop limit and buy stop limit types orders. These order types give flexibility to traders executing buy-sell orders in the financial assets.

Hedging and netting

MT4 allows hedging. You can make positions in every direction for any financial assets that allow hedging by using this trading platform.

On the other hand, MT5 allows both netting and hedging. Netting mode allows having one position in any financial asset at once. This mode has some benefits as you don’t have to think about many orders.

Algorithmic trading

A sufficient development you can find in algorithms of both platforms. MT4 uses MQL4, and MT5 uses MQL5 programming language to develop EA or write scripts. There is also a difference in the strategy tester of both platforms. The 5-th one allows multi-currency pair backtesting while the 4-th doesn’t. Meanwhile, the copy trading model is the same for both terminals.

Final thoughts

Finally, choosing a trading platform is a matter of the personal preference of traders. A novice trader may choose MT4 for its simplicity and flexibility. Meanwhile, an expert trader may choose MT5 for platform versatility and extra resources.

Comments