Buying cryptocurrencies is a popular method to make money, where the ideal approach is to buy a token. However, in that case, investors have nothing to do when the broader crypto market faces selling pressure. Therefore, many people wonder whether it is possible to make money from short cryptocurrencies.

There are several ways to make money from short cryptocurrencies, whereas the most reliable way is to trade crypto CFDs. However, other methods like staking and reverse currency pairs made short trading possible in cryptocurrencies. The following section will uncover everything a trade should know about short cryptocurrencies with exact buying and selling methods.

What is short crypto?

It makes money from the bearish pressure in a crypto token or a crypto pair. Like the traditional stock market, the crypto tokens’ value provides profit by increasing its value. The core idea is to buy a crypto token at a lower value and sell the instrument when the price is significant.

On the other hand, short crypto can make money from the bearish run instead of the bull. It is a straightforward way to make money where traders use technical and fundamental tools and anticipate the downside pressure in the crypto token.

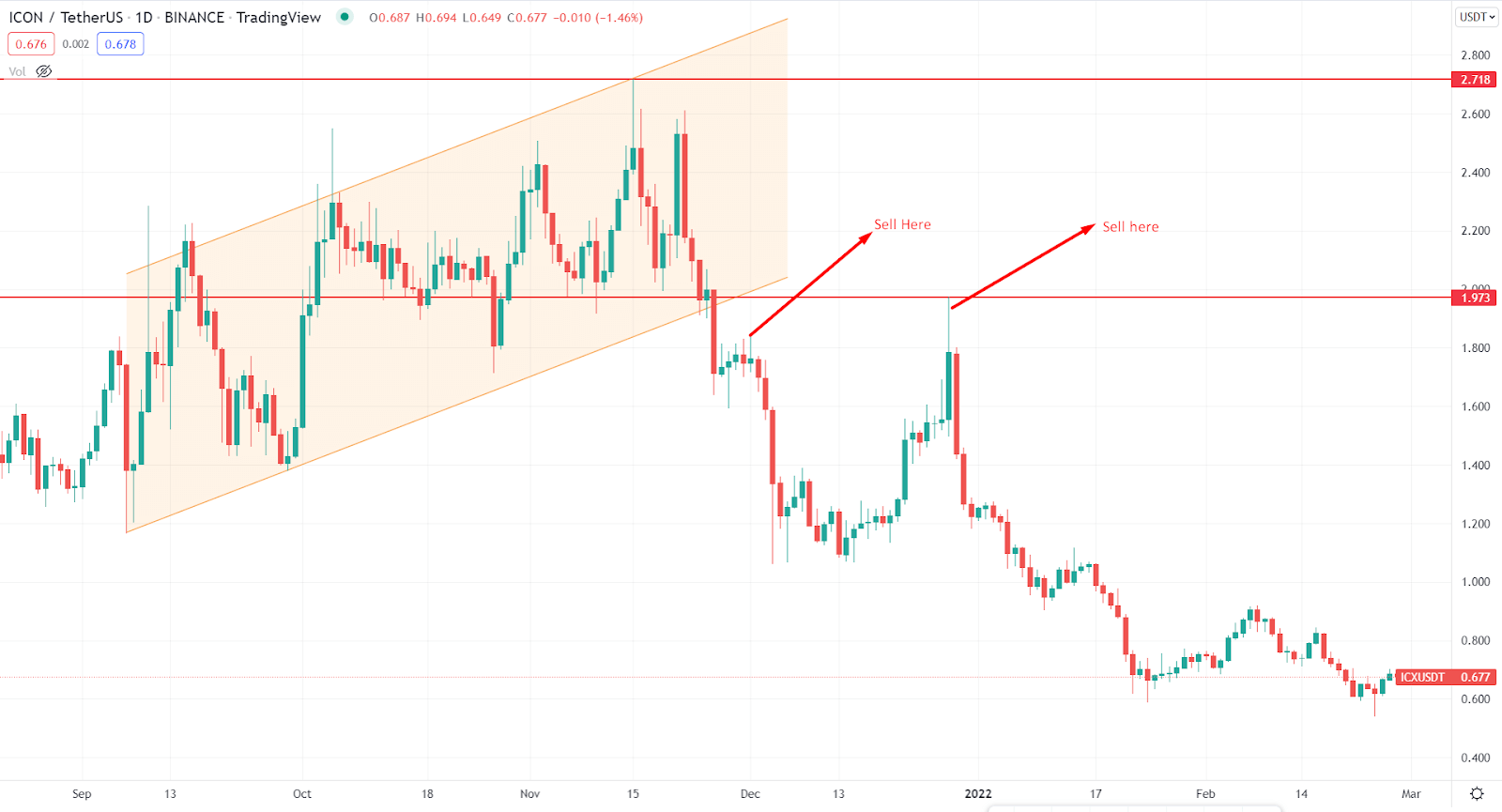

ICON/TETHER price chart

The above image shows how the bearish opportunity appears after the breakout from the rising wedge pattern.

How to trade using short crypto in trading strategy?

Like other trading methods, crypto short trading needs a specific trading strategy where buying and selling level comes from a predetermined condition. You cannot sell an instrument just by guessing the price. Instead, based on technical and fundamental analysis, you should follow what the price is doing right now and what it may do shortly.

In CFDs trading, you can short any crypto token from any place, which is the most effective way to trade cryptocurrencies. On the other hand, only top-tiered cryptocurrencies are available on CFDs where the profit opportunity is limited. In that case, crypto exchanges like Binance offer negatively correlated crypto pairs like ETHDOWN, BTCDOWN, etc.

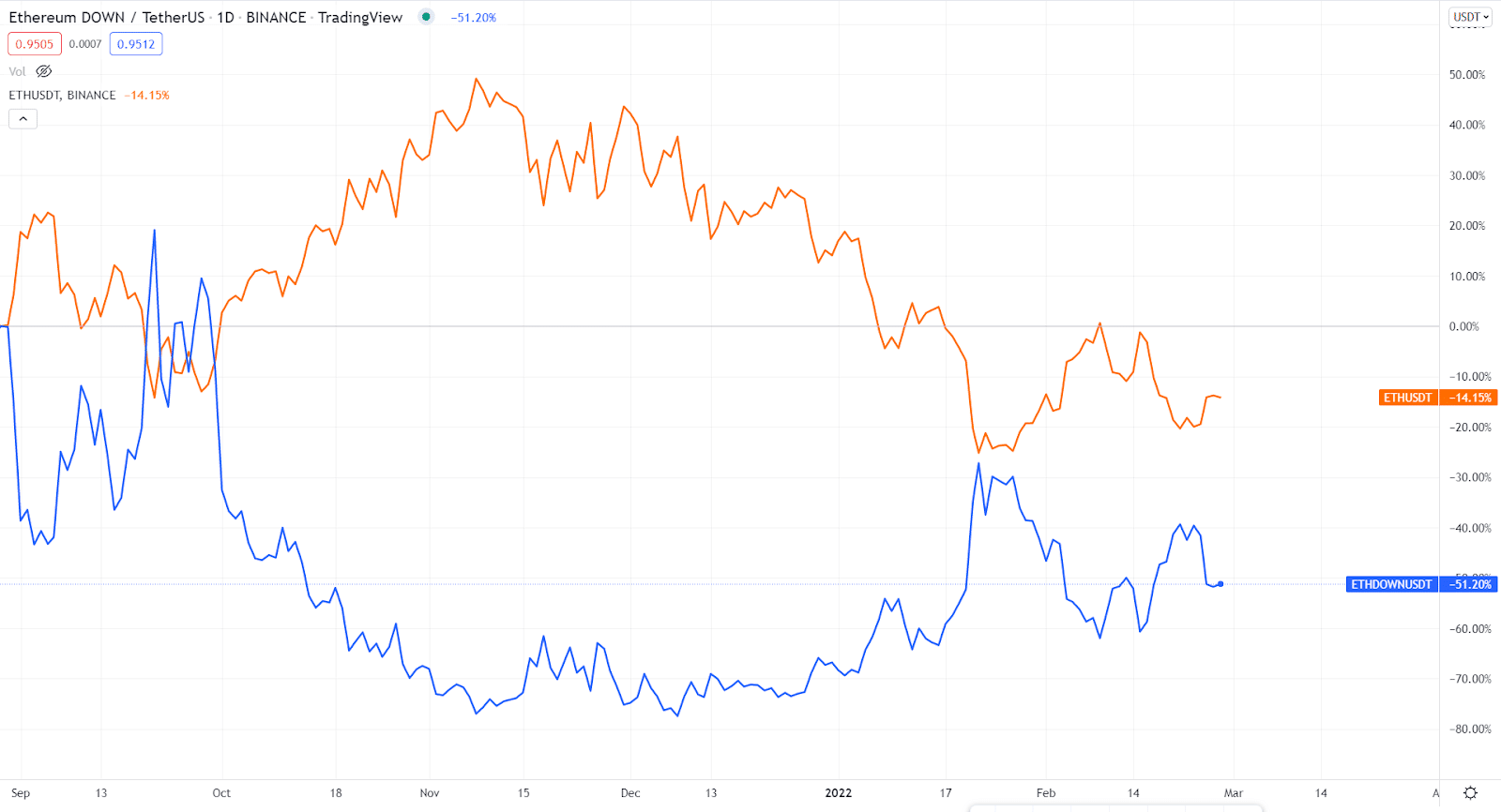

ETHDOWN and ETH/USD pair

The above image shows how the ETHDOWN and THE pair are negatively correlated. When ETH/USDT moves up, ETHDOWN moves down and vice versa. In that case, even if you buy ETHDOWN, you are expecting the original ETH to move down.

A short-term trading strategy

Crypto short is applicable on both short and long-term time frames where investors should find a reliable price pattern to appear before opening a buy or sell trade.

Bullish trade scenario

The bullish trade scenario is critical as we focus on shorting cryptocurrencies with a buy trade. In that case, we should choose trading pairs that move opposite to the actual pair. For example, ETHDOWN represents the negative correlation with the ETH/USDT price where buying in ETHDOWN is our core idea to buy the instrument.

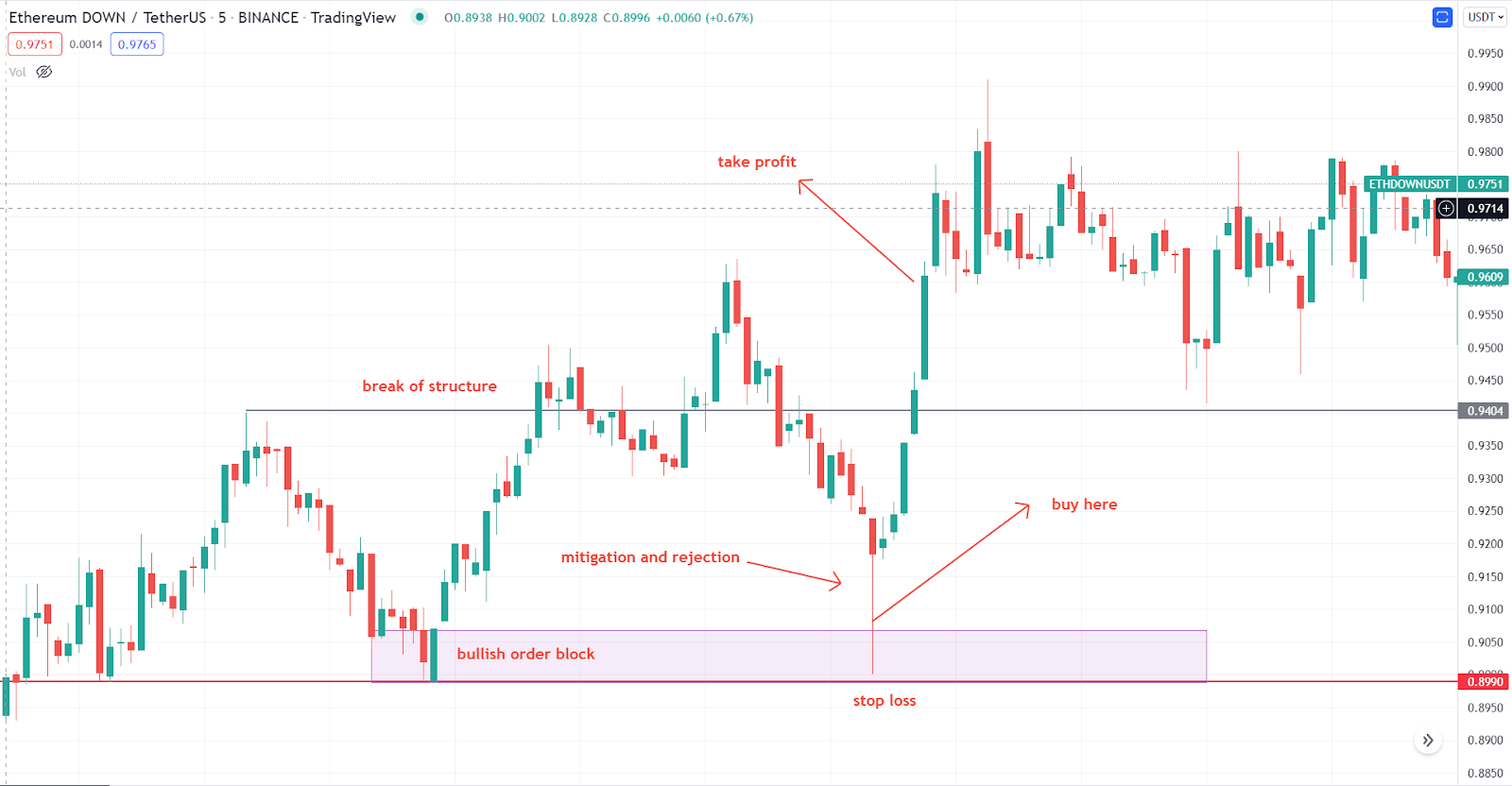

ETH/DOWN 5 min chart

Entry

Before openings buy trade, make sure to follow these conditions step-by-step:

- Identify a bullish breakout structure where the bullish trend exceeds the previous swing high.

- The bullish trend that made the break of structure — consider the last bearish candle of the trend as a bullish order block, which is the point of interest in this method.

- After the bullish break of structure, wait for the price to return to the bullish order block.

- You can open a buy trade immediately after reaching the order block, or you can wait for a bullish rejection candle before going long.

Stop loss

The stop loss is below the bullish order block with 0.1% or 0.5% buffer.

Take profit

The first take profit is the break of structure level where traders should close 50% of the trade. Later on, keep the trade running until the price reaches 161.8% Fibonacci extension level of the recent swing high to low.

Bearish trade scenario

The bearish trade scenario is the opposite version of the bullish trade, but this method only applies to CFDs.

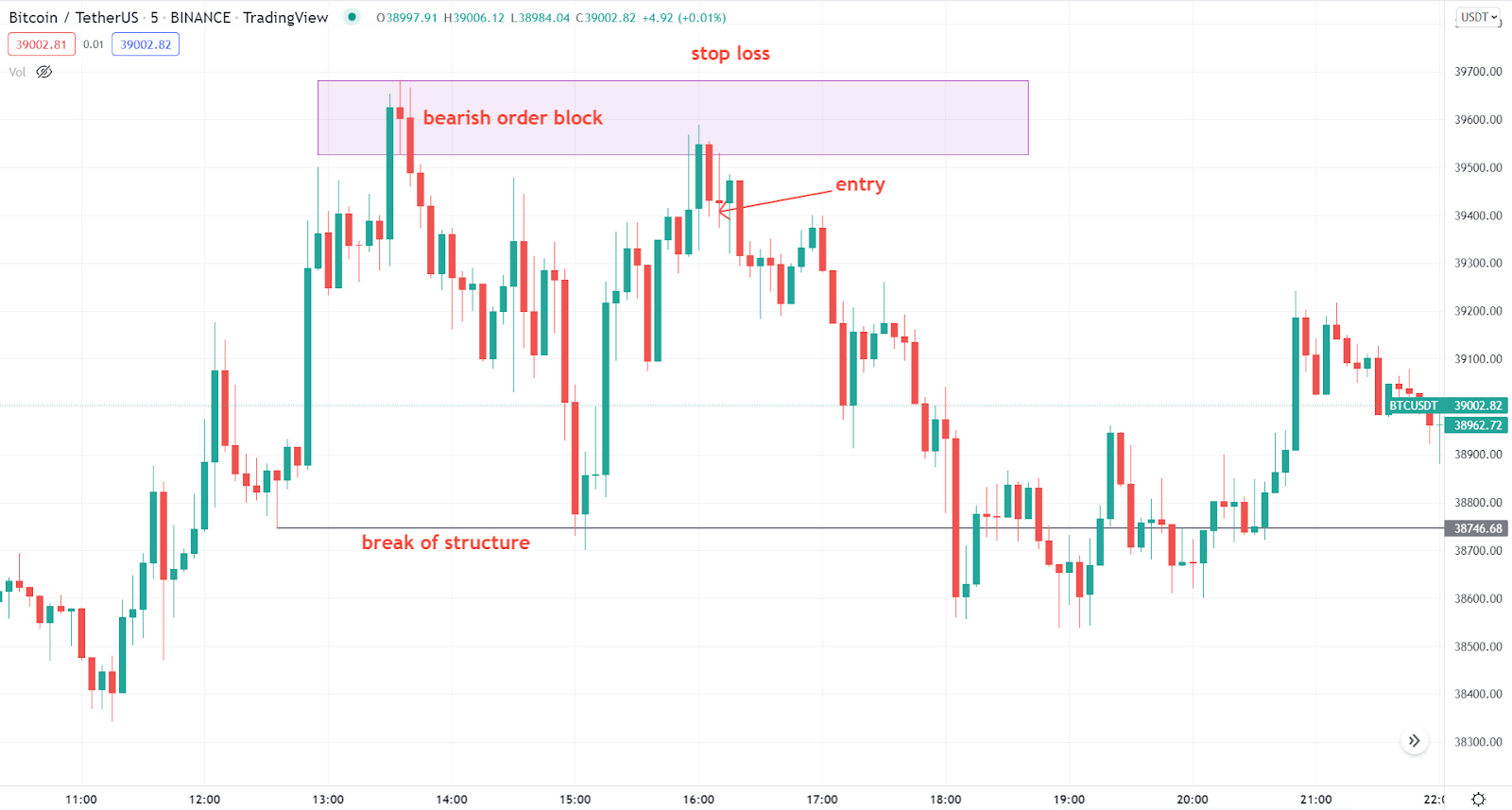

BTC/USDT 5 mins chart

Entry

The bearish trade is valid once the following conditions are present in the price:

- The price moved down from the bearish order block with a bearish break of structure.

- Later on, it moved higher to the order block and made the entry valid by forming a bearish rejection candlestick.

- Open the sell trade once the bearish candle closes.

Stop loss

The ideal stop loss is set above the order block with some buffer.

Take profit

The first take profit is the break of structure level, and the second take profit is based on market pressure and price behavior.

A long-term trading strategy

It needs a HODLing approach, involving trading in a higher time frame. However, the success rate in long-term trading is reasonable as the crypto market is more volatile than other financial markets.

Bullish trade scenario

In the bullish trade scenario, we will see how to open long trade while the broader crypto market is red.

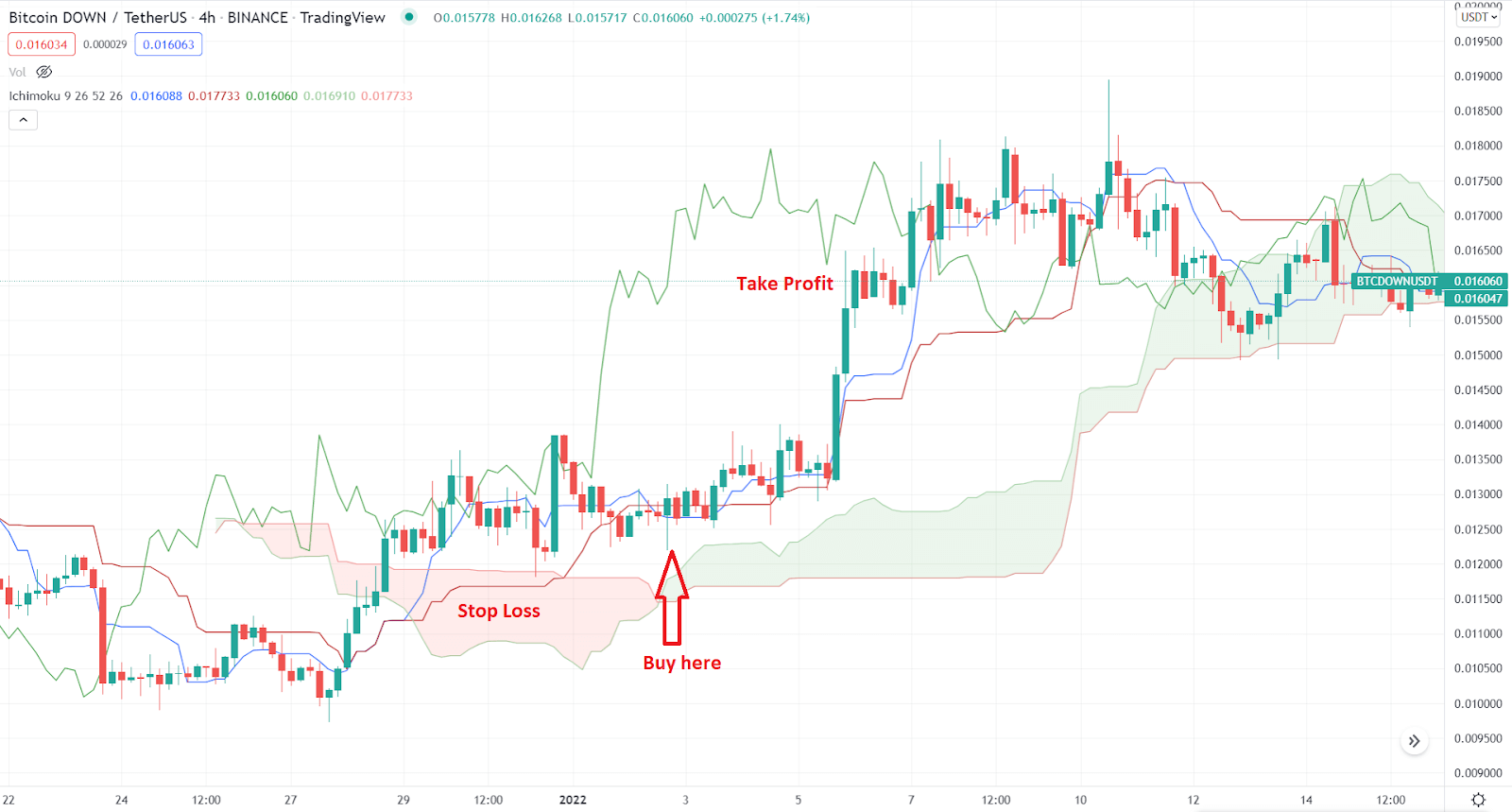

BITCOINDOWN/Tether H4 chart

Entry

The buy trade is valid once the following condition is available in the price chart:

- The price moved above the Ichimoku Kumo Cloud with bullish solid pressure.

- The dynamic Tenkan Sen moved above the dynamic Kijun Sen.

- A bullish H4 candle appears above the dynamic Tenkan Sen, validating the buy position.

Stop loss

The ideal stop loss is below the Kijun Sen line, but the conservative approach is set below the Kumo Cloud.

Take profit

The first take profit is based on the 1:2 risk vs. reward ratio, while you can extend the take profit based on the price pressure.

Bearish trade scenario

Let’s see the bearish trade example using the Ichimoku Kumo Cloud.

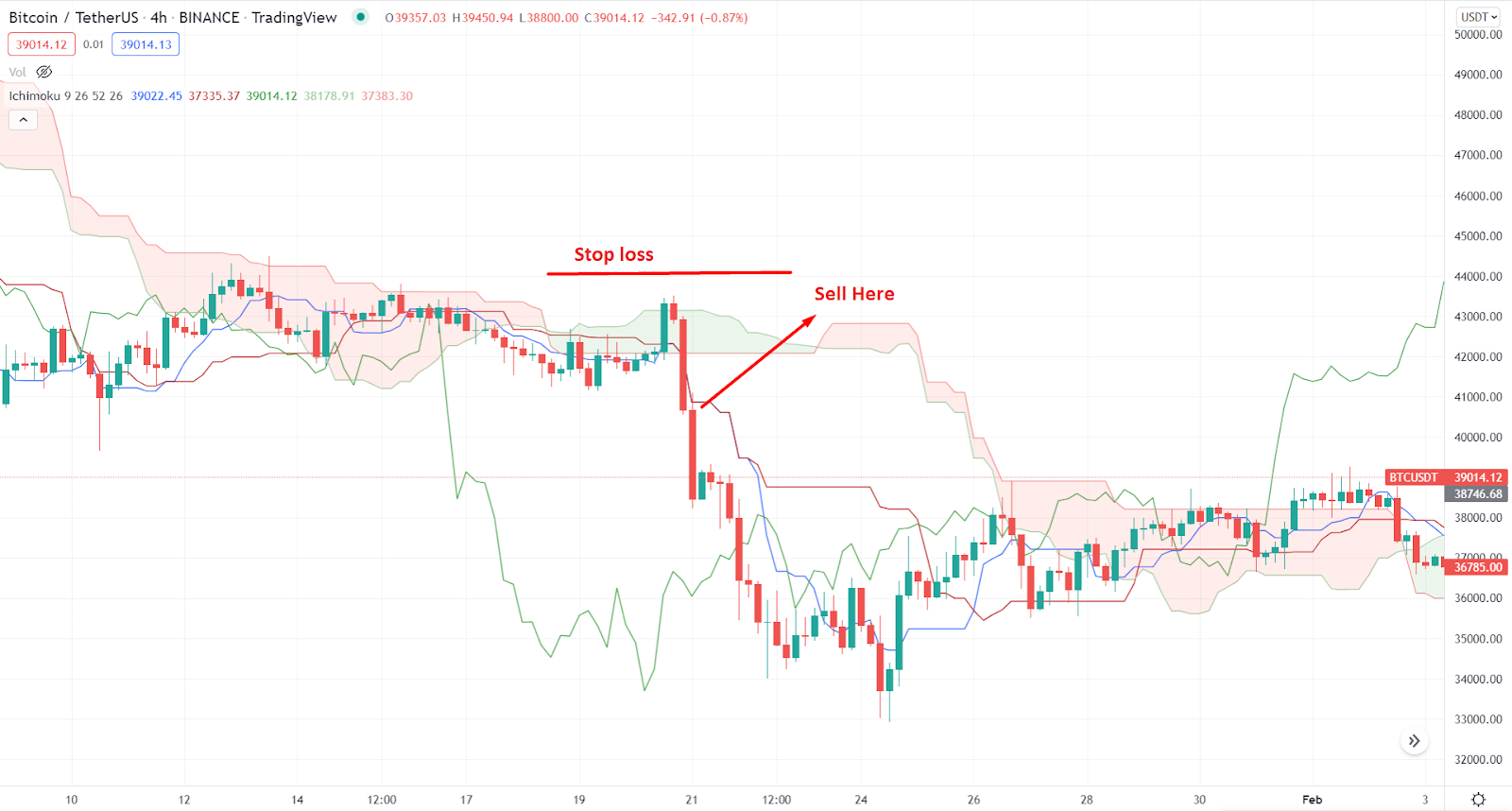

BiTC/USDT H4 chart

Entry

Open the sell trade once you see the following condition in the chart:

- The price moved below the Ichimoku Kumo Cloud with solid bearish pressure.

- The dynamic Tenkan Sen moved below the dynamic Kijun Sen.

- A bearish H4 candle appears below the dynamic Tenkan Sen, validating the sell position.

Stop loss

The ideal approach of setting stop loss is keeping it above the Kumo Cloud with some buffer.

Take profit

The first take profit is based on 1:2 RR, and the second take profit is based on the price pressure and broader market context.

Pros and cons

Let’s see the pros of the crypto short trading method.

| 👍 Pros | 👎 Cons |

|

|

|

|

|

|

Final thoughts

Trading cryptocurrencies needs a strong understanding of the project with its core potentiality. Otherwise, following the asset based on the price action only might incur a lousy timing for having future benefits. In that case, the best approach is to focus only on buy trades where any dip with future growth possibilities is a core consideration in making trading decisions.

Comments